Summary - 119 Norman House, Friar Gate, DERBY DE1 1NU

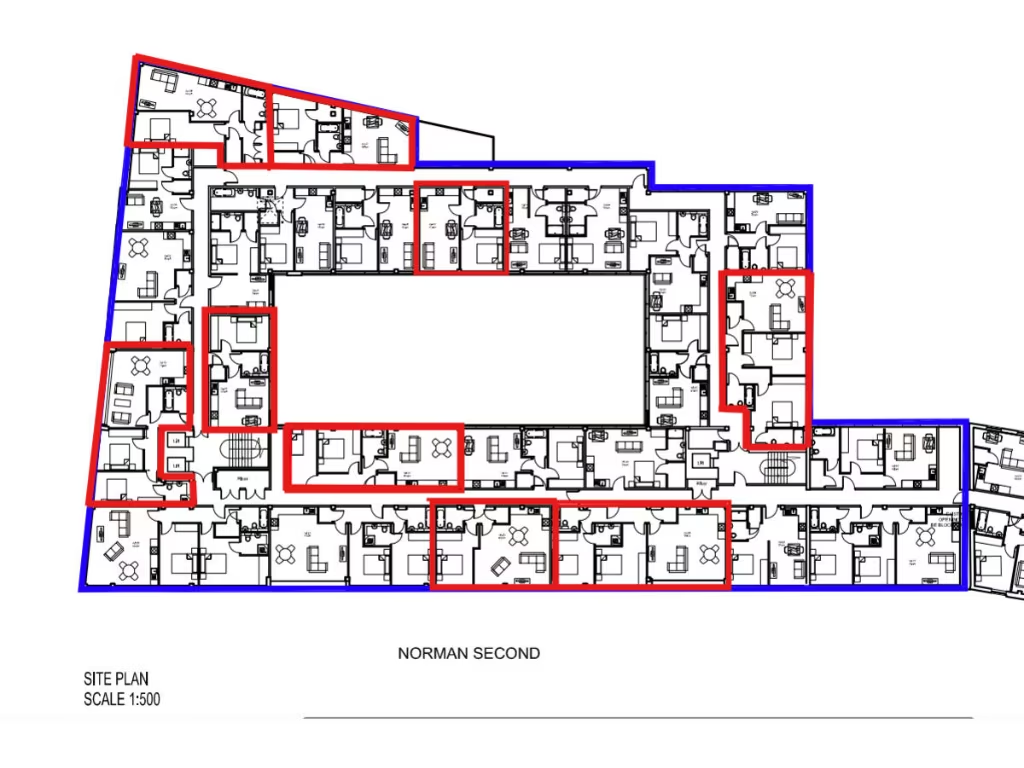

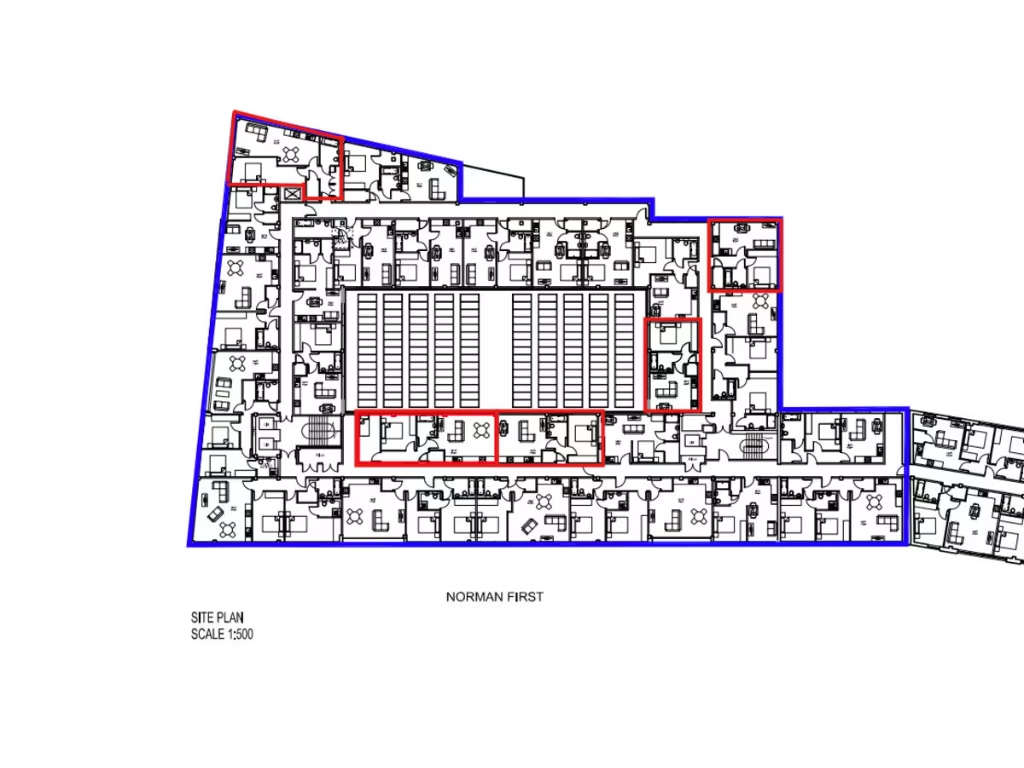

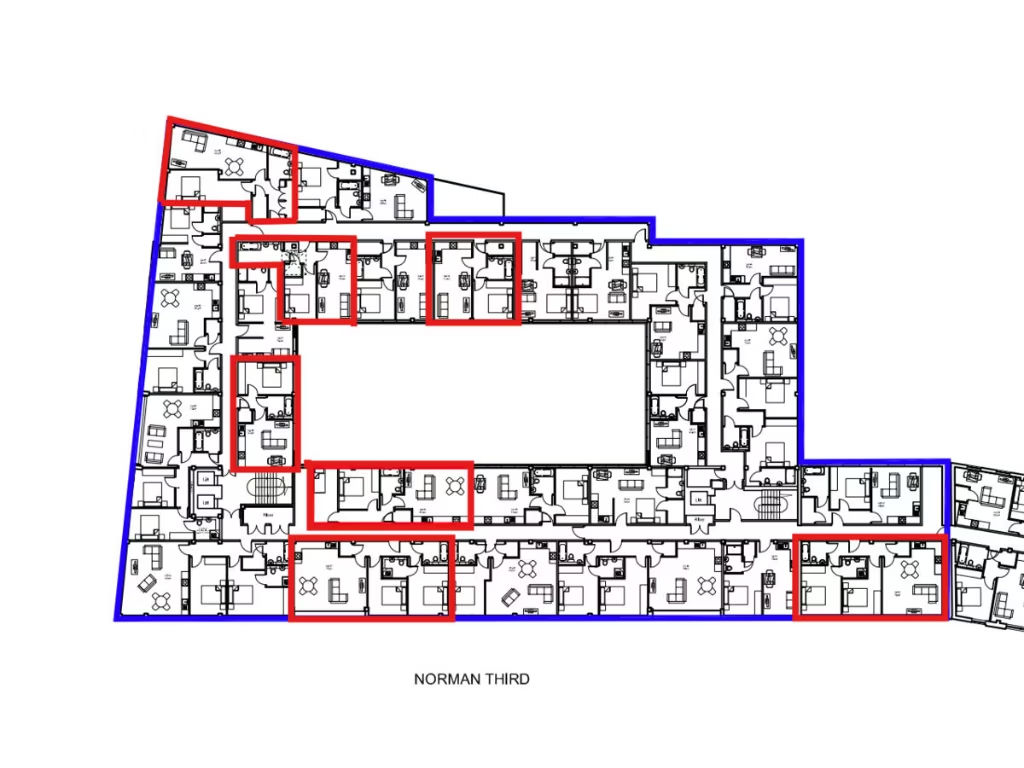

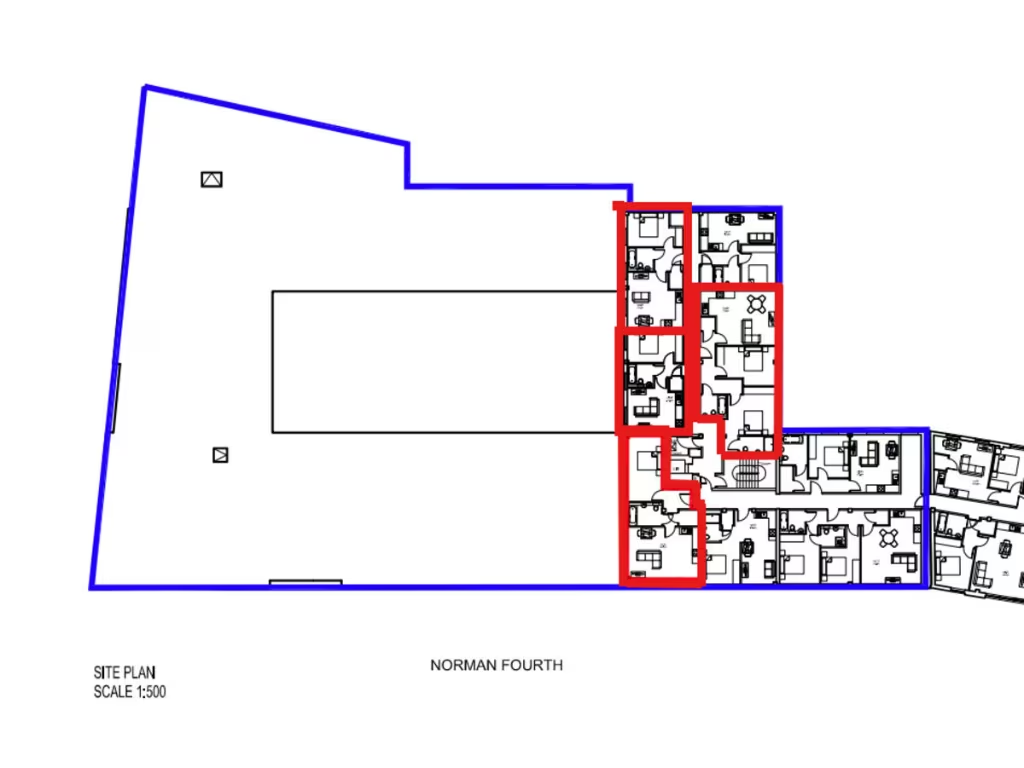

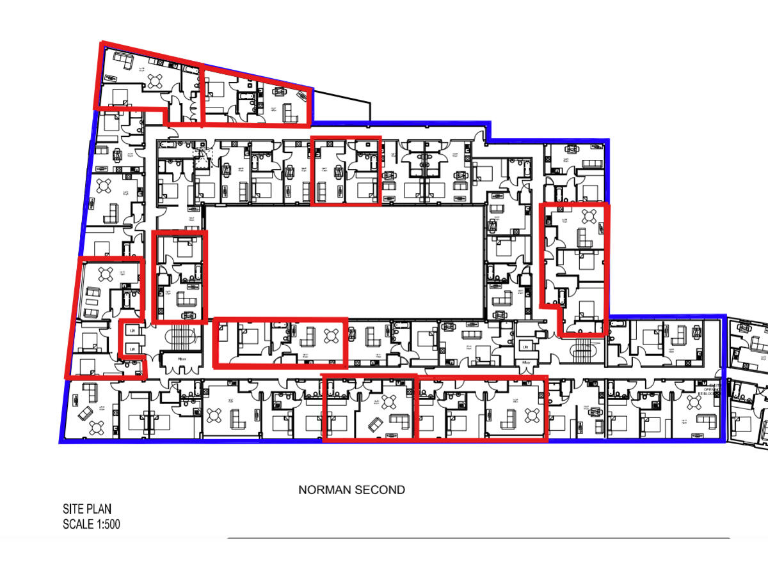

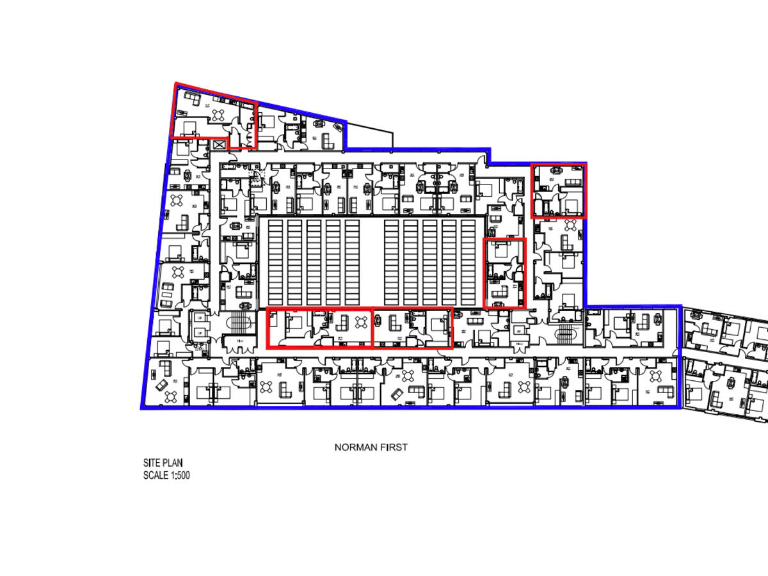

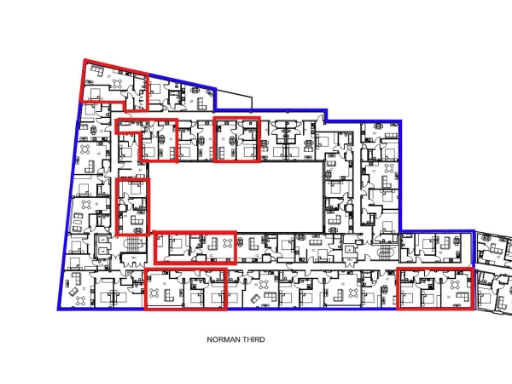

32 bed 30 bath Apartment

Turnkey, fully let 25-apartment block with strong headline yields — expect high service charges..

Fully let 25-apartment block generating ~£239,556pa rental income

Mix of one- and two-bedroom apartments; 32 bedrooms total

Long lease (approx. 241 years) supports financing options

High annual service charge £27,918.86 significantly reduces net yield

Ground rent £2,195.05 and additional building insurance costs apply

Located in DE1 city centre — strong tenant demand but very high crime

Medium flooding risk; factor in insurance and mitigation costs

Sold individually or as a whole; suitable for portfolio or entry investors

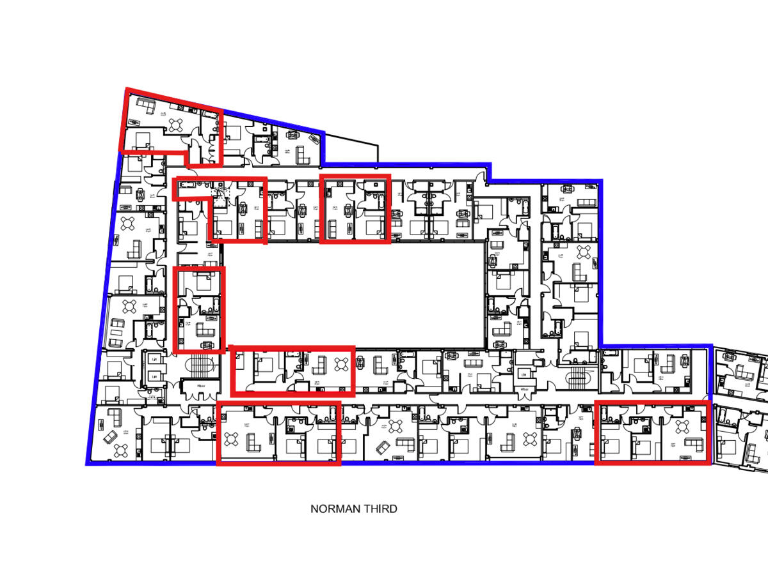

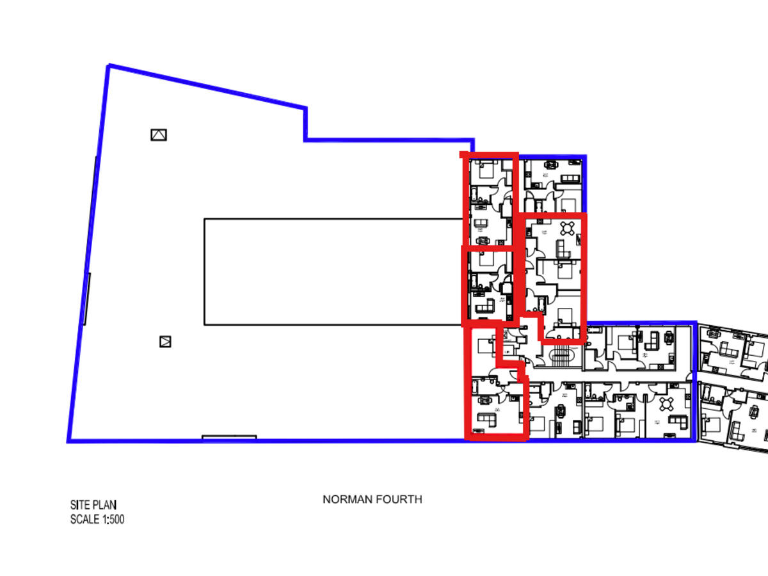

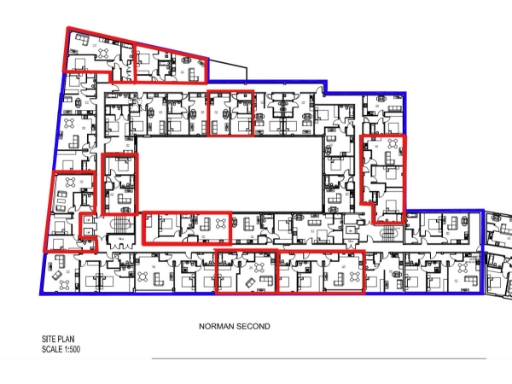

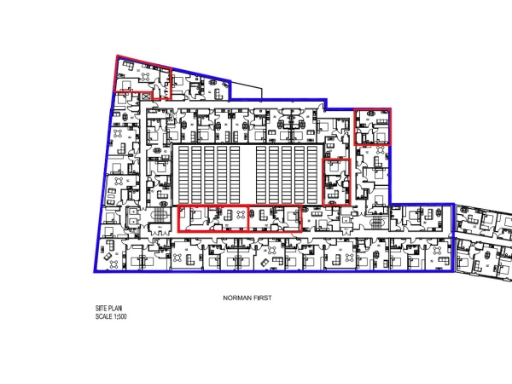

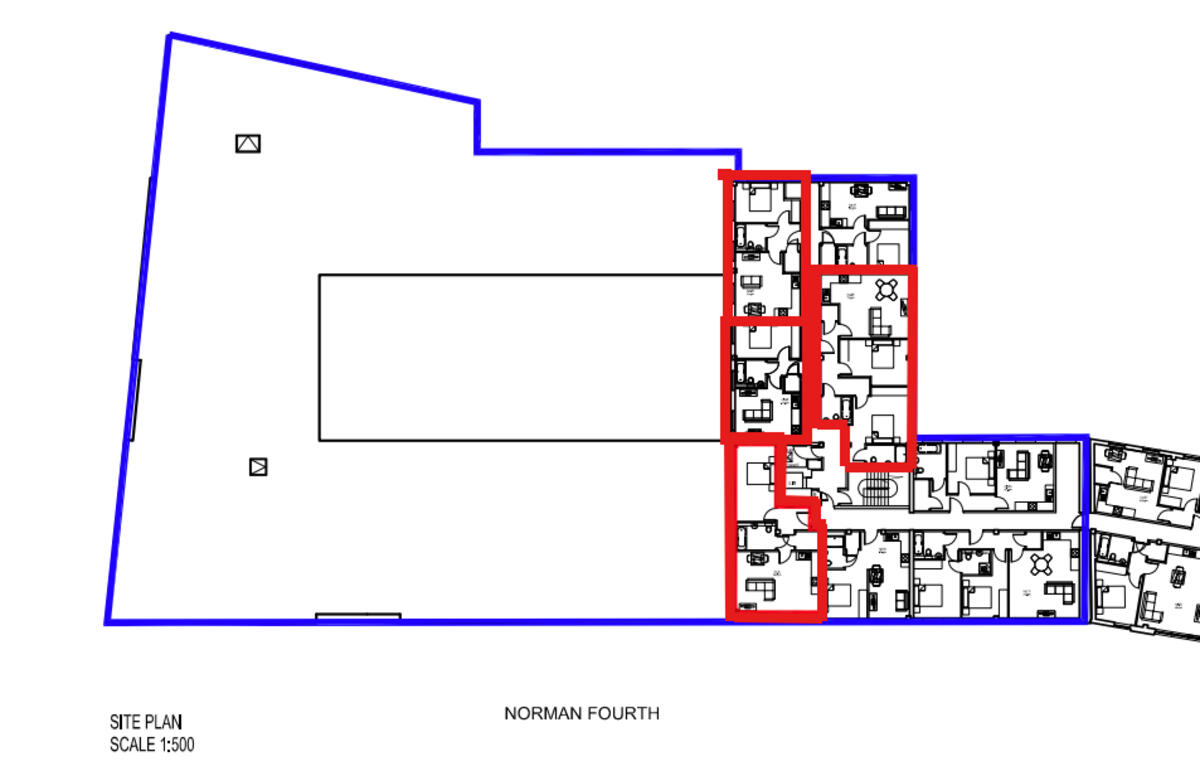

Norman House is a fully tenanted block of 25 modern one- and two-bedroom apartments in Derby city centre. Sold as a whole or as individual units, the portfolio generates immediate income with a stated total annual rental income of approximately £239,556 and average yields around 7.7% — attractive for buy-to-let investors seeking turnkey cashflow.

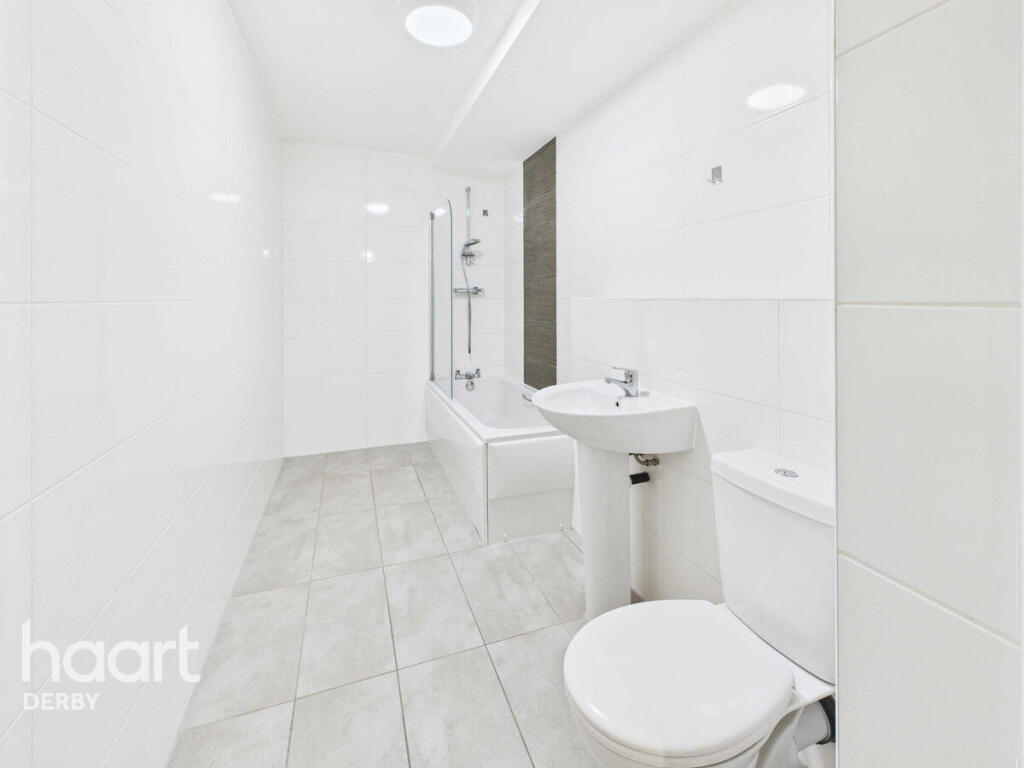

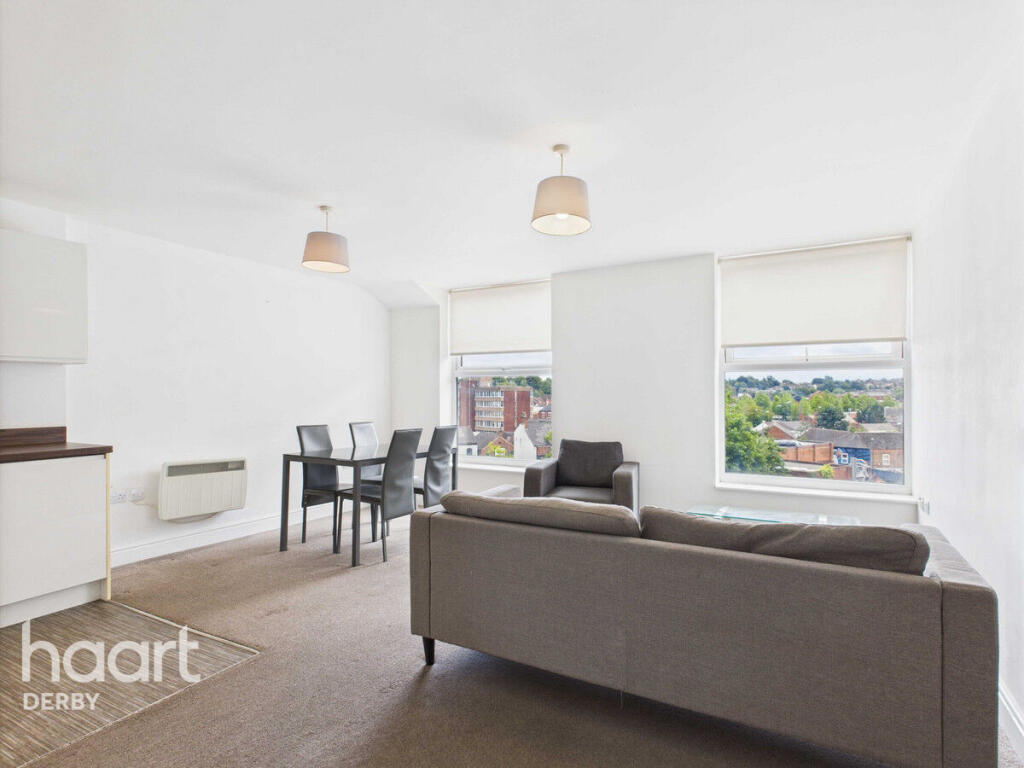

The building benefits from a central location close to transport, employers, shops and universities, sustaining demand from students and professionals. Apartments are described as well-presented with practical layouts and bright interiors; the long leases (circa 241 years remaining) support borrowing and long-term asset stability.

Buyers must weigh significant running costs: an annual service charge of £27,918.86 and ground rent of £2,195.05 materially reduce net returns. The area records very high crime and very high deprivation, and the property has a medium flooding risk — factors that affect management overheads, insurance and tenant profile.

This is a clear opportunity for investors comfortable with central urban portfolios and active asset management. It suits purchasers targeting immediate rental income and potential capital growth, but budget for elevated service charges, higher insurance and proactive security or refurbishment plans to maintain occupancy and rental levels.

2 bedroom apartment for sale in Friar Gate, Derby, DE1 — £130,000 • 2 bed • 1 bath • 627 ft²

2 bedroom apartment for sale in Friar Gate, Derby, DE1 — £130,000 • 2 bed • 1 bath • 627 ft² 2 bedroom apartment for sale in Friar Gate, Derby, DE1 — £145,000 • 2 bed • 2 bath • 753 ft²

2 bedroom apartment for sale in Friar Gate, Derby, DE1 — £145,000 • 2 bed • 2 bath • 753 ft² 1 bedroom apartment for sale in Friar Gate, Derby, DE1 — £115,000 • 1 bed • 1 bath • 565 ft²

1 bedroom apartment for sale in Friar Gate, Derby, DE1 — £115,000 • 1 bed • 1 bath • 565 ft² 1 bedroom apartment for sale in Friar Gate, Derby, DE1 — £115,000 • 1 bed • 1 bath • 411 ft²

1 bedroom apartment for sale in Friar Gate, Derby, DE1 — £115,000 • 1 bed • 1 bath • 411 ft² 2 bedroom flat for sale in Friar Gate, Derby, DE1 — £95,000 • 2 bed • 2 bath • 597 ft²

2 bedroom flat for sale in Friar Gate, Derby, DE1 — £95,000 • 2 bed • 2 bath • 597 ft² 1 bedroom apartment for sale in Friar Gate, Derby, DE1 — £110,000 • 1 bed • 1 bath • 495 ft²

1 bedroom apartment for sale in Friar Gate, Derby, DE1 — £110,000 • 1 bed • 1 bath • 495 ft²