Summary - 102 ST JOHNS ROAD DONCASTER DN4 0QL

2 bed 1 bath Terraced

Immediate rental income with scope for modest refurbishment.

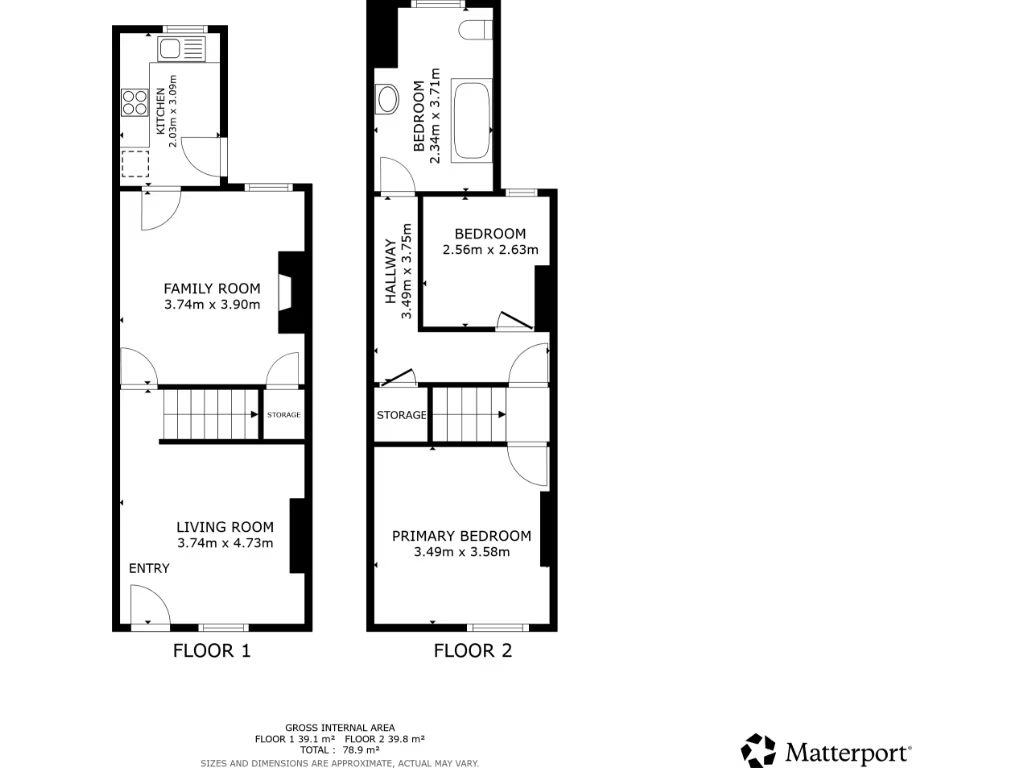

Two-bedroom Victorian mid-terrace, approx. 797 sq ft

This mid-terrace Victorian two-storey home offers a straightforward buy-to-let opportunity in DN4. With two bedrooms, standard ceiling heights and a compact 797 sq ft footprint, it suits investors seeking an easy-to-manage rental asset with immediate income.

The property is freehold and currently produces a gross annual rent of £5,940 with a long-term tenant in place who intends to remain. External maintenance appears low given the solid brick Victorian façade; there is a small rear garden and on-street parking only. Internal condition cannot be assessed from the external images, so an inspection is recommended before purchase.

Location factors will appeal to rental-focused buyers: good local transport links, nearby schools with favourable Ofsted outcomes and strong demand from private renters. Offsetting attractions, the neighbourhood records above-average crime and ranks as very deprived, which may affect future capital growth and tenant mix.

This listing is presented as an investment lot and a buyer’s premium will apply as part of the sale terms. For buy-to-let portfolio purchasers or developers comfortable with urban terrace stock, this property provides immediate income and scope for modest refurbishment to improve yields. Budget for any necessary internal upgrades after a full inspection.

2 bedroom terraced house for sale in Rose Avenue, Doncaster, DN4 — £75,000 • 2 bed • 1 bath • 882 ft²

2 bedroom terraced house for sale in Rose Avenue, Doncaster, DN4 — £75,000 • 2 bed • 1 bath • 882 ft² 2 bedroom terraced house for sale in Gladstone Road, Doncaster, DN4 — £85,000 • 2 bed • 2 bath • 775 ft²

2 bedroom terraced house for sale in Gladstone Road, Doncaster, DN4 — £85,000 • 2 bed • 2 bath • 775 ft² 2 bedroom terraced house for sale in Herbert Road, Doncaster, DN5 — £105,000 • 2 bed • 1 bath • 646 ft²

2 bedroom terraced house for sale in Herbert Road, Doncaster, DN5 — £105,000 • 2 bed • 1 bath • 646 ft² 3 bedroom terraced house for sale in Cross Street, Doncaster, DN4 — £75,000 • 3 bed • 1 bath • 807 ft²

3 bedroom terraced house for sale in Cross Street, Doncaster, DN4 — £75,000 • 3 bed • 1 bath • 807 ft² 3 bedroom terraced house for sale in St. Catherines Avenue, Doncaster, DN4 — £79,000 • 3 bed • 1 bath • 861 ft²

3 bedroom terraced house for sale in St. Catherines Avenue, Doncaster, DN4 — £79,000 • 3 bed • 1 bath • 861 ft² 2 bedroom terraced house for sale in Cunningham Road, Doncaster, South Yorkshire, DN1 — £95,000 • 2 bed • 1 bath • 904 ft²

2 bedroom terraced house for sale in Cunningham Road, Doncaster, South Yorkshire, DN1 — £95,000 • 2 bed • 1 bath • 904 ft²