Summary - 5b Radnor Street PL4 8DR

5 bed 3 bath Block of Apartments

Three fully let flats in Greenbank delivering high yield and immediate income..

- Freehold three-flat block, immediate income-producing asset

- Gross annual income £37,250; c.10.7% yield (exclusive)

- All flats fully let for 2025/26 on fixed terms

- Modern kitchens and bathrooms; period features retained

- Communal off-street parking for three cars

- EPCs modest (two E, one D); energy upgrades recommended

- Electric room heaters in Flats A and C; Flat B on gas

- Exterior needs maintenance; granite walls likely uninsulated

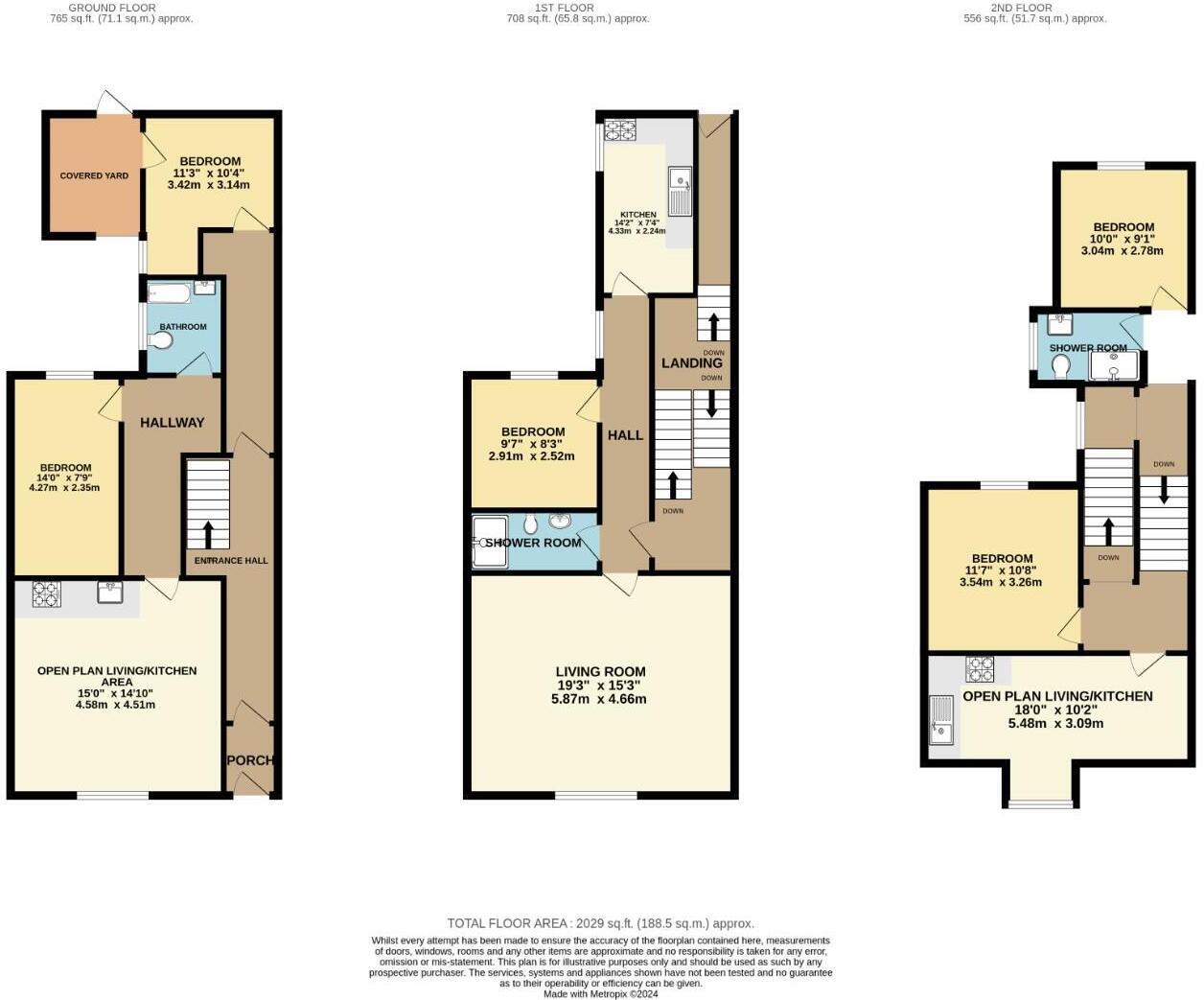

A rare freehold investment in Greenbank, Plymouth, offered with a gross annual income of £37,250 and a strong headline yield of c.10.7% (exclusive of bills). The mid-terraced Victorian block is arranged as three self-contained flats (two 2-beds and a 1-bed loft conversion), all let on fixed-term tenancies for 2025/26, providing immediate, hands-off rental income for a portfolio investor.

Flats are presented with modern kitchens and bathrooms while retaining period character such as high ceilings and feature fireplaces in parts. The building totals c.2,029 sq ft, includes communal off-street parking for three cars and occupies a central Greenbank location within walking distance of the university, city centre and local amenities—an area with strong tenant demand, particularly from students and young professionals.

Material considerations are clear and important to factor into purchase plans. The property was constructed 1900–1929 with granite walls that are assumed uninsulated, and several flats rely on electric room heaters (Flats A and C) while Flat B has mains gas. EPC ratings are modest (two E, one D). The exterior requires maintenance and some remedial works, and the local area records higher crime levels. These factors affect running costs, potential upgrade scope, and affordability of future lettings.

This asset suits investors seeking immediate income with short-term scope for value uplift through energy-efficiency improvements, exterior repairs and targeted refurbishment. All flats being fully let reduces void risk, but prospective purchasers should budget for capital works to improve EPCs, insulation and external condition to preserve rental appeal and long-term value.

Terraced house for sale in Hill Park Crescent, Plymouth, Devon, PL4 — £350,000 • 1 bed • 1 bath

Terraced house for sale in Hill Park Crescent, Plymouth, Devon, PL4 — £350,000 • 1 bed • 1 bath 3 bedroom terraced house for sale in Chester Place, Plymouth, PL4 — £225,000 • 3 bed • 3 bath • 1284 ft²

3 bedroom terraced house for sale in Chester Place, Plymouth, PL4 — £225,000 • 3 bed • 3 bath • 1284 ft² 4 bedroom terraced house for sale in Houndiscombe Road, Plymouth, PL4 6HF, PL4 — £400,000 • 4 bed • 4 bath • 1558 ft²

4 bedroom terraced house for sale in Houndiscombe Road, Plymouth, PL4 6HF, PL4 — £400,000 • 4 bed • 4 bath • 1558 ft² 3 bedroom terraced house for sale in Bedford Park, Plymouth, PL4 — £300,000 • 3 bed • 3 bath

3 bedroom terraced house for sale in Bedford Park, Plymouth, PL4 — £300,000 • 3 bed • 3 bath 6 bedroom terraced house for sale in Cheltenham Place, Greenbank.FULLY LET 2 x 3 bed flats. STUDENT investment property, PL4 — £340,000 • 6 bed • 2 bath • 862 ft²

6 bedroom terraced house for sale in Cheltenham Place, Greenbank.FULLY LET 2 x 3 bed flats. STUDENT investment property, PL4 — £340,000 • 6 bed • 2 bath • 862 ft² 6 bedroom end of terrace house for sale in Fore Street, Devonport, Plymouth, Devon, PL1 — £550,000 • 6 bed • 6 bath • 4609 ft²

6 bedroom end of terrace house for sale in Fore Street, Devonport, Plymouth, Devon, PL1 — £550,000 • 6 bed • 6 bath • 4609 ft²