Summary - THE ROYAL 80 WILTON PLACE SALFORD M3 6FT

1 bed 1 bath Flat

Ready-made buy-to-let with tenant, immediate income and market-upside potential.

Long-term tenant in situ producing £9,540 pa gross income

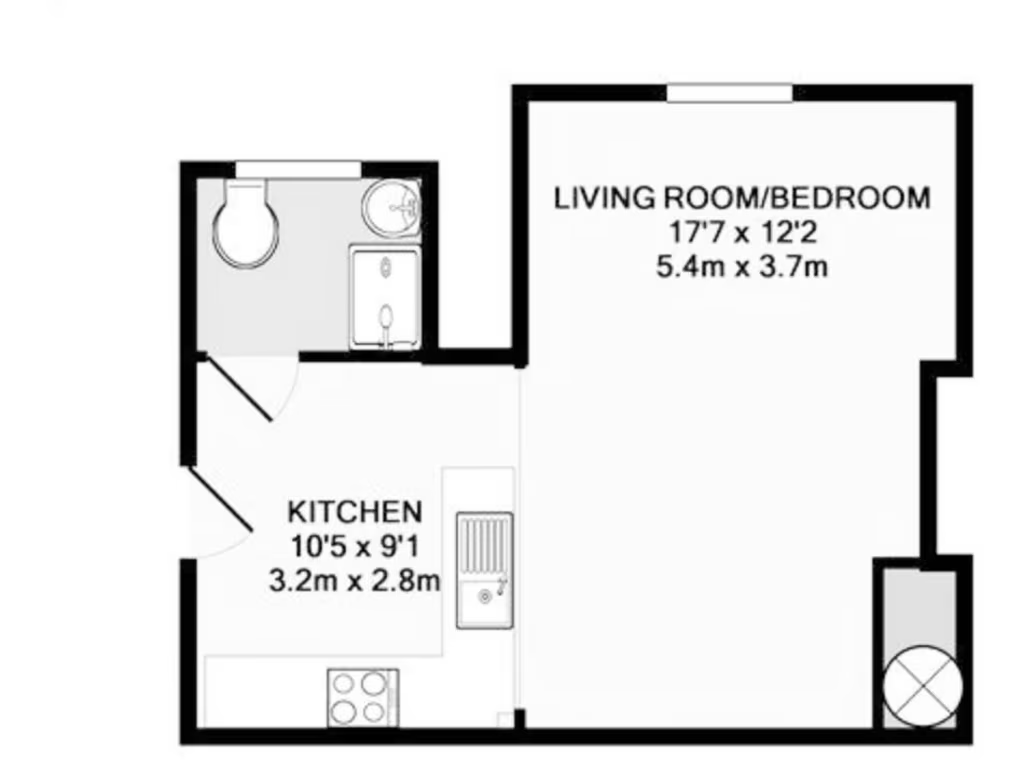

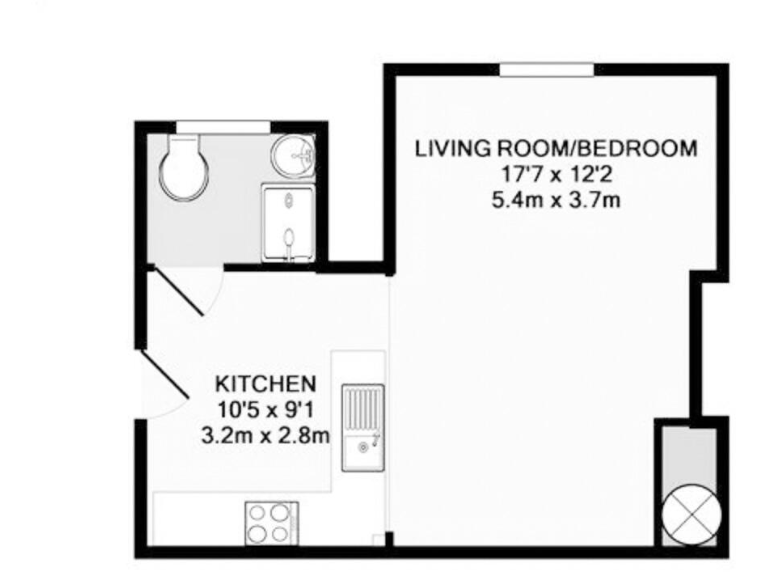

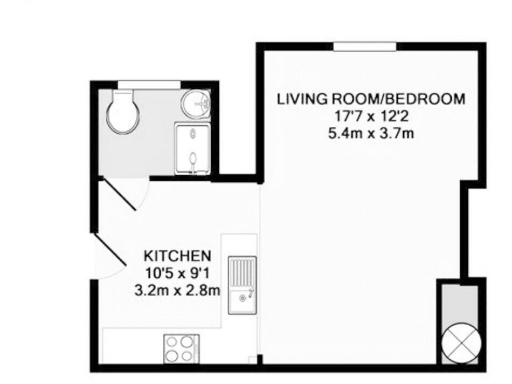

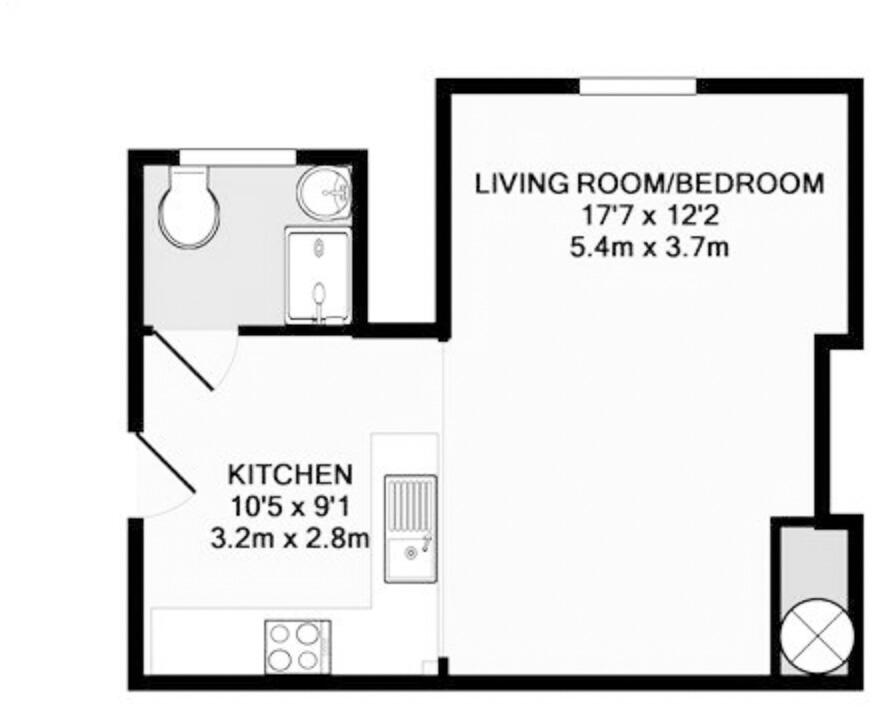

A compact studio flat in The Royal, Wilton Place, presented with a long-term tenant in situ—designed for buy-to-let investors seeking immediate income. The current gross rent is £9,540 pa with potential to reach about £11,400 pa at market rate, offering an attractive yield relative to the £90,000 asking price. The flat is well-maintained with a modern kitchen, contemporary living area and neutral finishes, ready for continued rental occupation.

Practical strengths include a 99-year lease, fast broadband and excellent mobile signal—important for professional tenants and short-term lettings. The building provides on-site parking and sits close to transport links, shops and city-centre amenities, making it easy to let to students, commuters and working professionals.

Buyers should note material facts: the property is leasehold, small at approximately 309 sq ft and located in a very deprived area (which can affect long-term capital growth). A Buyer's Premium applies on sale, and the property is marketed specifically as an investment with a tenancy in place, so any purchaser will take on the existing tenancy arrangements.

This is a straightforward, low-management investment for a buyer seeking immediate rental income and modest upside through re-letting at market rates. It will suit investors or developers focused on city-centre rental returns rather than an owner-occupier seeking long-term personal living space.

Studio flat for sale in Chester Road, Manchester, M16 — £115,000 • 1 bed • 1 bath

Studio flat for sale in Chester Road, Manchester, M16 — £115,000 • 1 bed • 1 bath 1 bedroom flat for sale in John William Street, Manchester, M30 — £120,000 • 1 bed • 1 bath • 441 ft²

1 bedroom flat for sale in John William Street, Manchester, M30 — £120,000 • 1 bed • 1 bath • 441 ft² 1 bedroom flat for sale in Talbot Road, Manchester, M16 — £110,000 • 1 bed • 1 bath • 409 ft²

1 bedroom flat for sale in Talbot Road, Manchester, M16 — £110,000 • 1 bed • 1 bath • 409 ft² 1 bedroom flat for sale in Taylorson Street South, Manchester, M5 — £85,000 • 1 bed • 1 bath • 700 ft²

1 bedroom flat for sale in Taylorson Street South, Manchester, M5 — £85,000 • 1 bed • 1 bath • 700 ft² Studio flat for sale in Clippers Quay, Manchester, M50 — £85,000 • 1 bed • 1 bath • 355 ft²

Studio flat for sale in Clippers Quay, Manchester, M50 — £85,000 • 1 bed • 1 bath • 355 ft² 1 bedroom flat for sale in Lord Street, Manchester, M4 — £170,000 • 1 bed • 1 bath • 535 ft²

1 bedroom flat for sale in Lord Street, Manchester, M4 — £170,000 • 1 bed • 1 bath • 535 ft²