Summary - 17 BRUNTONS MANOR COURT MIDDLESBROUGH TS3 8RP

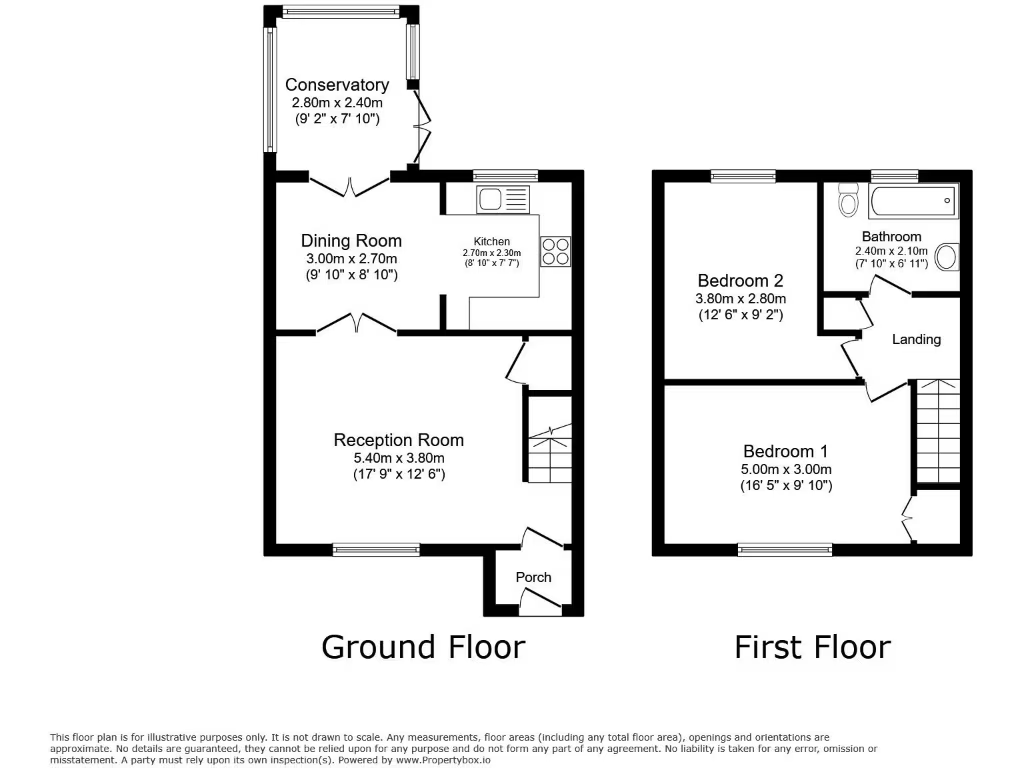

2 bed 1 bath Semi-Detached

Ready-income property with clear rent-upside for committed investors.

2-bed semi-detached with driveway, small front garden and patio

Long-term tenant in situ; consistent rental payments reported

Current gross income £5,520pa; estimated market rent £10,200pa

Leasehold tenure — check lease length and service/ground rent

Solar panels fitted; property described as well maintained

Located in a very deprived area with high recorded crime levels

Buyer’s Premium applies to sale — budget for additional purchase costs

Fast broadband and excellent mobile signal; no flood risk

This two-bedroom semi-detached house in TS3 presents a clear buy-to-let prospect for investors seeking immediate income and upside. The property is well maintained, features solar panels, a driveway and small front garden, and currently houses a long-term tenant who has consistently paid rent. The current gross income is £5,520 per year with evidence suggesting a market rent nearer £10,200 — offering scope to increase returns after review.

Important practical details: the property is leasehold, sits in an area classed as very deprived with high recorded crime levels, and a buyer’s premium will apply to the sale. The sitting tenants do not intend to leave, so a purchaser should be prepared to take the property with tenancy in place and to manage a tenancy transfer or potential rent uplift within that constraint.

For investors, strengths are immediate rental income, low maintenance presentation and transport/broadband connectivity. Material negatives are the location’s socioeconomic challenges, the leasehold tenure and the existing tenancy limiting vacant-possession options. Review the Let Property Pack and tenancy paperwork before offer to confirm rent review potential, leasehold terms and any fees associated with the sale.

2 bedroom terraced house for sale in St. Barnabas Road, Middlesbrough, North Yorkshire, TS5 — £110,000 • 2 bed • 1 bath • 1023 ft²

2 bedroom terraced house for sale in St. Barnabas Road, Middlesbrough, North Yorkshire, TS5 — £110,000 • 2 bed • 1 bath • 1023 ft² 2 bedroom terraced house for sale in Ryedale Street, Middlesbrough, North Yorkshire, TS3 — £60,000 • 2 bed • 1 bath • 721 ft²

2 bedroom terraced house for sale in Ryedale Street, Middlesbrough, North Yorkshire, TS3 — £60,000 • 2 bed • 1 bath • 721 ft² 3 bedroom semi-detached house for sale in Repton Avenue, Stockton-On-Tees, TS19 — £105,000 • 3 bed • 1 bath • 496 ft²

3 bedroom semi-detached house for sale in Repton Avenue, Stockton-On-Tees, TS19 — £105,000 • 3 bed • 1 bath • 496 ft² 3 bedroom semi-detached house for sale in Deal Close, Stockton-On-Tees, Durham, TS19 — £87,000 • 3 bed • 1 bath • 958 ft²

3 bedroom semi-detached house for sale in Deal Close, Stockton-On-Tees, Durham, TS19 — £87,000 • 3 bed • 1 bath • 958 ft² 3 bedroom semi-detached house for sale in Langridge Crescent, Middlesbrough, TS3 — £98,000 • 3 bed • 1 bath • 936 ft²

3 bedroom semi-detached house for sale in Langridge Crescent, Middlesbrough, TS3 — £98,000 • 3 bed • 1 bath • 936 ft² 3 bedroom house for sale in Chippenham Road, Middlesbrough, TS4 — £110,000 • 3 bed • 1 bath • 948 ft²

3 bedroom house for sale in Chippenham Road, Middlesbrough, TS4 — £110,000 • 3 bed • 1 bath • 948 ft²