Summary - No.1 Old Trafford, 4 Wharf End, Trafford Park, Manchester, M17 M17 1LD

1 bed 1 bath Apartment

High-yield modern one-bed with concierge, long lease and stunning Quays views.

17th-floor apartment with wide, panoramic city and Quays views

Let from Feb 2025 at £1,300pcm — immediate rental income

Indicative gross yield ~8.2% at asking price £190,000

Modern 2020 build with concierge and communal roof terrace

Long lease (~246 years) and peppercorn ground rent

Heating: electric room heaters — potentially higher running costs

Car space available via building, charged separately £80pcm

Cladding tested; no works required noted — buyer should verify

This 17th-floor one-bedroom apartment in No.1 Old Trafford offers clear investor appeal: modern 2020 build, far-reaching views, on-site concierge and communal roof terrace. The property is currently let from February 2025 at £1,300pcm, producing strong immediate income and giving an indicative gross yield of around 8.2% at the asking price of £190,000. The long lease (approximately 246 years) and peppercorn ground rent make future sales straightforward for buy-to-let or later resale.

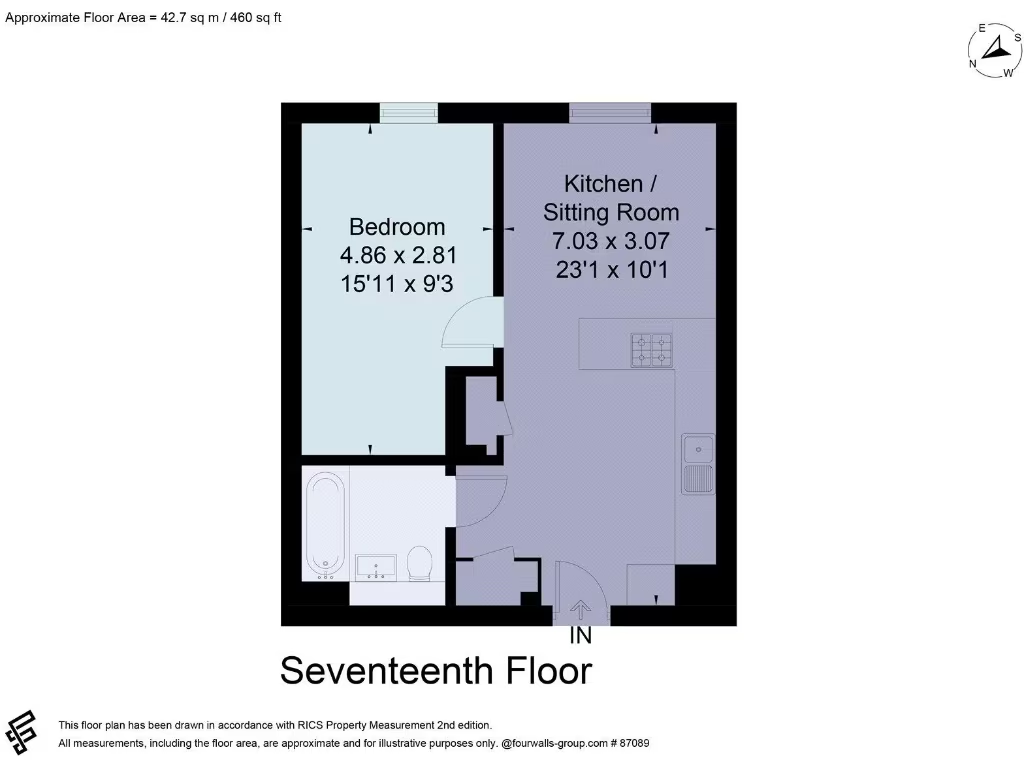

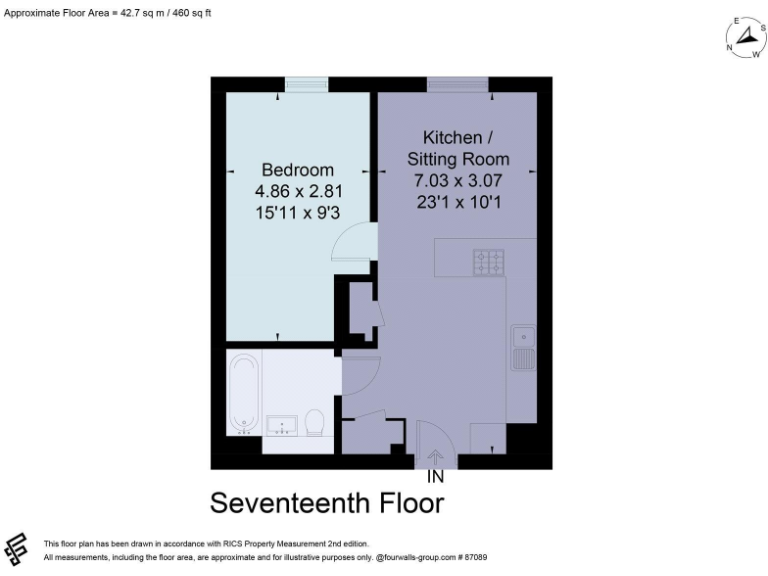

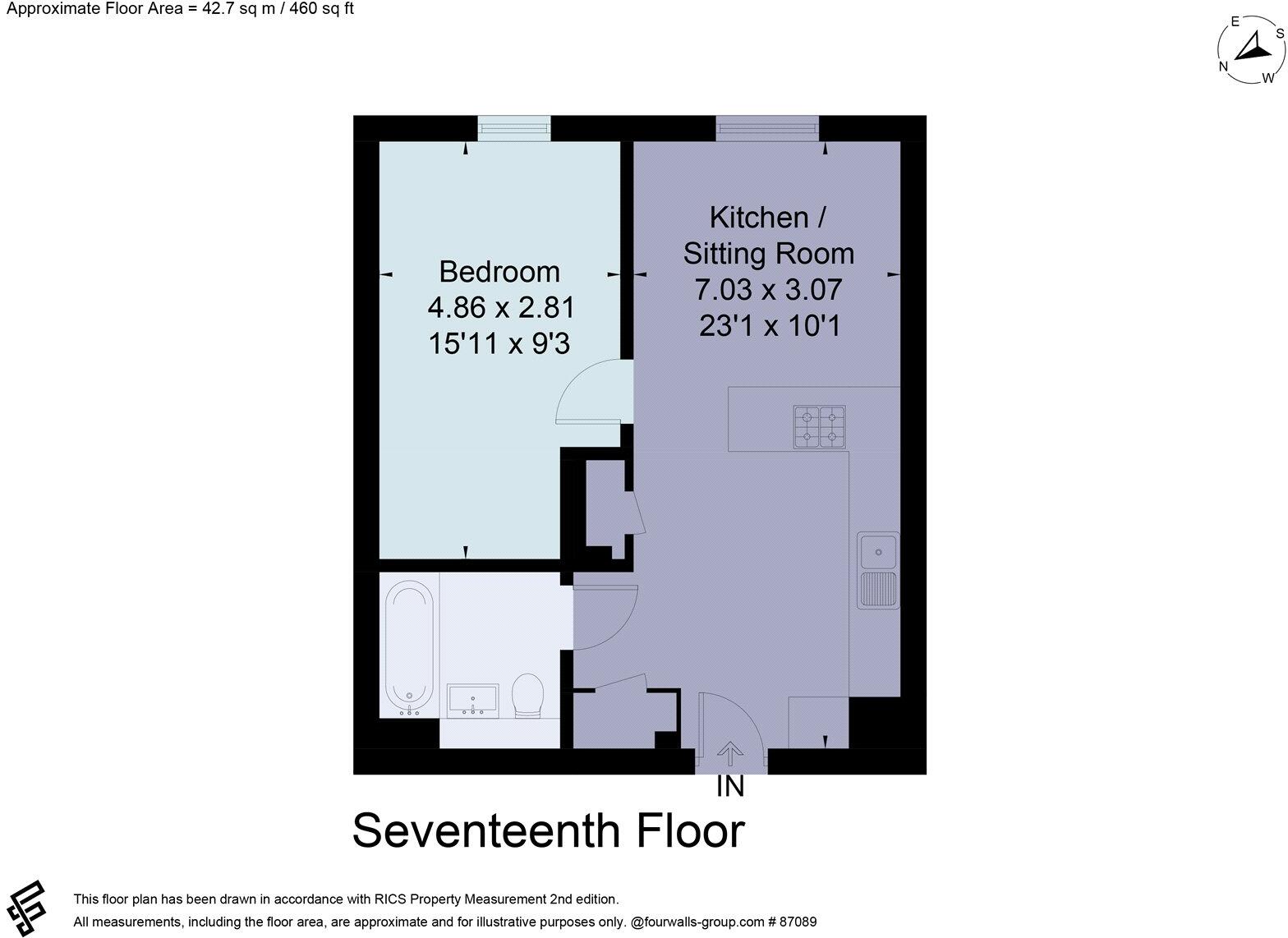

The interior is a compact, well-lit 460 sq ft layout with open-plan living/kitchen, a good-sized bedroom and a three-piece bathroom. Built-in kitchen appliances are included; heating is electric via room heaters so running costs can be higher than gas-heated homes — an important factor for future tenants or owner-occupiers. EPC rating C is reasonable for a modern apartment but not best-in-class.

Practical considerations are stated clearly: the flat has been tested for external wall systems and no remedial works were required at the time of testing, but buyers should make their own enquiries about cladding and any interim measures. The current tenancy includes a separately charged car space arranged through the building (£80pcm), and the tenancy contains a six-month break clause which could affect vacant possession timing.

Location-wise the development is well-connected: Exchange Quay tram stop and White City retail are within short distances, and Salford Quays/MediaCity is nearby for leisure and commuting. Low local crime, fast broadband and plentiful amenities support lettability. Overall, this is a turn-key income property with strong immediate yield and manageable, transparent risks — suitable for buy-to-let investors who understand electric heating running costs and the tenancy break clause.

1 bedroom apartment for sale in 4 Wharf End, Trafford Park, Manchester, M17 — £182,500 • 1 bed • 1 bath • 468 ft²

1 bedroom apartment for sale in 4 Wharf End, Trafford Park, Manchester, M17 — £182,500 • 1 bed • 1 bath • 468 ft² 1 bedroom apartment for sale in Wharf End, Trafford Park, Manchester, M17 — £150,000 • 1 bed • 1 bath • 449 ft²

1 bedroom apartment for sale in Wharf End, Trafford Park, Manchester, M17 — £150,000 • 1 bed • 1 bath • 449 ft² 2 bedroom apartment for sale in 4 Wharf End, Trafford Park, Manchester, Lancashire, M17 — £214,500 • 2 bed • 2 bath • 670 ft²

2 bedroom apartment for sale in 4 Wharf End, Trafford Park, Manchester, Lancashire, M17 — £214,500 • 2 bed • 2 bath • 670 ft² 1 bedroom apartment for sale in Wharf End, Trafford Park, Manchester, M17 — £190,000 • 1 bed • 1 bath • 452 ft²

1 bedroom apartment for sale in Wharf End, Trafford Park, Manchester, M17 — £190,000 • 1 bed • 1 bath • 452 ft² 1 bedroom apartment for sale in Wharf End, Trafford Park, Manchester, M17 — £180,000 • 1 bed • 1 bath • 473 ft²

1 bedroom apartment for sale in Wharf End, Trafford Park, Manchester, M17 — £180,000 • 1 bed • 1 bath • 473 ft² 2 bedroom flat for sale in Media City, Michigan Point Tower A, 9 Michigan Avenue, Salford, Salford, M50 — £185,000 • 2 bed • 2 bath • 660 ft²

2 bedroom flat for sale in Media City, Michigan Point Tower A, 9 Michigan Avenue, Salford, Salford, M50 — £185,000 • 2 bed • 2 bath • 660 ft²