Summary - HATTON PLACE, 118 FLAT 76 MIDLAND ROAD LUTON LU2 0FD

2 bed 2 bath Flat

Strong gross yield with long-term tenant and two bathrooms.

Private underground parking included

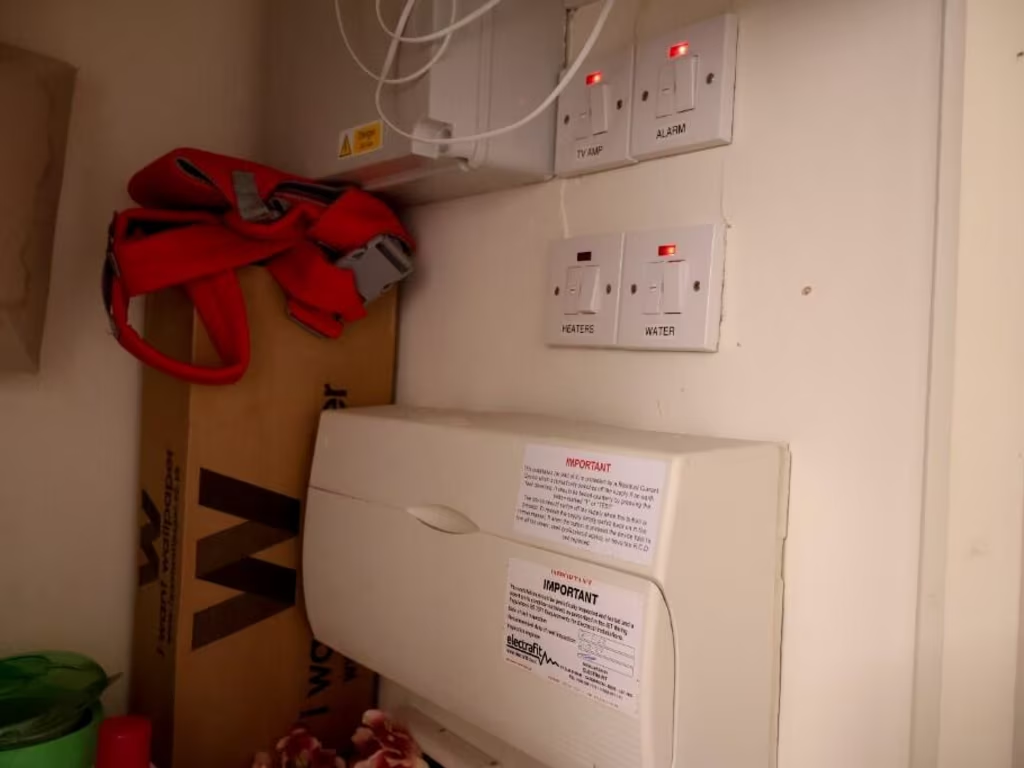

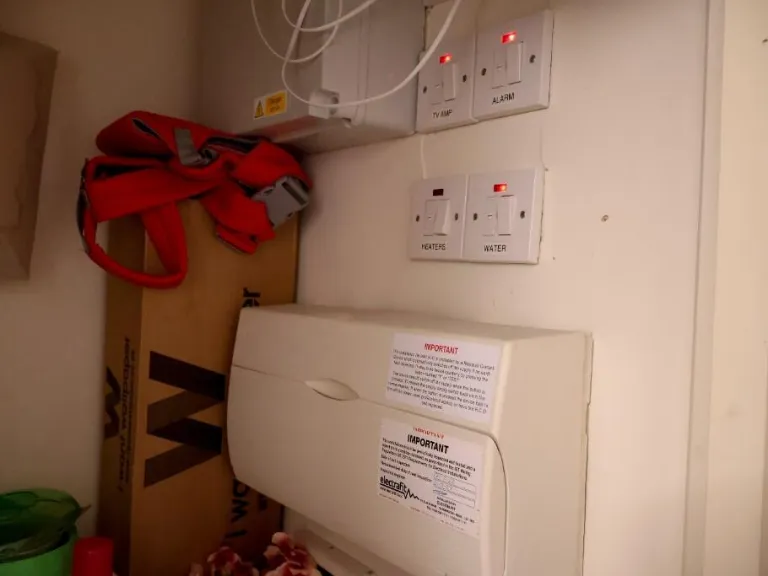

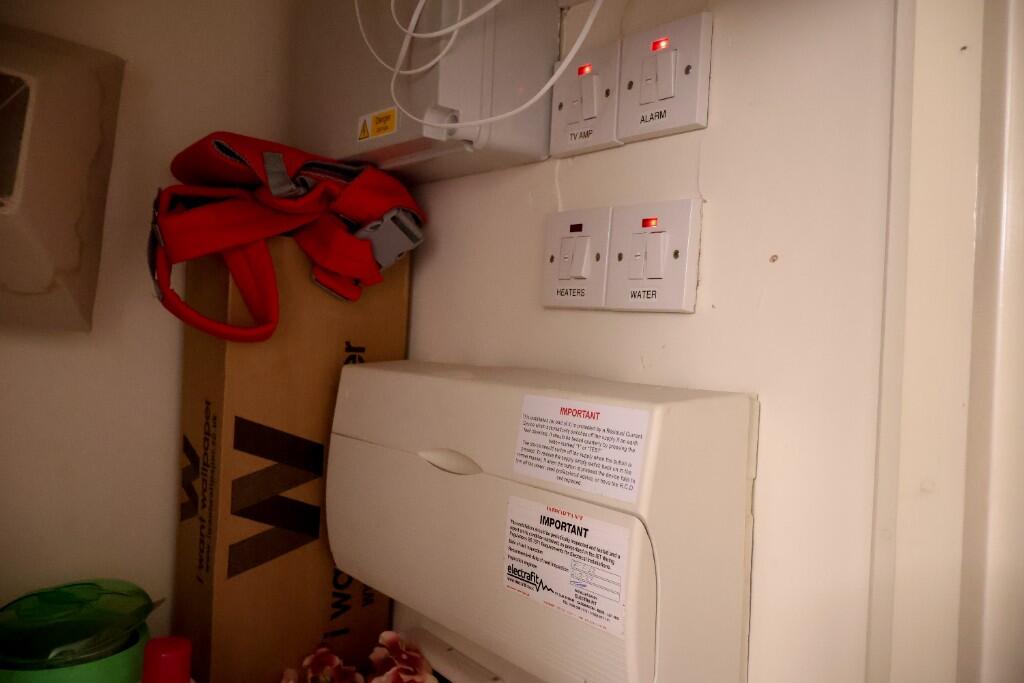

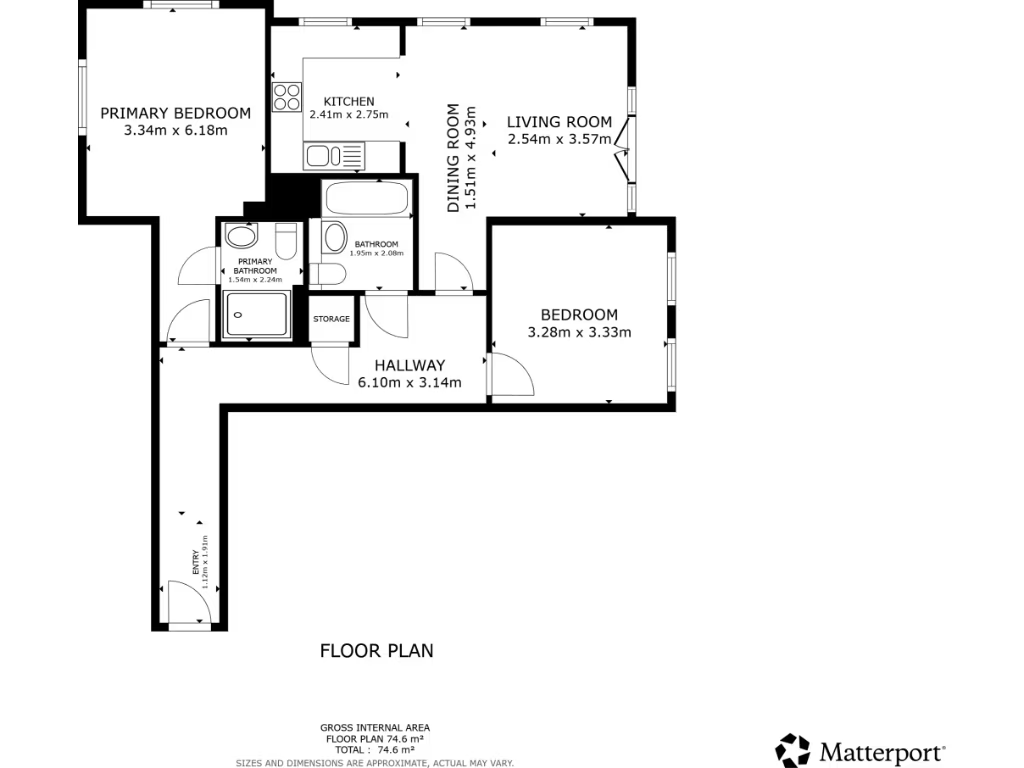

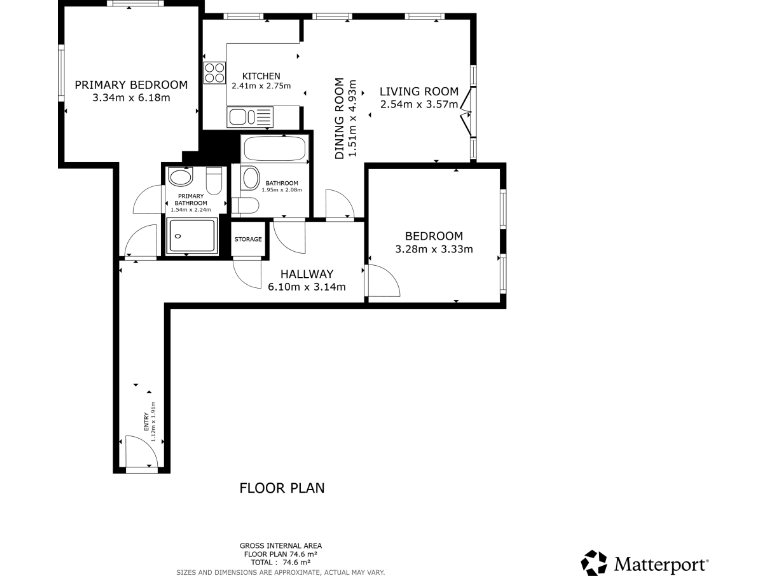

A two-bedroom apartment in a converted brick building on Midland Road, presented as a straightforward investment opportunity. The flat includes an open-plan lounge and kitchen, two bathrooms (one ensuite), private underground parking and an average overall size of about 840 sq ft. It currently produces £14,400 pa in gross income, giving a strong gross yield of about 7.9% at the listed price.

The property is leasehold and has a long-term tenant in situ who intends to remain, so buyers should expect no immediate vacant possession. The unit is well suited to investors seeking an income-producing addition to a portfolio and to developers exploring medium-term asset management or rent review potential. The building’s industrial conversion character and high ceilings add appeal to renters in this market.

Notable practical points: the area is classified as very deprived which can affect capital-growth prospects and tenant profiles, and there is no private garden — outdoor space is communal or street-facing. A buyer’s premium will apply on purchase; lease terms, service charges and the Let Property Pack should be reviewed carefully before offer. Overall, this is a clear income asset for a buyer focused on yield rather than immediate owner-occupation.

3 bedroom apartment for sale in Buy to Let Luton Flat, LU1 — £424,950 • 3 bed • 3 bath

3 bedroom apartment for sale in Buy to Let Luton Flat, LU1 — £424,950 • 3 bed • 3 bath 2 bedroom apartment for sale in Buy to Let Luton Flat, LU1 — £374,950 • 2 bed • 2 bath

2 bedroom apartment for sale in Buy to Let Luton Flat, LU1 — £374,950 • 2 bed • 2 bath 1 bedroom apartment for sale in Buy to Let Luton Flat, LU1 — £149,950 • 1 bed • 1 bath

1 bedroom apartment for sale in Buy to Let Luton Flat, LU1 — £149,950 • 1 bed • 1 bath 2 bedroom apartment for sale in Buy to Let Luton Flat, LU1 — £449,950 • 2 bed • 2 bath

2 bedroom apartment for sale in Buy to Let Luton Flat, LU1 — £449,950 • 2 bed • 2 bath 2 bedroom apartment for sale in Mill Street, Luton, LU1 — £180,000 • 2 bed • 2 bath • 427 ft²

2 bedroom apartment for sale in Mill Street, Luton, LU1 — £180,000 • 2 bed • 2 bath • 427 ft² 2 bedroom apartment for sale in Buy to Let Luton Flat, LU1 — £325,000 • 2 bed • 2 bath

2 bedroom apartment for sale in Buy to Let Luton Flat, LU1 — £325,000 • 2 bed • 2 bath