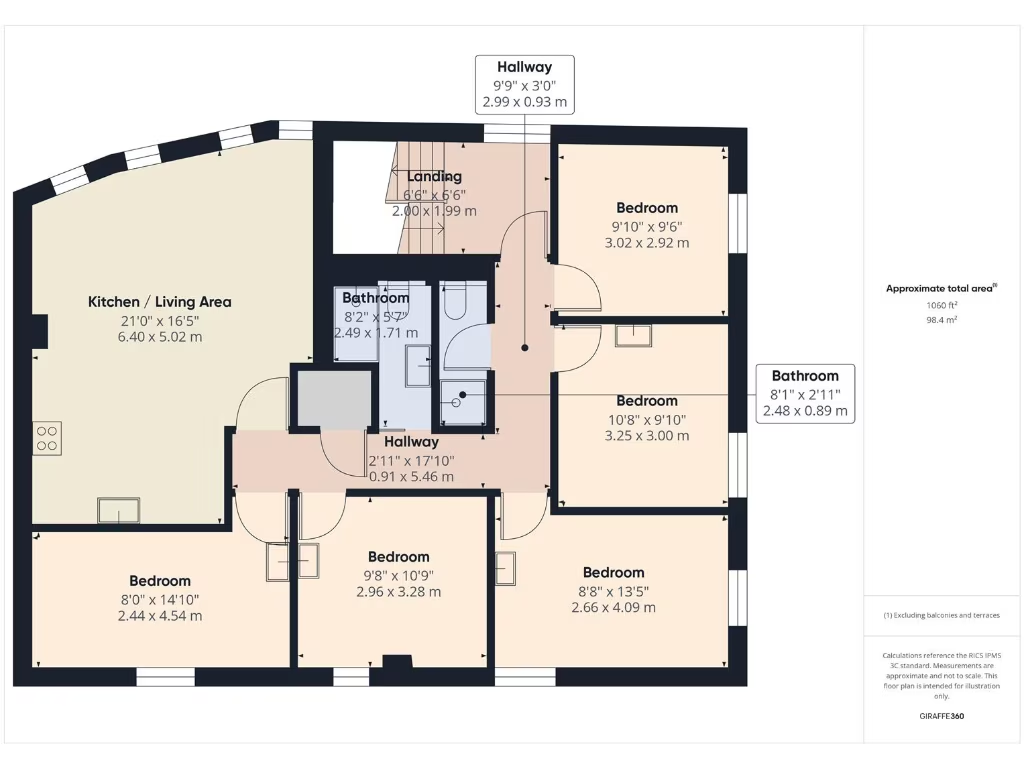

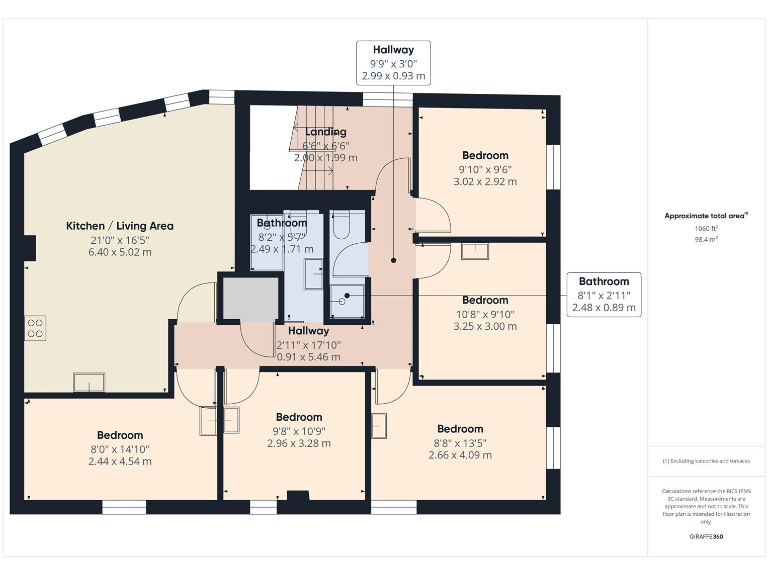

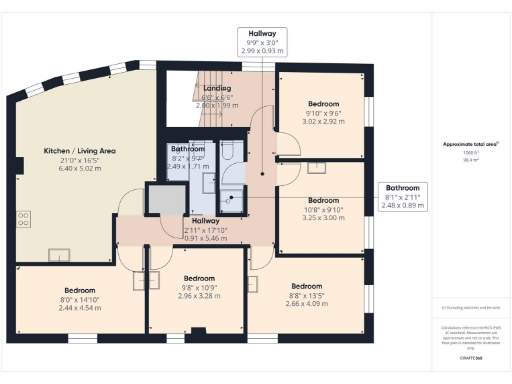

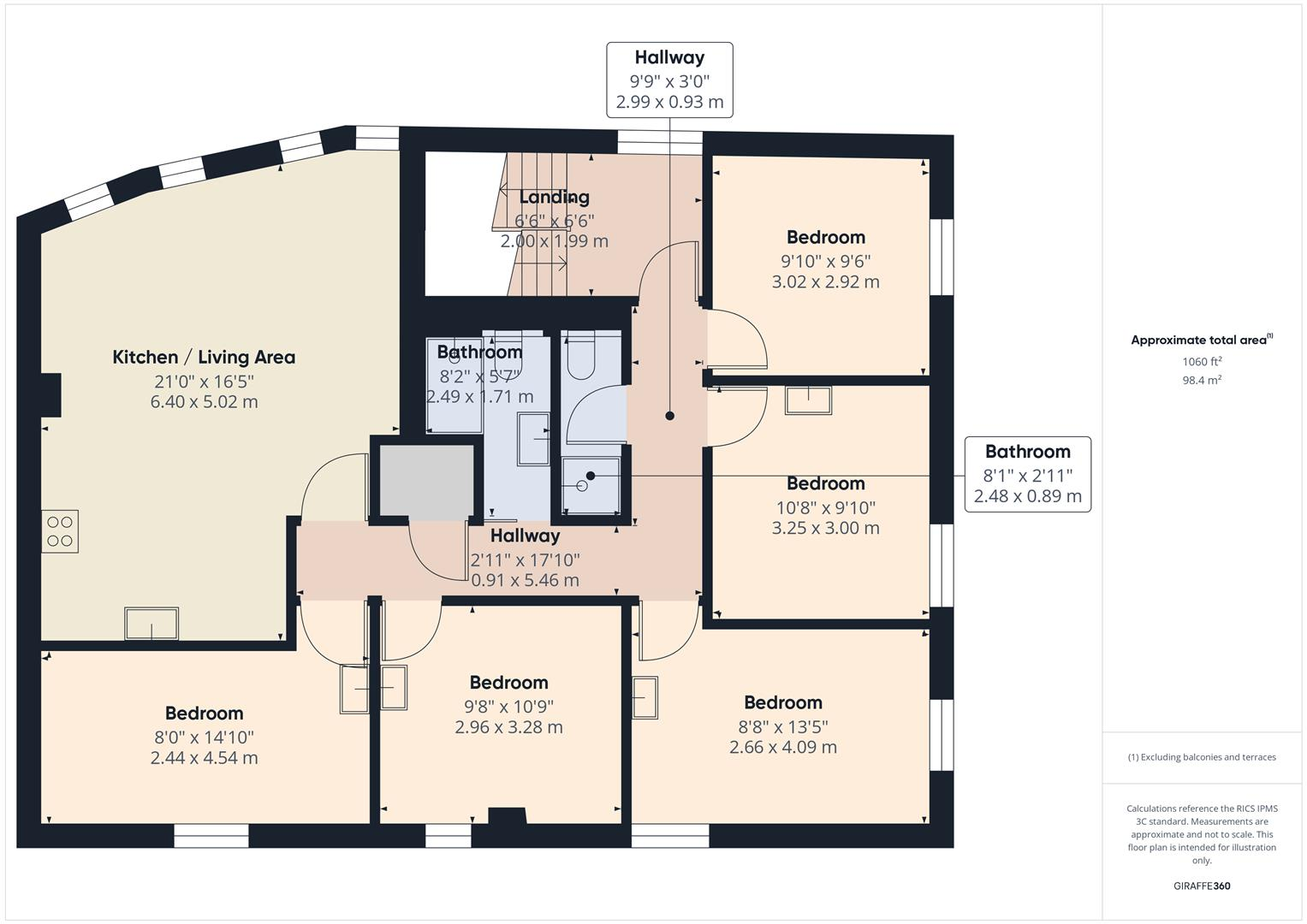

Summary - Flat 1, 3-5, Damside Street LA1 1PD

5 bed 2 bath Apartment

Turnkey student income with long lease and portfolio potential.

Licensed HMO with five letting bedrooms and two shower rooms

Let for 2025/2026 at £120 PPPW — projected gross £28,800 pa

Chain-free sale; furniture and white goods included

979 years remaining on lease; possible to buy a share of freehold

Option to purchase together with the property above (portfolio potential)

Electric room heaters only — higher running costs likely

Small overall flat size; compact rooms and low ceilings

Very high local crime classification — impacts insurance and screening

A ready-made, income-producing licensed HMO in the heart of Lancaster, offered chain-free and with a very long lease. The flat benefits from a consistent letting history and is currently let for the 2025/2026 academic year at 5 x £120 PPPW, projecting gross annual income of £28,800. Furniture and white goods are included, making the property turn-key for landlords.

Practicalities favour investors: a valid HMO licence is in place (a new owner must reapply), EICR and gas safety certificates exist, and there is the option to buy a share of the freehold or purchase alongside the property above to expand a portfolio. The building is traditional stone externally while the interior presents a modern, compact layout with an open-plan kitchen/lounge and two shower rooms.

Notable considerations are the property's small overall size and electric-only heating using room heaters, which can increase running costs compared with gas. The location sits within a very high crime area classification — important for insurer quotations and tenant screening. Broadband speeds are average and there is no private outdoor space.

This is best suited to investors targeting student lets or short-term city-centre rentals who want immediate income, minimal voids and low management setup time. The combination of long lease, established tenancy and furnished sale makes it a pragmatic, future-proof addition to a rental portfolio, provided buyers factor in heating costs and local area risk.

4 bedroom apartment for sale in Damside Street, Lancaster, LA1 — £265,000 • 4 bed • 2 bath • 1130 ft²

4 bedroom apartment for sale in Damside Street, Lancaster, LA1 — £265,000 • 4 bed • 2 bath • 1130 ft² Commercial property for sale in Cable Street, Lancaster, Lancashire, LA1 1HD, LA1 — £400,000 • 1 bed • 1 bath • 2116 ft²

Commercial property for sale in Cable Street, Lancaster, Lancashire, LA1 1HD, LA1 — £400,000 • 1 bed • 1 bath • 2116 ft² 8 bedroom terraced house for sale in Cable Street, Lancaster, LA1 — £400,000 • 8 bed • 3 bath • 2115 ft²

8 bedroom terraced house for sale in Cable Street, Lancaster, LA1 — £400,000 • 8 bed • 3 bath • 2115 ft² 5 bedroom terraced house for sale in St. Oswald Street, Lancaster, LA1 — £300,000 • 5 bed • 2 bath • 1059 ft²

5 bedroom terraced house for sale in St. Oswald Street, Lancaster, LA1 — £300,000 • 5 bed • 2 bath • 1059 ft² Commercial property for sale in Blades Street, Lancaster, Lancashire, LA1 1TT, LA1 — £400,000 • 1 bed • 1 bath • 2117 ft²

Commercial property for sale in Blades Street, Lancaster, Lancashire, LA1 1TT, LA1 — £400,000 • 1 bed • 1 bath • 2117 ft² 8 bedroom terraced house for sale in Blades Street, Lancaster, LA1 — £400,000 • 8 bed • 2 bath • 2117 ft²

8 bedroom terraced house for sale in Blades Street, Lancaster, LA1 — £400,000 • 8 bed • 2 bath • 2117 ft²