Summary -

75a, Leicester Road,Mountsorrel,LOUGHBOROUGH,LE12 7AJ

LE12 7AJ

2 bed 1 bath Flat

Freehold buy-to-let with sitting tenant and immediate income.

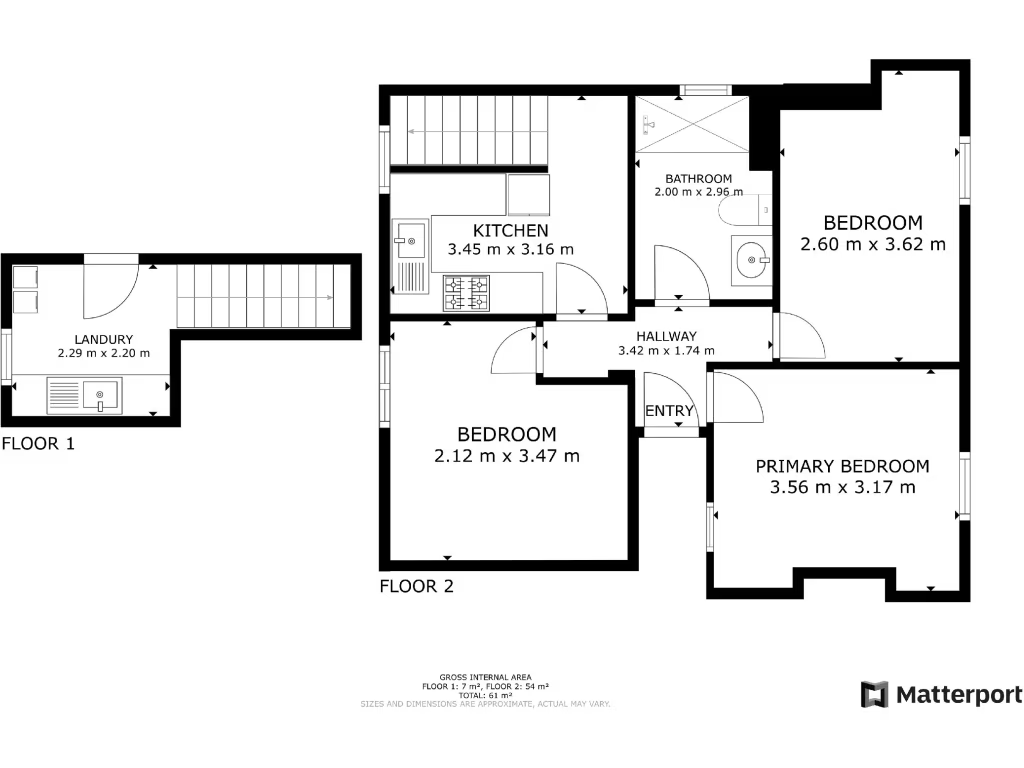

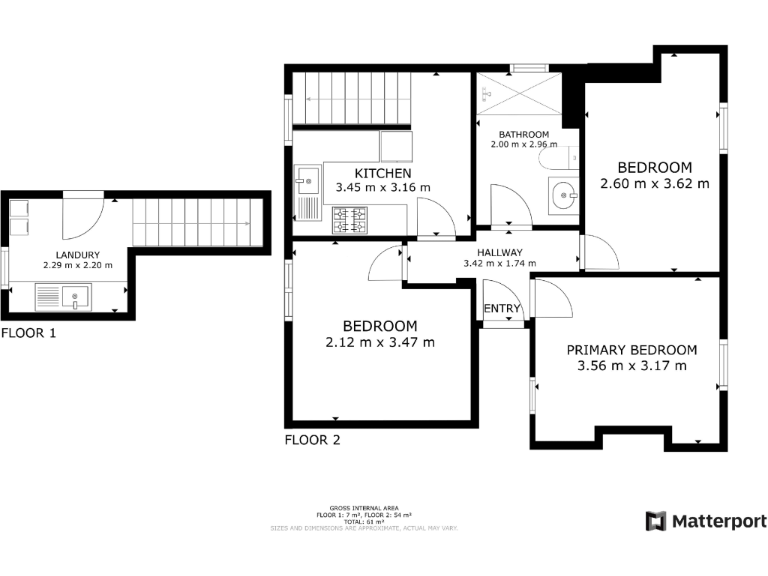

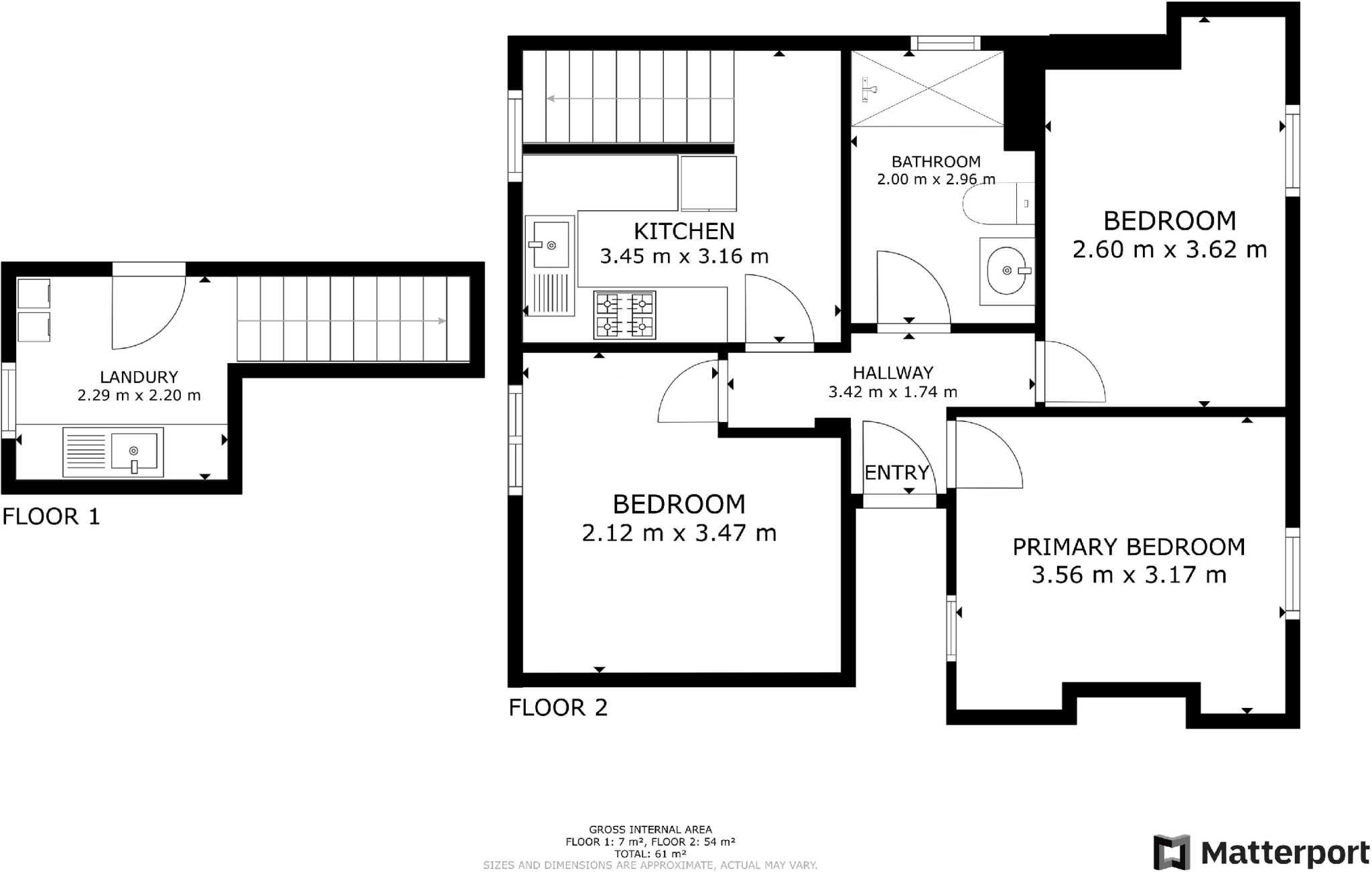

Freehold two-bedroom flat, approx. 667 sq ft

A two-bedroom flat within a Victorian mixed-use building on Leicester Road, offered freehold with a long-standing sitting tenant. The property produces a reported gross annual income of £8,220 and will appeal to buyers seeking immediate rental income and a straightforward addition to a buy-to-let portfolio.

Accommodation includes two bedrooms, a living room, kitchen and a three-piece bathroom across approximately 667 sq ft. On-street parking serves the property; broadband and mobile signals are average. The building sits on a main road with ground-floor commercial premises, so any changes to use or layout may require planning consent.

Key strengths are immediate rental income, freehold tenure and proximity to local amenities and schools. Notable considerations: the area records above-average crime, the tenant intends to remain in situ, a buyer’s premium applies to the sale process, and refurbishment potential should be assessed before purchase. Investors should review the Let Property Pack and tenancy documentation before committing.

2 bedroom flat for sale in Jordean Court, Brook Street, Sileby, LE12 — £100,000 • 2 bed • 1 bath • 527 ft²

2 bedroom flat for sale in Jordean Court, Brook Street, Sileby, LE12 — £100,000 • 2 bed • 1 bath • 527 ft² 2 bedroom flat for sale in Bath Lane, Leicester, LE3 — £167,580 • 2 bed • 1 bath • 764 ft²

2 bedroom flat for sale in Bath Lane, Leicester, LE3 — £167,580 • 2 bed • 1 bath • 764 ft² 2 bedroom end of terrace house for sale in Woodgate, Loughborough, Leicestershire, LE11 — £111,000 • 2 bed • 1 bath • 563 ft²

2 bedroom end of terrace house for sale in Woodgate, Loughborough, Leicestershire, LE11 — £111,000 • 2 bed • 1 bath • 563 ft² 2 bedroom flat for sale in Lombardy Rise, Leicester, LE5 — £135,000 • 2 bed • 1 bath • 517 ft²

2 bedroom flat for sale in Lombardy Rise, Leicester, LE5 — £135,000 • 2 bed • 1 bath • 517 ft² 2 bedroom flat for sale in Pavilion Close, Leicester, Leicestershire, LE2 — £145,000 • 2 bed • 2 bath • 657 ft²

2 bedroom flat for sale in Pavilion Close, Leicester, Leicestershire, LE2 — £145,000 • 2 bed • 2 bath • 657 ft² 2 bedroom flat for sale in Watkin Road, Leicester, Leicestershire, LE2 — £124,852 • 2 bed • 2 bath • 624 ft²

2 bedroom flat for sale in Watkin Road, Leicester, Leicestershire, LE2 — £124,852 • 2 bed • 2 bath • 624 ft²