Summary - 38, Mulgrave Road TS26 8EB

4 bed 1 bath Terraced

Compact freehold with strong yield upside after refurbishment.

- Three self-contained flats: one 2-bed and two studios

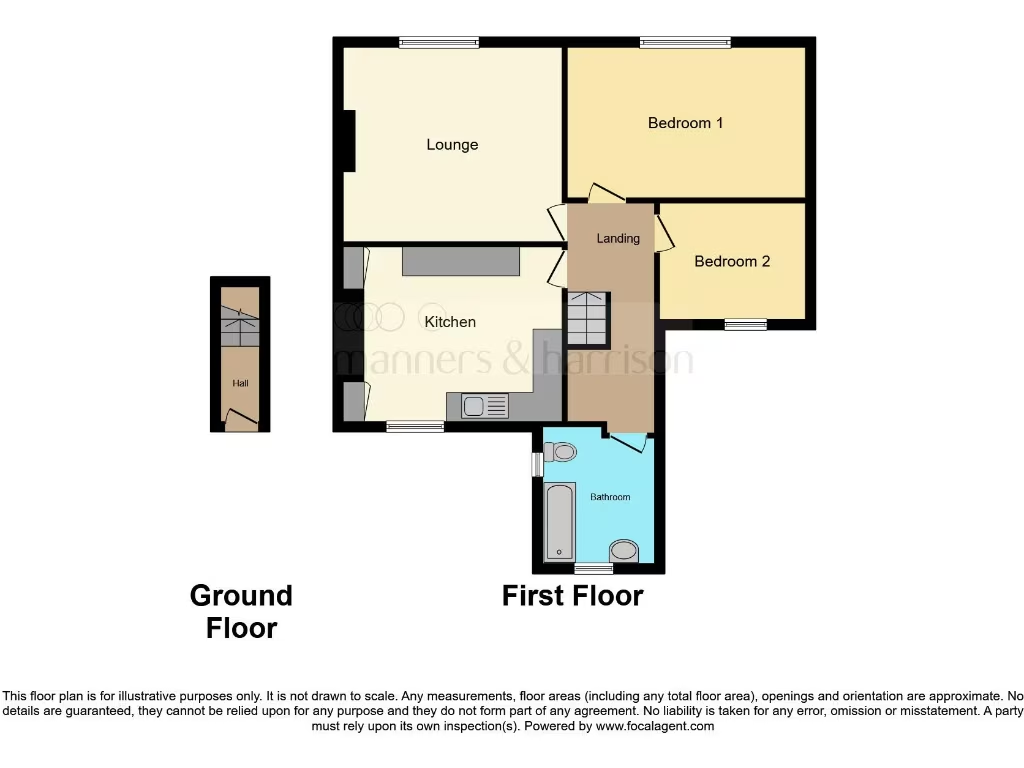

A compact end-terrace converted into three self-contained flats, offered freehold at a competitive price. The building comprises one two-bed flat and two studios, two of which currently produce rental income; the third studio is vacant and requires refurbishment. Estimated post-refurb annual rental (using Local Housing Allowance) is approximately £14,851, with current income around £678 pcm from the two let units.

The property needs renovation: one vacant unit requires works, overall EPCs are low (E and F for two units), and the original solid brick walls likely lack modern insulation. Heating is mains gas with a boiler and radiators; glazing is double but installation date is unknown. These are straightforward upgrade areas that can materially increase rents and energy performance.

Located in a deprived, blue-collar terrace area of Hartlepool (TS26), the building benefits from fast broadband, excellent mobile signal and proximity to local shops and several primary and secondary schools—useful for lettings to workers or students. Council tax is very cheap and tenure is freehold, simplifying long-term ownership and repositioning as a high-yield rental asset.

This is a clear buy-to-let play for an investor prepared to carry short-term voids and complete modest refurbishment works to improve EPC, warmth and layout. Expect durable yields after investment, but allow budget for remedial works, energy improvements and standard compliance checks prior to re-letting.

3 bedroom flat for sale in Wynyard Mews, Hartlepool, TS25 — £40,000 • 3 bed • 1 bath • 732 ft²

3 bedroom flat for sale in Wynyard Mews, Hartlepool, TS25 — £40,000 • 3 bed • 1 bath • 732 ft² 5 bedroom terraced house for sale in Avenue Road, Hartlepool, TS24 — £60,000 • 5 bed • 1 bath • 1852 ft²

5 bedroom terraced house for sale in Avenue Road, Hartlepool, TS24 — £60,000 • 5 bed • 1 bath • 1852 ft² 2 bedroom flat for sale in Church Street, Hartlepool, TS24 — £42,000 • 2 bed • 1 bath • 675 ft²

2 bedroom flat for sale in Church Street, Hartlepool, TS24 — £42,000 • 2 bed • 1 bath • 675 ft² 3 bedroom semi-detached house for sale in Chester Road, Hartlepool, TS24 — £77,500 • 3 bed • 1 bath • 872 ft²

3 bedroom semi-detached house for sale in Chester Road, Hartlepool, TS24 — £77,500 • 3 bed • 1 bath • 872 ft² 5 bedroom property for sale in Sydenham Road, Hartlepool, Hartlepool, TS25 1QB, TS25 — £80,000 • 5 bed • 2 bath • 1486 ft²

5 bedroom property for sale in Sydenham Road, Hartlepool, Hartlepool, TS25 1QB, TS25 — £80,000 • 5 bed • 2 bath • 1486 ft² 3 bedroom terraced house for sale in Mulgrave Road, Hartlepool, TS26 — £58,000 • 3 bed • 1 bath • 1163 ft²

3 bedroom terraced house for sale in Mulgrave Road, Hartlepool, TS26 — £58,000 • 3 bed • 1 bath • 1163 ft²