Summary -

Apartment 208,3, Stanhope Street,LIVERPOOL,L8 5TE

L8 5TE

2 bed 1 bath Flat

Ready-let two-bed investment with reliable low-maintenance rental income.

Long-term tenant producing £12,000 gross annual income

A straightforward buy-to-let in Liverpool L8, this two-bedroom flat is offered with a long-term tenant already in situ, producing £12,000 gross per year. The apartment sits in a contemporary mid-rise block close to local amenities, transport links and student hubs — making it attractive to investors targeting steady rental returns and minimal hands-on management.

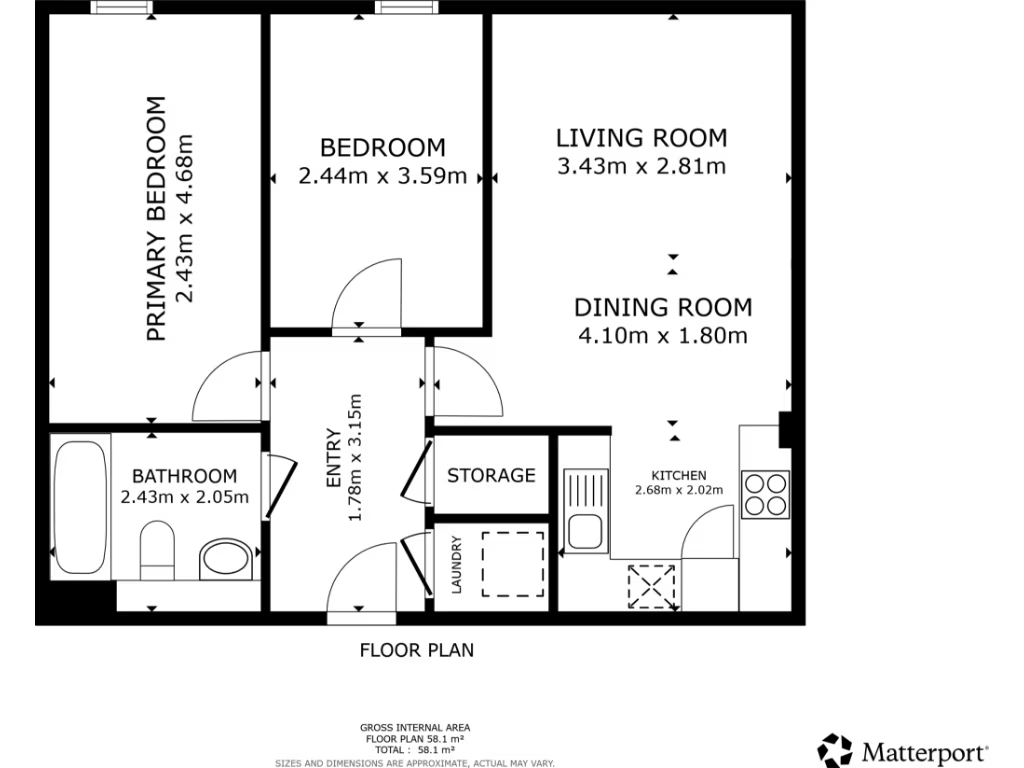

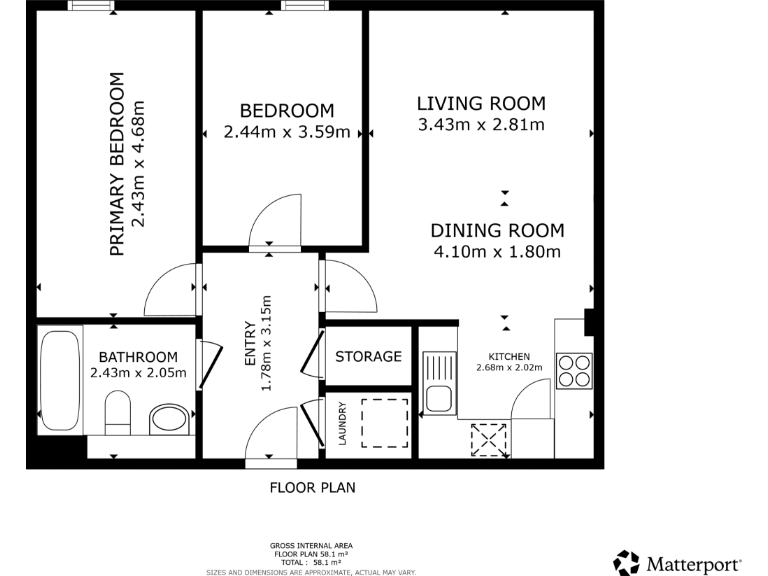

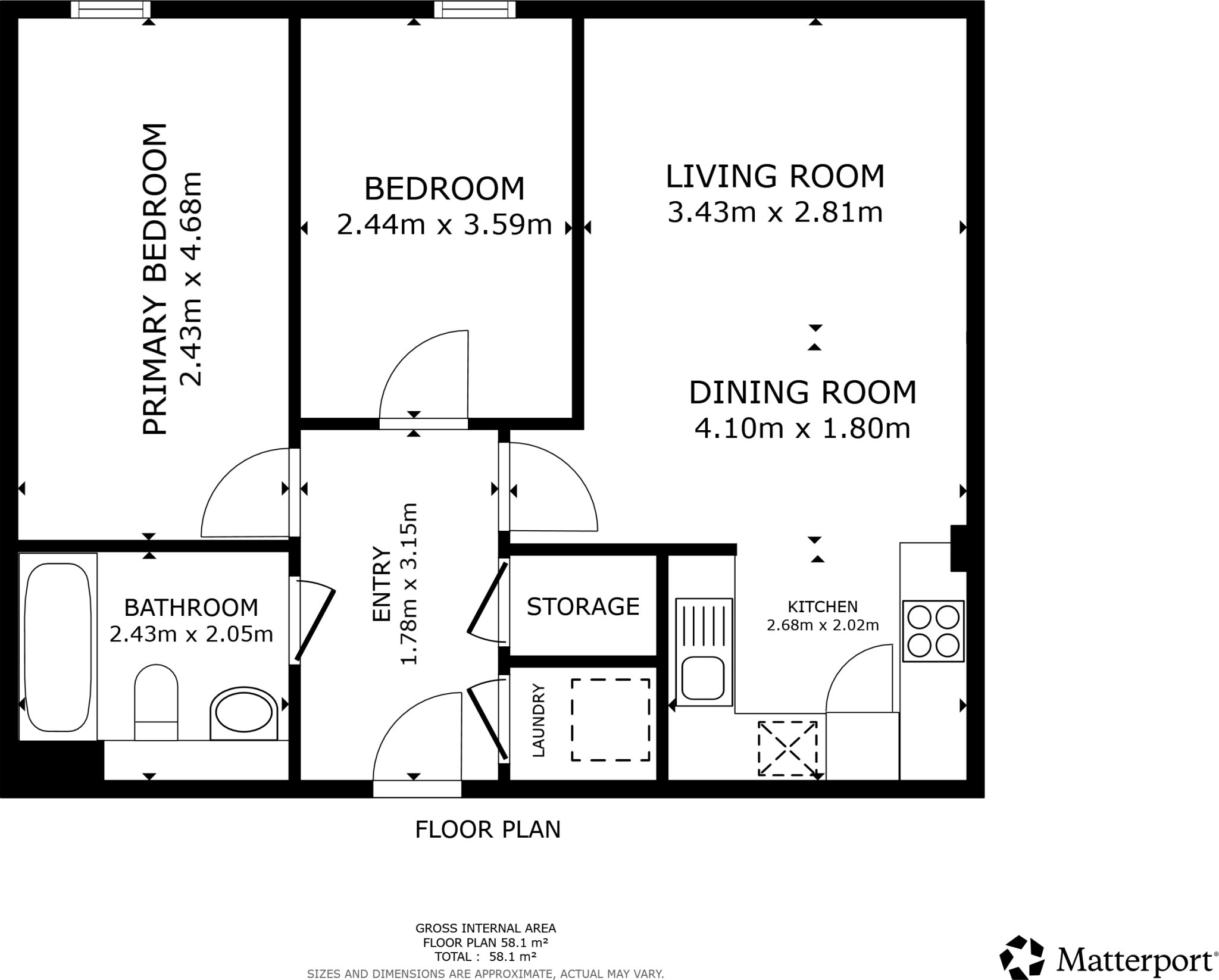

Internally the property provides an open-plan lounge/dining area, a fitted kitchen, two bedrooms, a three-piece bathroom and a small storage cupboard. The apartment is described as average-sized (approx. 646 sq ft) with modern finishes visible externally; broadband is fast and mobile signal excellent, supporting tenant demand from professionals and students.

Material points to note: the sale is leasehold, a Buyer’s Premium will apply on purchase, and the location records higher local crime statistics. There are no internal photos or floorplans included with this listing, so an on-site inspection and review of the Let Property Pack, tenancy documentation and the lease is recommended before offer.

This is a pragmatic pick for investors seeking an income-producing asset in a multicultural, student-oriented area. The existing tenancy and urban location reduce void risk, while the property’s modest size and city-centre position suit portfolio diversification or investor consolidation strategies.

2 bedroom flat for sale in Stowell Street, Liverpool, L7 — £133,000 • 2 bed • 1 bath • 532 ft²

2 bedroom flat for sale in Stowell Street, Liverpool, L7 — £133,000 • 2 bed • 1 bath • 532 ft² 2 bedroom flat for sale in Colquitt Street, Liverpool, Merseyside, L1 — £150,000 • 2 bed • 1 bath • 743 ft²

2 bedroom flat for sale in Colquitt Street, Liverpool, Merseyside, L1 — £150,000 • 2 bed • 1 bath • 743 ft² 2 bedroom flat for sale in Standish Street, Liverpool, L3 — £144,060 • 2 bed • 1 bath • 635 ft²

2 bedroom flat for sale in Standish Street, Liverpool, L3 — £144,060 • 2 bed • 1 bath • 635 ft² 2 bedroom flat for sale in Pall Mall, Liverpool, L3 — £127,400 • 2 bed • 1 bath

2 bedroom flat for sale in Pall Mall, Liverpool, L3 — £127,400 • 2 bed • 1 bath 1 bedroom flat for sale in Upper Parliament Street, Liverpool, L8 — £49,000 • 1 bed • 1 bath

1 bedroom flat for sale in Upper Parliament Street, Liverpool, L8 — £49,000 • 1 bed • 1 bath 1 bedroom flat for sale in Tithebarn Street, Liverpool, L2 — £90,000 • 1 bed • 1 bath • 484 ft²

1 bedroom flat for sale in Tithebarn Street, Liverpool, L2 — £90,000 • 1 bed • 1 bath • 484 ft²