Summary - 126 Borough Road TS1 2ES

10 bed 10 bath Flat

Ten-room investment close to campus with strong rental history and immediate income potential.

Freehold mid-terrace building, ideal for student lets

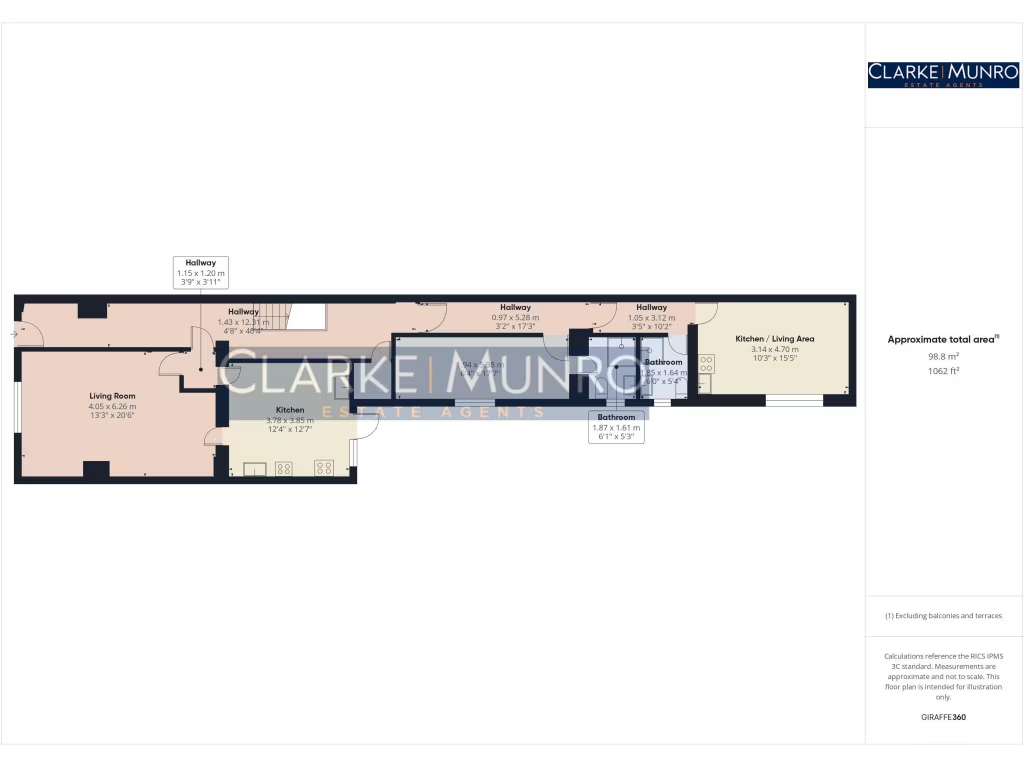

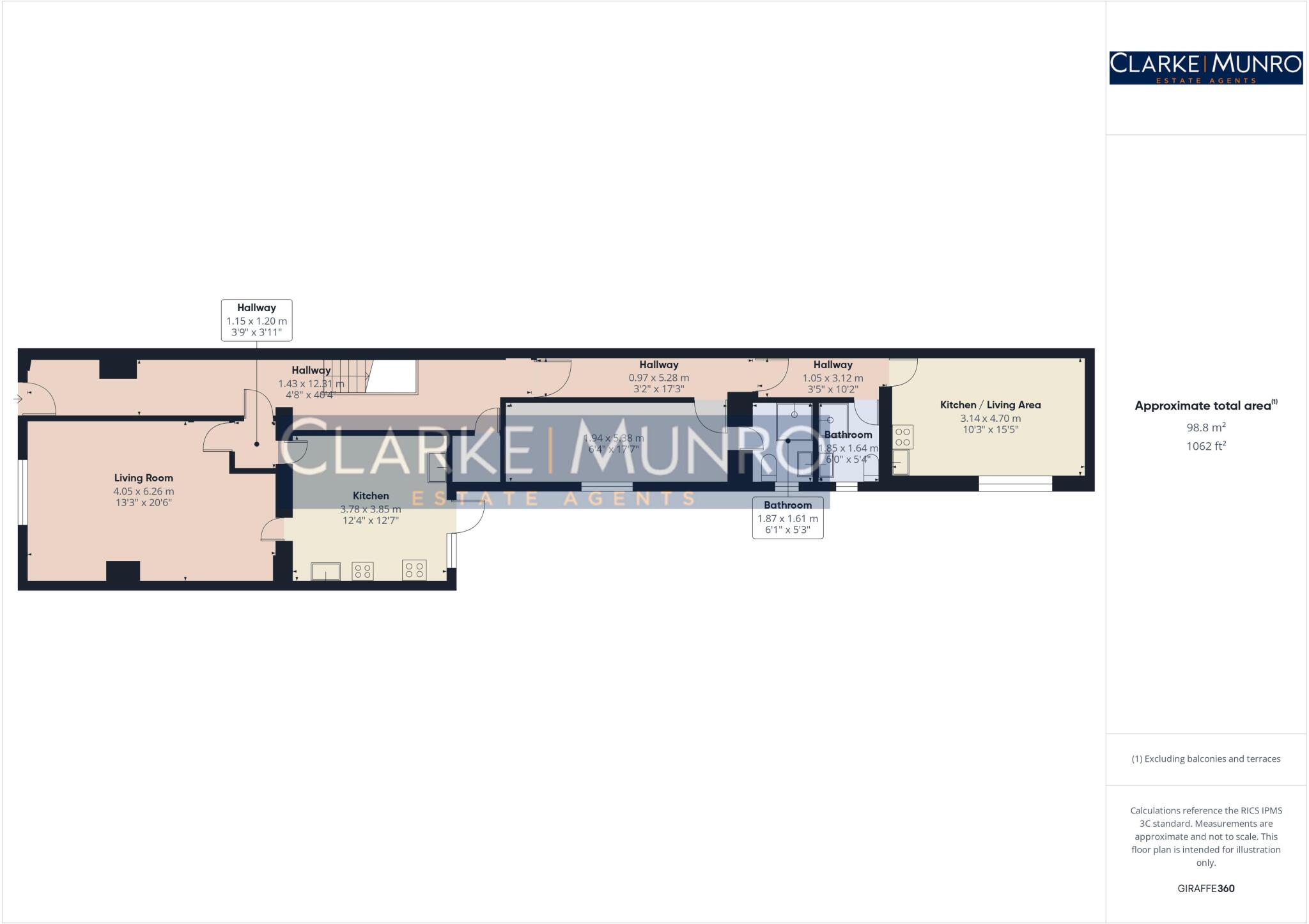

A substantial, freehold mid-terrace building arranged for multi-occupancy, positioned less than five minutes’ walk from the university campus. The property currently provides seven en-suite rooms plus three self-contained studios, a large communal lounge, and a fully equipped communal kitchen. In 2024/25 the building produced rental income of £44,000, representing a reported gross yield of about 9.7% at the asking price.

The layout and location suit investor buyers targeting student lets or serviced accommodation: strong proximity to campus, excellent mobile signal and fast broadband, and an established management arrangement are immediate operational advantages. The landlord currently pays electricity, water, TV licence and Wi‑Fi, which supports occupancy but represents an ongoing cost to factor into net returns.

Buyers should budget for building‑age maintenance and energy improvements. Constructed circa 1950–66 with cavity walls assumed uninsulated and double glazing of unknown age, the property would benefit from targeted insulation and energy upgrades to reduce running costs. There is no private garden and the building fronts directly onto a main road.

Location considerations are material: the immediate area is classified as very deprived with very high crime levels. These factors influence tenant demand, management needs and insurance; experienced on‑site management is already in place, which helps mitigate operational risk. Overall this is a high-yield, hands-on investment with clear potential for improved net returns after capital investment and efficient cost control.

10 bedroom semi-detached house for sale in Southfield Road, Middlesbrough, TS1 — £450,000 • 10 bed • 4 bath • 1925 ft²

10 bedroom semi-detached house for sale in Southfield Road, Middlesbrough, TS1 — £450,000 • 10 bed • 4 bath • 1925 ft² 12 bedroom end of terrace house for sale in Southfield Road, Middlesbrough, North Yorkshire, TS1 — £450,000 • 12 bed • 12 bath • 2580 ft²

12 bedroom end of terrace house for sale in Southfield Road, Middlesbrough, North Yorkshire, TS1 — £450,000 • 12 bed • 12 bath • 2580 ft² 4 bedroom terraced house for sale in Percy Street, Middlesbrough, TS1 — £110,000 • 4 bed • 4 bath • 389 ft²

4 bedroom terraced house for sale in Percy Street, Middlesbrough, TS1 — £110,000 • 4 bed • 4 bath • 389 ft² 11 bedroom terraced house for sale in Borough Road, Middlesbrough, North Yorkshire, TS1 — £490,000 • 11 bed • 11 bath • 2589 ft²

11 bedroom terraced house for sale in Borough Road, Middlesbrough, North Yorkshire, TS1 — £490,000 • 11 bed • 11 bath • 2589 ft² 2 bedroom end of terrace house for sale in Kildare Street, Middlesbrough, North Yorkshire, TS1 — £75,000 • 2 bed • 1 bath • 732 ft²

2 bedroom end of terrace house for sale in Kildare Street, Middlesbrough, North Yorkshire, TS1 — £75,000 • 2 bed • 1 bath • 732 ft² 6 bedroom house of multiple occupation for sale in Borough Road, Middlesbrough, North Yorkshire, TS1 — £300,000 • 6 bed • 6 bath

6 bedroom house of multiple occupation for sale in Borough Road, Middlesbrough, North Yorkshire, TS1 — £300,000 • 6 bed • 6 bath