Summary - Roof Gardens, Bentinck Street, Castlefield M15 4RS

1 bed 1 bath Apartment

Turnkey city-centre buy-to-let with allocated parking and rooftop terrace.

Active tenant in place, producing immediate rental income (circa 6.6% yield)

A compact, city-centre one-bedroom apartment offered as a ready-made investment in Roof Gardens, Bentinck Street, Castlefield. The property is let to an active tenant and currently produces a strong reported yield (circa 6.6%), delivering immediate rental income for a buyer seeking a hands-off addition to a portfolio.

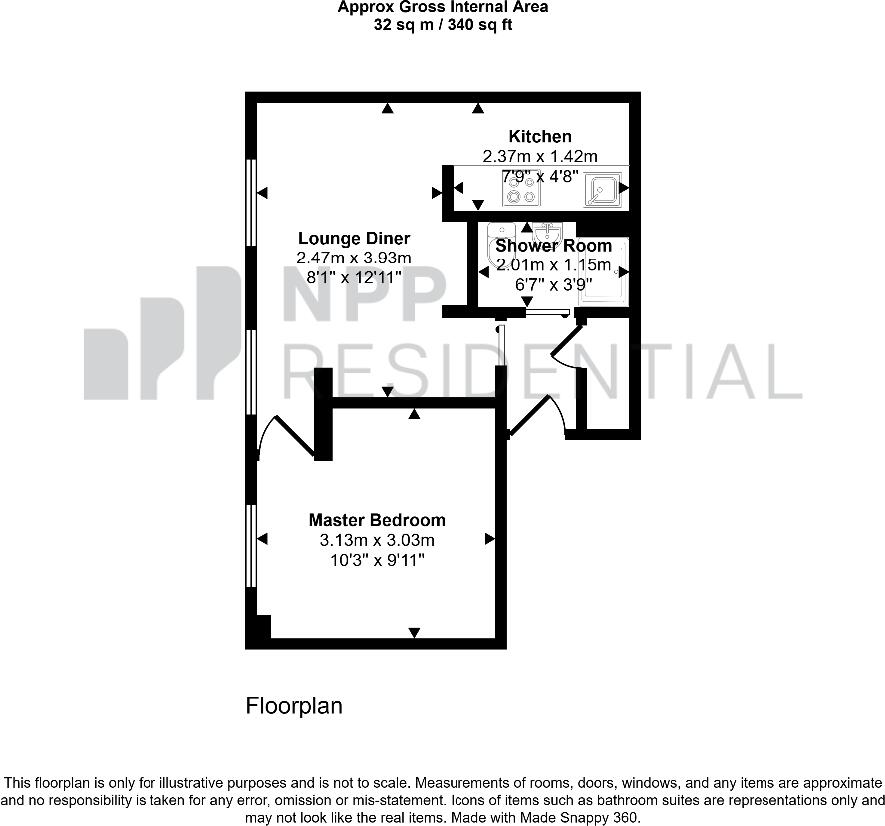

The apartment measures approximately 340 sq ft and is well specified with an open-plan living/kitchen, double bedroom and contemporary bathroom. Practical benefits include allocated off-street parking, secure fob entry, video intercom and access to a communal roof terrace — features that support strong tenant demand in this neighbourhood.

Financial details are straightforward: asking price £175,000, leasehold with 239 years remaining, annual service charge £2,034.26 and ground rent £200. Council tax is low. The building sits in the heart of Castlefield close to Deansgate, excellent transport links and local amenities, offering consistent demand from city professionals and tech workers.

Investment considerations: the apartment is small (340 sq ft) and best suited to investors rather than owner-occupiers. The service charge is a notable ongoing cost relative to the unit size, and the surrounding area is classified as very deprived despite very low recorded crime. Buyers should review tenancy details, rental history and service charge accounts before committing.

2 bedroom apartment for sale in Excelsior Works, Castlefield, M15 — £250,000 • 2 bed • 2 bath • 756 ft²

2 bedroom apartment for sale in Excelsior Works, Castlefield, M15 — £250,000 • 2 bed • 2 bath • 756 ft² 2 bedroom apartment for sale in Kelso Place, Manchester, M15 — £215,000 • 2 bed • 2 bath • 560 ft²

2 bedroom apartment for sale in Kelso Place, Manchester, M15 — £215,000 • 2 bed • 2 bath • 560 ft² 1 bedroom apartment for sale in St Georges Gardens, Castlefield, M15 — £210,000 • 1 bed • 1 bath • 446 ft²

1 bedroom apartment for sale in St Georges Gardens, Castlefield, M15 — £210,000 • 1 bed • 1 bath • 446 ft² 1 bedroom apartment for sale in Burton Place, Castlefield, M15 — £160,000 • 1 bed • 1 bath • 513 ft²

1 bedroom apartment for sale in Burton Place, Castlefield, M15 — £160,000 • 1 bed • 1 bath • 513 ft² 1 bedroom apartment for sale in City Gardens, Spinners Way, M15 — £155,000 • 1 bed • 1 bath • 424 ft²

1 bedroom apartment for sale in City Gardens, Spinners Way, M15 — £155,000 • 1 bed • 1 bath • 424 ft² 2 bedroom apartment for sale in Sky Gardens, Spinners Way, M15 — £170,000 • 2 bed • 2 bath • 528 ft²

2 bedroom apartment for sale in Sky Gardens, Spinners Way, M15 — £170,000 • 2 bed • 2 bath • 528 ft²