Summary - County Road, Liverpool, L4 L4 3QD

4 bed 4 bath Mixed Use

Turnkey mixed-use freehold with strong current income and rent-review upside..

- Fully let freehold mixed-use building with immediate income

- Current income £47,100 pa; gross yield c. 9.9%

- Commercial unit on FRI lease to Feb 2029; rent review due this year

- Four self-contained 1-bed flats (tenanted), commercial restaurant active

- Large Victorian corner building; prominent main-road position

- Very deprived area with very high recorded crime rates

- Small plot; potential maintenance and refurbishment costs

- Lease and rent-review details unverified — solicitor due diligence advised

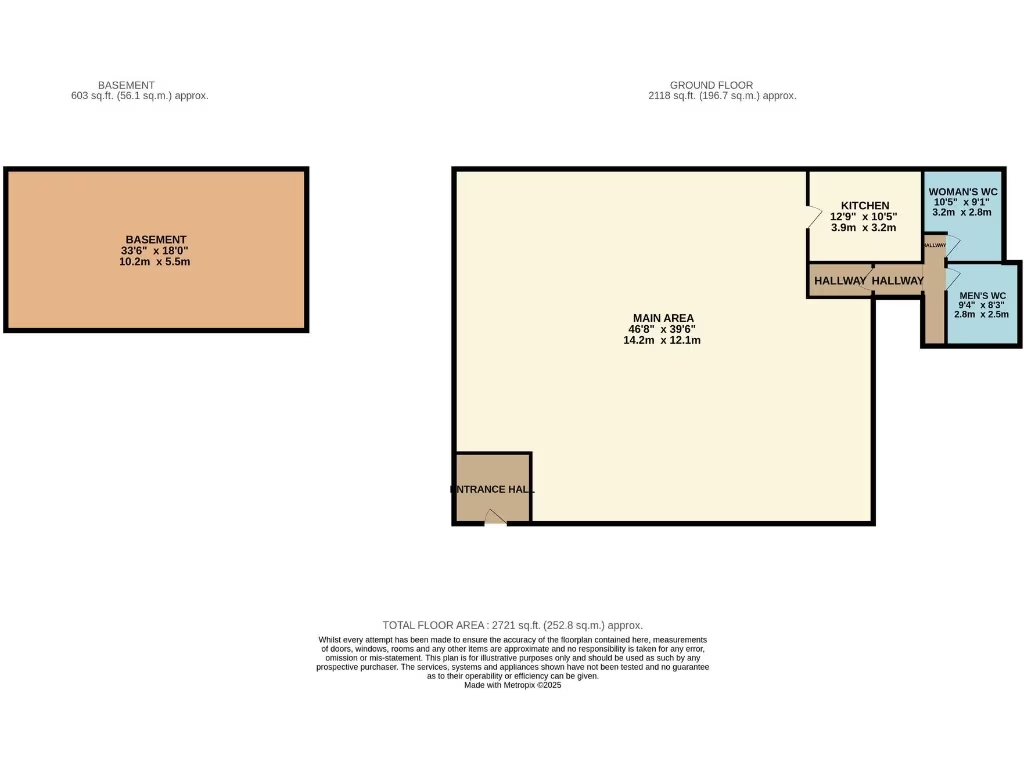

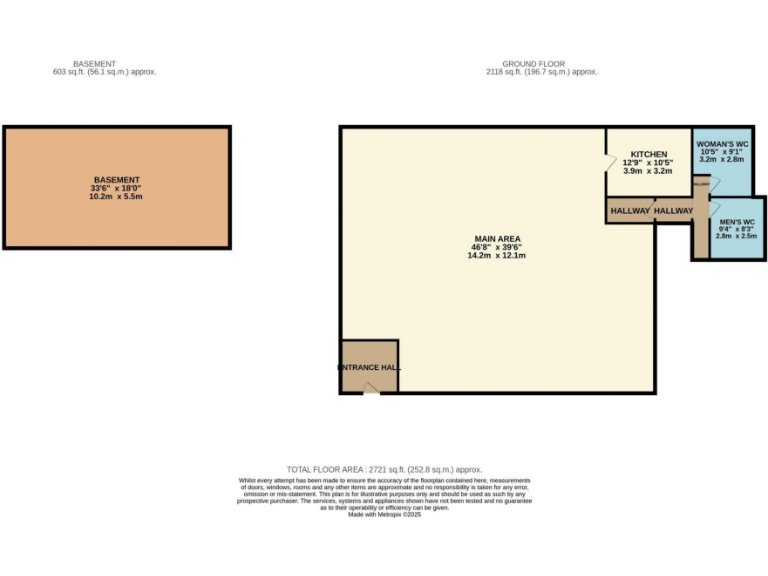

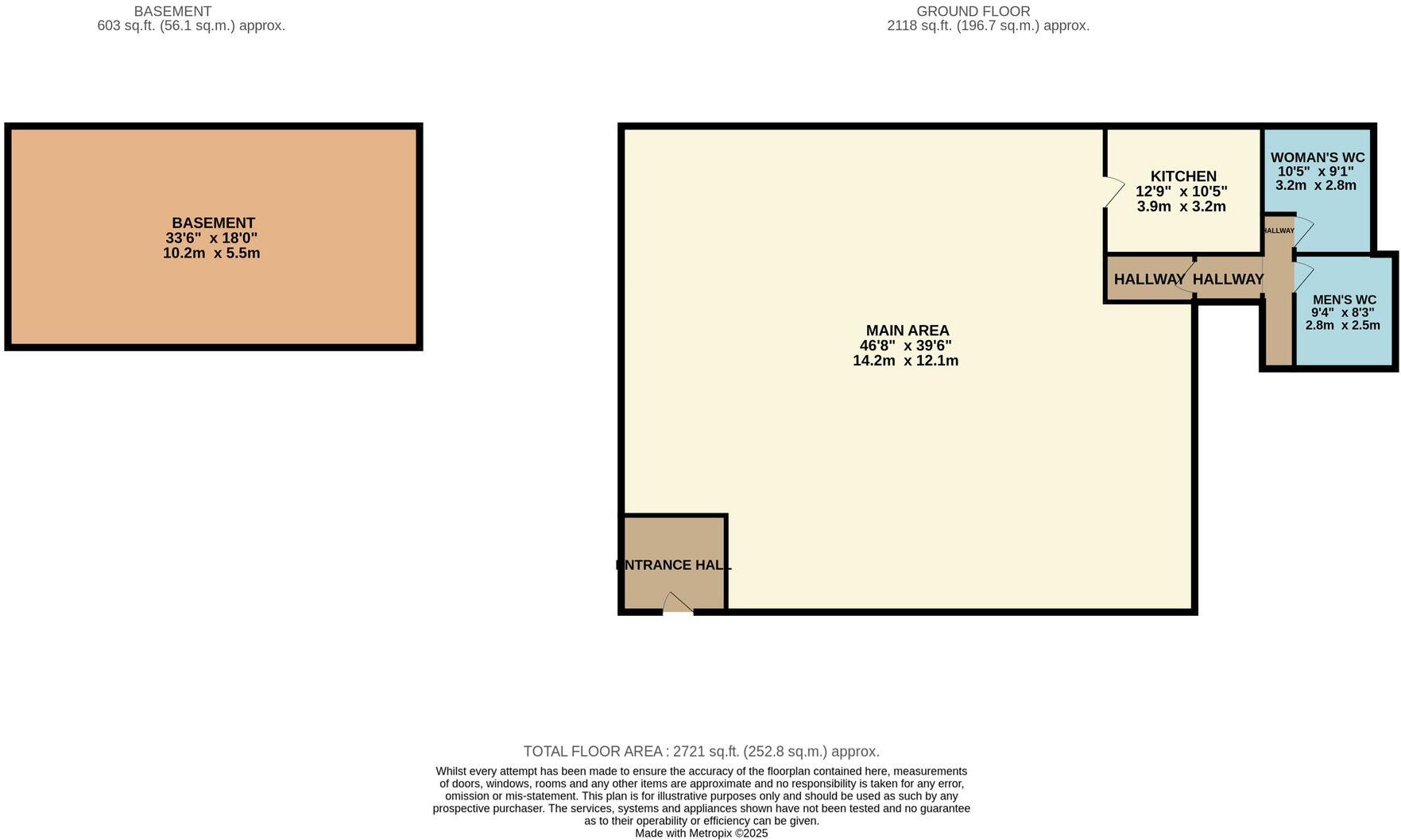

A high-yield, fully let mixed-use freehold on busy County Road, offering immediate income and long-term upside. The building comprises a ground-floor commercial restaurant on a Full Repairing & Insuring (FRI) lease plus four self-contained one-bedroom flats, producing a current aggregate income of £47,100 pa (gross yield c. 9.9%). The commercial lease runs to February 2029 with a rent review due this year, providing a potential uplift in income but also timing that buyers should verify.

The property is a large Victorian corner building with retained period brickwork and a prominent shopfront, set on a small plot in a major conurbation. Residential flats are modern in feel (laminate floors, recessed lighting) and are fully let, giving a turnkey income stream. There is no reported flood risk and broadband/mobile connectivity are good — useful for tenant demand and management.

Buyers should note this asset sits in a very deprived area with very high recorded crime rates, and local socio-economic indicators are weak. The commercial tenant occupies on an FRI basis until 2029, so short-term reversion is limited until lease expiry; purchasers should confirm lease documentation, any service charge arrangements and rent review outcomes. As a large, older building, periodic maintenance or refurbishment costs are possible — due diligence on structure and services is recommended.

Overall, this is a straightforward income-producing investment for an investor seeking immediate cashflow from mixed residential and commercial streams, with potential for rental growth at the imminent commercial rent review and longer-term asset management opportunities.

5 bedroom house for sale in Rufford Road, Liverpool, Merseyside, L6 — £340,000 • 5 bed • 1 bath • 559 ft²

5 bedroom house for sale in Rufford Road, Liverpool, Merseyside, L6 — £340,000 • 5 bed • 1 bath • 559 ft² 5 bedroom semi-detached house for sale in Balmoral Road, Fairfield, Liverpool, Merseyside, L6 — £340,000 • 5 bed • 1 bath • 510 ft²

5 bedroom semi-detached house for sale in Balmoral Road, Fairfield, Liverpool, Merseyside, L6 — £340,000 • 5 bed • 1 bath • 510 ft² High street retail property for sale in Priory Road, Anfield, Liverpool, Merseyside, L4 2RZ, L4 — £120,000 • 1 bed • 1 bath

High street retail property for sale in Priory Road, Anfield, Liverpool, Merseyside, L4 2RZ, L4 — £120,000 • 1 bed • 1 bath Commercial property for sale in 245/245A County Road, Walton, Liverpool, L4 — £95,000 • 1 bed • 1 bath • 840 ft²

Commercial property for sale in 245/245A County Road, Walton, Liverpool, L4 — £95,000 • 1 bed • 1 bath • 840 ft² 1 bedroom apartment for sale in Moss Lane, Orrell Park, Bootle, L9 — £100,000 • 1 bed • 1 bath • 913 ft²

1 bedroom apartment for sale in Moss Lane, Orrell Park, Bootle, L9 — £100,000 • 1 bed • 1 bath • 913 ft² 1 bedroom terraced house for sale in Lisburn Lane, Liverpool, Merseyside, L13 — £120,000 • 1 bed • 1 bath • 1130 ft²

1 bedroom terraced house for sale in Lisburn Lane, Liverpool, Merseyside, L13 — £120,000 • 1 bed • 1 bath • 1130 ft²