Summary - 105 WELLINGTON ROAD, ASHTON-ON-RIBBLE PR2 1BX

6 bed 1 bath Semi-Detached

High-yield, fully let HMO in commuter-friendly Ashton-on-Ribble.

- Six-bedroom HMO producing approx. £28,560 gross annually

A six-bedroom HMO in Ashton-on-Ribble offered as a freehold investment with strong rental history. The property currently generates approximately £28,560 gross per year (around 11.9% gross yield at the asking price), and comes fully let to six tenants on ASTs — providing immediate income for a buy-to-let portfolio.

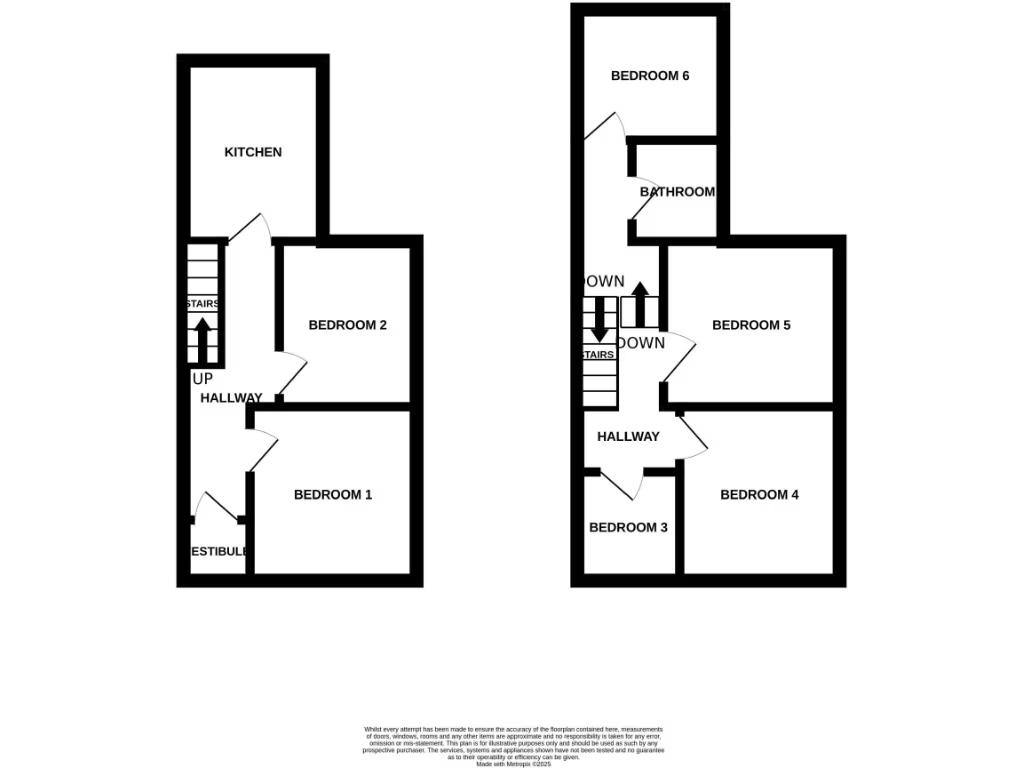

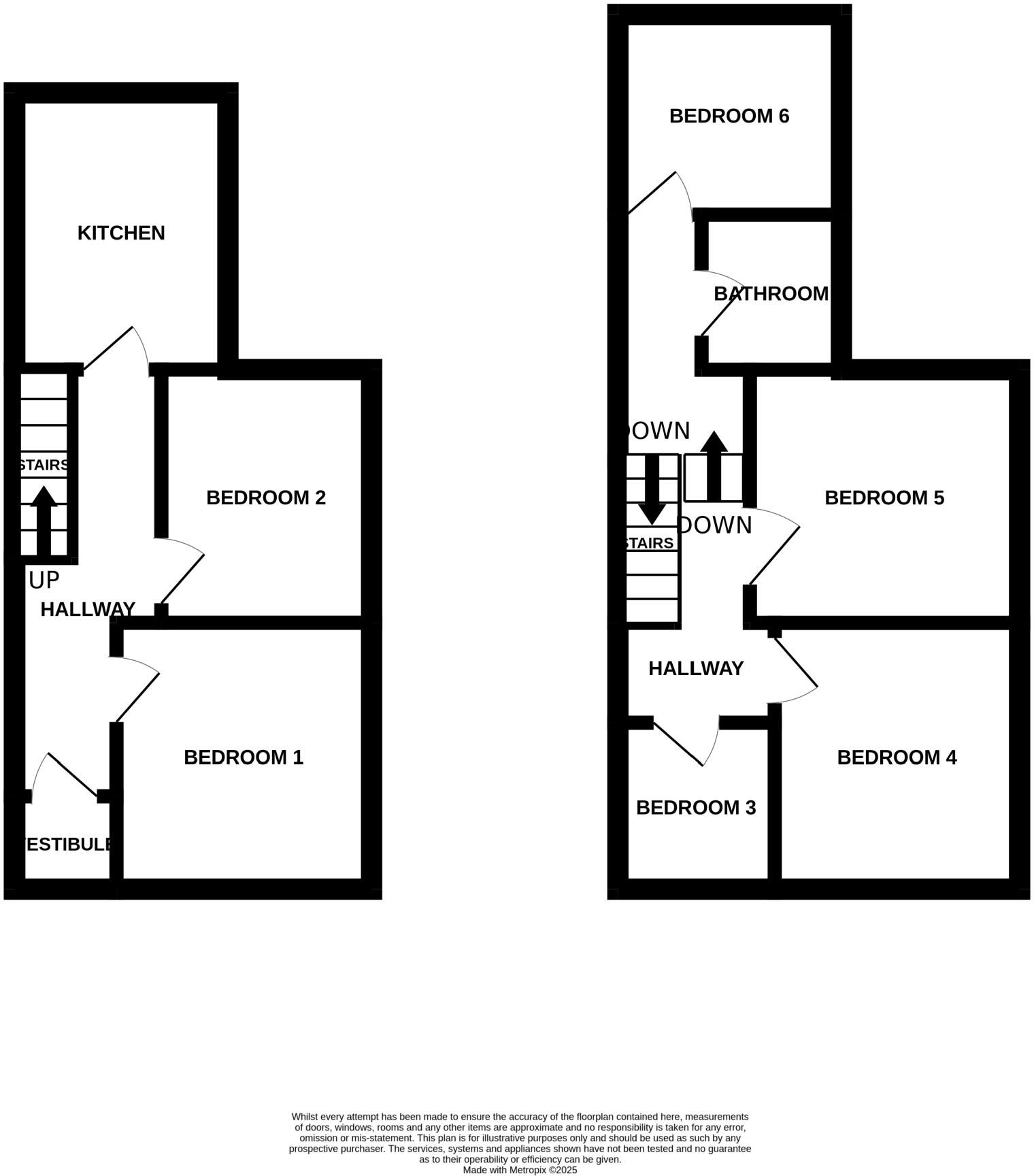

The house is a Victorian semi-detached with character features and bay windows, gas central heating, and double glazing installed after 2002. Accommodation includes six let bedrooms, a communal fitted kitchen and a single shared bathroom; total floor area is about 1,314 sq ft with a small garden. Location is practical for tenants with good bus links, nearby shops, and several schools close by.

Important considerations: the property sits in a very deprived area with a higher local crime rate, and the EPC is rated E. There is only one bathroom for six rooms and the cavity walls are assumed to lack insulation — both factors that may require investment to improve comfort, compliance and marketability. Management responsibility continues with tenants in situ, so viewings and transfer require coordination.

This is a clear specialist purchase for investors seeking immediate rental income and potential upside from refurbishment and energy upgrades. The combination of established tenancy, strong local rental demand and a compact plot makes it suitable for landlords who can manage an HMO in a higher-need neighbourhood and are prepared to budget for modernization and compliance works.

6 bedroom terraced house for sale in Wellington Street, PRESTON, Lancashire PR1 8TQ, PR1 — £330,000 • 6 bed • 6 bath • 1486 ft²

6 bedroom terraced house for sale in Wellington Street, PRESTON, Lancashire PR1 8TQ, PR1 — £330,000 • 6 bed • 6 bath • 1486 ft² 12 bedroom house of multiple occupation for sale in Blackpool Road, Ashton-on-Ribble, Preston, PR2 — £715,000 • 12 bed • 12 bath • 5232 ft²

12 bedroom house of multiple occupation for sale in Blackpool Road, Ashton-on-Ribble, Preston, PR2 — £715,000 • 12 bed • 12 bath • 5232 ft² 4 bedroom house share for sale in Eldon Street, Preston, PR1 — £275,000 • 4 bed • 4 bath • 1228 ft²

4 bedroom house share for sale in Eldon Street, Preston, PR1 — £275,000 • 4 bed • 4 bath • 1228 ft² 9 bedroom block of apartments for sale in Fishergate, Preston, PR1 — £450,000 • 9 bed • 9 bath • 2509 ft²

9 bedroom block of apartments for sale in Fishergate, Preston, PR1 — £450,000 • 9 bed • 9 bath • 2509 ft² 3 bedroom house for sale in Powis Road, Ashton On Ribble, Preston, PR2 — £240,000 • 3 bed • 1 bath • 1069 ft²

3 bedroom house for sale in Powis Road, Ashton On Ribble, Preston, PR2 — £240,000 • 3 bed • 1 bath • 1069 ft² 6 bedroom terraced house for sale in Tulketh Brow, Ashton, PR2 — £350,000 • 6 bed • 6 bath • 2067 ft²

6 bedroom terraced house for sale in Tulketh Brow, Ashton, PR2 — £350,000 • 6 bed • 6 bath • 2067 ft²