Summary - Bromwich Road, St Johns, Worcester WR2 4AD

8 bed 8 bath Link Detached House

Immediate income with refurbishment upside and development potential on a large Worcestershire plot.

Freehold eight‑unit property achieving c.£65,700 pa gross rental income

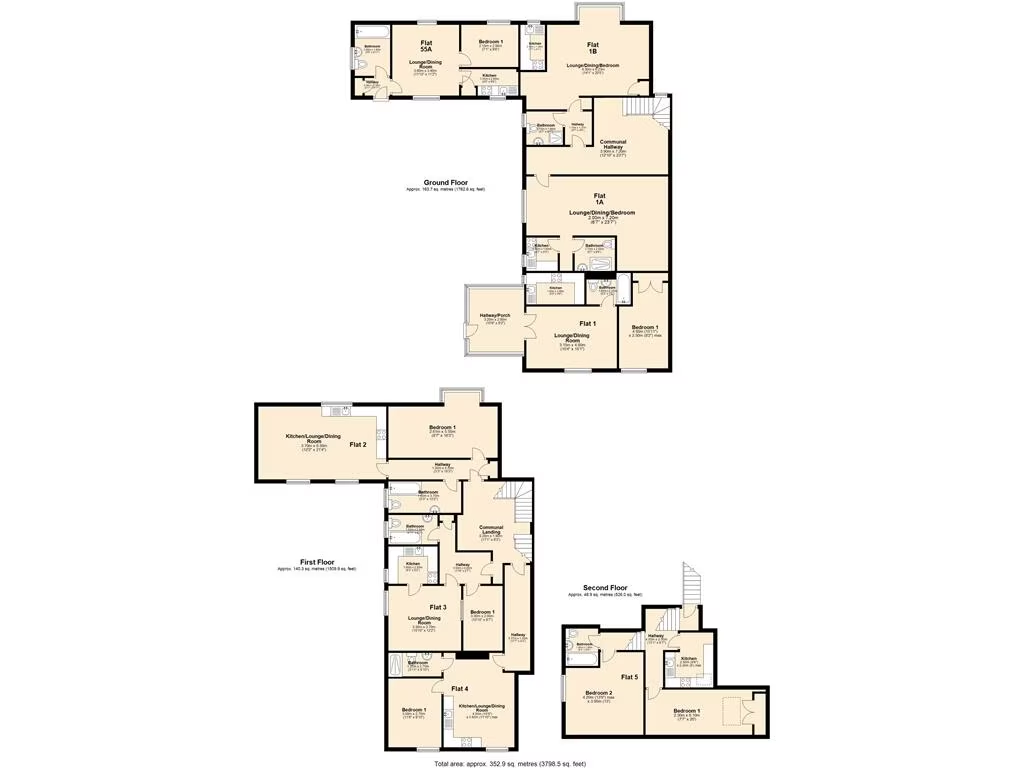

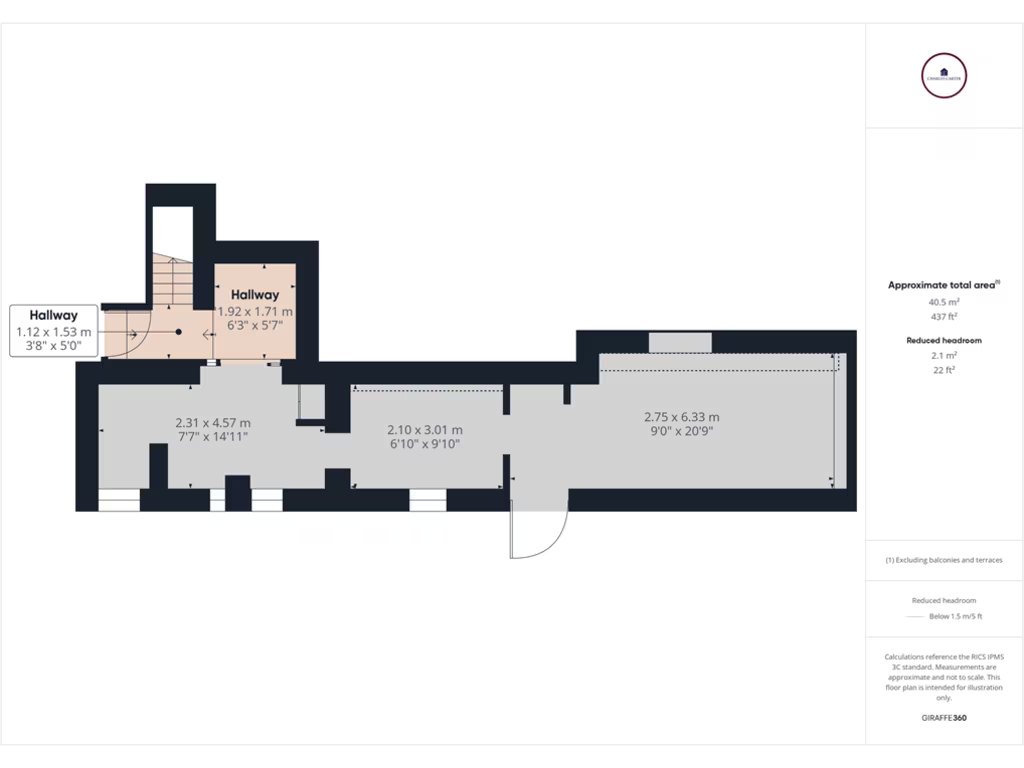

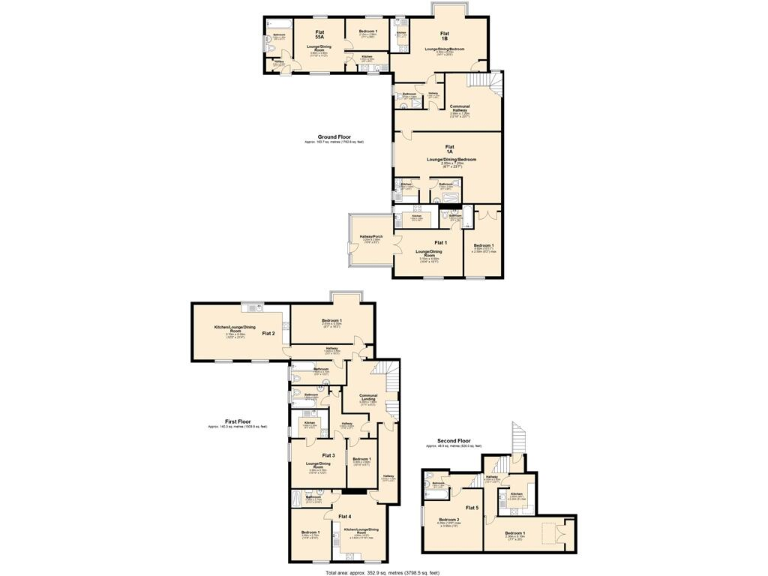

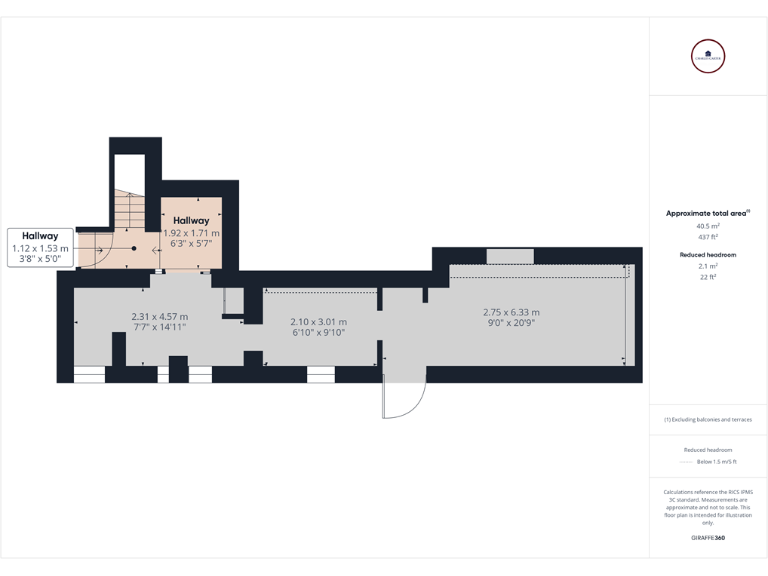

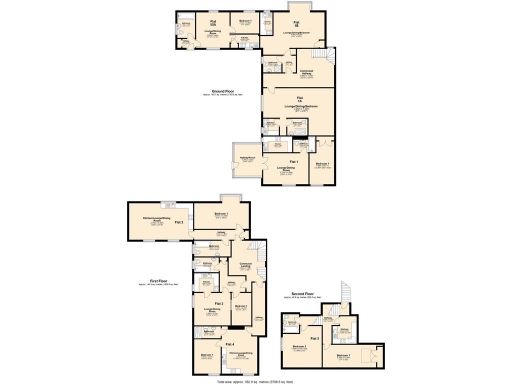

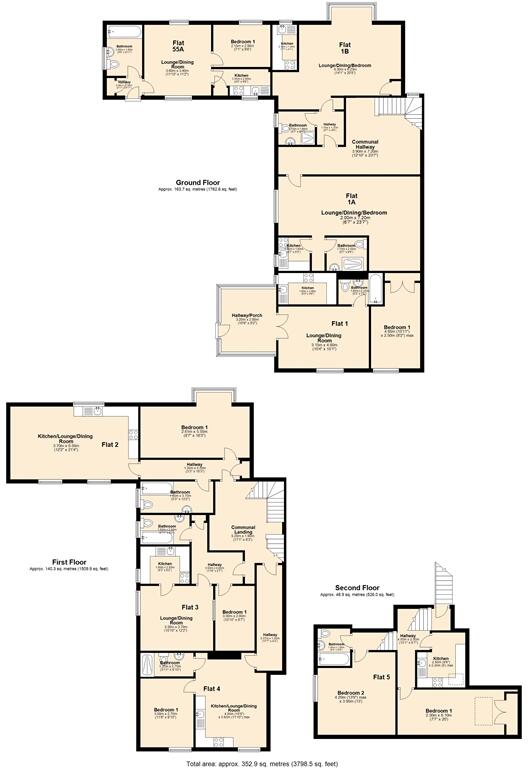

An eight‑unit freehold property on Bromwich Road offering an established rental income and clear scope to grow value. Six one‑bed flats were refurbished within the last five years and are producing regular rent; two studio units remain unmodernised, presenting straightforward upside for a buyer willing to invest in light refurbishments. The building sits on a substantial plot with off‑street parking and potential development areas (cellar, side grounds, driveway) subject to planning consent.

This is a practical purchase for an investor seeking immediate yield and longer‑term capital upside. Current gross annual rent is approximately £65,700, delivering over a 9% gross yield at the asking price. Several flats are held on long‑term tenancies, providing income continuity; others could be reworked to improve returns or reposition the asset.

Buyers should note the material considerations: two studios require modernisation, EPC ratings range from C to E, and the property is constructed as solid brick with assumed no cavity insulation. There is a medium flood risk and local crime levels are above average — factors that may affect insurance and management costs. Any development plans require planning permission and verification of services, tenure, and council tax bands.

Overall, this link‑detached period property suits an investor with refurbishment capability or a small portfolio buyer seeking instant income plus clear redevelopment potential. The freehold, large plot and central Worcester location combine immediate cashflow with options to enhance value over time.

4 bedroom semi-detached house for sale in Oldbury Road, Worcester, WR2 — £300,000 • 4 bed • 3 bath • 1581 ft²

4 bedroom semi-detached house for sale in Oldbury Road, Worcester, WR2 — £300,000 • 4 bed • 3 bath • 1581 ft² 24 bedroom apartment for sale in Mealcheapen Street, Worcester, WR1 — £1,350,000 • 24 bed • 24 bath • 731 ft²

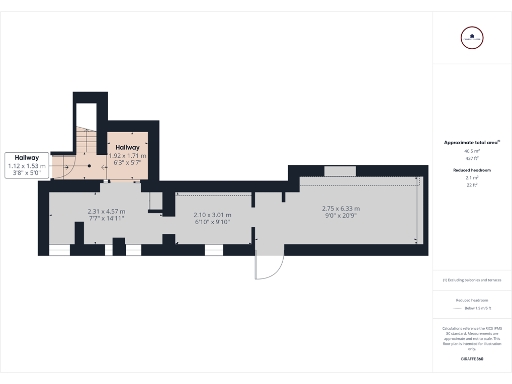

24 bedroom apartment for sale in Mealcheapen Street, Worcester, WR1 — £1,350,000 • 24 bed • 24 bath • 731 ft² 1 bedroom flat for sale in Woolhope Road, Worcester, Worcestershire, WR5 — £85,000 • 1 bed • 1 bath • 431 ft²

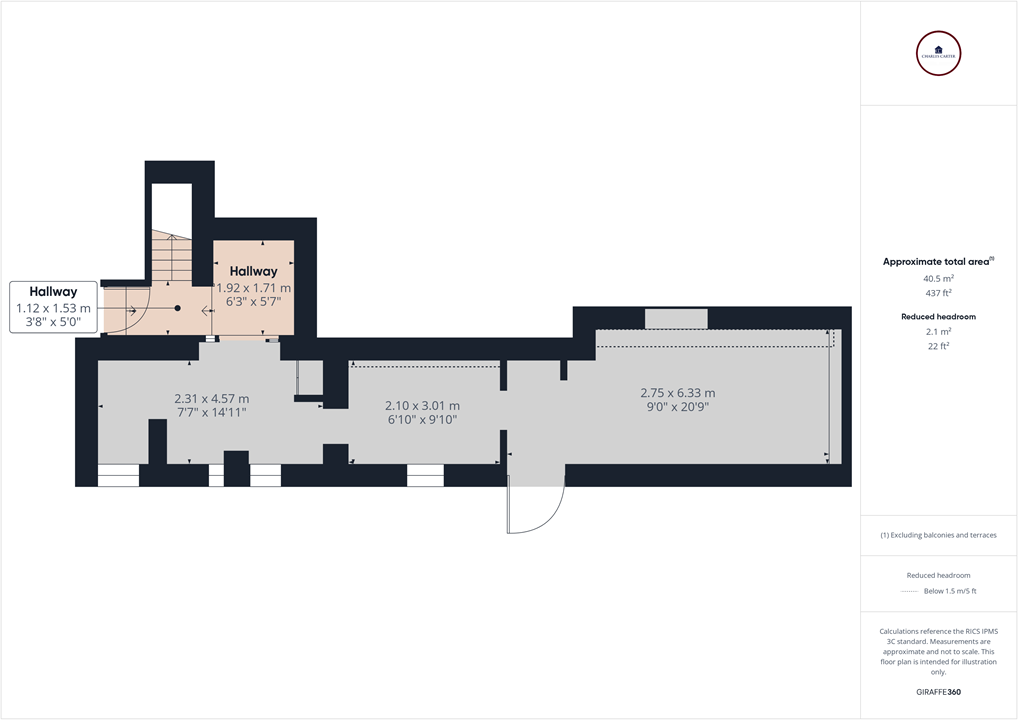

1 bedroom flat for sale in Woolhope Road, Worcester, Worcestershire, WR5 — £85,000 • 1 bed • 1 bath • 431 ft² 1 bedroom duplex for sale in Hop Warehouse, Southfield Street , Worcester, WR1 — £100,000 • 1 bed • 1 bath • 545 ft²

1 bedroom duplex for sale in Hop Warehouse, Southfield Street , Worcester, WR1 — £100,000 • 1 bed • 1 bath • 545 ft² 2 bedroom flat for sale in Toftdale Green, Lyppard Bourne, Worcester, Worcestershire, WR4 0PE, WR4 — £150,000 • 2 bed • 1 bath • 560 ft²

2 bedroom flat for sale in Toftdale Green, Lyppard Bourne, Worcester, Worcestershire, WR4 0PE, WR4 — £150,000 • 2 bed • 1 bath • 560 ft² 5 bedroom apartment for sale in The Hop Warehouse, 35 Southfield Street, Worcester, Worcestershire, WR1 1NJ, WR1 — £500,000 • 5 bed • 5 bath • 582 ft²

5 bedroom apartment for sale in The Hop Warehouse, 35 Southfield Street, Worcester, Worcestershire, WR1 1NJ, WR1 — £500,000 • 5 bed • 5 bath • 582 ft²