Summary - 6 BROOM COTTAGES FERRYHILL DL17 8AY

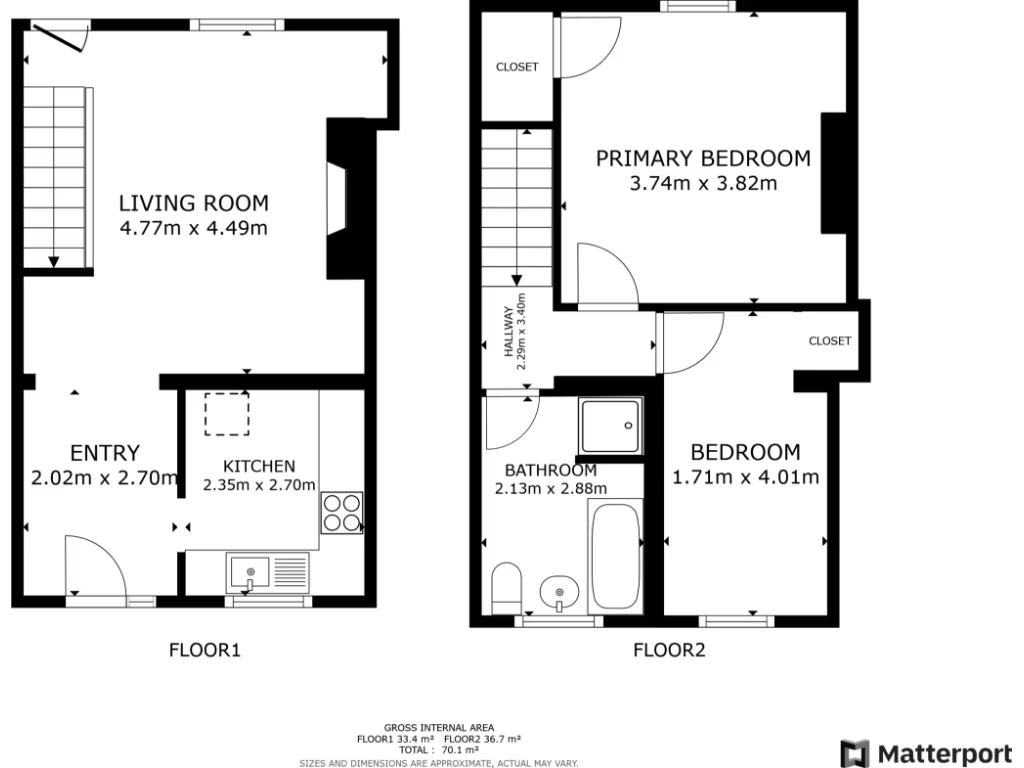

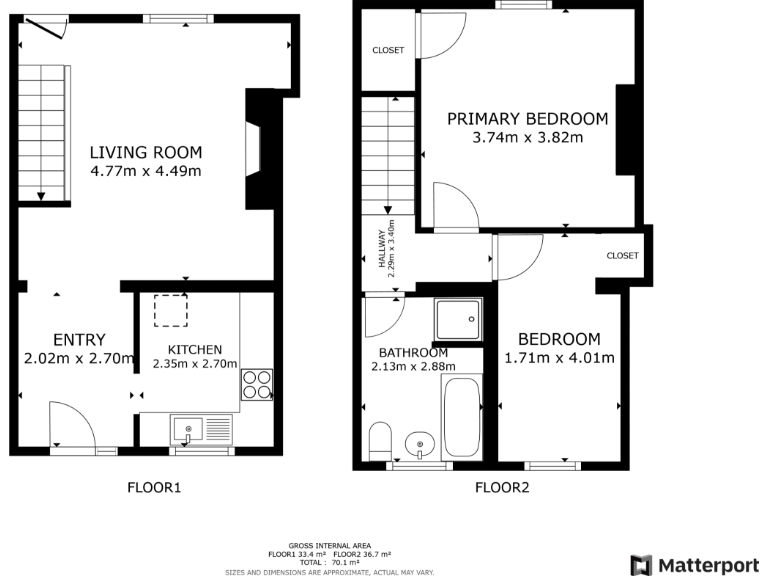

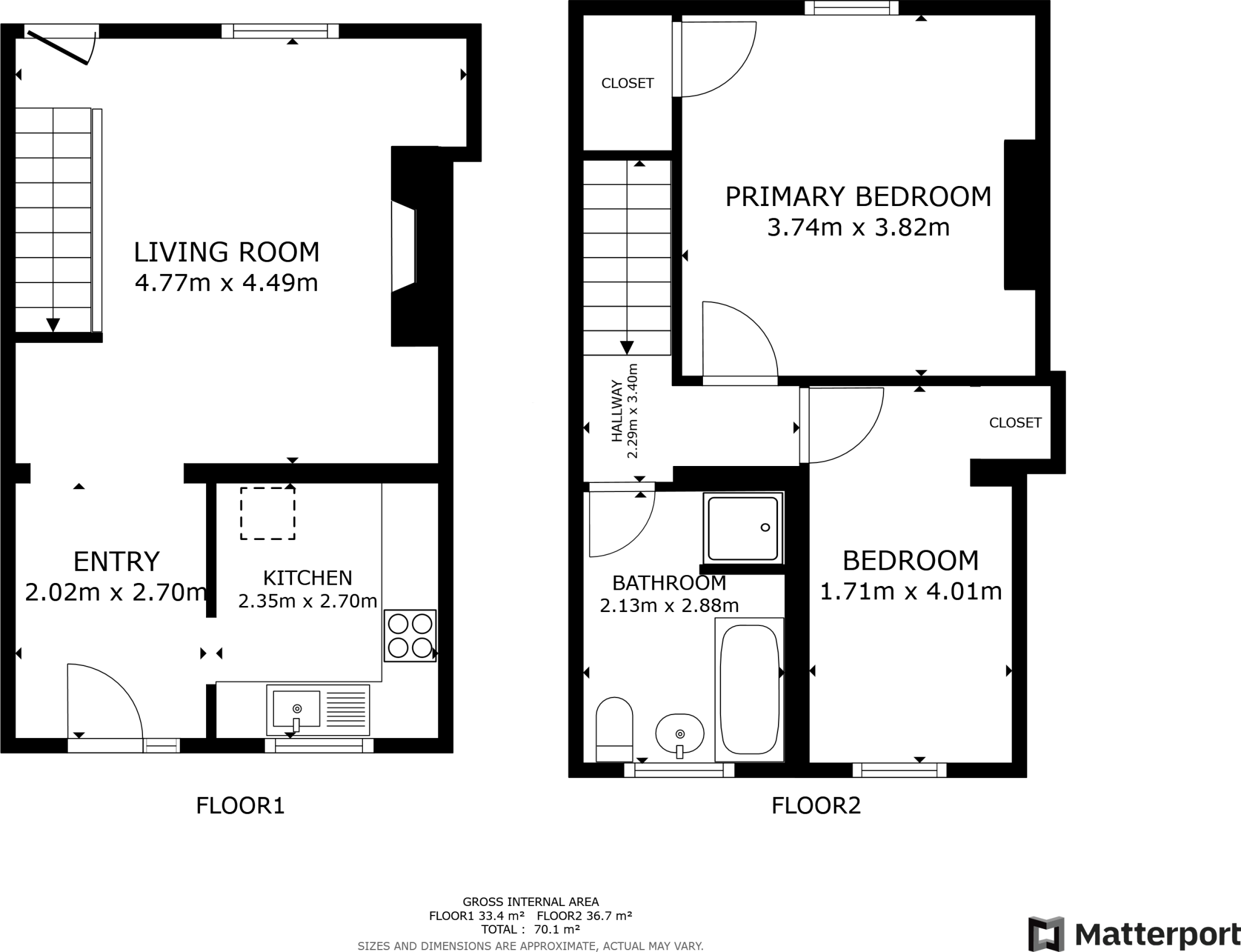

2 bed 1 bath Terraced

Immediate rental income with clear refurbishment upside for investors.

- Freehold two-bedroom terrace with immediate rental income

- Current annual rent £5,400; potential to reach £6,000

- Gross yield approx 12.3% (current) rising to 13.6% (projected)

- Tenant in situ with stable payment history and intends to stay

- Mid-20th-century terrace; cracks in facade, dated exterior

- Small plot, no garage and limited outdoor space

- Area classified as very deprived; may limit capital growth

- Buyers Premium applies on purchase

This two-bedroom terraced house in Ferryhill is presented primarily as a buy-to-let opportunity. It is freehold, currently let and producing a gross annual income of £5,400, with a realistic market rent projection of £6,000. At the asking price of £44,000 the current gross yield is approximately 12.3%, rising to about 13.6% at the projected rent, offering an attractive income return for investors.

The property is a mid-20th-century, two-storey terrace with a spacious lounge, fitted kitchen, and a three-piece bathroom. The current tenant has a reliable payment history and intends to remain, which provides immediate rental income and low void risk. The house benefits from fast broadband, average mobile signal, and close access to local amenities and several well-rated primary and secondary schools.

There are clear maintenance and location considerations. The exterior shows cracks and a dated facade; some internal/updating works are likely needed. The plot is small with no garage and limited outdoor space. The area is in a very deprived ward with blue-collar terraces and higher local social housing, which can affect long-term capital growth and tenant profile. A buyer’s premium will apply on purchase.

This property suits investors seeking immediate cashflow and willing to manage a tenant-in-situ, or buyers prepared to carry out modest refurbishment to increase rent. Full investment and tenancy details are provided in the Let Property Pack for careful due diligence.

2 bedroom terraced house for sale in Stratford Gardens, Ferryhill, DL17 — £78,000 • 2 bed • 1 bath • 775 ft²

2 bedroom terraced house for sale in Stratford Gardens, Ferryhill, DL17 — £78,000 • 2 bed • 1 bath • 775 ft² 3 bedroom end of terrace house for sale in Brancepeth Road, Ferryhill, DL17 — £78,000 • 3 bed • 1 bath • 786 ft²

3 bedroom end of terrace house for sale in Brancepeth Road, Ferryhill, DL17 — £78,000 • 3 bed • 1 bath • 786 ft² 2 bedroom terraced house for sale in Darlington Road, Ferryhill, DL17 — £53,000 • 2 bed • 1 bath • 1033 ft²

2 bedroom terraced house for sale in Darlington Road, Ferryhill, DL17 — £53,000 • 2 bed • 1 bath • 1033 ft² 3 bedroom terraced house for sale in Darlington Road, Ferryhill, DL17 — £75,000 • 3 bed • 2 bath • 1206 ft²

3 bedroom terraced house for sale in Darlington Road, Ferryhill, DL17 — £75,000 • 3 bed • 2 bath • 1206 ft² 3 bedroom terraced house for sale in Brunel Street, Ferryhill, DL17 8NX, DL17 — £39,999 • 3 bed • 1 bath

3 bedroom terraced house for sale in Brunel Street, Ferryhill, DL17 8NX, DL17 — £39,999 • 3 bed • 1 bath 2 bedroom terraced house for sale in Windsor Avenue, Ferryhill, DL17 — £65,000 • 2 bed • 1 bath • 786 ft²

2 bedroom terraced house for sale in Windsor Avenue, Ferryhill, DL17 — £65,000 • 2 bed • 1 bath • 786 ft²