Summary -

2 Higher Brook Street,TEIGNMOUTH,TQ14 8HY

TQ14 8HY

1 bed 1 bath Flat

Compact income-producing flat with refurbishment upside near town amenities.

Long-term tenant in situ, producing £6,636 pa

A compact one-bedroom flat on Higher Brook Street offered with a long-term tenant in situ, making it immediately income-producing for investors. The property is freehold, totals 365 sq ft and currently returns £6,636 pa, giving an approximate gross yield of about 6.3% at the asking price of £105,000.

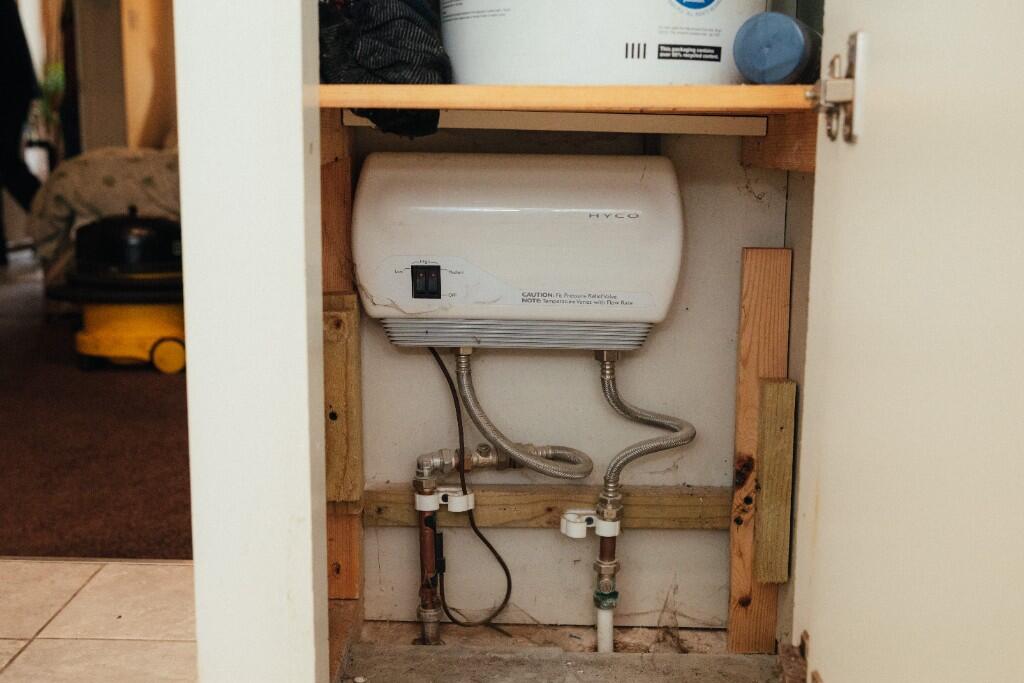

The flat has a medium-sized living room, one bedroom with ensuite and a small private rear garden. Interiors are dated and will benefit from modernization to raise rent or capital value; the lounge shows older carpet and fixtures. There is no flood risk, and mobile and broadband connectivity are good for the area.

Important negatives: the building sits in a very deprived area with high local crime statistics, which may limit mid- to long-term capital growth and tenant pool. Street parking only. The current tenant intends to remain, so purchaser must accept the tenancy arrangements or wait for vacancy.

This is a straightforward buy-to-let or refurbishment opportunity for a cash buyer or portfolio investor seeking an immediately let, low-maintenance addition. Buyers should review the Let Property Pack and tenancy terms carefully and factor refurbishment costs and local area challenges into yield projections.

1 bedroom apartment for sale in Orchard Gardens, Teignmouth, TQ14 8DP, TQ14 — £90,000 • 1 bed • 1 bath • 318 ft²

1 bedroom apartment for sale in Orchard Gardens, Teignmouth, TQ14 8DP, TQ14 — £90,000 • 1 bed • 1 bath • 318 ft² 1 bedroom flat for sale in Waterloo Road, Torquay, Devon, TQ1 — £100,000 • 1 bed • 2 bath • 518 ft²

1 bedroom flat for sale in Waterloo Road, Torquay, Devon, TQ1 — £100,000 • 1 bed • 2 bath • 518 ft² 2 bedroom flat for sale in Waterloo Road, Torquay, Devon, TQ1 — £120,000 • 2 bed • 1 bath • 502 ft²

2 bedroom flat for sale in Waterloo Road, Torquay, Devon, TQ1 — £120,000 • 2 bed • 1 bath • 502 ft² 8 bedroom terraced house for sale in Northumberland Place, Teignmouth, TQ14 — £500,000 • 8 bed • 6 bath • 3351 ft²

8 bedroom terraced house for sale in Northumberland Place, Teignmouth, TQ14 — £500,000 • 8 bed • 6 bath • 3351 ft² 2 bedroom terraced house for sale in Den Road, Teignmouth, Devon, TQ14 — £299,000 • 2 bed • 2 bath • 936 ft²

2 bedroom terraced house for sale in Den Road, Teignmouth, Devon, TQ14 — £299,000 • 2 bed • 2 bath • 936 ft² Takeaway for sale in 7 Teign Street, Teignmouth, Devon, TQ14 — £125,000 • 1 bed • 2 bath • 1744 ft²

Takeaway for sale in 7 Teign Street, Teignmouth, Devon, TQ14 — £125,000 • 1 bed • 2 bath • 1744 ft²