Summary - Henry Street, Liverpool, L1 L1 5BS

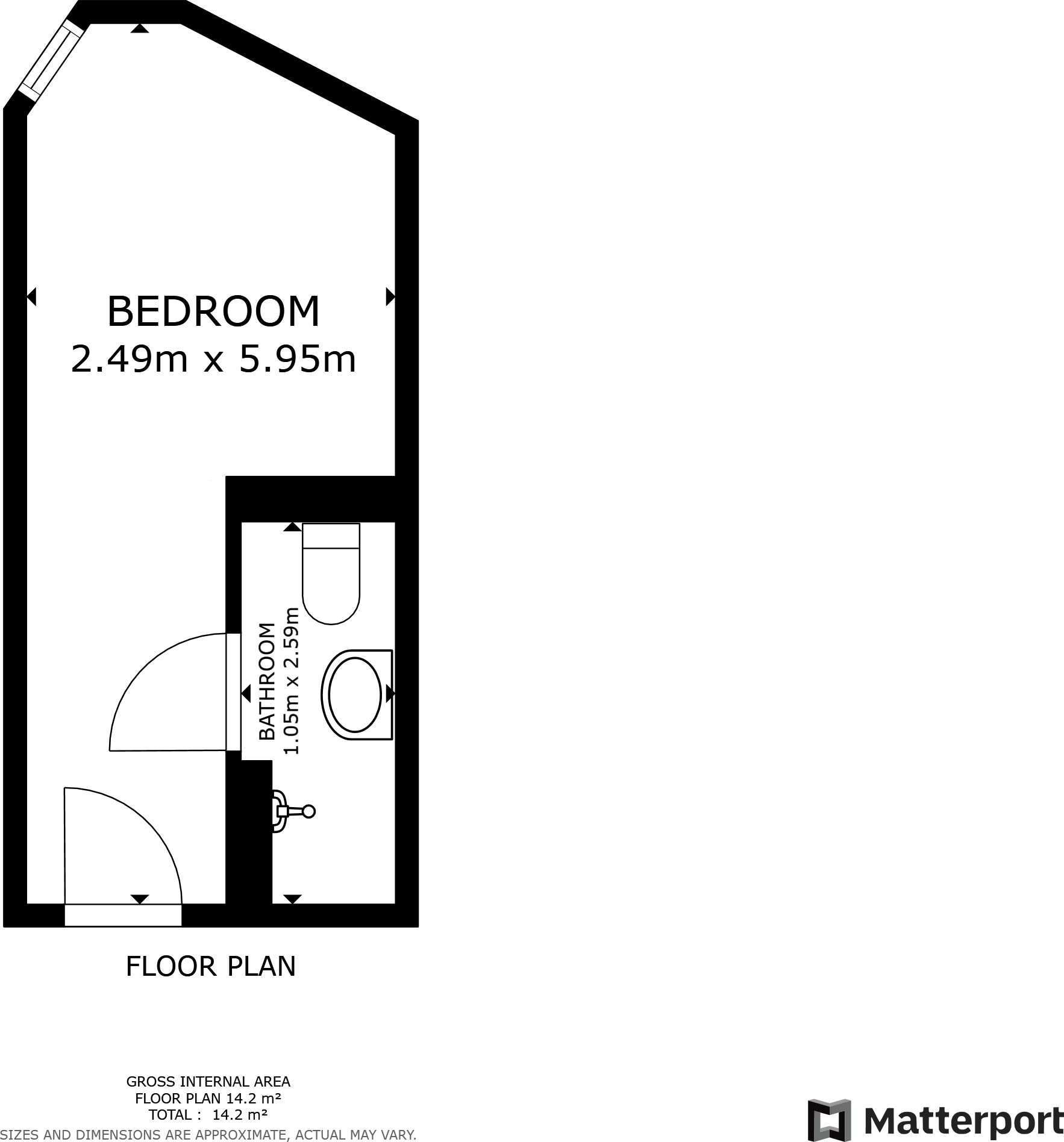

1 bed 1 bath Studio

High-yield city studio with tenant in place and strong rental appeal.

Immediate rental income in place (tenant in situ)

A compact studio in Liverpool city centre offering immediate rental income and strong headline yields for investors. Set in a converted-warehouse building, the flat combines industrial character, high ceilings and modern kitchen fittings—appealing to city renters and students in a cosmopolitan neighbourhood.

The property is currently let and produces a gross income of £6,000 per year; at the asking price of £24,500 this equates to an approximate gross yield of around 24.5%. The tenant has been in place for under a year and intends to remain, providing continuity of income for a buyer seeking a hands-off investment.

Practical facts: the flat is leasehold (circa 250 years remaining) with communal private parking and no private garden. The area is a busy student and city-centre neighbourhood with excellent broadband and mobile coverage, but recorded crime levels are very high—an important consideration for future management, insurance and tenant screening.

Buyers should note a buyer’s premium applies on purchase. The building appears well-converted and low-maintenance from available details, but purchasers should review the Let Property Pack and commission usual surveys and checks before exchange.

Studio flat for sale in Jamaica Street, Liverpool, Merseyside, L1 — £41,000 • 1 bed • 1 bath • 327 ft²

Studio flat for sale in Jamaica Street, Liverpool, Merseyside, L1 — £41,000 • 1 bed • 1 bath • 327 ft² 2 bedroom flat for sale in Colquitt Street, Liverpool, Merseyside, L1 — £150,000 • 2 bed • 1 bath • 743 ft²

2 bedroom flat for sale in Colquitt Street, Liverpool, Merseyside, L1 — £150,000 • 2 bed • 1 bath • 743 ft² 1 bedroom flat for sale in Duke Street, Liverpool, Liverpool, L1 — £95,000 • 1 bed • 1 bath • 420 ft²

1 bedroom flat for sale in Duke Street, Liverpool, Liverpool, L1 — £95,000 • 1 bed • 1 bath • 420 ft² Studio flat for sale in Upper Parliament Street, Liverpool, L8 — £31,000 • 1 bed • 1 bath

Studio flat for sale in Upper Parliament Street, Liverpool, L8 — £31,000 • 1 bed • 1 bath 2 bedroom flat for sale in Stowell Street, Liverpool, L7 — £133,000 • 2 bed • 1 bath • 532 ft²

2 bedroom flat for sale in Stowell Street, Liverpool, L7 — £133,000 • 2 bed • 1 bath • 532 ft² 2 bedroom flat for sale in Standish Street, Liverpool, L3 — £144,060 • 2 bed • 1 bath • 635 ft²

2 bedroom flat for sale in Standish Street, Liverpool, L3 — £144,060 • 2 bed • 1 bath • 635 ft²