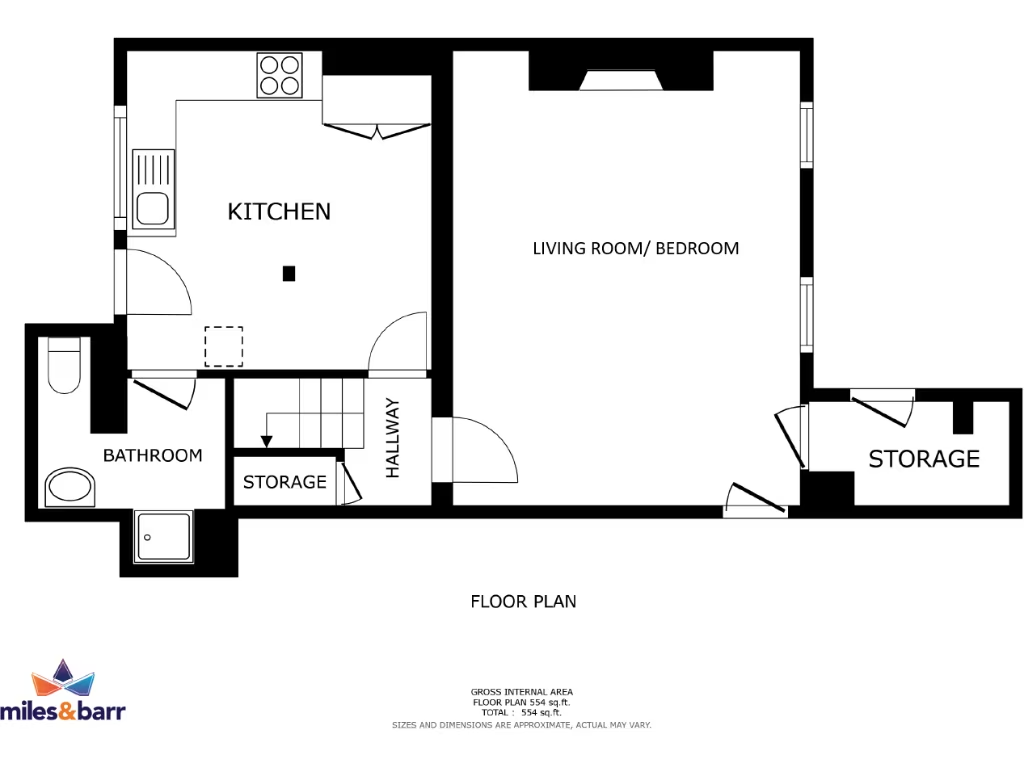

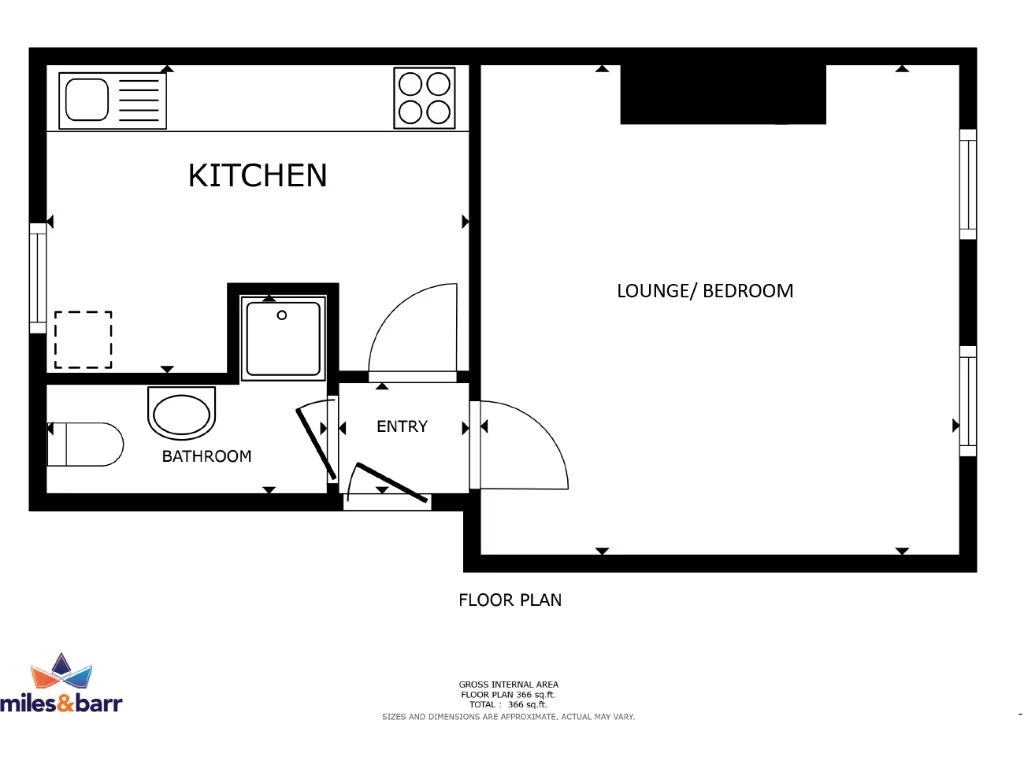

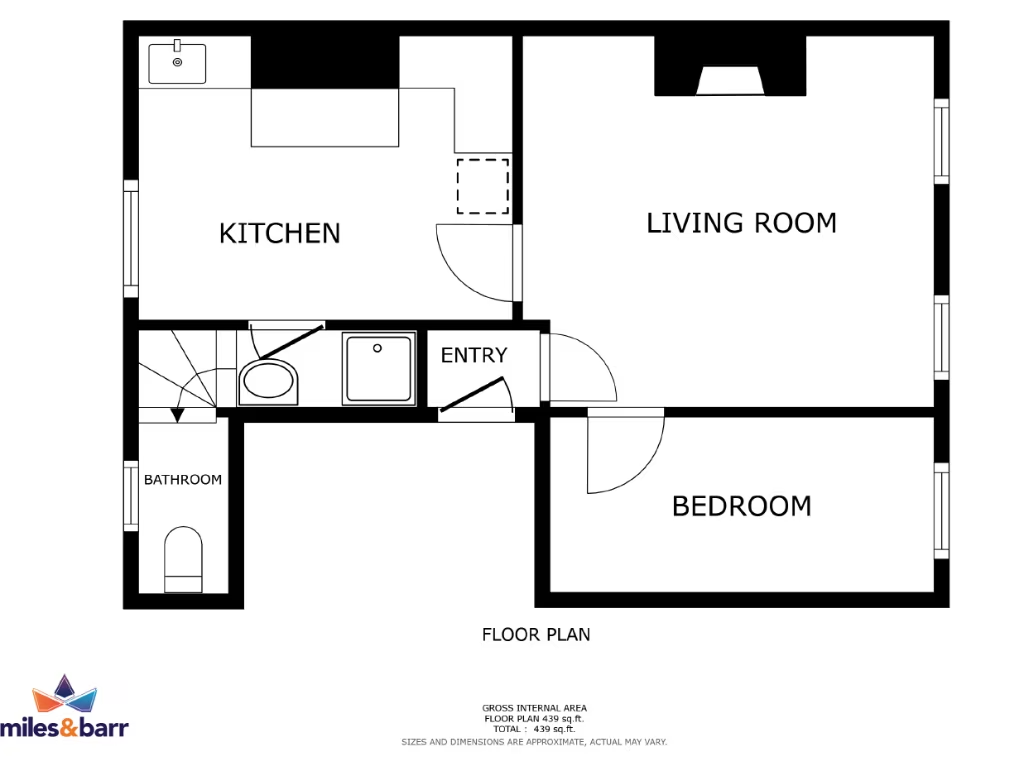

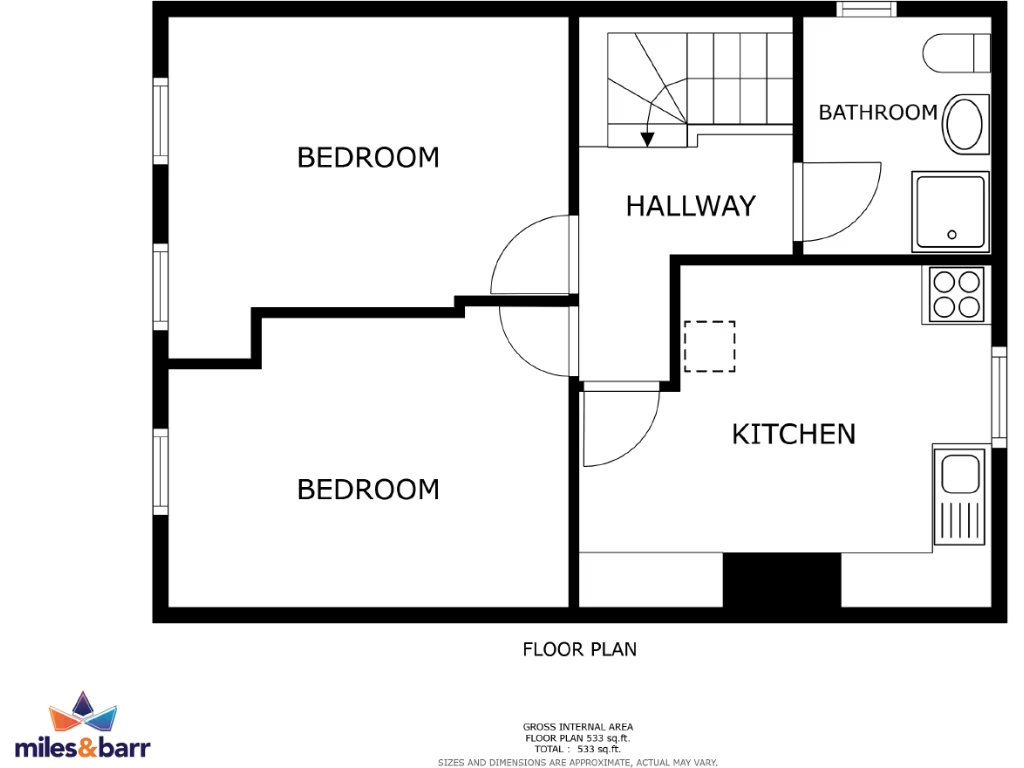

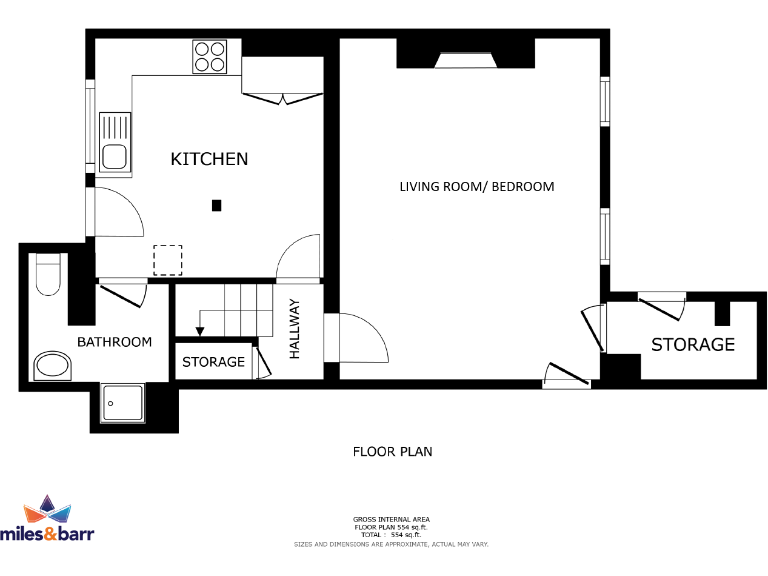

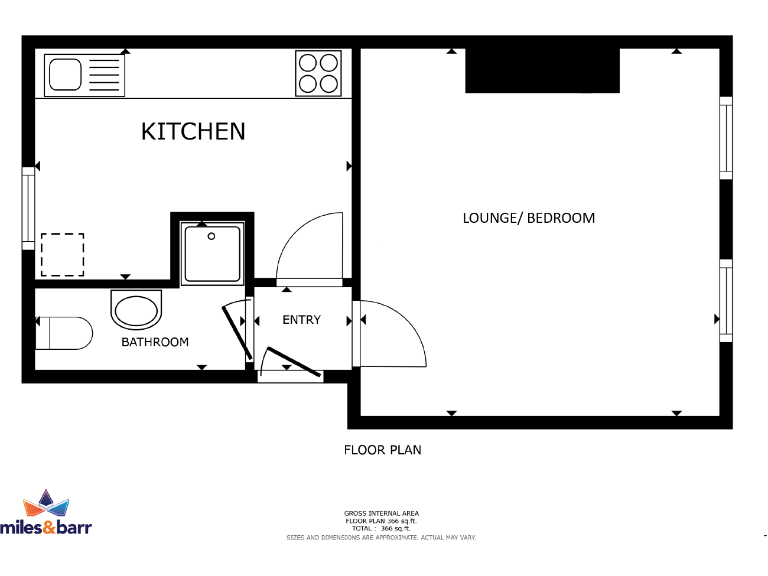

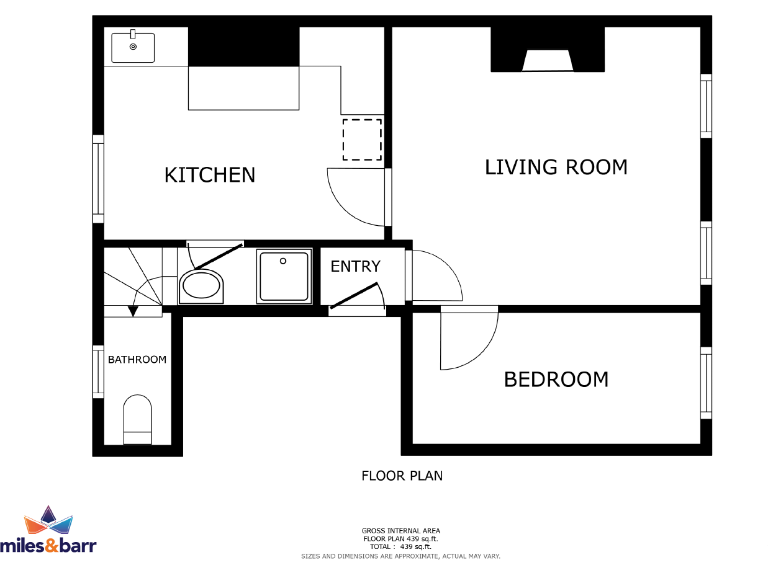

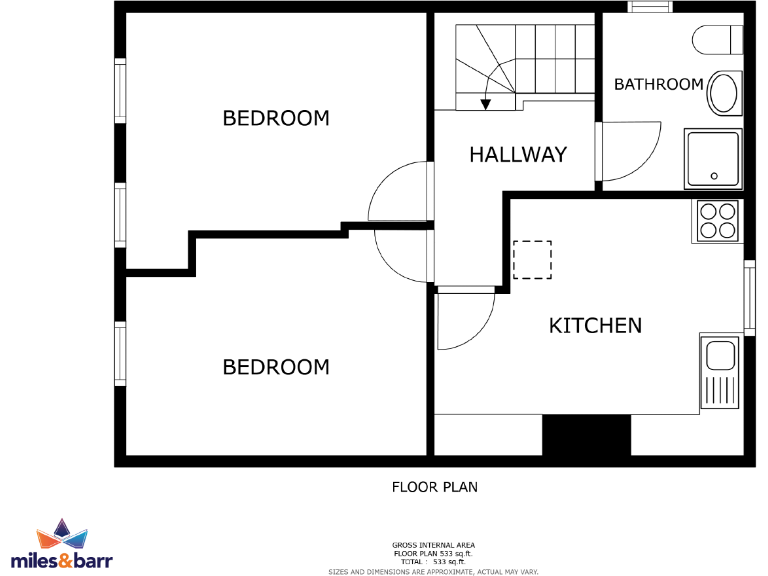

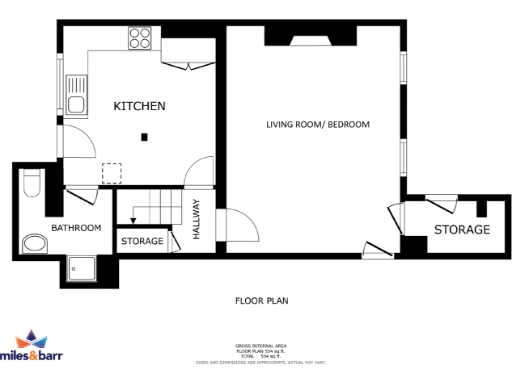

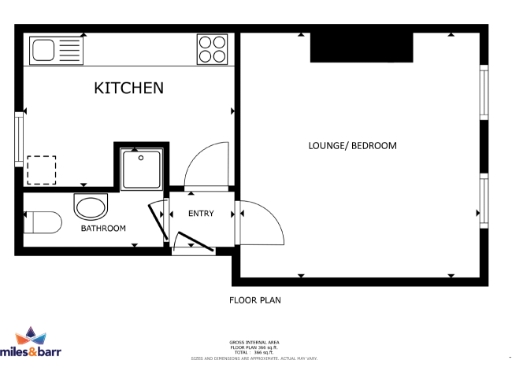

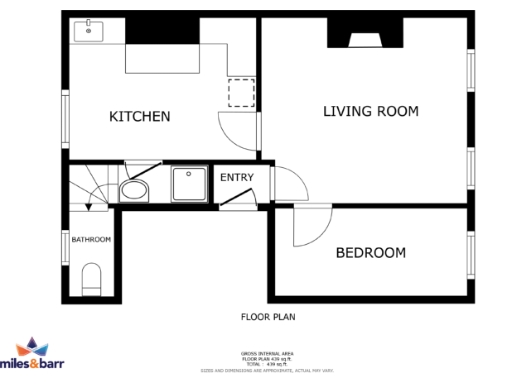

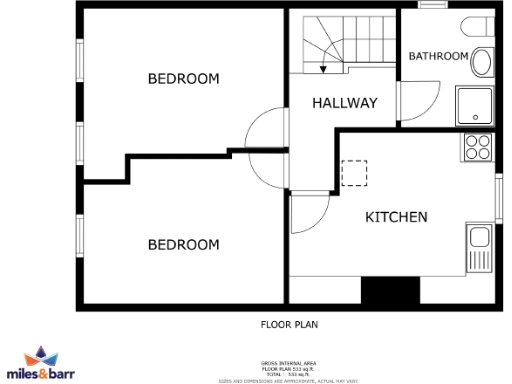

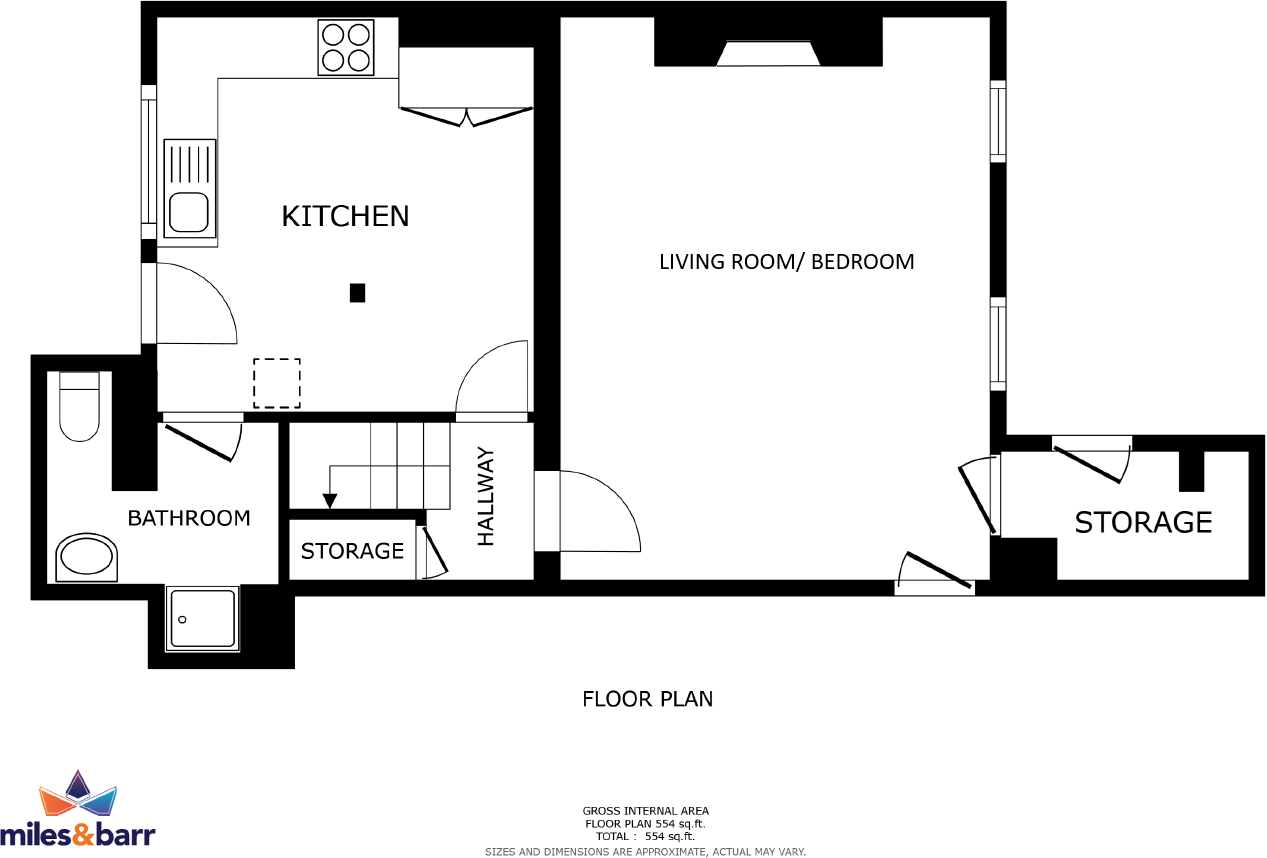

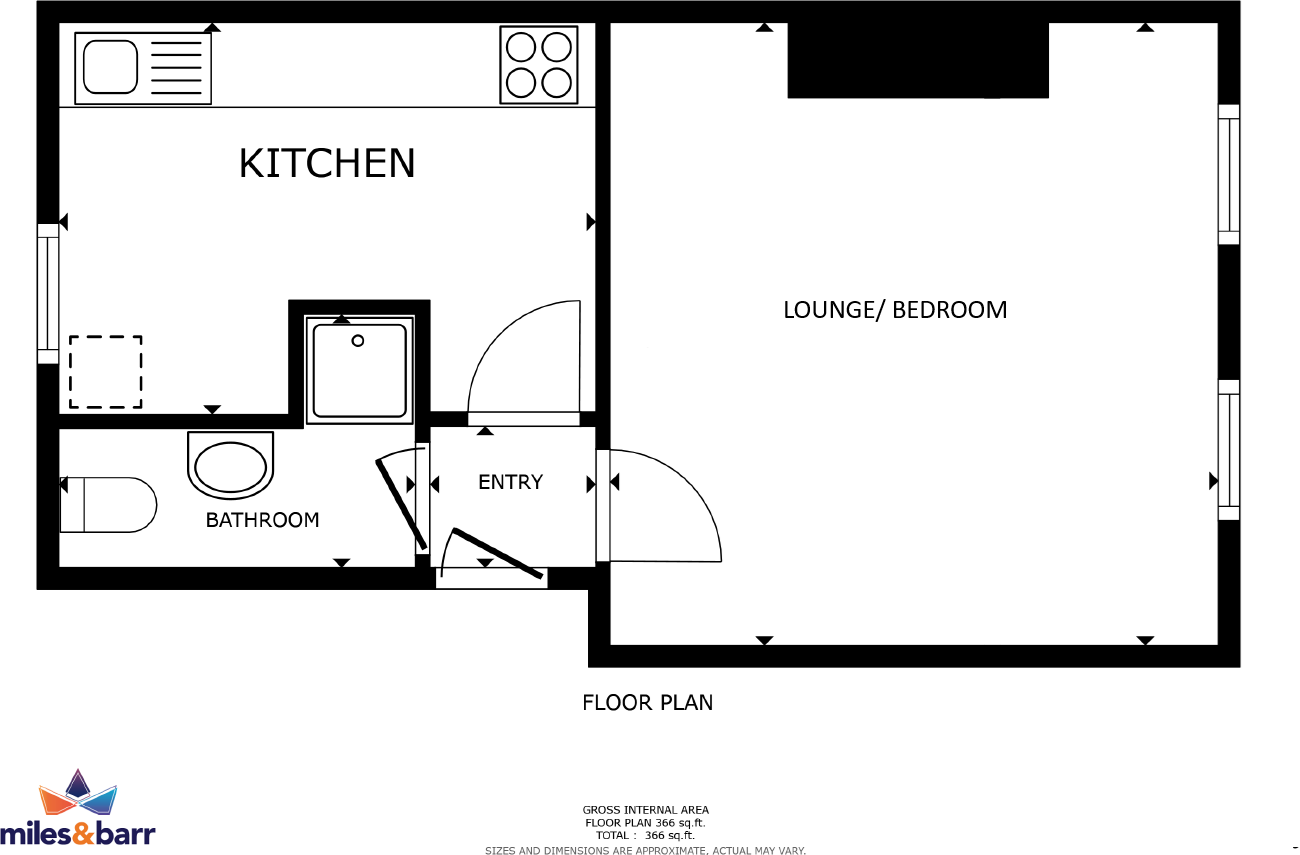

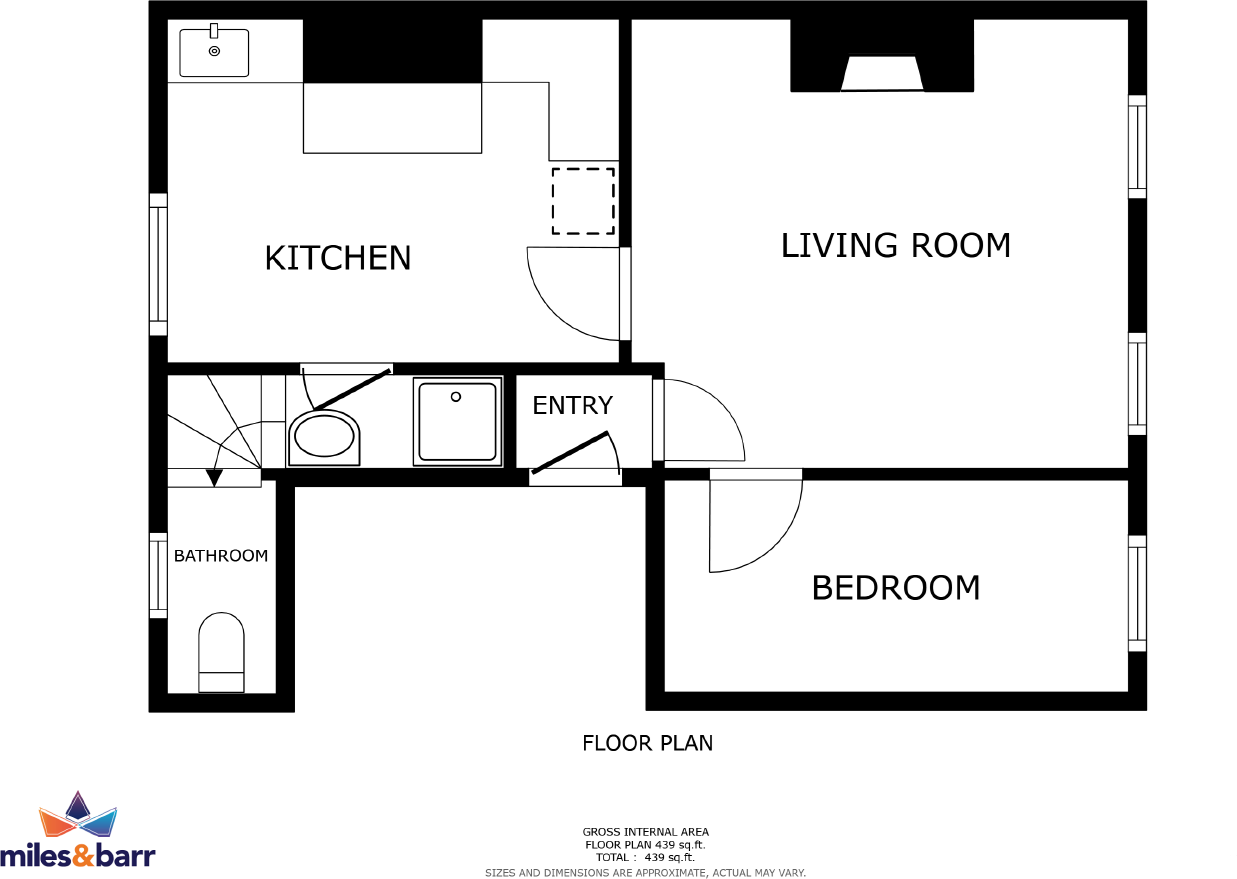

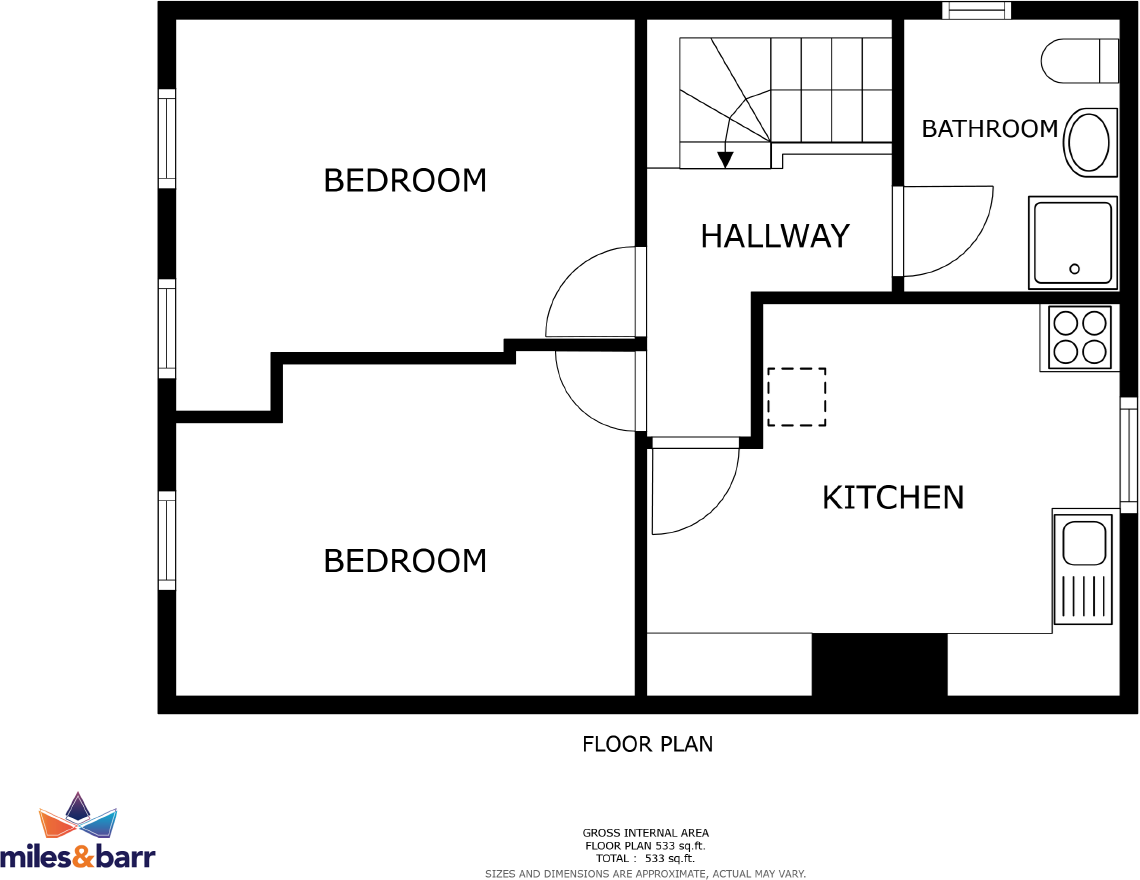

Four self-contained flats generating immediate rental income (tenants in situ)

Freehold period townhouse with Georgian brick façade and sash windows

Walking distance to Ramsgate Harbour, shops and transport links

Small private paved rear courtyard and external storage outbuilding

Solid brick walls likely uninsulated; potential for energy improvements

Located in a very deprived area with very high crime rates

Sold with occupants — purchase subject to existing tenancy agreements

Small plot and limited external amenity; some internal modernisation likely

A rare freehold investment in Ramsgate: this four-flat, end-of-terrace period house offers immediate rental income with tenants in situ and no onward chain. The building retains Georgian character externally — sash windows, brick façade and iron-railed forecourt — while the internal layout is arranged as four self-contained units that maximise lettable space. Its city-centre location places Ramsgate Harbour, shops and transport links within easy walking distance, helping letability.

The rear courtyard is a private, low-maintenance outdoor space and includes a small brick outbuilding for storage. The property is built c.1900–1929 from solid brick (likely with no wall insulation) and benefits from mains gas central heating and double glazing (install dates unknown). Broadband speeds are average but mobile signal is excellent — useful for tenants and short-term lets.

Important considerations: the area is classified as very deprived with very high crime and a high proportion of constrained renters and a transitional Eastern European neighbourhood profile. The property is sold with tenants in situ, so buyers should expect to purchase an occupied asset and respect existing tenancy agreements. Internal modernisation or insulation upgrades may be required to improve energy performance and long-term capital growth. The plot and garden are small; there are limited external amenity prospects.

This is best suited to buy-to-let investors or portfolio buyers seeking an income-producing town-centre asset with character and refurbishment potential. It offers immediate cashflow and future upside from sensible upgrades, but buyers should factor in management requirements and area-related lettability risks.