Summary - 34 MOORLAND ROAD LYTHAM ST ANNES FY8 3TD

2 bed 1 bath Flat

Reliable rental income with garage and parking in established seaside suburb.

Long‑term tenant in situ producing £6,360 gross annually

Leasehold tenure — buyer to review lease length and charges

Private garage nearby; shared private parking available

Shared rear garden only; external amenity space is limited

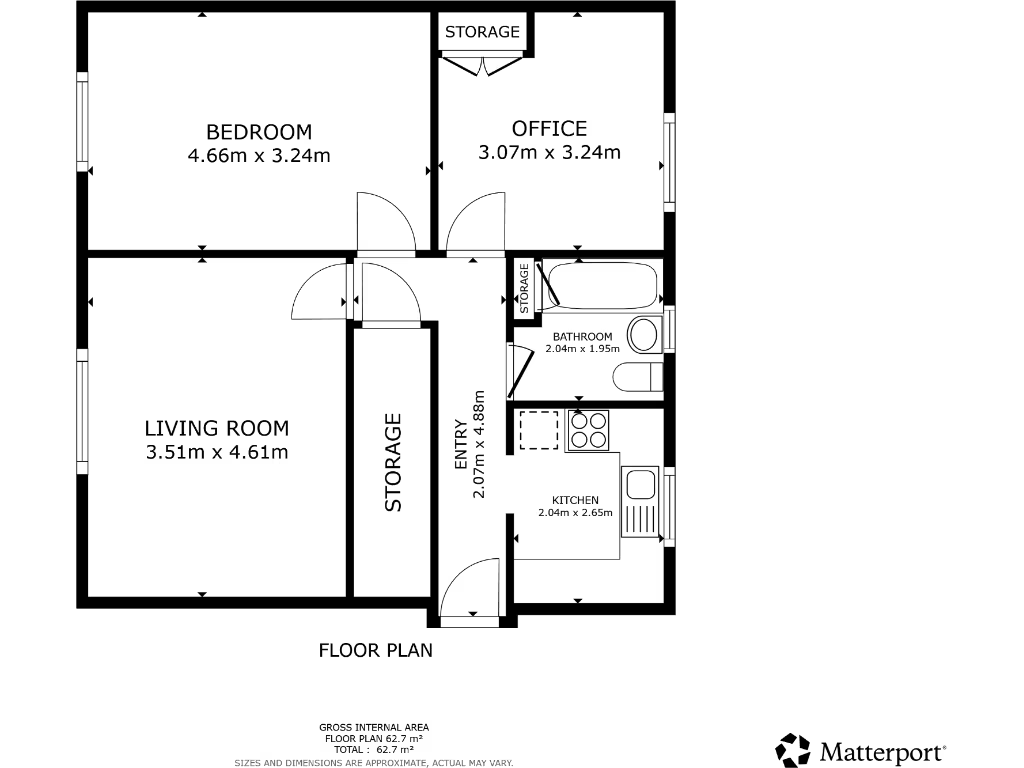

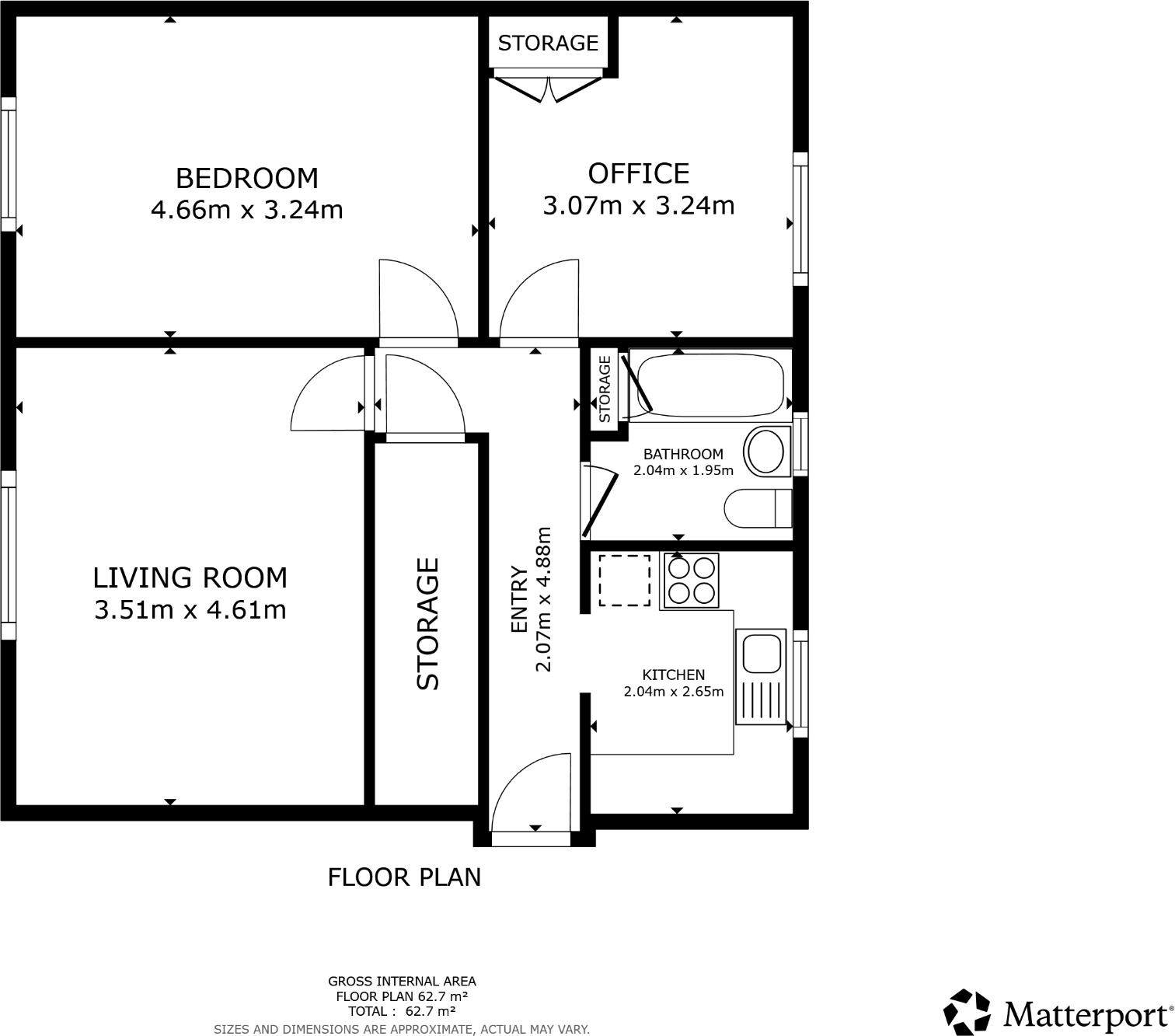

Average overall size (624 sq ft); ground‑floor access

Buyers Premium applies on completion — factor into purchase costs

Suitable for investors or developers; sale marketed as investment

Internal condition and refurbishment needs unknown — inspect

Situated on Moorland Road in Lytham St. Annes, this two-bedroom ground‑floor flat is presented primarily as a buy-to-let opportunity. The long-term tenant currently in situ produces a gross annual income of £6,360, making the property cashflow-positive at the current asking price of £80,000. A private garage in a nearby row and shared private parking add practical appeal for lettings.

The accommodation is an average-sized 624 sq ft unit in a mid‑20th century red‑brick block with a small shared rear garden. Externally the building appears sound from street level; internal inspection and a review of the Let Property Pack (rental history and tenancy documents) are recommended to confirm condition and tenancy terms.

Important sale details: the property is leasehold, comes with a sitting tenant who intends to remain, and a Buyers Premium will apply to the sale. These factors suit a committed investor or developer prepared to purchase with tenant in place and to factor in any heads of terms attached to the lease or premium.

This flat suits investors seeking a low‑management suburban rental with reliable rental income and straightforward local amenity access. For those considering future value-add, obtain the floor plans and internal photos to assess refurbishment scope or re-let potential once tenancy terms allow.

1 bedroom flat for sale in Clifton Street, Lytham St. Annes, FY8 — £115,000 • 1 bed • 1 bath • 849 ft²

1 bedroom flat for sale in Clifton Street, Lytham St. Annes, FY8 — £115,000 • 1 bed • 1 bath • 849 ft² 5 bedroom terraced house for sale in St. Albans Road, Lytham St. Annes, Lancashire, FY8 — £175,000 • 5 bed • 4 bath • 1863 ft²

5 bedroom terraced house for sale in St. Albans Road, Lytham St. Annes, Lancashire, FY8 — £175,000 • 5 bed • 4 bath • 1863 ft² 1 bedroom flat for sale in Whitegate Drive, Blackpool, Lancashire, FY3 — £97,500 • 1 bed • 1 bath • 527 ft²

1 bedroom flat for sale in Whitegate Drive, Blackpool, Lancashire, FY3 — £97,500 • 1 bed • 1 bath • 527 ft² 2 bedroom flat for sale in St Davids Grove, Lytham St. Annes, Lancashire, FY8 — £105,000 • 2 bed • 1 bath • 603 ft²

2 bedroom flat for sale in St Davids Grove, Lytham St. Annes, Lancashire, FY8 — £105,000 • 2 bed • 1 bath • 603 ft² 2 bedroom apartment for sale in Shepherd Road, Lytham St. Annes, FY8 — £95,000 • 2 bed • 1 bath • 598 ft²

2 bedroom apartment for sale in Shepherd Road, Lytham St. Annes, FY8 — £95,000 • 2 bed • 1 bath • 598 ft² 2 bedroom flat for sale in Kilnhouse Lane, Lytham St. Annes, FY8 — £80,000 • 2 bed • 1 bath • 592 ft²

2 bedroom flat for sale in Kilnhouse Lane, Lytham St. Annes, FY8 — £80,000 • 2 bed • 1 bath • 592 ft²