Summary - 11 MERSEY STREET BACUP OL13 9RQ

2 bed 1 bath Terraced

Immediate rental income with clear refurbishment upside for investors.

- Freehold Victorian mid-terrace with two bedrooms

- Tenant in situ, long-term and reportedly intending to stay

- Current gross rental income £5,040 per year

- Approx 657 sq ft; small footprint, compact room sizes

- Small forecourt only; limited rear/amenity space

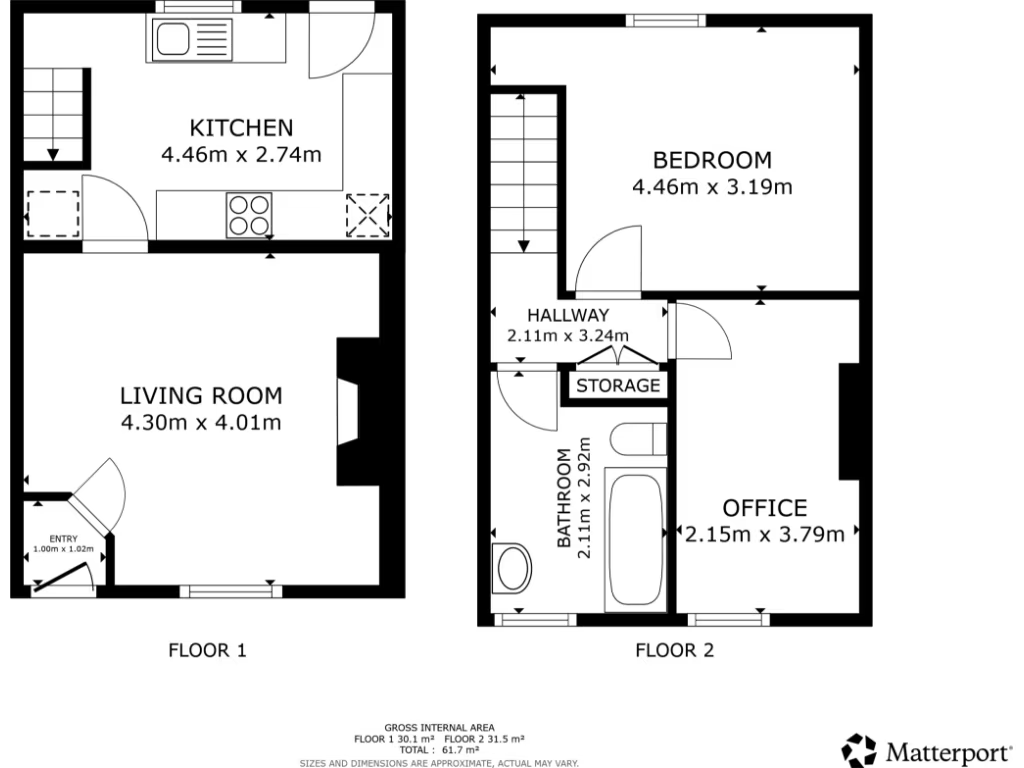

- No internal photos or floorplan provided; inspection advised

- Likely requires cosmetic/updating work to reach market rent

- Buyers Premium applies to secure purchase

A compact two-bedroom Victorian terrace in Bacup presented as a clear buy-to-let opportunity. The property is freehold, currently let to long-term tenants producing a gross annual income of £5,040, making it suitable for investors seeking an immediate rental return and low-management acquisition.

Internally the house offers a spacious lounge, a well-equipped kitchen with ample storage, a three-piece bathroom and two bedrooms across a modest footprint of about 657 sq ft. The terrace form and traditional brick façade retain period character, while the small forecourt and limited outside space mean external amenity is minimal.

Important considerations: the property is marketed from a lettings/investment perspective with tenants in situ who state they wish to remain, so purchase will likely be as an investment rather than vacant possession. The listing includes no internal floorplans or recent photographs, so an internal inspection is recommended to confirm condition, room sizes and any refurbishment needs.

Other practical points: broadband and mobile signal are reported as strong and flood risk is nil. A Buyers Premium is noted as part of the sale process. Investors should review the Let Property Pack and tenancy documents, and allow for likely minor-to-moderate updating to maximise rental value.

2 bedroom terraced house for sale in Dale Street, Bacup, OL13 — £70,000 • 2 bed • 1 bath • 646 ft²

2 bedroom terraced house for sale in Dale Street, Bacup, OL13 — £70,000 • 2 bed • 1 bath • 646 ft² 2 bedroom terraced house for sale in Albert Terrace, Bacup, Rossendale, OL13 — £110,000 • 2 bed • 1 bath • 735 ft²

2 bedroom terraced house for sale in Albert Terrace, Bacup, Rossendale, OL13 — £110,000 • 2 bed • 1 bath • 735 ft² 2 bedroom terraced house for sale in Alma Street, Bacup, OL13 — £69,950 • 2 bed • 1 bath • 674 ft²

2 bedroom terraced house for sale in Alma Street, Bacup, OL13 — £69,950 • 2 bed • 1 bath • 674 ft² 1 bedroom terraced house for sale in Burnley Road, Rossendale, BB4 — £120,000 • 1 bed • 1 bath • 474 ft²

1 bedroom terraced house for sale in Burnley Road, Rossendale, BB4 — £120,000 • 1 bed • 1 bath • 474 ft² 2 bedroom terraced house for sale in Bury Road, Bury, BL8 — £159,000 • 2 bed • 1 bath • 860 ft²

2 bedroom terraced house for sale in Bury Road, Bury, BL8 — £159,000 • 2 bed • 1 bath • 860 ft² 2 bedroom terraced house for sale in New Line, Bacup, Rossendale, OL13 — £110,000 • 2 bed • 1 bath • 689 ft²

2 bedroom terraced house for sale in New Line, Bacup, Rossendale, OL13 — £110,000 • 2 bed • 1 bath • 689 ft²