Summary - ELWICK COURT 85 OSBORNE ROAD HARTLEPOOL TS26 9LH

2 bed 1 bath Apartment

High-yield, low-lease-risk unit near shops and bus links.

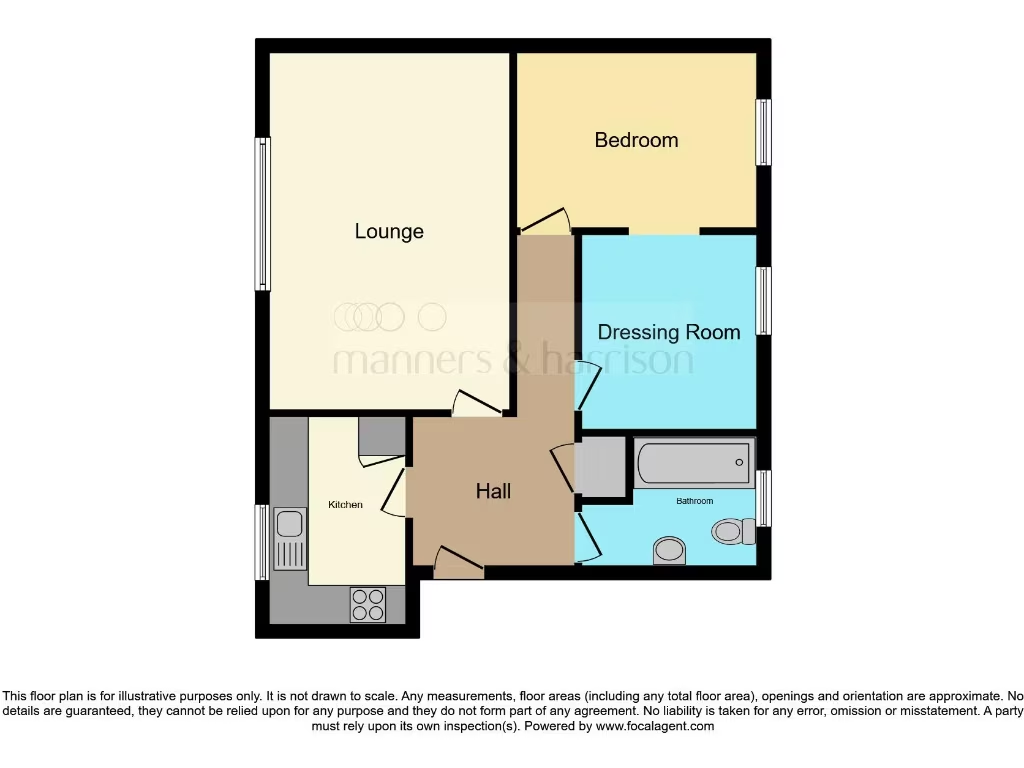

Top-floor two-bedroom flat, deceptively spacious at ~679 sq ft

Allocated off-street parking bay to rear of development

Long lease (circa 956 years) reduces long-term leasehold risk

Sold by Modern Auction — undisclosed reserve and buyer fees apply

Non‑refundable reservation fee 4.5% (min £6,600) plus admin pack costs

Electric room heaters only — no communal gas heating; possible running costs

Area shows very high crime and very high deprivation — assess rental demand

Currently arranged as one-bedroom via internal access; easy reinstatement

This top-floor, two-bedroom flat in Hartlepool presents a clear investment opportunity, with advertised rental yields of 8–9% and an allocated off-street parking bay. The apartment is deceptively spacious at around 679 sq ft, fitted with contemporary kitchen and living-room finishes and double glazing. A long lease (circa 956 years) reduces long-term leasehold risk for buyers.

Buyers should note the property is sold via Modern Auction with an undisclosed reserve. Successful purchasers must pay a non-refundable reservation fee (4.5% of purchase price, minimum £6,600) plus buyer administration fees; additional costs for the buyer information pack may apply. Allow 56 days to complete the purchase and complete ID and funding checks.

Practical considerations: heating is by individual electric room heaters (no communal gas), and the building dates from the late 1970s/early 1980s. Service charge and ground rent are both listed at £240 (service charge described as below average), and council tax is very low. The area records very high crime and very high deprivation indices, which may affect tenant demand and rents; perform local market checks and a full survey.

Internally the layout currently uses bedroom 1 to access bedroom 2, effectively configured as a one-bedroom; reinstating two separate bedrooms would be straightforward and low cost. The flat’s location near shops, schools and bus routes supports rental appeal, but purchasers should factor in potential refurbishment and management costs when calculating net yield.

1 bedroom apartment for sale in Stockton Road, Hartlepool, TS25 — £20,000 • 1 bed • 1 bath • 431 ft²

1 bedroom apartment for sale in Stockton Road, Hartlepool, TS25 — £20,000 • 1 bed • 1 bath • 431 ft² 1 bedroom terraced house for sale in Stockton Road, HARTLEPOOL, TS25 — £20,000 • 1 bed • 1 bath • 431 ft²

1 bedroom terraced house for sale in Stockton Road, HARTLEPOOL, TS25 — £20,000 • 1 bed • 1 bath • 431 ft² 2 bedroom flat for sale in Park Road, HARTLEPOOL, TS24 — £35,000 • 2 bed • 1 bath • 410 ft²

2 bedroom flat for sale in Park Road, HARTLEPOOL, TS24 — £35,000 • 2 bed • 1 bath • 410 ft² 2 bedroom apartment for sale in Park Road, Hartlepool, TS24 — £35,000 • 2 bed • 1 bath • 700 ft²

2 bedroom apartment for sale in Park Road, Hartlepool, TS24 — £35,000 • 2 bed • 1 bath • 700 ft² 2 bedroom apartment for sale in 4 Waterlily Court, Hartlepool, Cleveland, TS26 0RR, TS26 — £50,000 • 2 bed • 2 bath • 586 ft²

2 bedroom apartment for sale in 4 Waterlily Court, Hartlepool, Cleveland, TS26 0RR, TS26 — £50,000 • 2 bed • 2 bath • 586 ft² 2 bedroom flat for sale in Church Street, Hartlepool, TS24 — £42,000 • 2 bed • 1 bath • 675 ft²

2 bedroom flat for sale in Church Street, Hartlepool, TS24 — £42,000 • 2 bed • 1 bath • 675 ft²