Summary - 80 TEWKESBURY STREET CARDIFF CF24 4QT

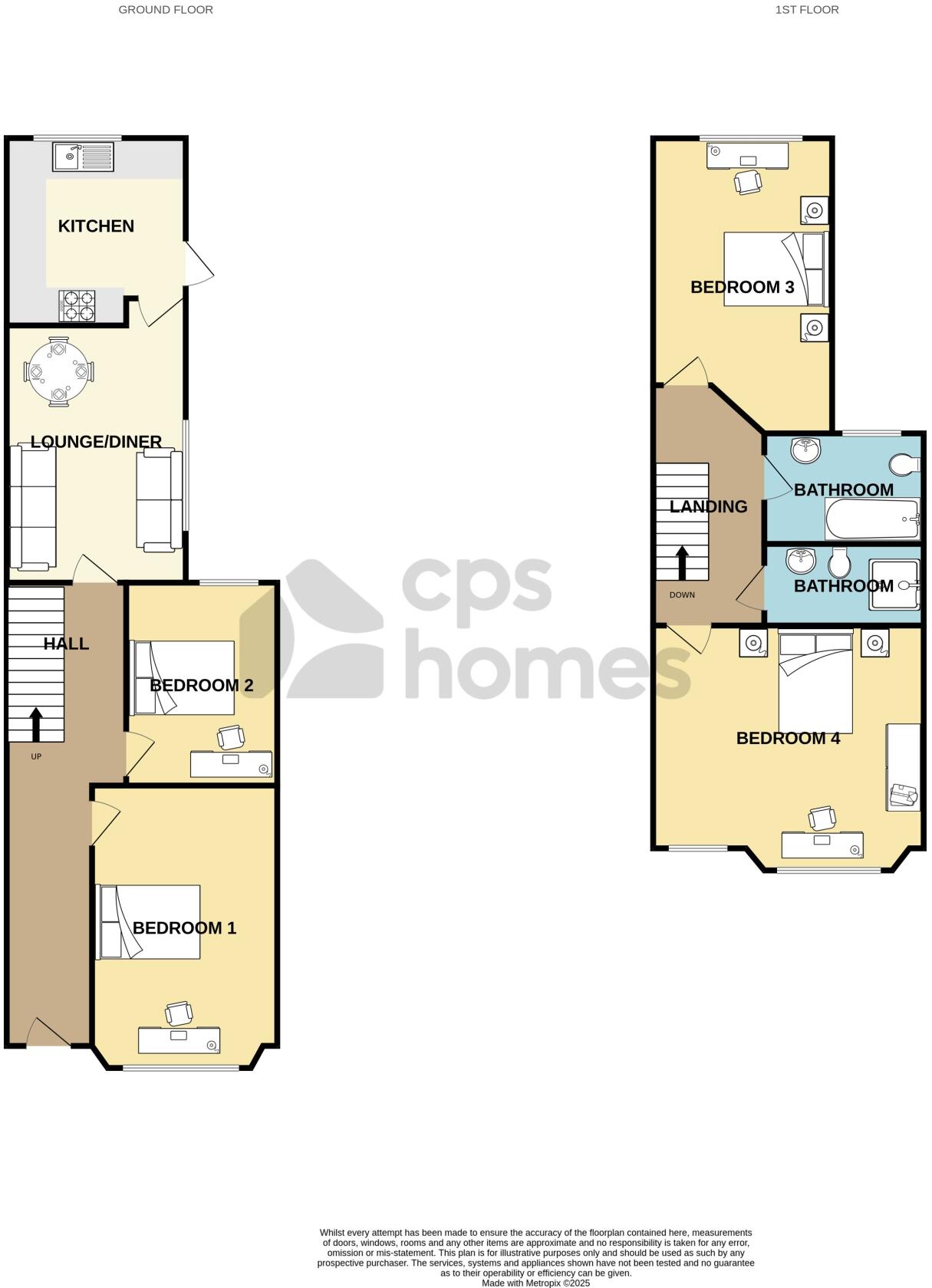

4 bed 2 bath Terraced

Turn-key HMO in Cathays producing immediate income with scope to increase rent..

Licensed 4-bedroom HMO granted Feb 2024, ready to rent

Current income £2,220 PCM inclusive of bills; growth potential

Freehold mid-terrace Victorian property, c.1900–1929

Total area c.1,012 sq ft over multiple storeys

Two bathrooms, communal modern kitchen, well presented internally

No wall insulation assumed; potential higher running costs

Located close to universities, hospital and city centre transport

Area classed as very deprived; council tax above average

A licensed 4-bedroom HMO in Cathays, offered freehold and currently producing £2,220 PCM inclusive of bills. The property is well presented throughout and benefits from an HMO licence granted in February 2024, making it immediately income-generating for investor buyers targeting students and young professionals. Proximity to Cardiff’s universities, the University Hospital of Wales and the city centre supports strong demand and rental resilience.

Internally the layout suits sharers: four generous bedrooms, two bathrooms and a communal modern kitchen. The house is mid-terrace Victorian stock (c.1900–1929) with high ceilings and period features at the front, plus practical modern fittings in communal areas. Total internal area is about 1,012 sq ft over multiple storeys, with mains gas boiler and double glazing noted (install dates unknown).

Buyers should note material considerations: the property sits in a very deprived local area classification and council tax is above average. The building’s external walls are described as granite/whinstone with no known insulation, so thermal performance and running costs may be higher than modern stock. There is clear scope to increase rental income, but prospective purchasers should factor in potential remedial works, insulation upgrades and ongoing maintenance for a property of this age.

Overall this is a turn-key HMO investment in a high-demand student/young-professional neighbourhood. It suits investors seeking immediate rental income with upside from active management and modest capital improvements.

4 bedroom terraced house for sale in Blackweir Terrace, Cathays, CF10 — £235,000 • 4 bed • 1 bath • 948 ft²

4 bedroom terraced house for sale in Blackweir Terrace, Cathays, CF10 — £235,000 • 4 bed • 1 bath • 948 ft² 4 bedroom terraced house for sale in Rhymney Street, Cathays, Cardiff, CF24 4DG, CF24 — £290,000 • 4 bed • 1 bath • 1174 ft²

4 bedroom terraced house for sale in Rhymney Street, Cathays, Cardiff, CF24 4DG, CF24 — £290,000 • 4 bed • 1 bath • 1174 ft² 4 bedroom house for sale in Cottrell Road, Roath, Cardiff, CF24 — £330,000 • 4 bed • 1 bath • 872 ft²

4 bedroom house for sale in Cottrell Road, Roath, Cardiff, CF24 — £330,000 • 4 bed • 1 bath • 872 ft² 4 bedroom terraced house for sale in Tewkesbury Street, Cardiff, CF24 4QT, CF24 — £300,000 • 4 bed • 1 bath • 1130 ft²

4 bedroom terraced house for sale in Tewkesbury Street, Cardiff, CF24 4QT, CF24 — £300,000 • 4 bed • 1 bath • 1130 ft² 4 bedroom flat for sale in Gelligaer Street, Cardiff, CF24 — £360,000 • 4 bed • 4 bath • 1120 ft²

4 bedroom flat for sale in Gelligaer Street, Cardiff, CF24 — £360,000 • 4 bed • 4 bath • 1120 ft² 4 bedroom terraced house for sale in Tewkesbury Street, Cathays, CF24 — £280,000 • 4 bed • 1 bath

4 bedroom terraced house for sale in Tewkesbury Street, Cathays, CF24 — £280,000 • 4 bed • 1 bath