Summary -

Apartment 51,Mather House,Mather Lane,LEIGH,WN7 2FS

WN7 2FS

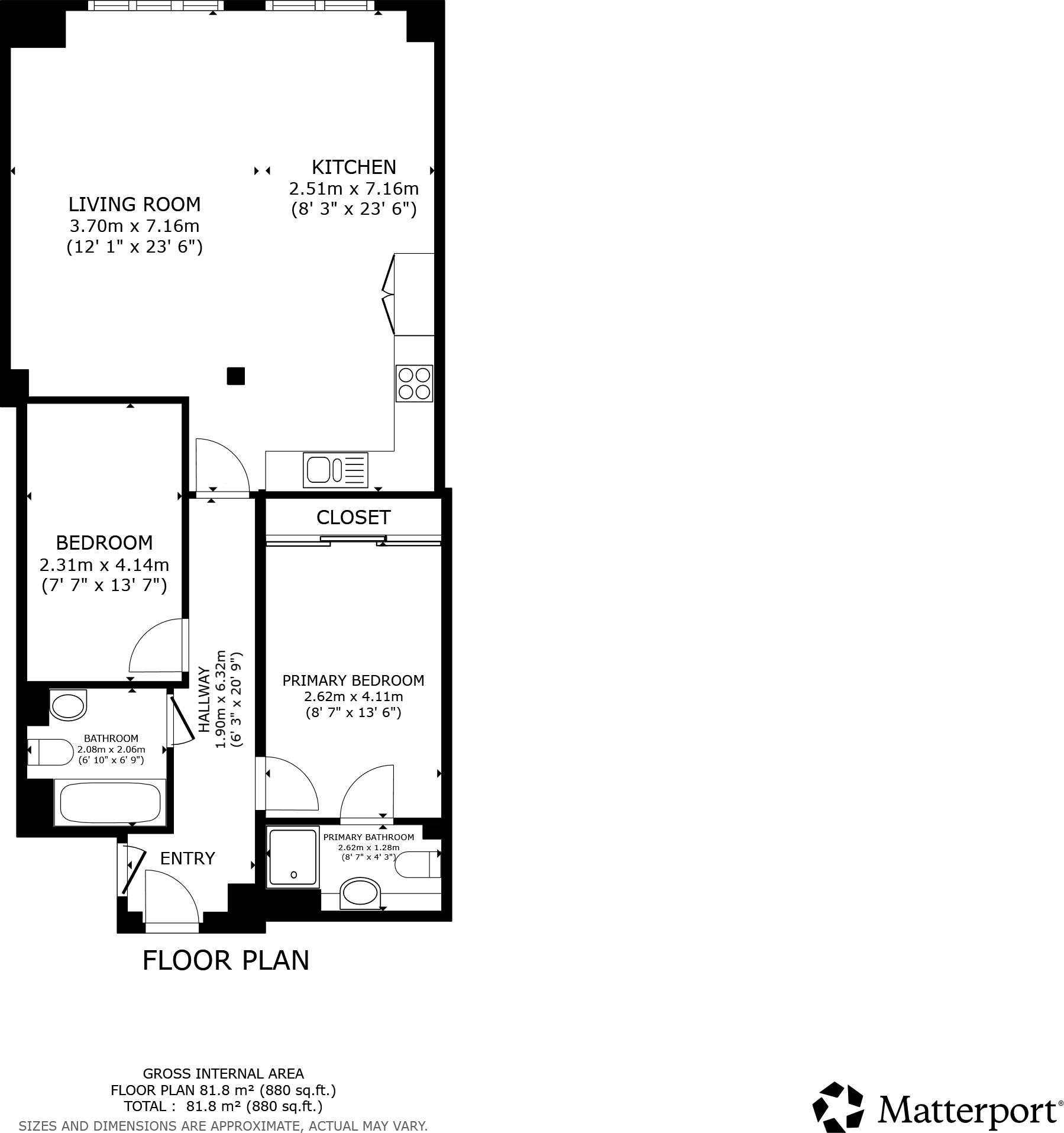

2 bed 2 bath Flat

Ready income-producing flat for portfolio growth and immediate return.

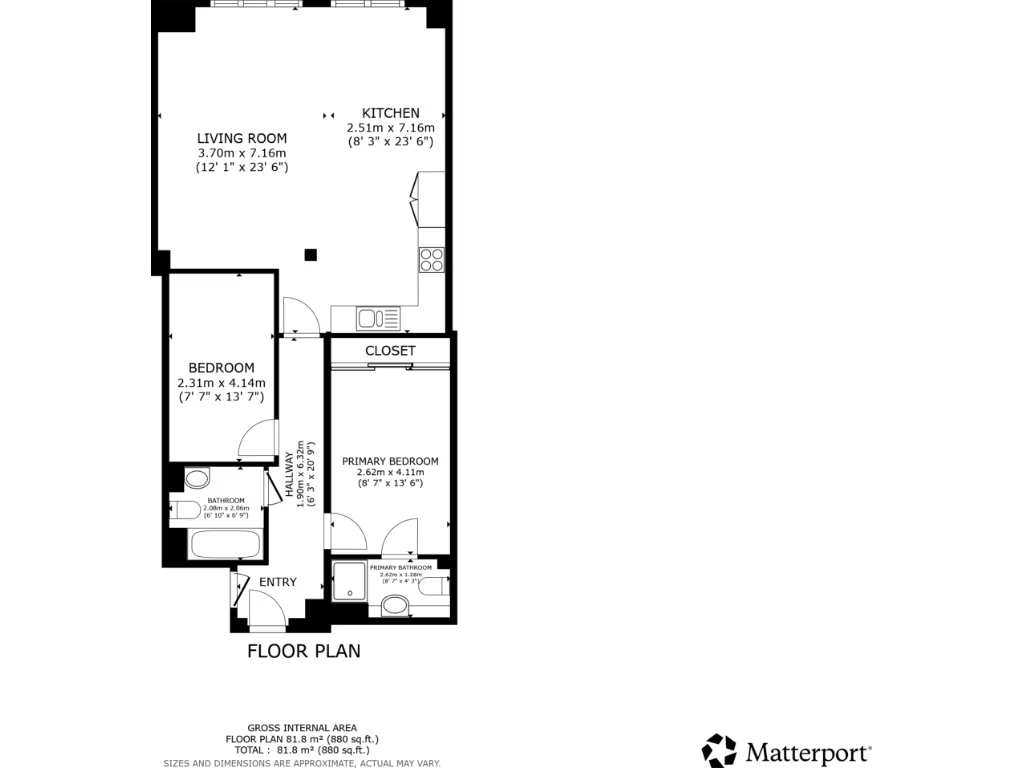

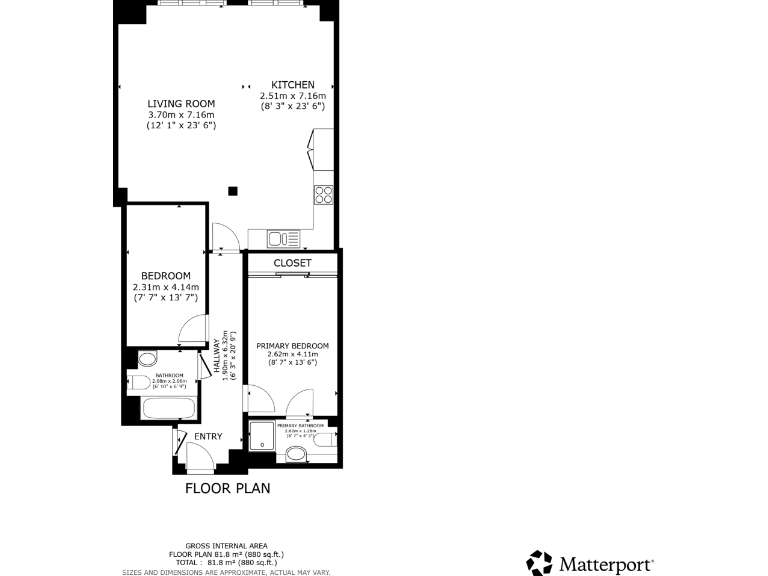

Large 2-bed leasehold apartment, approx. 1,227 sq ft

Produces gross annual income £13,200 with tenants in situ

Converted mill with high ceilings and large windows

Open-plan layout, two bathrooms, modern kitchen

Communal private off-street parking included

Long lease — 245 years remaining

No private garden; urban setting with limited outlook

Area classified as deprived; consider local growth prospects

This two-bedroom leasehold apartment in a converted industrial building on Mather Lane is presented as a ready-made investment. It currently produces a gross annual income of £13,200 with reliable tenants in situ who wish to remain; that immediate income stream suits buy-to-let portfolios and investor buyers seeking low-vacancy stock.

The apartment is spacious (approx. 1,227 sq ft) with high ceilings and large industrial-style windows that give strong natural light and a loft-like feel. The layout is open-plan with two bathrooms, a modern kitchen and a generous living area. Communal private off-street parking is provided and the long lease (245 years remaining) reduces near-term lease concerns.

Notable drawbacks are straightforward: the property is leasehold, situated in a broadly deprived local area (classified as Hampered Aspiration / Ageing Urban Communities), and broadband speeds are average. There is no private garden shown and the sale includes sitting tenants, so owner-occupiers seeking immediate vacant possession may not be able to move in. A buyer's premium will be applied as part of the transaction terms.

For investors this is a practical, income-producing addition with characterful features and redevelopment upside typical of converted mill stock. However, growth prospects should be weighed against local area indicators and the tenancy terms provided in the Let Property Pack.

2 bedroom apartment for sale in Pendle Court, Leigh, WN7 3AB, WN7 — £100,000 • 2 bed • 1 bath • 556 ft²

2 bedroom apartment for sale in Pendle Court, Leigh, WN7 3AB, WN7 — £100,000 • 2 bed • 1 bath • 556 ft² 1 bedroom flat for sale in Garden Vale, Leigh, WN7 — £70,000 • 1 bed • 1 bath • 517 ft²

1 bedroom flat for sale in Garden Vale, Leigh, WN7 — £70,000 • 1 bed • 1 bath • 517 ft² 2 bedroom terraced house for sale in Lingard Street, Leigh, WN7 — £117,000 • 2 bed • 1 bath • 828 ft²

2 bedroom terraced house for sale in Lingard Street, Leigh, WN7 — £117,000 • 2 bed • 1 bath • 828 ft² 1 bedroom flat for sale in Garden Vale, Leigh, WN7 — £75,000 • 1 bed • 1 bath • 527 ft²

1 bedroom flat for sale in Garden Vale, Leigh, WN7 — £75,000 • 1 bed • 1 bath • 527 ft² 2 bedroom flat for sale in 14 Windermere Court, WN7 — £92,000 • 2 bed • 1 bath • 1017 ft²

2 bedroom flat for sale in 14 Windermere Court, WN7 — £92,000 • 2 bed • 1 bath • 1017 ft² 2 bedroom flat for sale in Firs Lane, Leigh, WN7 — £100,000 • 2 bed • 1 bath • 517 ft²

2 bedroom flat for sale in Firs Lane, Leigh, WN7 — £100,000 • 2 bed • 1 bath • 517 ft²