Summary - Apartment 2905 Arena Tower, 25, Crossharbour Plaza E14 9UE

1 bed 1 bath Apartment

Immediate income and Canary Wharf views — investment-ready one-bed with strong building amenities.

- 37th-floor one-bedroom with large north-east private terrace and landmark views

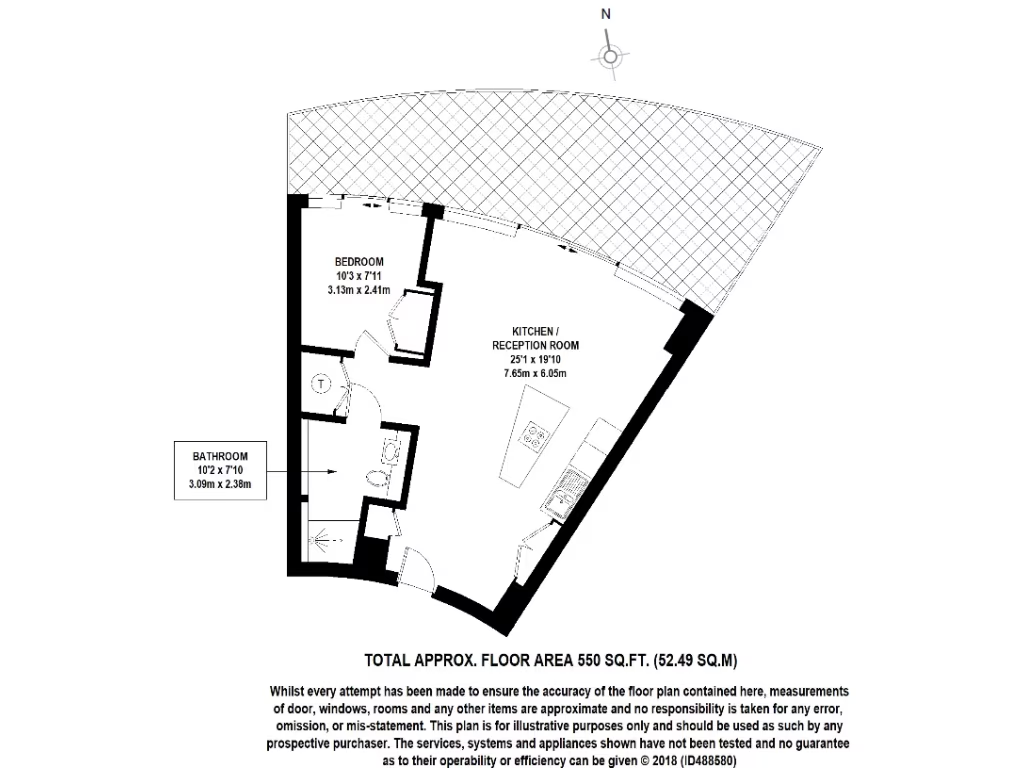

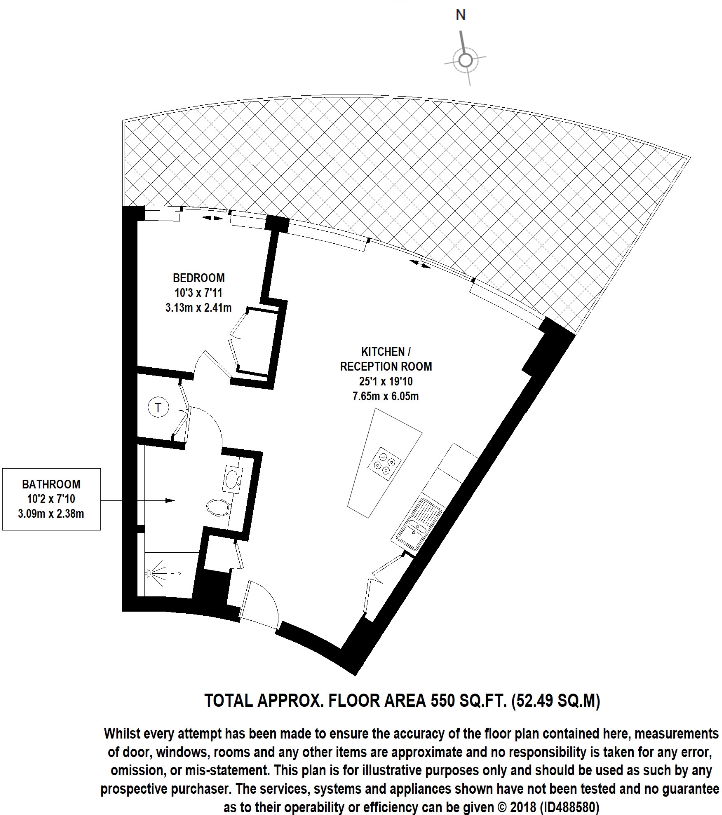

- Approximately 550 sq ft; modern kitchen with integrated SMEG appliances

- Currently let at £2,847 pcm until Sept 2026 — immediate rental income

- Residents' amenities: 24-hour concierge, gym, pool and cinema

- Excellent transport: 0.2 miles to Crossharbour DLR, 0.7 miles to Canary Wharf Jubilee Line

- Long lease (~979 years) and ground rent ~£500 p.a.

- Service charge c. £4,500 p.a. (above average) and council tax rated expensive

- On community heating scheme; limited individual heating control

A high-floor one-bedroom apartment in Arena Tower offering a large private north-east terrace with direct views toward Canary Wharf, the River Thames and the O2. The apartment measures approximately 550 sq ft and is finished with a modern kitchen (integrated SMEG appliances), built-in wardrobe, comfort cooling and underfloor heating in the bathroom — attractive fixtures for a city rental market.

This unit is currently let at £2,847 pcm until September 2026, presenting an immediate income stream and an indicative net yield of about 6.2%. Residents benefit from 24-hour concierge, gym, swimming pool and a cinema, adding to tenant appeal and supporting long-term lettability in the Canary Wharf area. Transport links are strong: 0.2 miles to Crossharbour DLR and 0.7 miles to Canary Wharf Jubilee Line.

Notable running costs and tenure details are straightforward: a long lease of c.979 years and a ground rent of c. £500 p.a., but an above-average service charge (c. £4,500 p.a.) and higher local council tax will affect net returns. The property sits on a community heating scheme, which can limit individual heating control and may influence service cost changes over time.

Overall this is a clear investment purchase for buyers seeking immediate rental income in a major London centre. It combines strong building amenities, a prized high-floor terrace and excellent transport links, while buyers should factor in the elevated service charge, current tenancy until 2026 and council tax when assessing net yield.

1 bedroom flat for sale in Arena Tower, Crossharbour Plaza, Canary Wharf, E14 — £549,999 • 1 bed • 1 bath • 521 ft²

1 bedroom flat for sale in Arena Tower, Crossharbour Plaza, Canary Wharf, E14 — £549,999 • 1 bed • 1 bath • 521 ft² 1 bedroom apartment for sale in Arena Tower, 25 Crossharbour Plaza, Canary Wharf, London, E14 — £500,000 • 1 bed • 1 bath • 550 ft²

1 bedroom apartment for sale in Arena Tower, 25 Crossharbour Plaza, Canary Wharf, London, E14 — £500,000 • 1 bed • 1 bath • 550 ft² 2 bedroom apartment for sale in Arena Tower, 25 Crossharbour, London, E14 — £800,000 • 2 bed • 2 bath • 780 ft²

2 bedroom apartment for sale in Arena Tower, 25 Crossharbour, London, E14 — £800,000 • 2 bed • 2 bath • 780 ft² 1 bedroom apartment for sale in Arena Tower, Crossharbour Plaza, E14 — £525,000 • 1 bed • 1 bath • 549 ft²

1 bedroom apartment for sale in Arena Tower, Crossharbour Plaza, E14 — £525,000 • 1 bed • 1 bath • 549 ft² 2 bedroom apartment for sale in Arena Tower, 25 Crossharbour Plaza, London, E14 — £750,000 • 2 bed • 2 bath • 780 ft²

2 bedroom apartment for sale in Arena Tower, 25 Crossharbour Plaza, London, E14 — £750,000 • 2 bed • 2 bath • 780 ft² 1 bedroom apartment for sale in Arena Tower, 25 Crossharbour Plaza, E14 9YF, E14 — £600,000 • 1 bed • 1 bath • 541 ft²

1 bedroom apartment for sale in Arena Tower, 25 Crossharbour Plaza, E14 9YF, E14 — £600,000 • 1 bed • 1 bath • 541 ft²