Summary - 151 CADGE ROAD NORWICH NR5 8DB

6 bed 3 bath Semi-Detached

Turnkey HMO investment with strong income and immediate rental continuity.

Six-bedroom extended semi-detached HMO with valid licence

Current annual rental income £29,160; 12-month student tenancy in place

Approximate gross yield c.10.4% at £280,000 guide price

Two ground-floor bedrooms and two shower rooms for flexibility

Off-street parking to front and large enclosed rear garden with shed

Freehold, double-glazed, mains gas central heating and appliances included

Area shows high crime and very deprived socio-economic indicators

Walls assumed cavity with no insulation; EPC rating D, verify condition

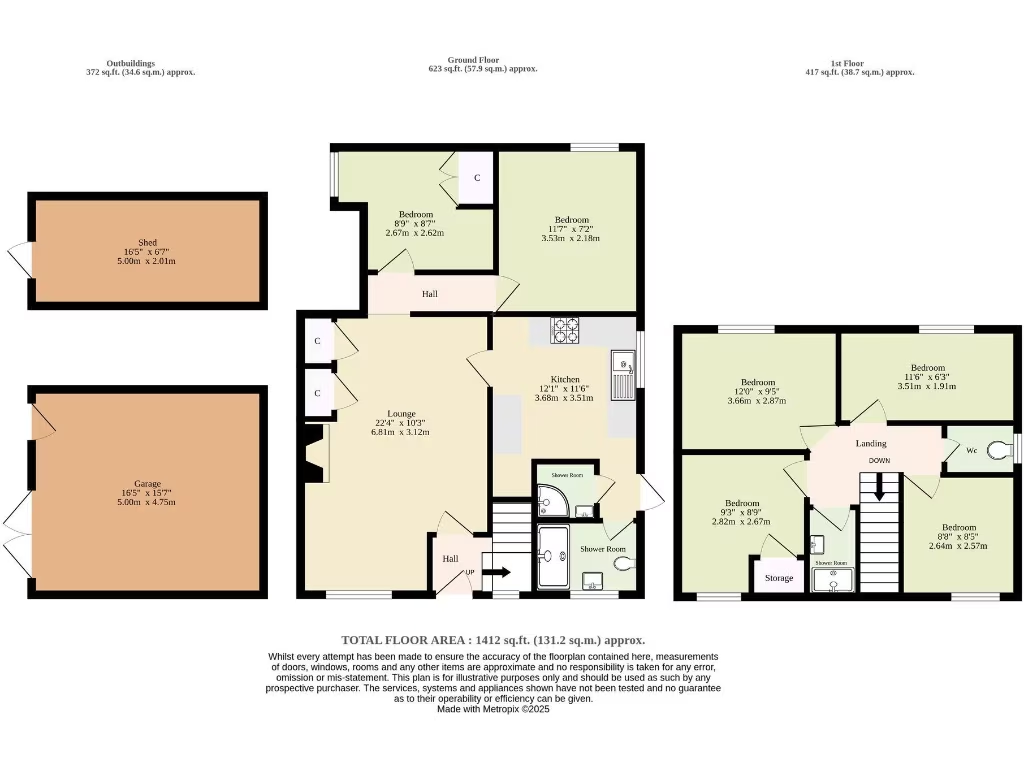

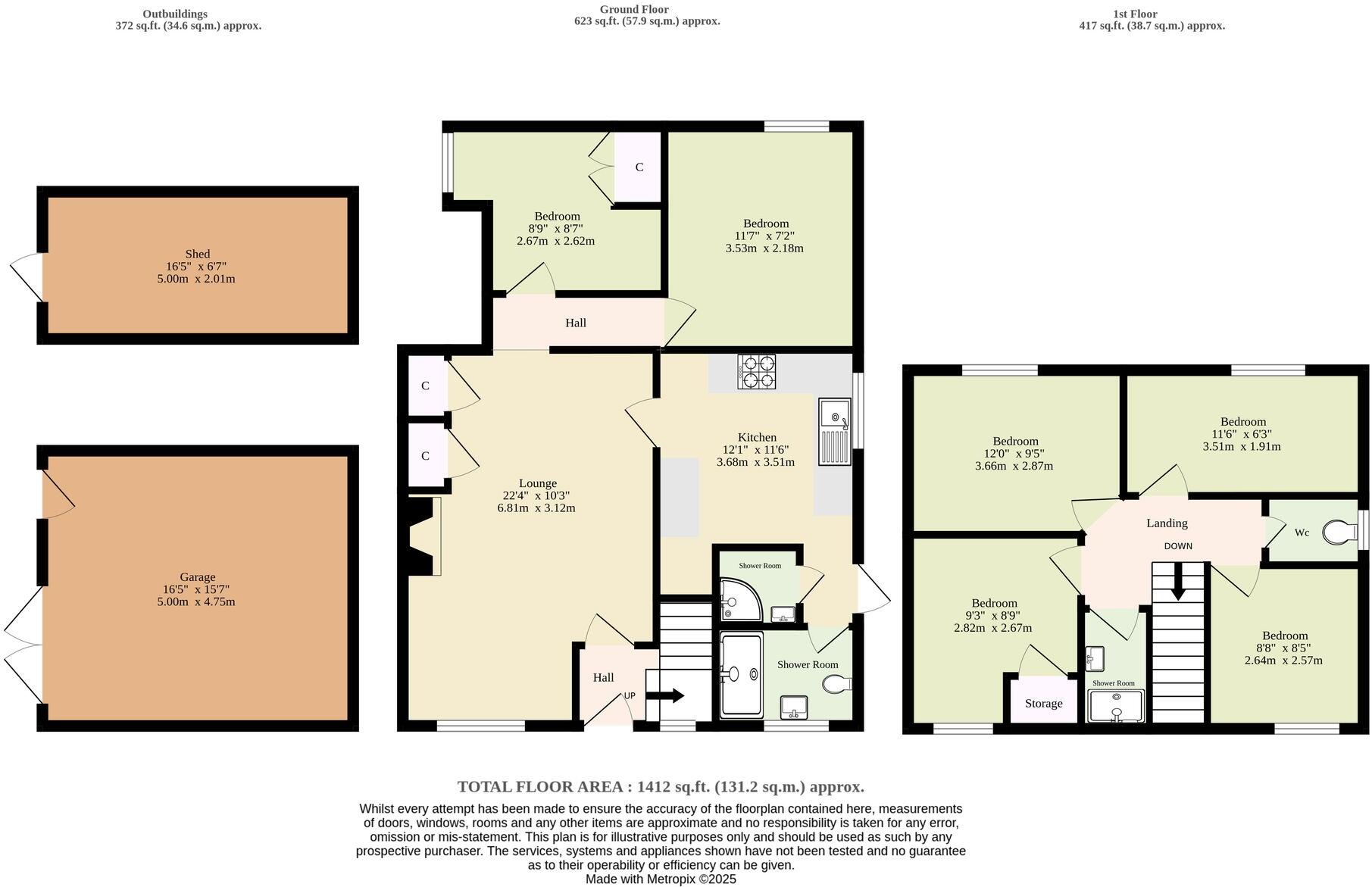

A ready-made high-yield investment in west Norwich, this extended six-bedroom semi delivers strong income and immediate HMO compliance. Currently let as a 12-month student tenancy (six tenants, Aug 2025–Sep 2026) and producing £29,160pa, the property offers an approximate gross yield of around 10.4% at the lower guide price. The layout is practical for multiple occupants: bright lounge, fitted kitchen with appliances, two ground-floor bedrooms and two shower rooms, plus four upstairs bedrooms, a further shower room and separate WC.

Externally there is off-street parking to the front and a large enclosed rear garden with a substantial shed — low-maintenance as-is but with scope to enhance for tenant amenity or value uplift. The house is freehold, double-glazed and connected to mains services; it holds a valid HMO licence, providing a turnkey letting solution for investors focused on student or HMO income.

Material points to note: the property sits in an area with higher crime rates and significant deprivation indicators, which may affect long-term tenant profile and management requirements. The walls are assumed to be cavity with no insulation (as built), the EPC is D, and communal maintenance and tenant management for an HMO will require active oversight. Council tax level is very low, but purchasers should verify all rental figures, licences and compliance before exchange.

Overall, this is a substantial, income-producing HMO with immediate cash flow and further potential for small improvements. It will suit investors seeking a hands-on, city-centre student or shared-rental opportunity with proven returns and room for operational optimisation.

6 bedroom semi-detached house for sale in Cadge Road, Norwich, NR5 — £300,000 • 6 bed • 3 bath • 1034 ft²

6 bedroom semi-detached house for sale in Cadge Road, Norwich, NR5 — £300,000 • 6 bed • 3 bath • 1034 ft² 5 bedroom semi-detached house for sale in The Avenues, Norwich, NR4 — £300,000 • 5 bed • 1 bath • 936 ft²

5 bedroom semi-detached house for sale in The Avenues, Norwich, NR4 — £300,000 • 5 bed • 1 bath • 936 ft² 5 bedroom detached house for sale in Earlham Green Lane, Norwich, NR5 — £325,000 • 5 bed • 1 bath • 1002 ft²

5 bedroom detached house for sale in Earlham Green Lane, Norwich, NR5 — £325,000 • 5 bed • 1 bath • 1002 ft² 6 bedroom house for sale in Colman Road, Norwich, NR4 — £375,000 • 6 bed • 5 bath • 1128 ft²

6 bedroom house for sale in Colman Road, Norwich, NR4 — £375,000 • 6 bed • 5 bath • 1128 ft² 5 bedroom semi-detached house for sale in Peckover Road, Norwich, NR4 — £350,000 • 5 bed • 2 bath • 893 ft²

5 bedroom semi-detached house for sale in Peckover Road, Norwich, NR4 — £350,000 • 5 bed • 2 bath • 893 ft² 4 bedroom semi-detached house for sale in Attoe Walk, Norwich, NR3 — £300,000 • 4 bed • 2 bath • 1189 ft²

4 bedroom semi-detached house for sale in Attoe Walk, Norwich, NR3 — £300,000 • 4 bed • 2 bath • 1189 ft²