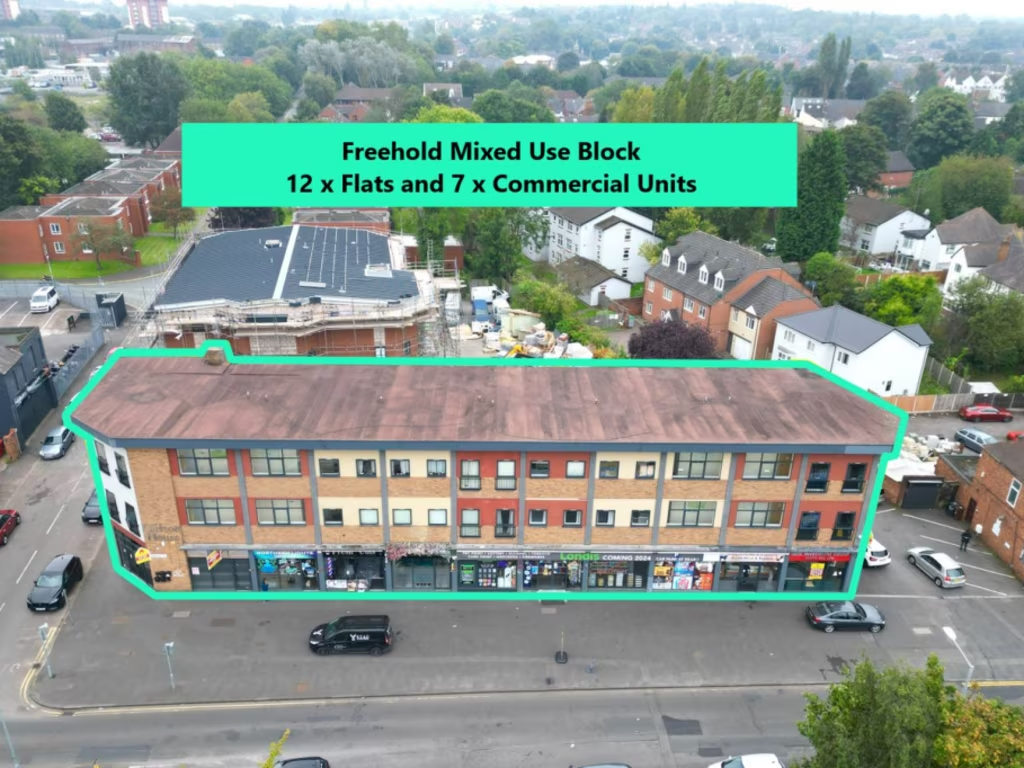

Summary - Clifton House Clifton House Clifton House Clifton House Merridale Rd-12 x Flats and 7 x Commercial Units, Wolverhampton, WV3 WV3 9RS

1 bed 1 bath Mixed Use

Income-producing investment with planning upside and large rear car park.

Fully let mixed-use block generating £244,300 pa

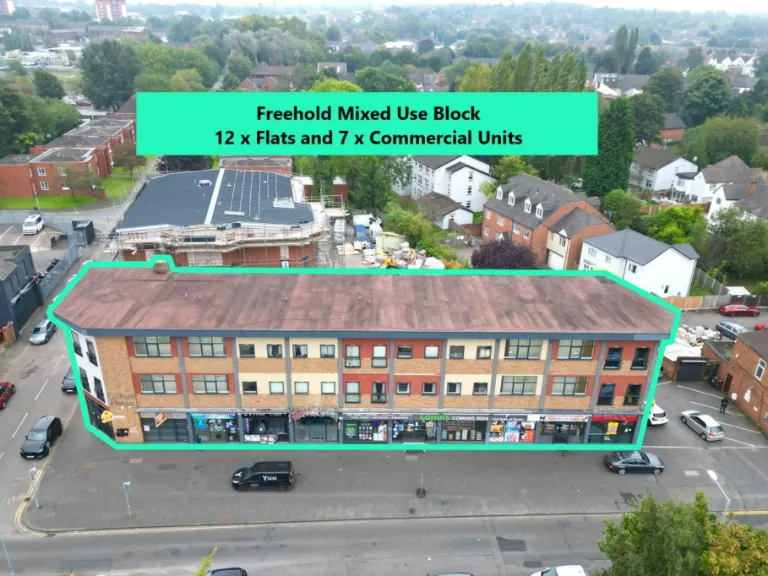

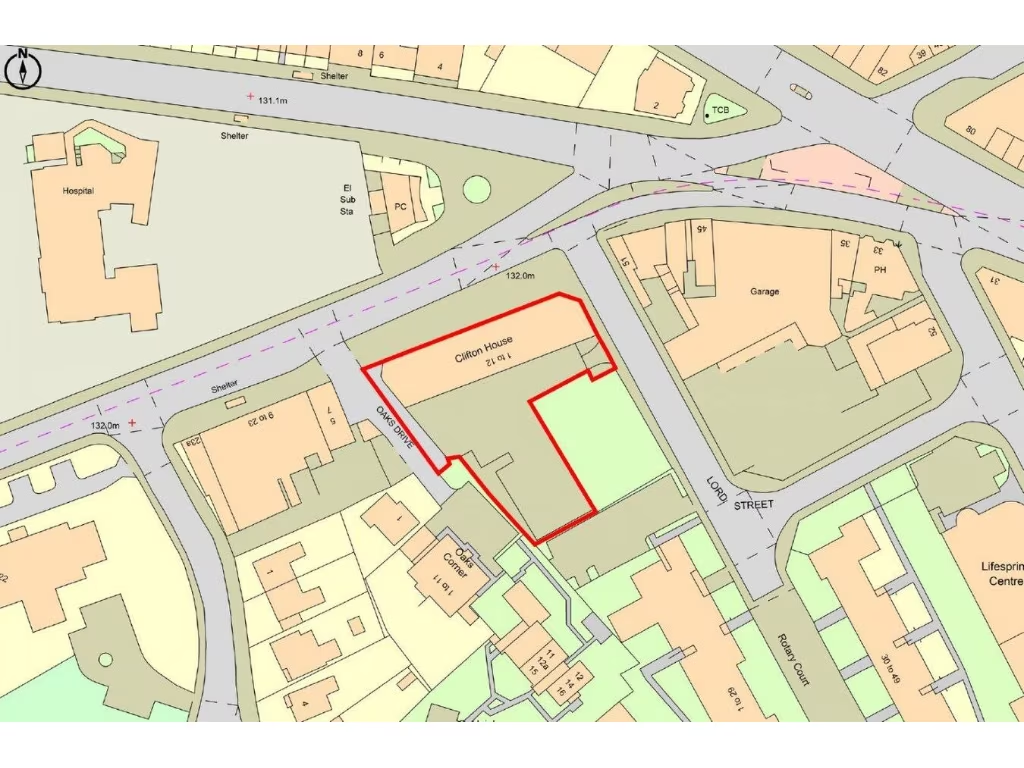

A freehold mixed-use block on a prominent roadside pitch in Wolverhampton offering immediate income and near-term development upside. The property comprises 12 upper-floor flats and seven ground-floor commercial units across three storeys, set on a large 0.4-acre site with approximately 36 rear car parking spaces. It is fully let and currently produces £244,300 per annum with scope to increase rents through lease renewals and active asset management.

Planning consent (03/0051/FP) was implemented for 18 flats but only 12 were built. The implemented consent could be used to develop an additional floor and six more flats, subject to obtaining required consents, presenting a clear value-add development route for an investor comfortable managing planning and construction risk. The site’s size and roadside prominence also support alternative refurbishment or reconfiguration strategies.

Important practical points: the building has standard mid-20th century construction with electric heating and mains services. The area is classified as deprived with a very high local crime rate, which will affect tenant mix, management costs and lettability for higher-value residential conversions. There is no step-free access to upper parts. Buyers should note the sale process includes a non-refundable exclusivity fee and an exclusivity agreement — undertake full due diligence and legal advice before committing.

This is aimed at investors and developers seeking a ready-made income stream with upside through planning-led development or lease re-gearing. The combination of immediate yield, parking provision and implemented planning consent makes this a proposition for buyers with experience in operating and upgrading mixed-use assets in challenging urban locations.

Mixed use property for sale in **INVESTMENT OPPORTUNITY** 70 & 70a Ettingshall Road, Wolverhampton, West Midlands, WV14 — £315,000 • 1 bed • 1 bath • 1478 ft²

Mixed use property for sale in **INVESTMENT OPPORTUNITY** 70 & 70a Ettingshall Road, Wolverhampton, West Midlands, WV14 — £315,000 • 1 bed • 1 bath • 1478 ft² Mixed use property for sale in Tettenhall Road, Wolverhampton, West Midlands, WV6 — £680,000 • 1 bed • 1 bath • 2350 ft²

Mixed use property for sale in Tettenhall Road, Wolverhampton, West Midlands, WV6 — £680,000 • 1 bed • 1 bath • 2350 ft² 6 bedroom semi-detached house for sale in 33 Paget Road, Wolverhampton, WV6 0DS, WV6 — £200,000 • 6 bed • 1 bath

6 bedroom semi-detached house for sale in 33 Paget Road, Wolverhampton, WV6 0DS, WV6 — £200,000 • 6 bed • 1 bath Mixed use property for sale in 163-165 High Street, West Bromwich B70 7QX, B70 — £425,000 • 1 bed • 1 bath • 2284 ft²

Mixed use property for sale in 163-165 High Street, West Bromwich B70 7QX, B70 — £425,000 • 1 bed • 1 bath • 2284 ft² Commercial development for sale in The Old School, 73 Dudley Road, Wolverhampton, West Midlands, WV2 3BY, WV2 — POA • 1 bed • 1 bath • 14823 ft²

Commercial development for sale in The Old School, 73 Dudley Road, Wolverhampton, West Midlands, WV2 3BY, WV2 — POA • 1 bed • 1 bath • 14823 ft² 6 bedroom semi-detached house for sale in Kingsland Road, Whitmore Reans, Wolverhampton, WV1 — £310,000 • 6 bed • 2 bath • 1927 ft²

6 bedroom semi-detached house for sale in Kingsland Road, Whitmore Reans, Wolverhampton, WV1 — £310,000 • 6 bed • 2 bath • 1927 ft²