Two self-contained 1-bed flats producing £12,300 pa combined income

Freehold block with off-street parking for both units

Ground-floor flat includes private courtyard garden

Guide price £120k–£140k; >10% yield at lower guide

Sold at auction: 10% deposit, 28-day completion, £1,200 admin fee

Tenancies long-standing but now periodic (limited rent review certainty)

EPCs D & E — likely need energy/maintenance improvements

Located in deprived area with above-average crime statistics

Located in the heart of Ipswich town centre, 1 & 3 Blanche Street offer a compact freehold investment comprising two self-contained one-bedroom flats. Both flats include off-street parking and the ground-floor unit benefits from a private courtyard garden. The combined current rents are £12,300 per year, producing a guide-price yield in excess of 10% at the lower guide — a strong headline return for a central, town-centre holding.

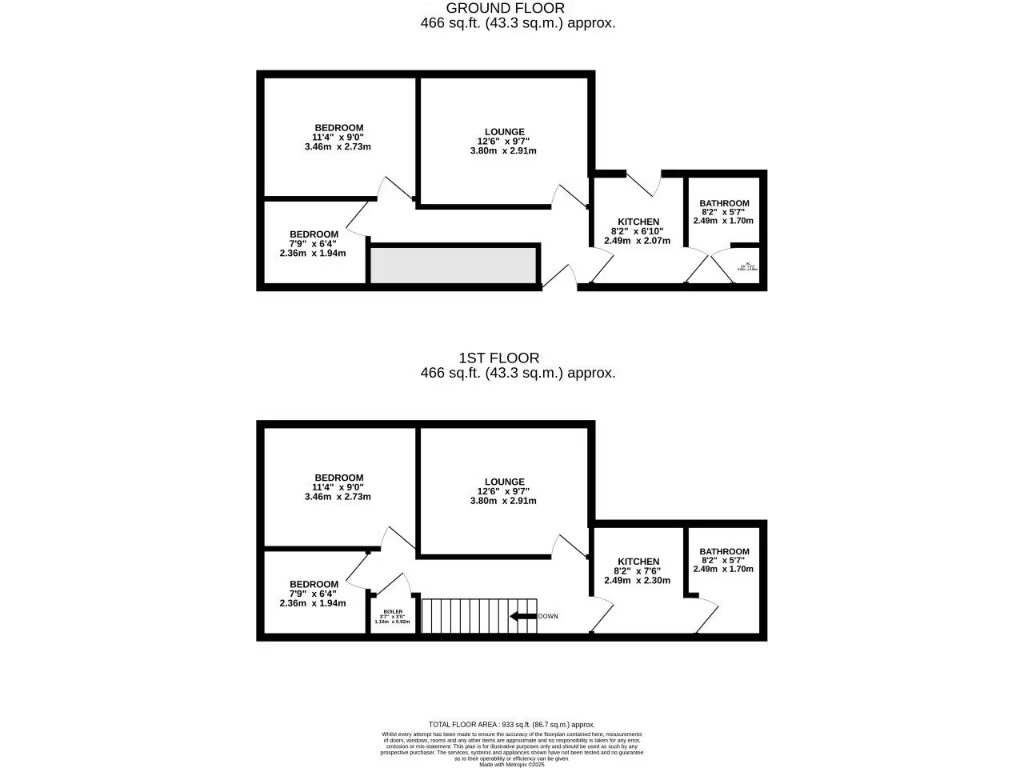

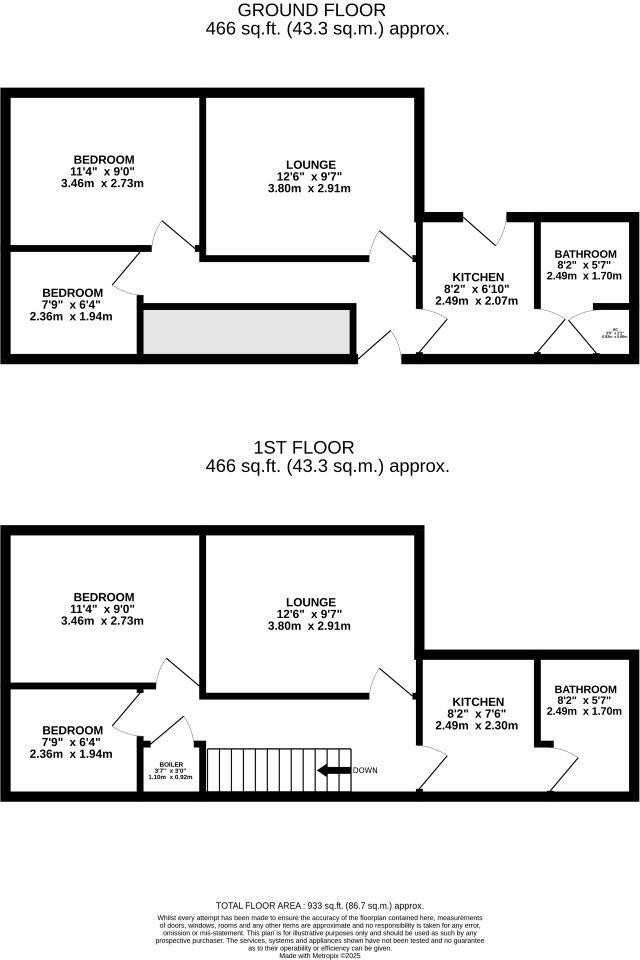

Both units are let to long-standing occupants (tenancies originating 2012 and 2020) and are now on periodic tenancies, giving an investor immediate income but limited immediate rent review certainty. EPC ratings of D and E indicate that some improvement works could reduce future voids and increase rental value, but will require capital outlay. The property’s total internal area is approximately 933 sq ft and is presented as a period, multi-storey building with typical Victorian features and standard ceiling heights.

This lot is being sold at auction, chain-free, where contracts exchange on the day of sale. Bidders should note the auction conditions: a 10% deposit on the fall of the hammer, the remaining 90% typically due within 28 days, and a fixed administration fee of £1,200 payable on completion. Prospective buyers must review the legal pack and confirm finances ahead of bidding; no buyer’s premium applies beyond the stated administration fee.

Material considerations for investors: the property sits within an area classed as deprived with above-average crime statistics, which may affect tenant demand and management costs. The central location, reliable historic tenancies and included parking are strong positives for continued rental demand, but refurbishment to improve EPC and internal presentation would be prudent to protect long-term value and letability.