Summary - 26, HIGH STREET, MONTROSE DD10 8JL

2 bed 1 bath Flat

Immediate income investment — tenanted, furnished, and town-centre located..

Tenanted buy-to-let producing £600pcm (£7,200pa) with tenants in situ

Immediate yield approximately 11% based on asking price

Sold furnished with inventory included; income from day one

EPC rating C; gas central heating and partial double glazing

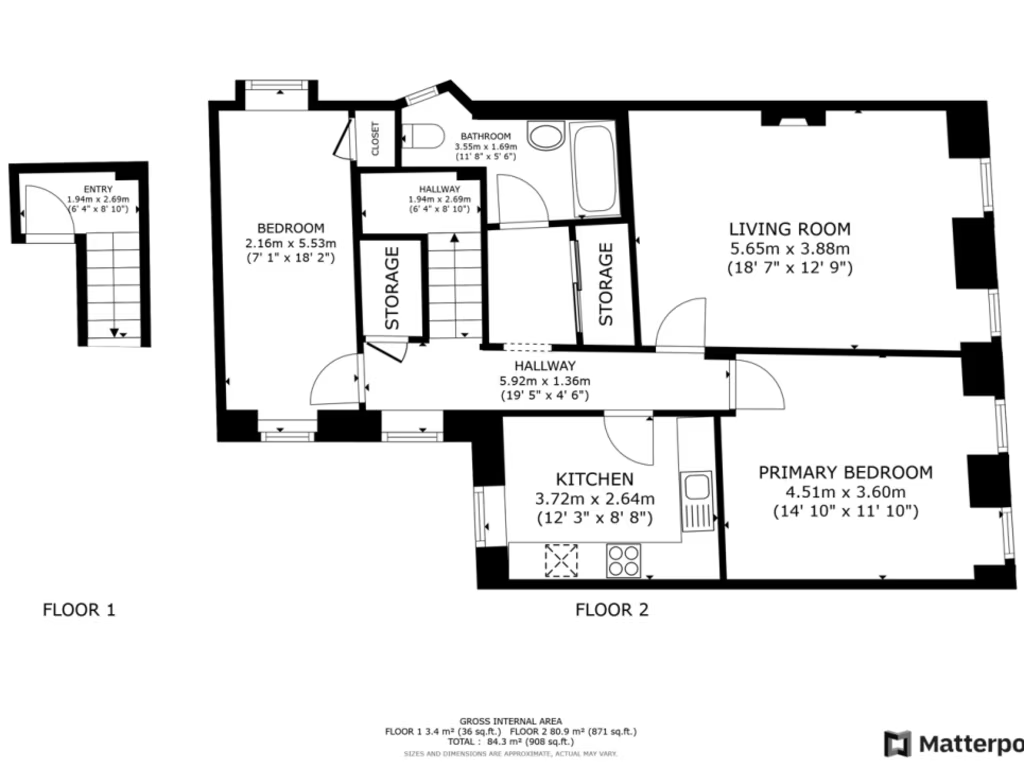

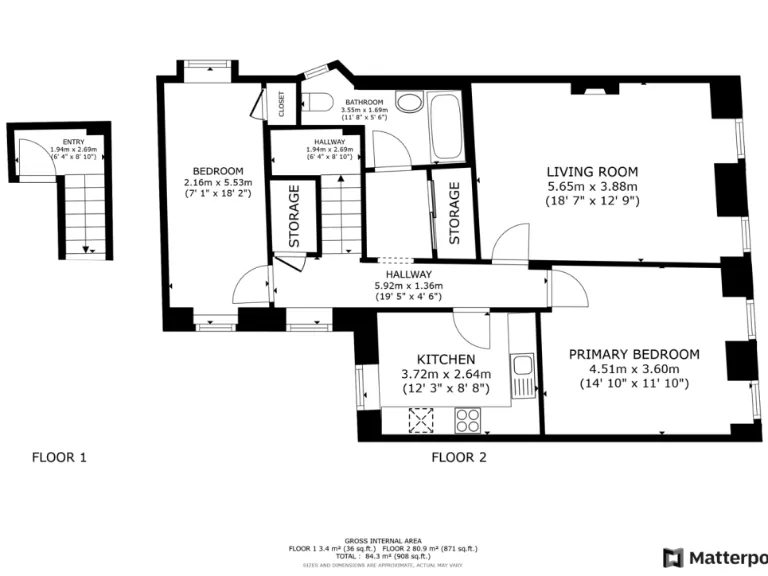

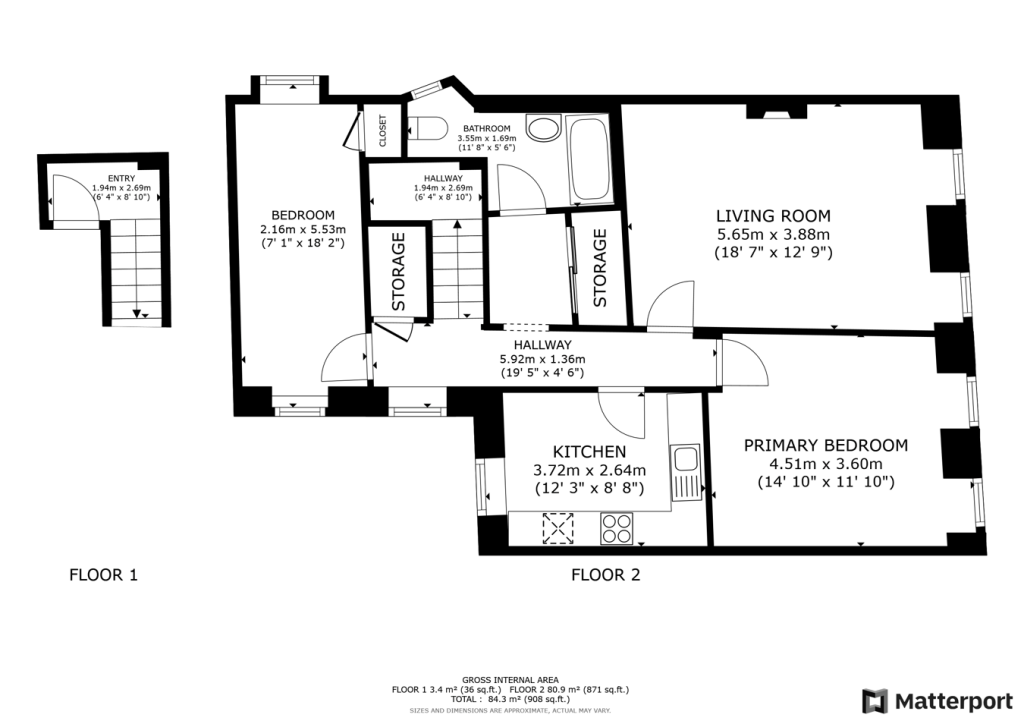

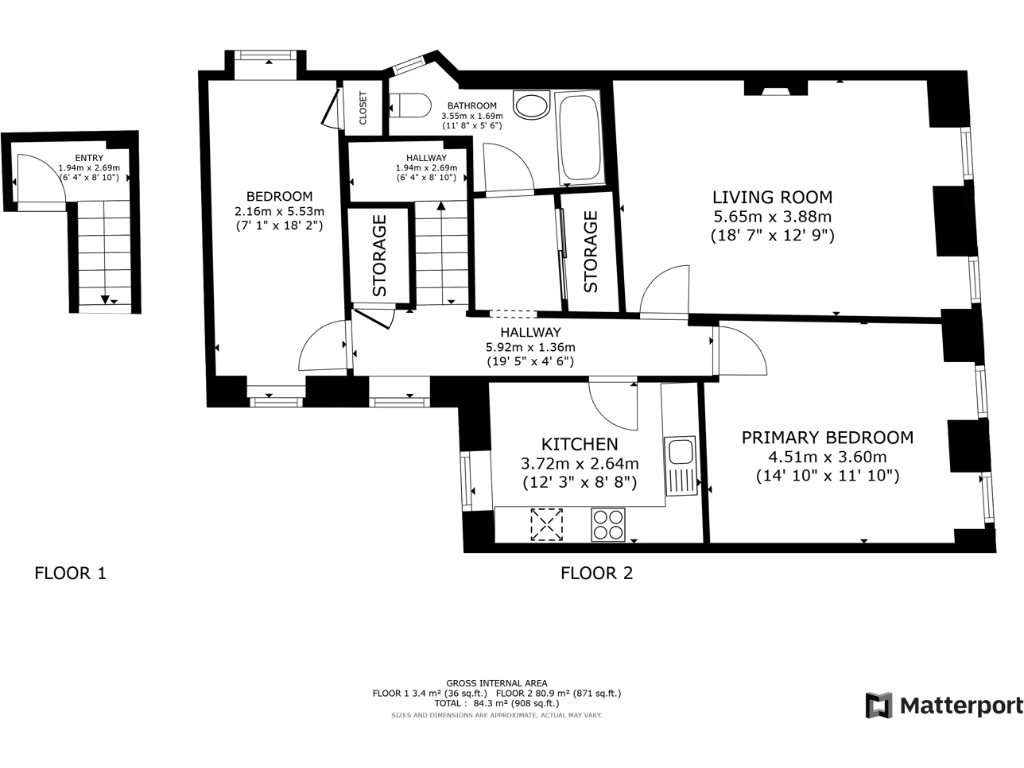

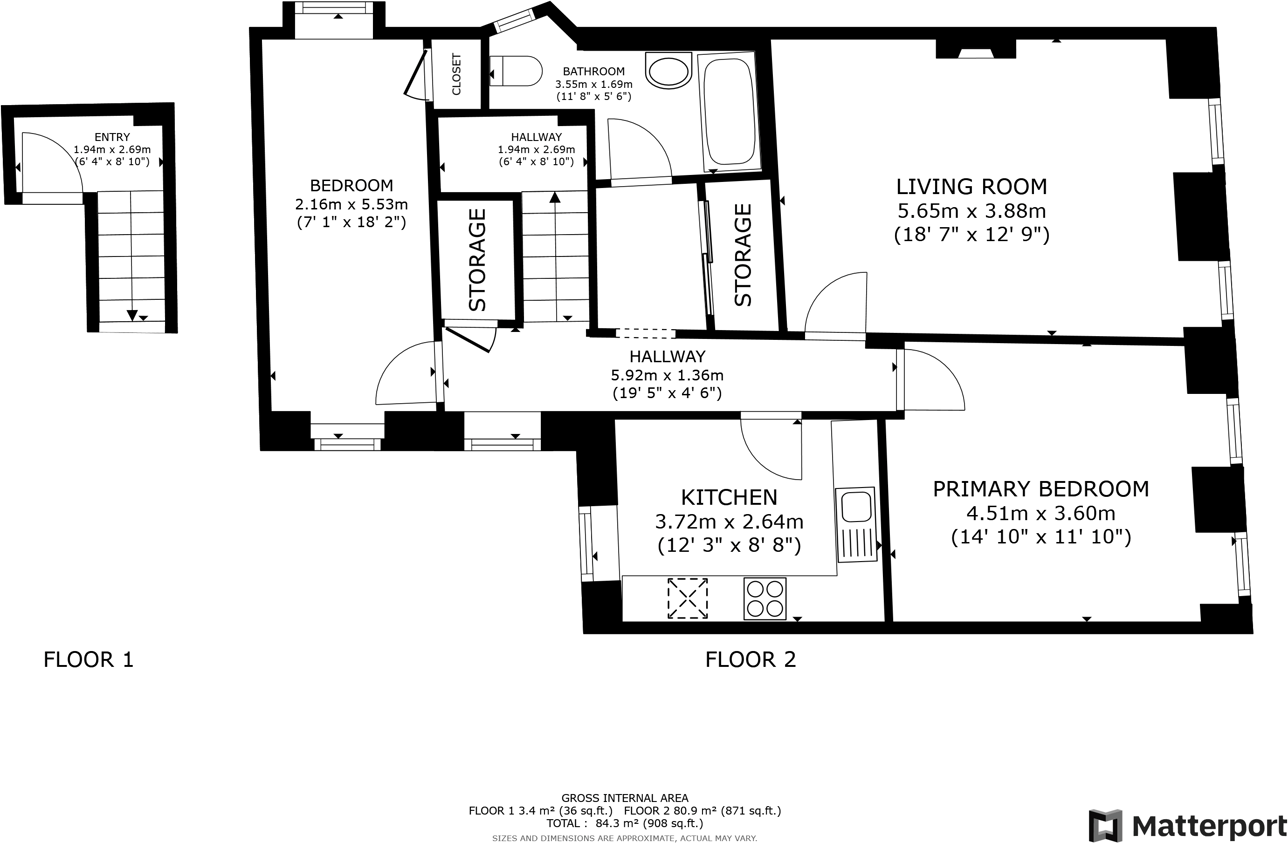

Second-floor flat with attic; sold as seen, requires maintenance

Located in very deprived, constrained-renter area — limited growth risk

Town-centre location; five-minute walk to train station and amenities

Home Report valuation £68,000 for buyer comparison

This second-floor, two-bedroom flat on Montrose High Street is offered as a buy-to-let investment with tenants in situ. It produces £600pcm (£7,200pa), reflecting an immediate yield of c.11% against the asking price of £64,995. The tenancy began September 2023 and the property is sold fully furnished with inventory included, providing rental income from day one.

The building is a Georgian mixed-use structure with period character to the exterior and typical upper-floor accommodation internally. The flat benefits from gas central heating, partial double glazing, an upper-floor attic, an EPC rating of C, fast broadband and excellent mobile signal—practical features for lettings in a town-centre location close to shops and the train station.

Notable considerations for investors: the property sits in a very deprived local area with a transitional Eastern European neighbourhood and constrained renter market, which may limit capital-growth prospects. The interior shows dated elements and some wall damage; the property is sold as seen and will require ongoing maintenance or cosmetic updating over time.

Overall this is a straightforward income purchase for a buyer prioritising immediate yield and hands-off tenancy. Buyers should budget for periodic maintenance, consider the local market conditions when modelling long-term returns, and note the Home Report valuation of £68,000 for comparison to the asking price.

1 bedroom flat for sale in High Street, Angus, Montrose, DD10 — £25,000 • 1 bed • 1 bath • 516 ft²

1 bedroom flat for sale in High Street, Angus, Montrose, DD10 — £25,000 • 1 bed • 1 bath • 516 ft² 4 bedroom flat for sale in High Street, Montrose, Angus, DD10 — £129,999 • 4 bed • 3 bath • 1851 ft²

4 bedroom flat for sale in High Street, Montrose, Angus, DD10 — £129,999 • 4 bed • 3 bath • 1851 ft² 2 bedroom flat for sale in 92C High Street, Montrose, Angus, DD10 8JE, DD10 — £35,000 • 2 bed • 1 bath

2 bedroom flat for sale in 92C High Street, Montrose, Angus, DD10 8JE, DD10 — £35,000 • 2 bed • 1 bath 3 bedroom terraced house for sale in Provost Reids Road, Montrose, DD10 8, DD10 — £125,000 • 3 bed • 2 bath • 969 ft²

3 bedroom terraced house for sale in Provost Reids Road, Montrose, DD10 8, DD10 — £125,000 • 3 bed • 2 bath • 969 ft² 2 bedroom flat for sale in 92B High Street, Montrose, Angus, DD10 8JE, DD10 — £35,000 • 2 bed • 1 bath

2 bedroom flat for sale in 92B High Street, Montrose, Angus, DD10 8JE, DD10 — £35,000 • 2 bed • 1 bath 2 bedroom flat for sale in High Street, Montrose, DD10 — £60,000 • 2 bed • 1 bath

2 bedroom flat for sale in High Street, Montrose, DD10 — £60,000 • 2 bed • 1 bath