Summary - 46 RACECOMMON ROAD BARNSLEY S70 6AF

2 bed 1 bath Terraced

Sitting let with solid yield and refurbishment upside.

- Freehold Victorian mid-terrace with period brickwork features

- Sitting tenant in place; tenants intend to remain

- Current annual gross income £7,800 (approx. 7.8% gross yield)

- Private front garden; on-street parking only

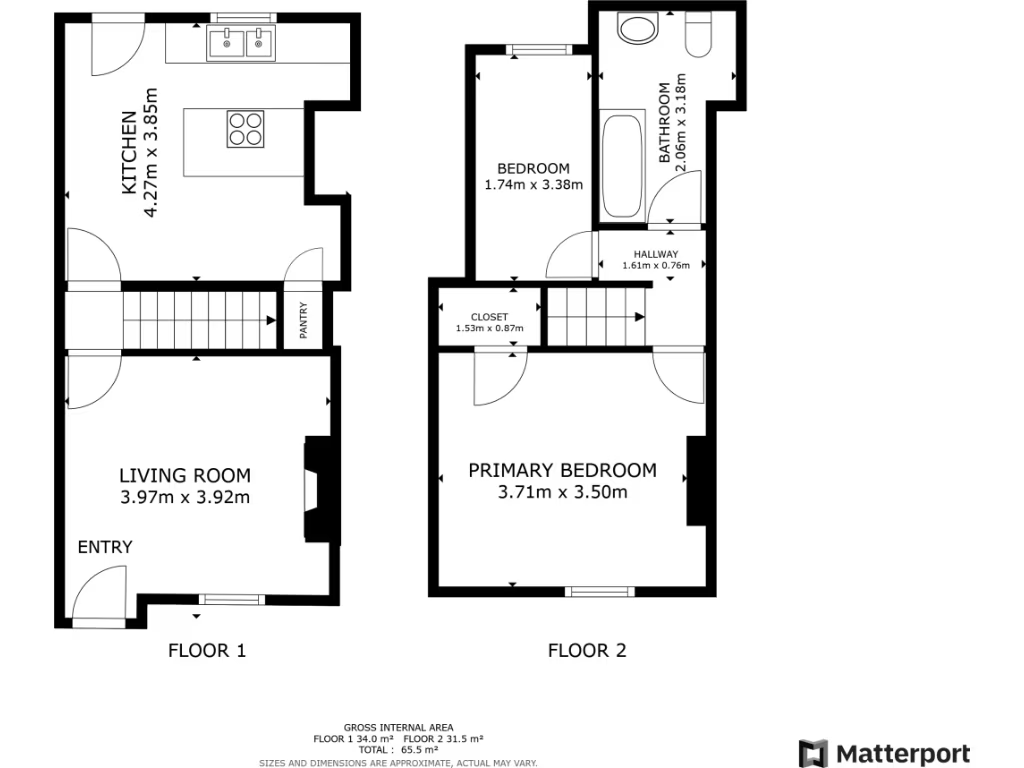

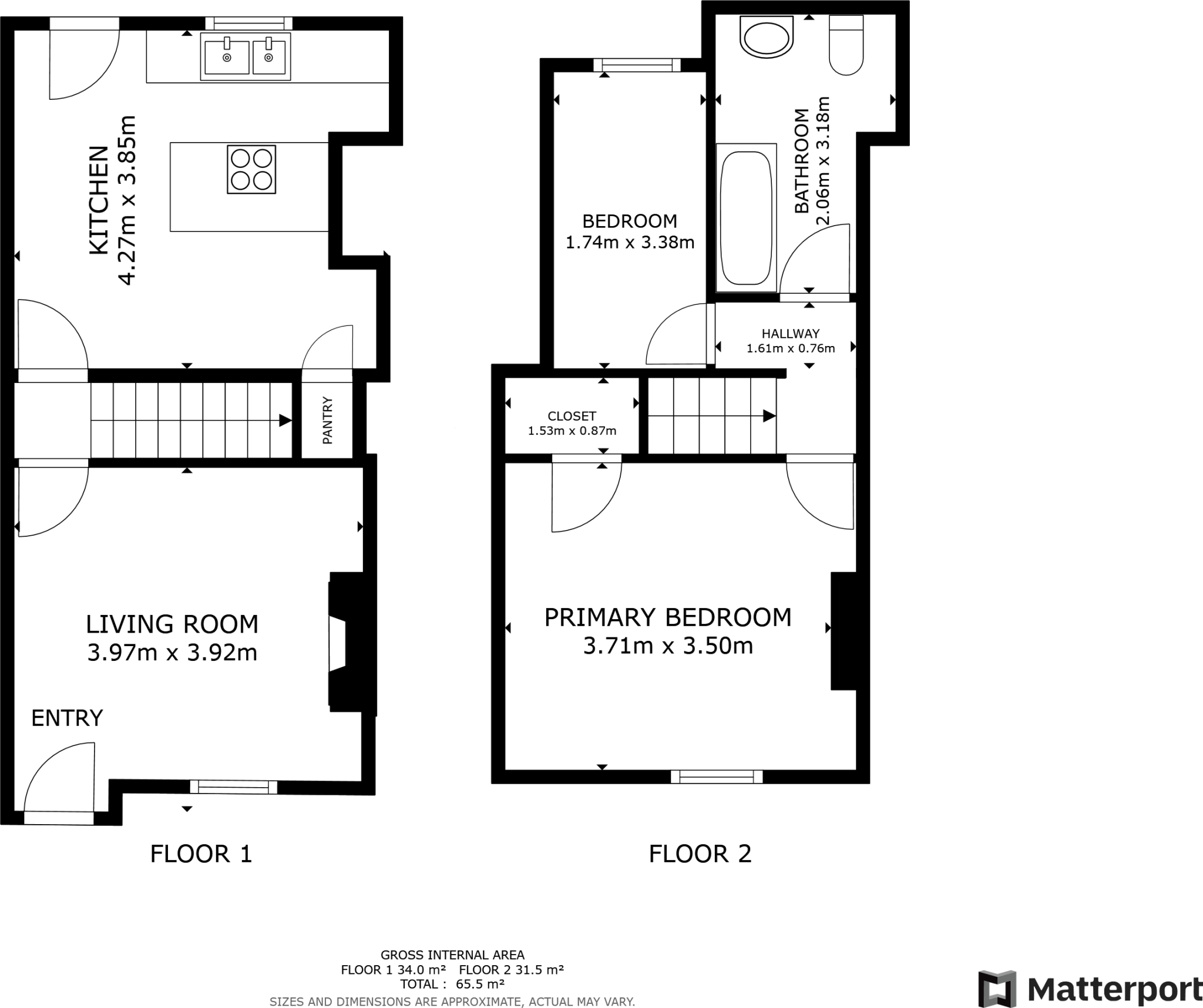

- Small plot and modest internal space, circa 936 sq ft

- Located in a very deprived area with high local crime

- Constrained renters market; strong investor interest likely

- Requires cosmetic refurbishment to increase rental value

This two-bedroom mid-terrace is a straightforward investment opportunity in S70, offered freehold with a sitting tenant. The property generates a current gross income of £7,800 per year, giving an approximate gross yield of 7.8% at the asking price of £100,000. Tenants have been in place less than a year and intend to remain.

The house retains Victorian period brickwork and simple kerb appeal, with a private front garden and on-street parking. Internally there are two bedrooms, a lounge, kitchen and three-piece bathroom across roughly 936 sq ft, presenting sensible rental accommodation with scope to improve finishes and increase returns.

Buyers should note the wider area shows high crime levels and very high deprivation indicators, and the neighbourhood is described as a constrained renters market. The property has clear refurbishment potential rather than being a turn-key family home. A buyer’s premium applies on sale — factor this into acquisition costs.

For investors or developers seeking a low-management let with refurbishment upside, this terraced house offers a compact, easy-to-let asset with room for rental growth after improvements. The Let Property Pack contains tenancy paperwork and further income detail for due diligence.

2 bedroom terraced house for sale in Clyde Street, Barnsley, S71 — £76,000 • 2 bed • 1 bath • 560 ft²

2 bedroom terraced house for sale in Clyde Street, Barnsley, S71 — £76,000 • 2 bed • 1 bath • 560 ft² 2 bedroom terraced house for sale in Pitt Street West, Barnsley, S70 — £75,000 • 2 bed • 1 bath • 796 ft²

2 bedroom terraced house for sale in Pitt Street West, Barnsley, S70 — £75,000 • 2 bed • 1 bath • 796 ft² 2 bedroom end of terrace house for sale in Brooke Street, Barnsley,S74 — £85,000 • 2 bed • 1 bath • 926 ft²

2 bedroom end of terrace house for sale in Brooke Street, Barnsley,S74 — £85,000 • 2 bed • 1 bath • 926 ft² 3 bedroom terraced house for sale in Sherwood Street, Barnsley, S71 — £82,000 • 3 bed • 1 bath • 872 ft²

3 bedroom terraced house for sale in Sherwood Street, Barnsley, S71 — £82,000 • 3 bed • 1 bath • 872 ft² 3 bedroom semi-detached house for sale in Beech Street, Barnsley, South Yorkshire, S70 — £120,000 • 3 bed • 1 bath • 797 ft²

3 bedroom semi-detached house for sale in Beech Street, Barnsley, South Yorkshire, S70 — £120,000 • 3 bed • 1 bath • 797 ft² 3 bedroom terraced house for sale in Main Street, Barnsley, S73 — £75,000 • 3 bed • 1 bath • 732 ft²

3 bedroom terraced house for sale in Main Street, Barnsley, S73 — £75,000 • 3 bed • 1 bath • 732 ft²