Summary - 62A RUSKIN ROAD NORTHAMPTON NN2 7SY

1 bed 1 bath Flat

Tenanted income with immediate yield and refurbishment upside.

On-street parking and private rear garden

A compact one-bedroom flat in NN2 offering immediate rental income and clear investor appeal. The property is currently tenanted and produces £7,200 gross per year, giving a market-level gross yield of about 7.6% at the asking price. Long-term occupants wish to remain, providing continuity of income from day one.

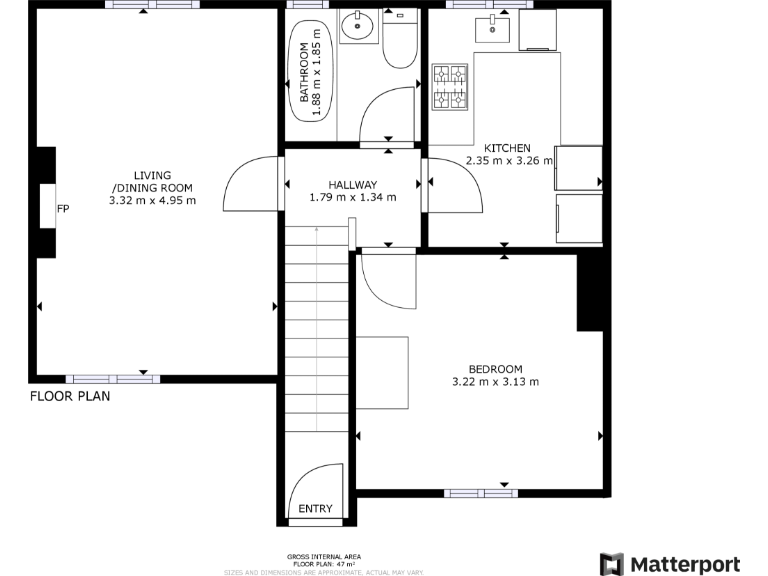

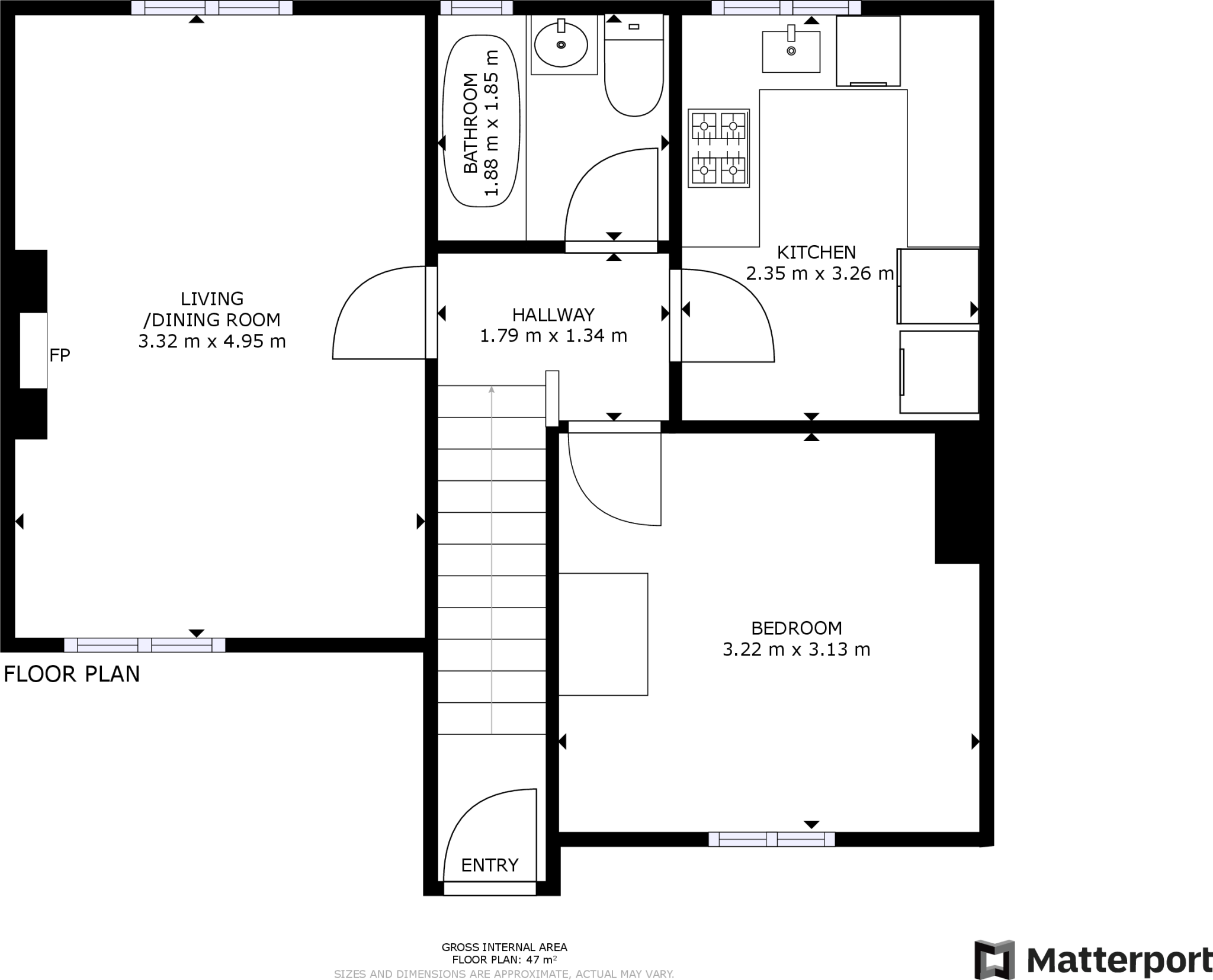

The flat includes a living room, kitchen, one bedroom, three-piece bathroom and a private rear garden. There is on-street parking and the wider area has strong rental demand from private renters and student/new-arrival demographics. Broadband and mobile signals are reported as fast and excellent.

Buyers should note material drawbacks: the lease has about 80 years remaining which may limit mortgage options and could deter some lenders; purchasers should confirm finance availability before committing. Internally the living room shows dated décor and evidence of damp that will require attention and likely refurbishment to sustain rental growth or future resale.

Overall, this is a straightforward buy-to-let for investors able to accept a short lease and carry modest remedial works. The property’s tenant-in-situ, accessible location and rental history make it a plug-and-play income asset, while refurbishment or lease-extension work creates potential to add value.

1 bedroom flat for sale in Broad Street, Northampton, NN1 — £109,000 • 1 bed • 1 bath • 506 ft²

1 bedroom flat for sale in Broad Street, Northampton, NN1 — £109,000 • 1 bed • 1 bath • 506 ft² 1 bedroom flat for sale in Henry Street, Northampton, NN1 — £125,000 • 1 bed • 1 bath • 398 ft²

1 bedroom flat for sale in Henry Street, Northampton, NN1 — £125,000 • 1 bed • 1 bath • 398 ft² 2 bedroom flat for sale in Broad Street, Northampton, NN1 — £119,000 • 2 bed • 1 bath • 667 ft²

2 bedroom flat for sale in Broad Street, Northampton, NN1 — £119,000 • 2 bed • 1 bath • 667 ft² 2 bedroom flat for sale in Brockton Street, Northampton, NN2 — £170,000 • 2 bed • 1 bath • 797 ft²

2 bedroom flat for sale in Brockton Street, Northampton, NN2 — £170,000 • 2 bed • 1 bath • 797 ft² 4 bedroom end of terrace house for sale in Vicarage Road, Northampton, Northamptonshire, NN5 — £215,000 • 4 bed • 1 bath • 958 ft²

4 bedroom end of terrace house for sale in Vicarage Road, Northampton, Northamptonshire, NN5 — £215,000 • 4 bed • 1 bath • 958 ft² 2 bedroom apartment for sale in St. Edmunds Road, Northampton, NN1 — £148,950 • 2 bed • 1 bath

2 bedroom apartment for sale in St. Edmunds Road, Northampton, NN1 — £148,950 • 2 bed • 1 bath