Summary - 10-12, THE BRIDGE WS1 1LR

1 bed 1 bath Mixed Use

Period town‑centre freehold with redevelopment upside and immediate income.

Current income £24,000pa; low initial yield against guide price £500,000

Playland lease to Dec 2031; tenant break and upward-only rent review Dec 2026

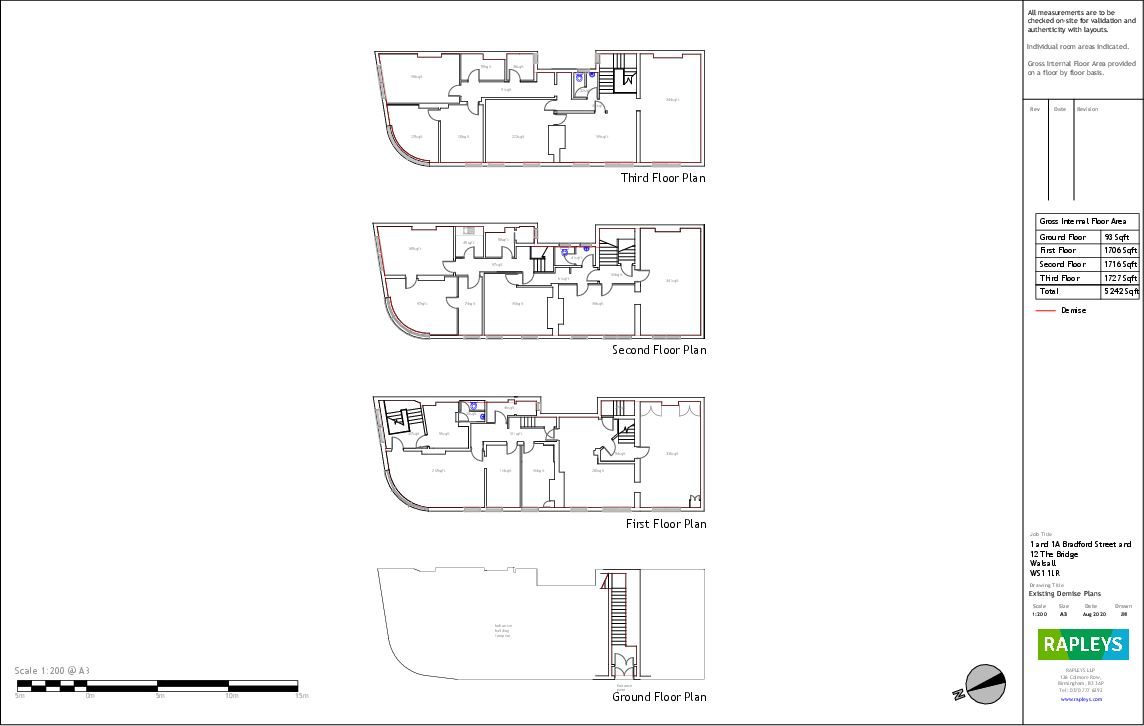

Planning advice for nine 2-bed units (approx. 550–600ft²) on upper floors

Period façade and prominent corner position with high footfall and station nearby

Two ground-floor units on 999-year leases; ground rents total £500pa (doubling every 33 years)

Very slow broadband, very high local crime and high area deprivation — impacts demand

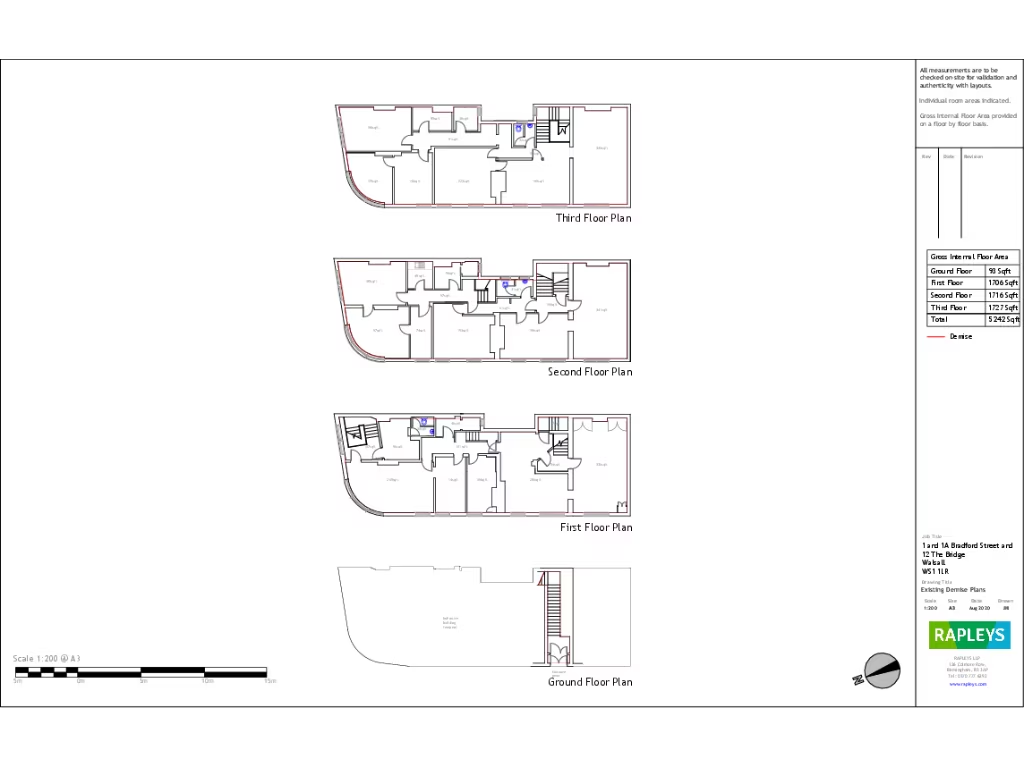

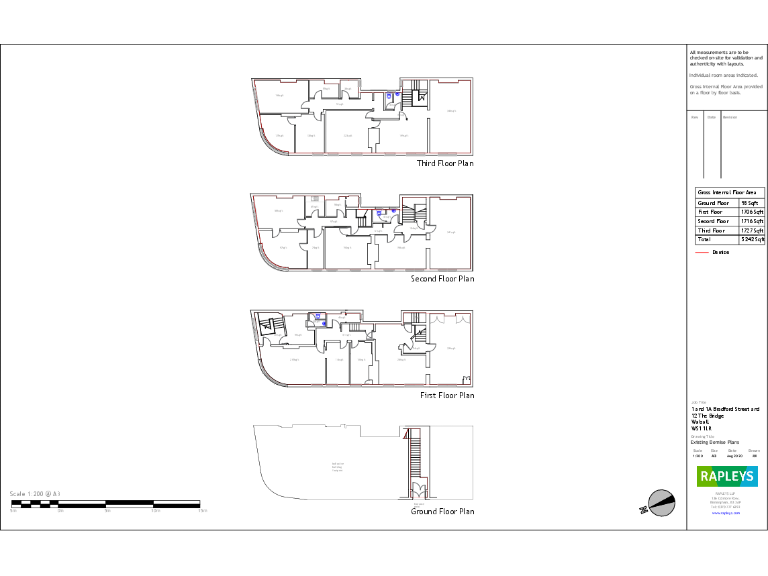

Large total floor area (approx. 7,163ft²) across ground plus three upper floors

Conversion/refurbishment required for uppers; carry costs and statutory consents expected

This prominent Victorian corner freehold offers a low-yielding town centre investment with clear upside through redevelopment. Ground-floor arcade is producing predictable income while three vacant upper floors present conversion potential — planning advice has been sought for nine two-bed units, which could materially increase rental value and capital worth.

Income today is modest: the property currently generates £24,000pa, largely from a lease to Playland Amusements which has a tenant-only break and an upward-only review in December 2026. Two further ground-floor units are held on 999-year long leases with a small ground rent that doubles every 33 years. Prospective purchasers should factor these lease terms into any income projections and future sales strategy.

The building’s period façade, high street corner presence and immediate proximity to Walsall train station and strong local amenity are genuine strengths for both occupiers and residents. Practical considerations include very slow broadband speeds, a very high local crime rate and a deprived surrounding area — factors that could affect lettability and resident demand and that will require sensitive management.

This lot suits an investor or developer able to carry short-term voids and deliver conversion works, or an owner-occupier seeking long-term value through active asset management. Full due diligence is essential: verify exact floor areas, services, party wall/tenure splitting, and planning consents before committing.

Commercial property for sale in 1-27 Bridge Street, Walsall, WS1 1DP, WS1 — £1,495,000 • 1 bed • 1 bath • 22000 ft²

Commercial property for sale in 1-27 Bridge Street, Walsall, WS1 1DP, WS1 — £1,495,000 • 1 bed • 1 bath • 22000 ft² Commercial property for sale in 86 Bradford Street, Walsall, West Midlands, WS1 1NU, WS1 — £220,000 • 1 bed • 1 bath • 1992 ft²

Commercial property for sale in 86 Bradford Street, Walsall, West Midlands, WS1 1NU, WS1 — £220,000 • 1 bed • 1 bath • 1992 ft² High street retail property for sale in 71-75 Park Street, Walsall, WS1 1NW, WS1 — £1,200,000 • 1 bed • 1 bath

High street retail property for sale in 71-75 Park Street, Walsall, WS1 1NW, WS1 — £1,200,000 • 1 bed • 1 bath Commercial development for sale in Tudor House Bridge Street, Walsall, WS1 1EW, WS1 — £745,000 • 1 bed • 1 bath • 5556 ft²

Commercial development for sale in Tudor House Bridge Street, Walsall, WS1 1EW, WS1 — £745,000 • 1 bed • 1 bath • 5556 ft² High street retail property for sale in 8 - 9 Freer Street, Walsall, West Midlands, WS1 1QD, WS1 — £300,000 • 1 bed • 1 bath • 4176 ft²

High street retail property for sale in 8 - 9 Freer Street, Walsall, West Midlands, WS1 1QD, WS1 — £300,000 • 1 bed • 1 bath • 4176 ft² Commercial property for sale in 13 Bridge Street, Walsall, West Midlands, WS1 1DP, WS1 — £75,000 • 1 bed • 1 bath • 419 ft²

Commercial property for sale in 13 Bridge Street, Walsall, West Midlands, WS1 1DP, WS1 — £75,000 • 1 bed • 1 bath • 419 ft²