Summary - 128, High Road Leyton,LONDON,E15 2BX E15 2BX

1 bed 1 bath Mixed Use

**Standout Features:**

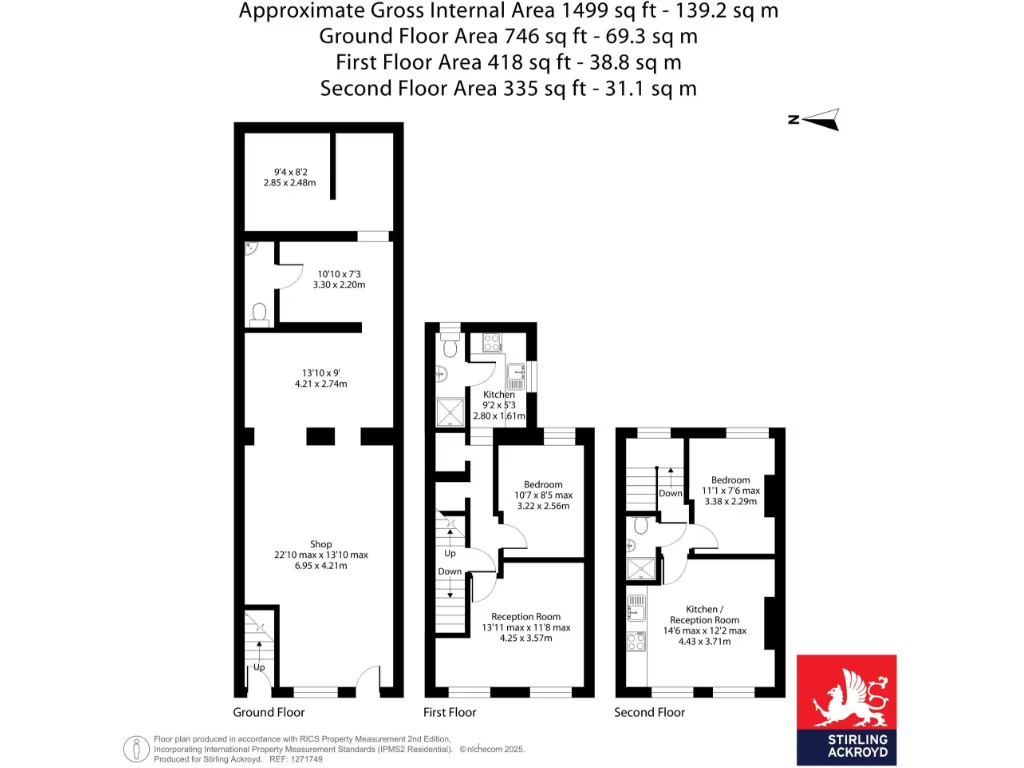

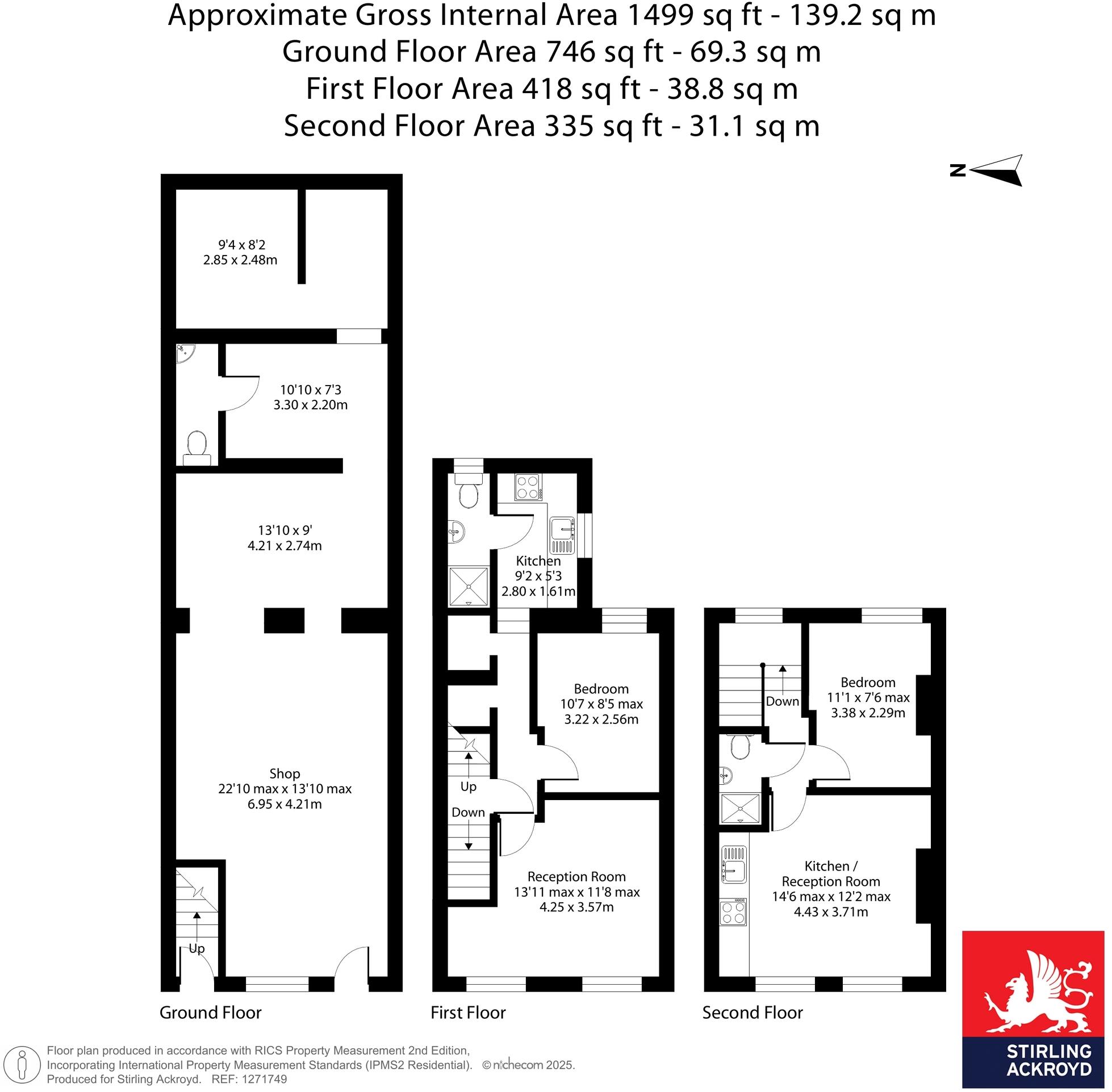

- Mixed-use property with retail unit and two self-contained one-bedroom flats.

- Prime central Leyton location, just a short walk from Leyton Underground Station.

- Total floorspace of 1,499 square feet, providing a generous combined income of £39,600 per annum.

- Gross yield of 6.7%, making it an attractive investment opportunity.

- Current commercial tenant with a food takeaway business paying £13,200 annually until lease expiration in 2031.

- Close proximity to a variety of local amenities, including shops, dining options, and recreational facilities.

**Potential Concerns:**

- The area has a higher crime rate.

- The surrounding environment is classified as deprived, which may impact future property value.

This mixed-use property at 128 High Road, Leyton, offers an ideal investment opportunity for buyers looking to capitalize on a promising residential and commercial rental market. Featuring a charming Victorian facade and comprising a commercial unit with a consistent tenant, as well as two well-sized residential flats, this property ensures steady income flow. The property’s central location within a vibrant community provides easy access to local amenities, making it appealing for families and young professionals alike.

With a gross yield of 6.7% before costs, this asset is perfect for investors seeking reliable returns. However, prospective buyers should consider the high crime rates and community challenges, which might require additional attention to ensure long-term security and growth potential. Don’t miss this chance to secure a versatile property in a bustling East London neighborhood—properties like this don’t stay on the market long.

12 bedroom mixed use property for sale in High Road Leyton, London, E10 — £4,000,000 • 12 bed • 8 bath • 988 ft²

12 bedroom mixed use property for sale in High Road Leyton, London, E10 — £4,000,000 • 12 bed • 8 bath • 988 ft² High street retail property for sale in 124 High Road Leyton, London, Greater London, E15 — £495,000 • 1 bed • 1 bath • 953 ft²

High street retail property for sale in 124 High Road Leyton, London, Greater London, E15 — £495,000 • 1 bed • 1 bath • 953 ft² High street retail property for sale in High Street, Walthamstow, E17 — £2,400,000 • 1 bed • 1 bath • 5220 ft²

High street retail property for sale in High Street, Walthamstow, E17 — £2,400,000 • 1 bed • 1 bath • 5220 ft² Commercial property for sale in High Road Leytonstone, London, E11 4PB, E11 — £250,000 • 1 bed • 1 bath • 667 ft²

Commercial property for sale in High Road Leytonstone, London, E11 4PB, E11 — £250,000 • 1 bed • 1 bath • 667 ft² High street retail property for sale in 621/621a Romford Road, London, E12 — £700,000 • 3 bed • 1 bath • 2758 ft²

High street retail property for sale in 621/621a Romford Road, London, E12 — £700,000 • 3 bed • 1 bath • 2758 ft² Commercial property for sale in 321 Ley Street, Ilford, IG1 4AA, IG1 — £395,000 • 1 bed • 1 bath • 1798 ft²

Commercial property for sale in 321 Ley Street, Ilford, IG1 4AA, IG1 — £395,000 • 1 bed • 1 bath • 1798 ft²