Summary - Court Parade, Wembley, HA0 HA0 3HU

1 bed 1 bath Shop

Large freehold shop with two leased flats, steady income and strong transport links — refurbishment potential for uplift.

Freehold shop with two 1‑bed flats above

Current gross income £23,500 per annum

Two flats on 92‑year leases; finance may be affected

Small ground rent: £50 per flat per year

D1 usage on ground floor; versatile commercial use

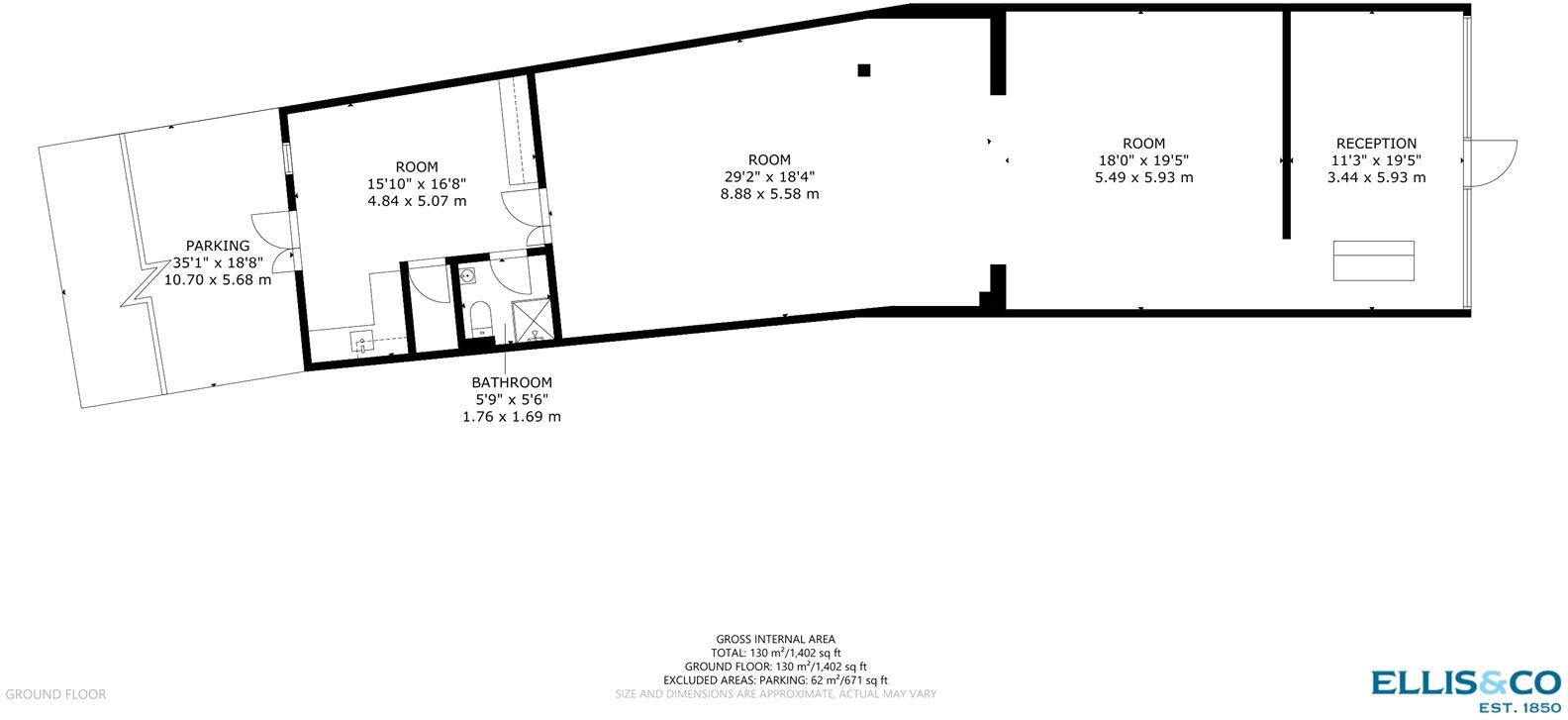

Off‑street parking to rear; excellent broadband and mobile

Built 1930–49; solid brick walls likely uninsulated

Area classed as deprived — affects footfall dynamics

A substantial freehold shop with two one‑bed flats above, currently producing a combined income of £23,500 per year. The ground floor benefits from a wide frontage, good passing trade and D1 usage, making it suitable for a range of commercial occupiers or continued mixed-use investment.

Both flats sit on 92‑year leases with modest ground rent (£50 each), giving steady rental income now but with less than 100 years remaining on the leases — a common financing and value consideration for buyers. The building dates from the 1930s–40s and has solid brick walls; insulation and energy upgrades may be needed to improve EPC and tenant comfort.

Practical positives include off‑street parking to the rear, excellent mobile and broadband connectivity, and very low local crime. The property sits in a busy Wembley location with strong transport links, nearby schools (some rated Outstanding) and local amenities, which support occupation and future letting prospects.

Key limitations are the shorter lease terms on the flats, the property's location within a relatively deprived ward which can affect footfall patterns, and likely maintenance/modernisation needs (windows double glazed but install date unknown; solid brick walls assumed uninsulated). These should be factored into yield calculations and any refurbishment budget.

High street retail property for sale in Ealing Road, Wembley, Middlesex HA0 — £1,500,000 • 1 bed • 1 bath

High street retail property for sale in Ealing Road, Wembley, Middlesex HA0 — £1,500,000 • 1 bed • 1 bath High street retail property for sale in High Road, Willesden, NW10 — £750,000 • 2 bed • 2 bath • 1575 ft²

High street retail property for sale in High Road, Willesden, NW10 — £750,000 • 2 bed • 2 bath • 1575 ft² 2 bedroom flat for sale in Priory Close, Wembley, HA0 — £300,000 • 2 bed • 1 bath • 592 ft²

2 bedroom flat for sale in Priory Close, Wembley, HA0 — £300,000 • 2 bed • 1 bath • 592 ft² High street retail property for sale in St. Albans Road, Watford, WD24 — £675,000 • 3 bed • 2 bath

High street retail property for sale in St. Albans Road, Watford, WD24 — £675,000 • 3 bed • 2 bath High street retail property for sale in 49 Craven Park Road, Harlesden, London, NW10 8SE, NW10 — £550,000 • 1 bed • 1 bath • 2145 ft²

High street retail property for sale in 49 Craven Park Road, Harlesden, London, NW10 8SE, NW10 — £550,000 • 1 bed • 1 bath • 2145 ft² 1 bedroom flat for sale in Ashwood Court, Wembley Park Drive, Wembley Park, HA9 8HA, HA9 — £300,000 • 1 bed • 1 bath • 689 ft²

1 bedroom flat for sale in Ashwood Court, Wembley Park Drive, Wembley Park, HA9 8HA, HA9 — £300,000 • 1 bed • 1 bath • 689 ft²