Summary - 3, LUNEDALE HOUSE, MARKET STREET LA4 5DW

1 bed 1 bath Apartment

Two income-producing one-bed flats near Morecambe seafront, sold individually or together..

Two one‑bed flats sold individually or as a pair

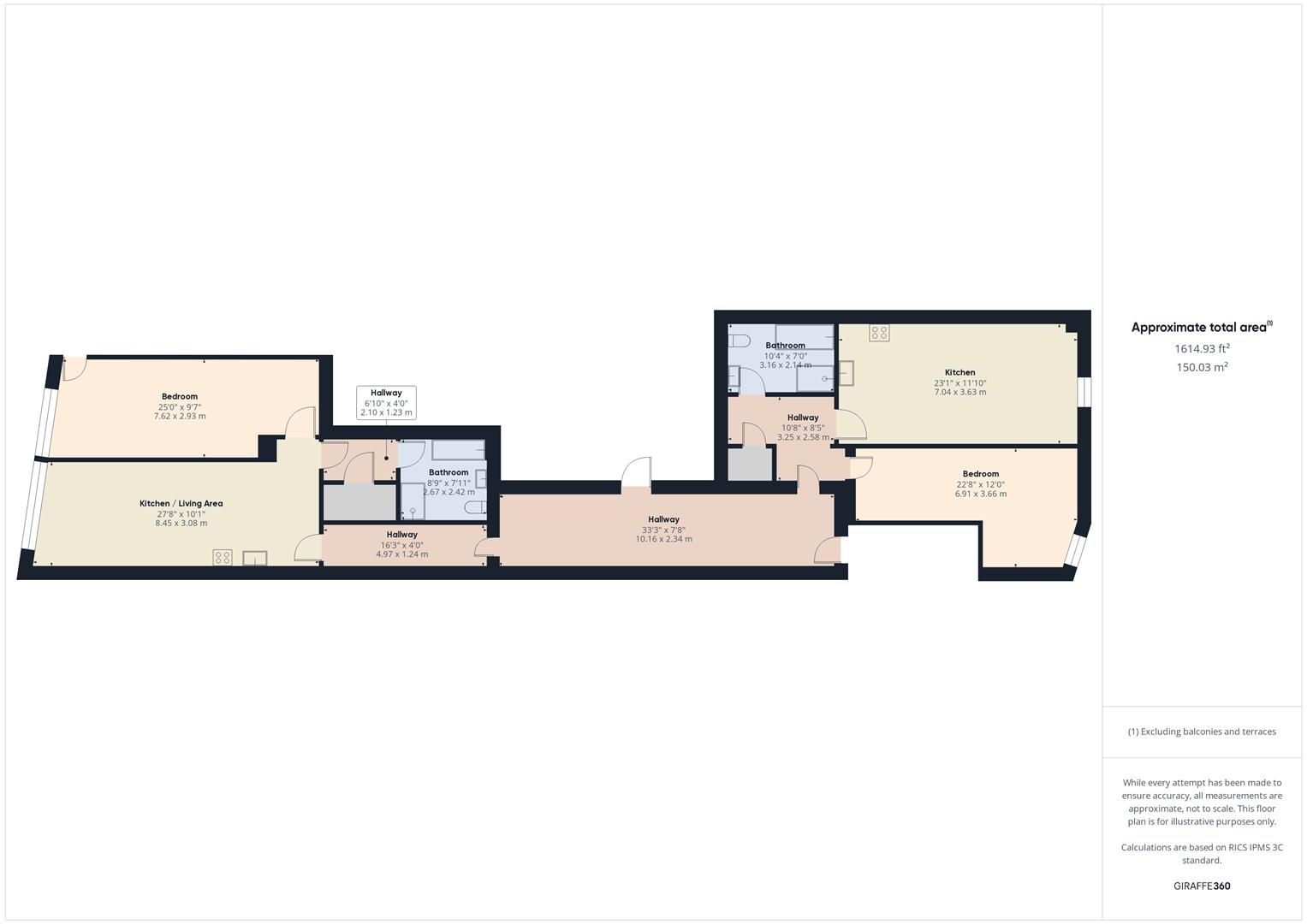

Two generously proportioned one-bedroom apartments in a 1920s brick building, offered individually or as a pair—ideal for buy-to-let investors seeking immediate income. Both flats are currently let on short ASTs with inclusive rents, delivering clear cashflow from day one. Each unit has been refurbished with contemporary fittings and open-plan living, presenting well for longer-term lets or short-stay/holiday use.

Financially attractive projected yields are provided: flat 3A shows around 9.7% gross (≈7% net) and 3B about 10.5% gross (≈7.9% net). Holiday/serviced-accommodation forecasts included suggest significantly higher gross income potential (circa £19,000 gross per unit), giving scope to reposition the units for short-stay trading if planning and licensing allow.

Practical points and drawbacks are clear: both flats are leasehold (about 99 years remaining), sold chain-free, and the current tenancies are short ASTs (six months), so buyer due diligence on tenancy terms and titles is essential. The building sits in Morecambe town centre, two minutes from the seafront and close to the train station, but note the immediate area has high crime statistics and very high deprivation—these social factors can affect long-term capital growth and management costs.

Overall, this is a hands-on investment: strong immediate rental income and short-stay upside, combined with a central seaside location and well-presented interiors. Suitable for investors prepared to manage tenanted flats in a city-centre, higher-risk neighbourhood or for those planning refurbishment and repositioning into serviced accommodation.

1 bedroom flat for sale in Euston Road, Morecambe, LA4 — £81,950 • 1 bed • 1 bath • 410 ft²

1 bedroom flat for sale in Euston Road, Morecambe, LA4 — £81,950 • 1 bed • 1 bath • 410 ft² 1 bedroom apartment for sale in Euston Road, Morecambe, LA4 — £68,000 • 1 bed • 1 bath • 373 ft²

1 bedroom apartment for sale in Euston Road, Morecambe, LA4 — £68,000 • 1 bed • 1 bath • 373 ft² 2 bedroom flat for sale in Marine Road Central, Morecambe, LA4 — £210,000 • 2 bed • 2 bath • 1421 ft²

2 bedroom flat for sale in Marine Road Central, Morecambe, LA4 — £210,000 • 2 bed • 2 bath • 1421 ft² 3 bedroom apartment for sale in Townley Street, Morecambe, LA4 — £150,000 • 3 bed • 2 bath • 388 ft²

3 bedroom apartment for sale in Townley Street, Morecambe, LA4 — £150,000 • 3 bed • 2 bath • 388 ft² 6 bedroom terraced house for sale in Clarendon Road, Morecambe, Lancashire, LA3 — £185,000 • 6 bed • 3 bath • 1888 ft²

6 bedroom terraced house for sale in Clarendon Road, Morecambe, Lancashire, LA3 — £185,000 • 6 bed • 3 bath • 1888 ft² 3 bedroom house for sale in Lines Street, Morecambe, LA4 — £119,950 • 3 bed • 1 bath • 466 ft²

3 bedroom house for sale in Lines Street, Morecambe, LA4 — £119,950 • 3 bed • 1 bath • 466 ft²