Summary - 36, Craddock Street DL16 7SZ

3 bed 1 bath End of Terrace

High-yield rental with clear refurbishment potential in a convenient town location.

Freehold end-terrace with immediate rental income (£550 pcm)

This end-of-terrace freehold at 36 Craddock Street is a low-cost entry for investors seeking high gross returns. Currently let at £550 pcm, the property produces an approximate gross yield of about 13% at the asking price of £50,000, offering immediate rental income and short-term cashflow.

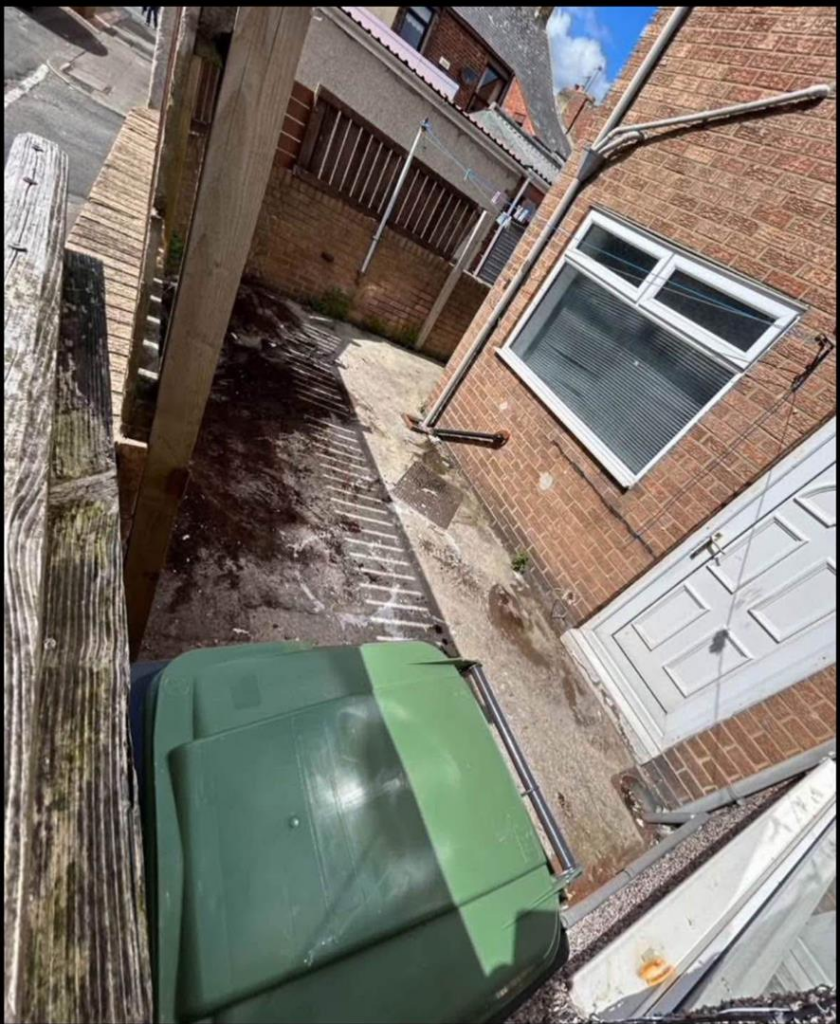

The house is a modest, solid-brick terrace of early 20th-century construction with double glazing and gas central heating. Interiors are serviceable but dated and will benefit from modernization and energy-efficiency upgrades; the current EPC is E and walls likely lack insulation. Typical mid-century fittings and carpets remain in place, giving scope to add value through refurbishment or targeted improvements.

Location delivers convenience: fast broadband, excellent mobile signal, and close proximity to shops, bus routes and several Ofsted-rated Good schools. Note the neighbourhood context — a deprived, blue-collar terrace area with higher-than-average crime rates — which impacts tenant demand, resale prospects and management considerations.

Practical points: the plot is small with limited street parking and no flood risk. Council Tax Band A keeps running costs low. This property suits buy-to-let investors comfortable managing a renovation and letting in a working-class town environment, or renovators aiming to add value through sensible upgrades.

2 bedroom terraced house for sale in Craddock Street, Spennymoor, DL16 — £49,000 • 2 bed • 1 bath • 1076 ft²

2 bedroom terraced house for sale in Craddock Street, Spennymoor, DL16 — £49,000 • 2 bed • 1 bath • 1076 ft² 3 bedroom terraced house for sale in Craddock Street, Spennymoor, DL16 — £49,950 • 3 bed • 1 bath • 926 ft²

3 bedroom terraced house for sale in Craddock Street, Spennymoor, DL16 — £49,950 • 3 bed • 1 bath • 926 ft² 3 bedroom terraced house for sale in Baff Street, Spennymoor, County Durham, DL16 — £92,250 • 3 bed • 2 bath • 1206 ft²

3 bedroom terraced house for sale in Baff Street, Spennymoor, County Durham, DL16 — £92,250 • 3 bed • 2 bath • 1206 ft² 2 bedroom terraced house for sale in Stratton Street, Spennymoor, DL16 — £54,950 • 2 bed • 1 bath • 940 ft²

2 bedroom terraced house for sale in Stratton Street, Spennymoor, DL16 — £54,950 • 2 bed • 1 bath • 940 ft² 3 bedroom end of terrace house for sale in Clyde Terrace, Spennymoor, Durham, DL16 — £100,000 • 3 bed • 1 bath • 936 ft²

3 bedroom end of terrace house for sale in Clyde Terrace, Spennymoor, Durham, DL16 — £100,000 • 3 bed • 1 bath • 936 ft² 2 bedroom terraced house for sale in South Street, Spennymoor, County Durham, DL16 — £45,000 • 2 bed • 1 bath • 765 ft²

2 bedroom terraced house for sale in South Street, Spennymoor, County Durham, DL16 — £45,000 • 2 bed • 1 bath • 765 ft²