Summary - 21 WEST AVENUE DONNINGTON TELFORD TF2 8BL

3 bed 1 bath Terraced

Yield-focused three-bed terraced investment with tenant in situ and refurbishment potential.

7.3% gross rental yield — tenant in situ

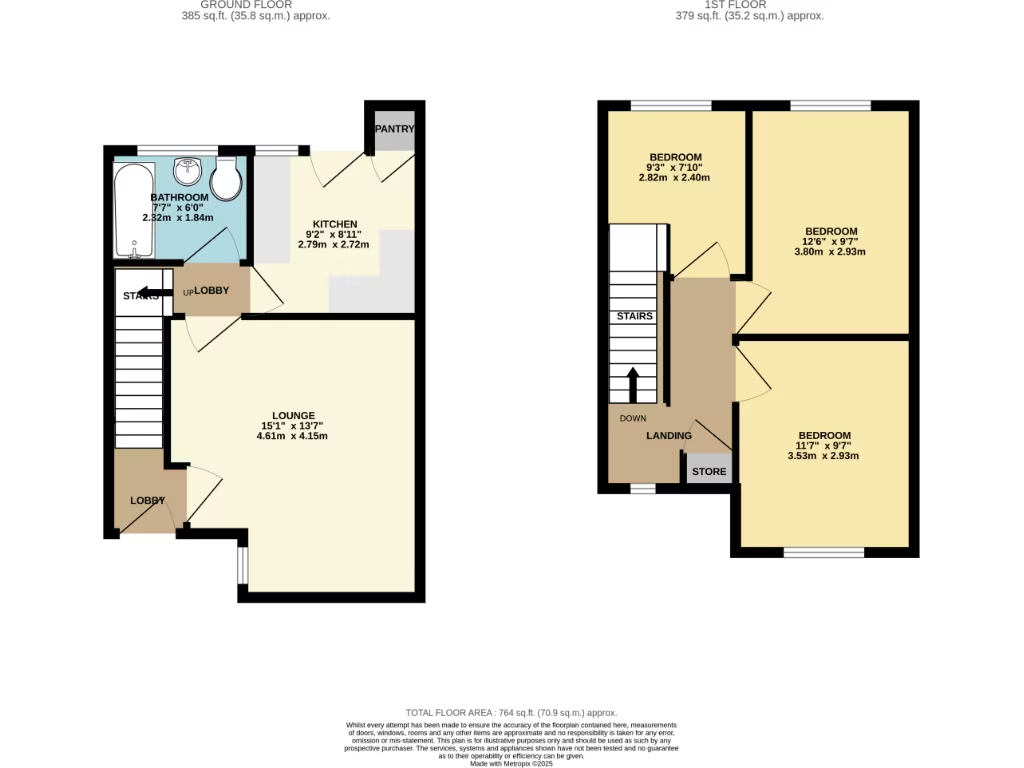

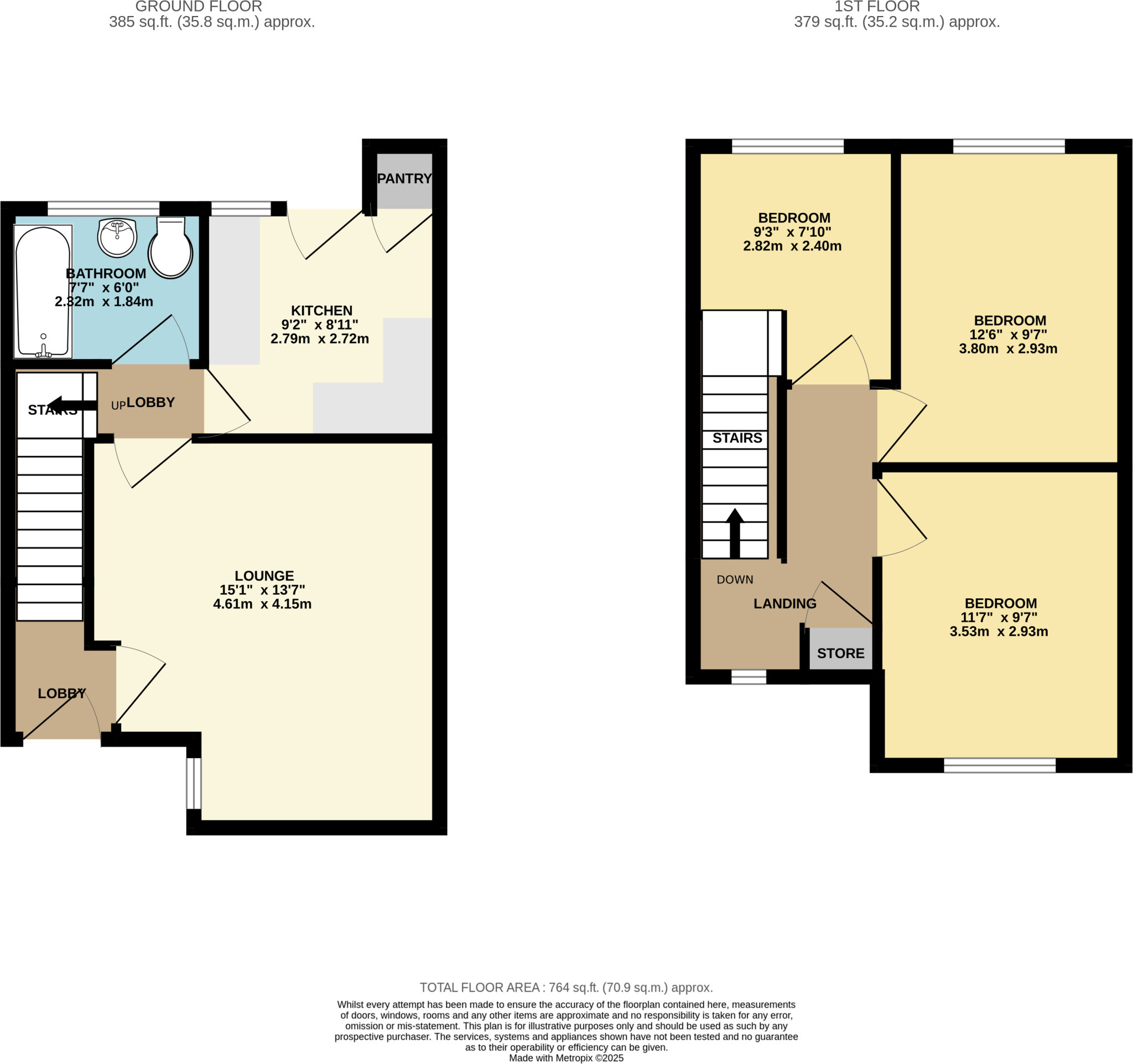

Freehold mid-terrace, three bedrooms, large living room

Small overall size: 807 sq ft, compact family footprint

Area classified very deprived; local demand steadied by low prices

Exterior and interior show wear; tidy-up or refurbishment needed

Double glazing fitted before 2002; consider window upgrades

Mains gas boiler and radiators — functional but may need servicing

No flood risk; fast broadband and very low council tax

An investor-focused mid-terrace offering a reliable 7.3% rental yield and tenant in situ, ideal for a buy-to-let addition. The three-bedroom layout and large living room provide straightforward rental appeal to families or sharers, and the freehold tenure simplifies long-term ownership.

The property is a mid‑20th-century brick build (c.1950–66) with mains gas central heating, filled cavity walls and double glazing fitted before 2002. Broadband speeds are reported as fast and there is no flood risk — practical factors that support tenancy stability. Council tax is very low, improving net returns.

This is a hands-on investment: the area sits in a very deprived, hard-pressed neighbourhood classification, and the house shows signs of general wear with external areas and interiors needing tidying or minor renovation. The tenant remains in situ, so any refurbishment will need scheduling around occupation. Investors should budget for updating finishes and potentially modernising heating controls and windows for long-term appeal.

Overall, the property offers steady income and scope to add value through careful, costed refurbishment. It suits investors seeking immediate yield and long-term uplift rather than buyers looking for a turnkey family home.

2 bedroom terraced house for sale in Park Street, Telford, TF7 — £138,000 • 2 bed • 1 bath • 603 ft²

2 bedroom terraced house for sale in Park Street, Telford, TF7 — £138,000 • 2 bed • 1 bath • 603 ft² 3 bedroom terraced house for sale in Summerhill, Sutton Hill, Telford, Shropshire, TF7 — £115,000 • 3 bed • 1 bath • 991 ft²

3 bedroom terraced house for sale in Summerhill, Sutton Hill, Telford, Shropshire, TF7 — £115,000 • 3 bed • 1 bath • 991 ft² 3 bedroom terraced house for sale in Coronation Drive, Donnington, Telford, Shropshire, TF2 — £140,000 • 3 bed • 1 bath • 700 ft²

3 bedroom terraced house for sale in Coronation Drive, Donnington, Telford, Shropshire, TF2 — £140,000 • 3 bed • 1 bath • 700 ft² 3 bedroom terraced house for sale in Summerhill, Sutton Hill, Telford, TF7 — £130,000 • 3 bed • 1 bath • 915 ft²

3 bedroom terraced house for sale in Summerhill, Sutton Hill, Telford, TF7 — £130,000 • 3 bed • 1 bath • 915 ft² 3 bedroom terraced house for sale in Wigmores, Telford, TF7 — £131,000 • 3 bed • 2 bath • 1012 ft²

3 bedroom terraced house for sale in Wigmores, Telford, TF7 — £131,000 • 3 bed • 2 bath • 1012 ft² 3 bedroom terraced house for sale in Brindley Ford, Telford, Shropshire, TF3 1SW, TF3 — £125,000 • 3 bed • 1 bath • 856 ft²

3 bedroom terraced house for sale in Brindley Ford, Telford, Shropshire, TF3 1SW, TF3 — £125,000 • 3 bed • 1 bath • 856 ft²