Advertised gross income £19,800 pa — approx 12% gross yield

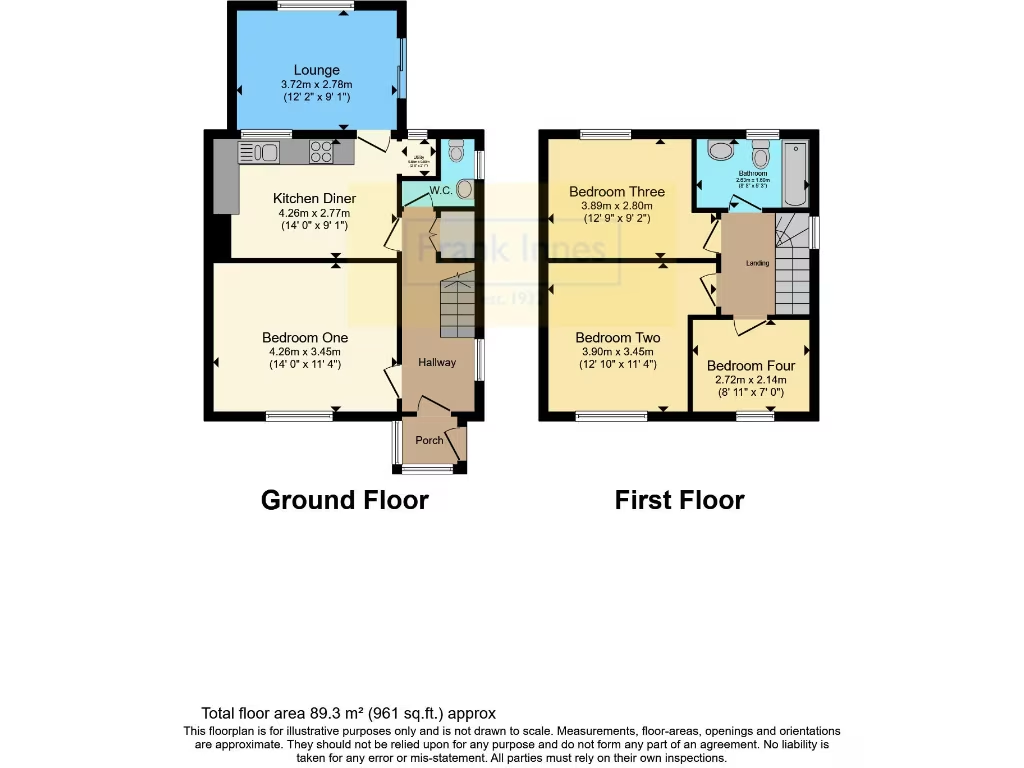

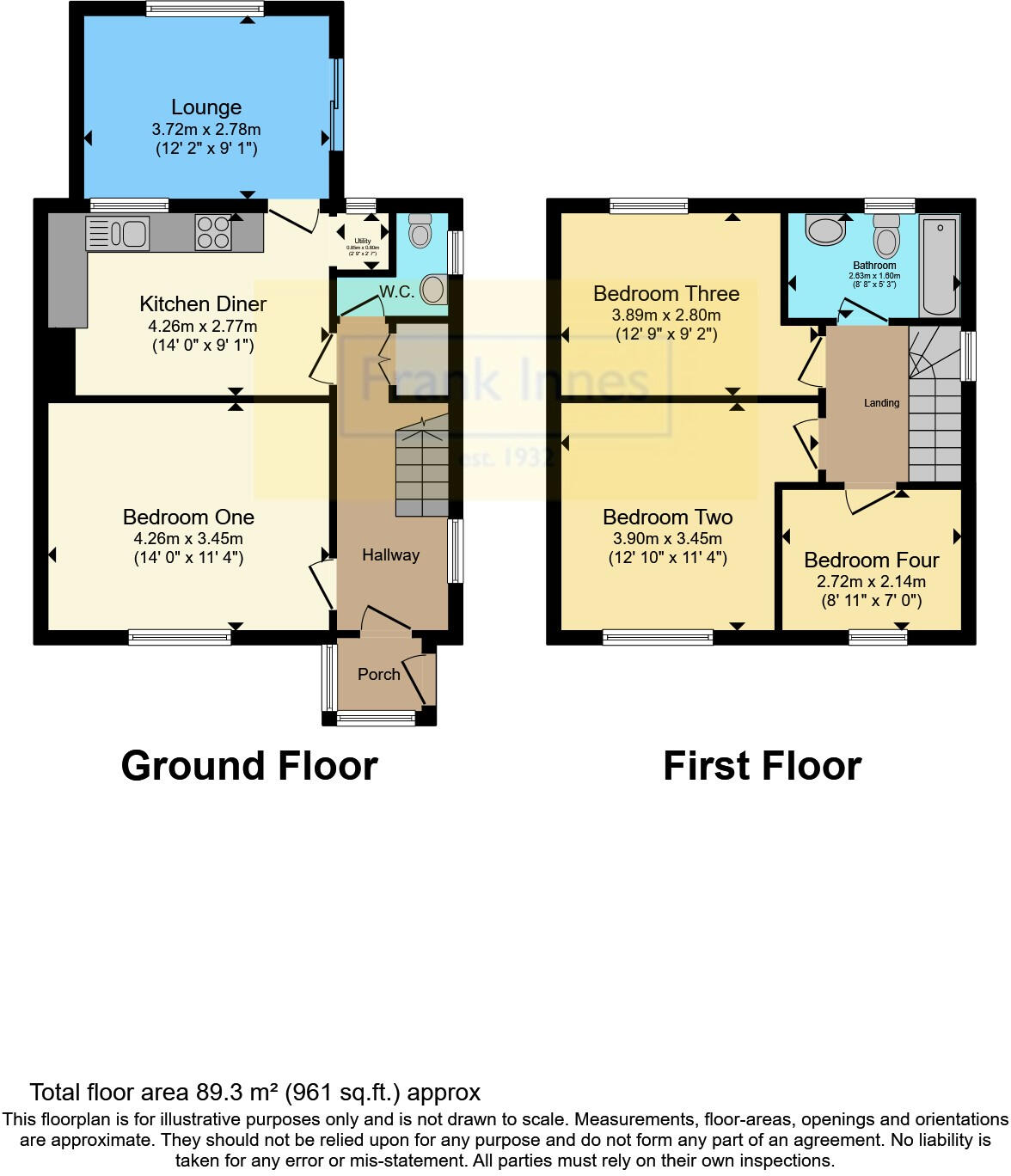

A straightforward buy-to-let with strong immediate income: this four-bedroom semi delivers an advertised gross rental income of £19,800 per year (approximately 12% gross return at the asking price of £165,000). Sold freehold and offered either with the current tenants in situ or with vacant possession, the house is arranged as four lettable rooms plus communal kitchen-diner, lounge and conservatory — a practical layout for individual-room lets or family use.

The property offers useful, tenant-ready features including gas central heating, double glazing and off-street parking, plus an enclosed rear garden and handy storage shed. The kitchen is described as modern and there is a driveway and decked patio area that add to lettability and everyday convenience. The location has good road links to the city centre, Pride Park, Rolls-Royce and the A6/A50 — useful for commuter tenants.

Buyers should factor in several material negatives. The surrounding area is recorded as very deprived with a very high local crime rate, which affects both rental demand and price growth. The building is solid-brick from the 1930s–40s with assumed no cavity insulation; windows are double glazed but installed before 2002. There is a single family bathroom for four bedrooms and the overall plot and internal size are small, so some refurbishment or reconfiguration may be required to maximise long-term capital growth.

This is best suited to an investor seeking immediate income or a buyer willing to refurbish to improve returns. Viewing is recommended to assess room sizes, standard of finish and to confirm any retrofit or improvement costs (insulation, window upgrades, bathroom modernisation) before purchase.