Summary - 30 SOUTH CRESCENT PETERLEE SR8 4AF

2 bed 1 bath Semi-Detached

Let property with immediate income and strong gross yield.

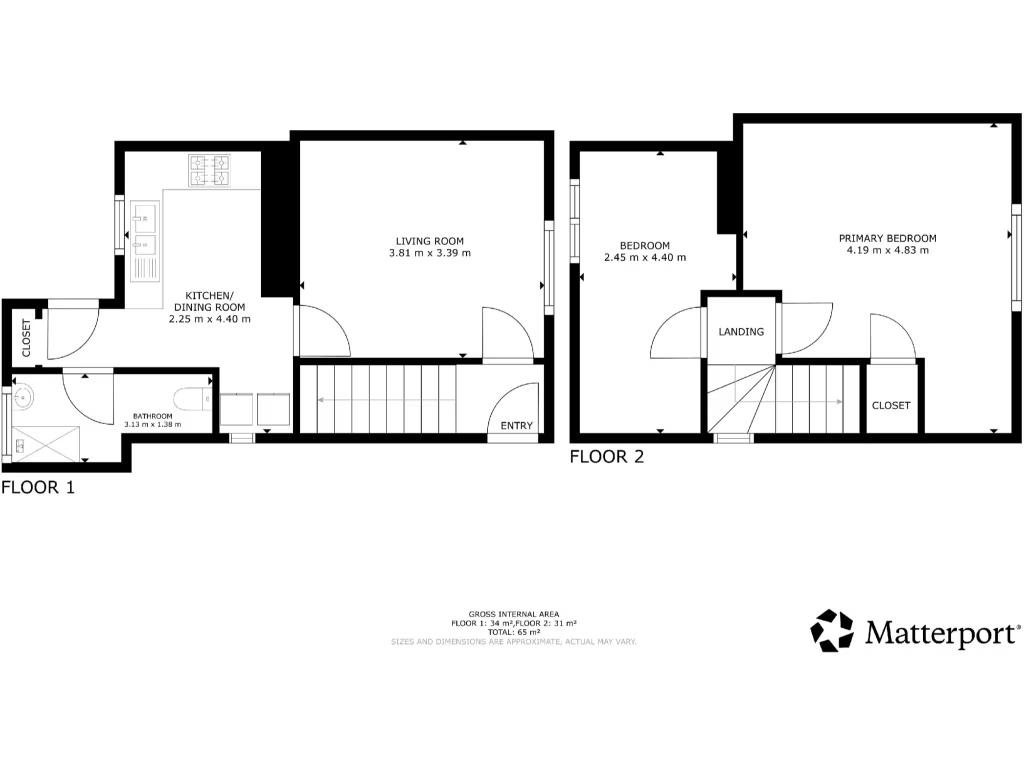

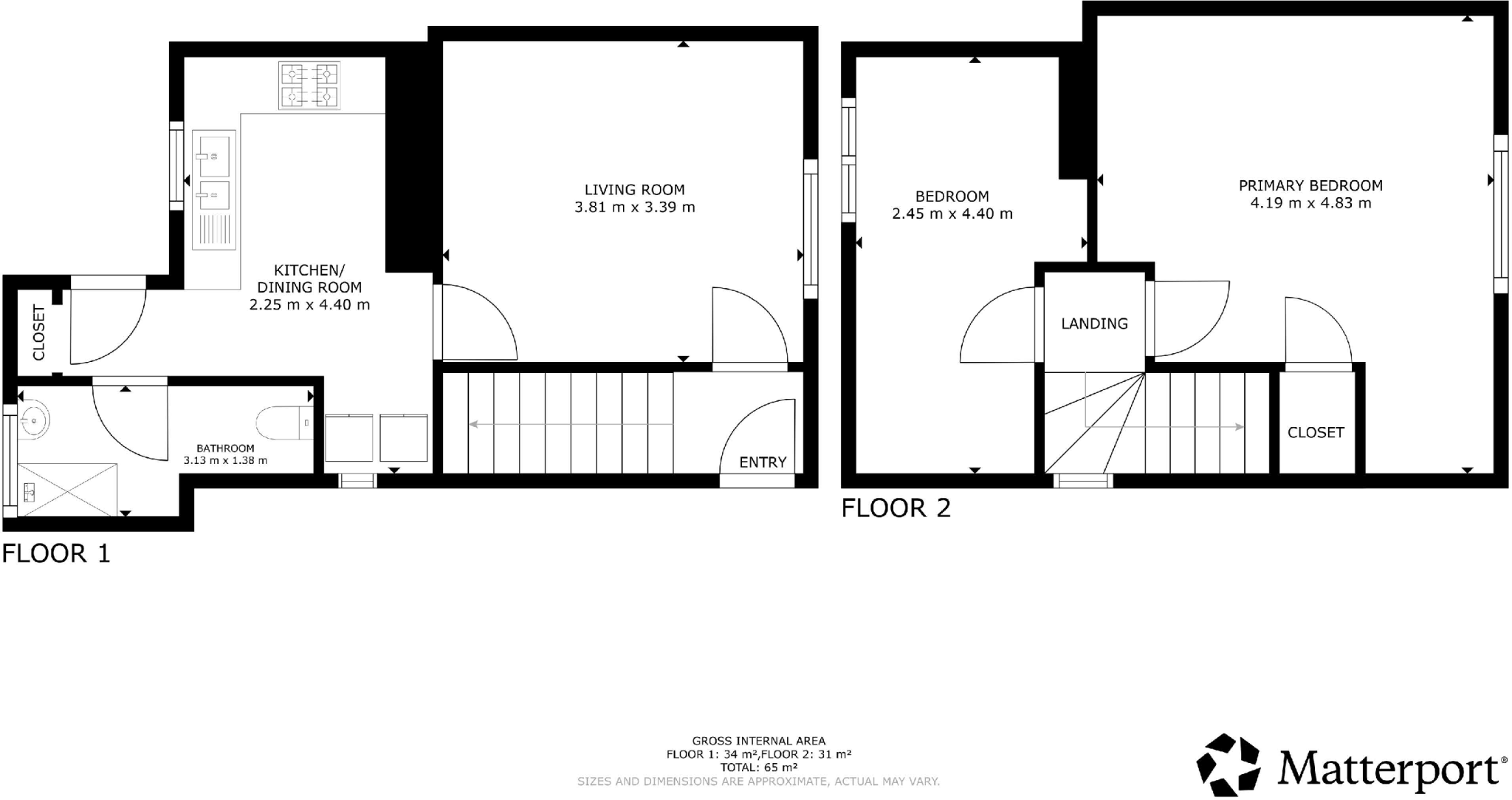

Two-bedroom semi-detached freehold, c. 689 sqft

A straightforward buy-to-let opportunity in Peterlee offering immediate rental income and simple management. The two-bedroom, semi‑detached freehold is let and currently produces a gross annual income of £5,400, equating to an approximate gross yield of around 9% at the £60,000 asking price — a clear attraction for yield-focused investors.

The home has a traditional layout: lounge, kitchen/diner, two bedrooms and a three-piece bathroom, plus private front and rear gardens and on-street parking. The property is of average overall size (c. 689 sqft), with good mobile signal and fast broadband — useful for tenant appeal and lettability.

Material considerations are straightforward: the area is very deprived and locally classified as a challenged community, which can affect demand, management and long-term capital growth. There is a tenant in situ who has paid reliably for a year and does not intend to vacate; any purchaser should review the Let Property Pack and tenancy details carefully. A buyer’s premium will be applied to secure the sale.

This is best suited to serious investors or developers seeking an addition to a rental portfolio or a property for modest refurbishment. It offers immediate cashflow and manageable running factors, but buyers should budget for ongoing management and be comfortable operating in a high-deprivation location.

2 bedroom terraced house for sale in Tees Street, Peterlee, SR8 — £49,000 • 2 bed • 1 bath • 775 ft²

2 bedroom terraced house for sale in Tees Street, Peterlee, SR8 — £49,000 • 2 bed • 1 bath • 775 ft² 2 bedroom terraced house for sale in Seventh Street, Peterlee, SR8 — £45,000 • 2 bed • 1 bath • 721 ft²

2 bedroom terraced house for sale in Seventh Street, Peterlee, SR8 — £45,000 • 2 bed • 1 bath • 721 ft² 2 bedroom terraced house for sale in Ninth Street, Peterlee, SR8 — £45,000 • 2 bed • 1 bath • 775 ft²

2 bedroom terraced house for sale in Ninth Street, Peterlee, SR8 — £45,000 • 2 bed • 1 bath • 775 ft² 3 bedroom terraced house for sale in Twelfth Street, Peterlee, SR8 — £60,000 • 3 bed • 1 bath

3 bedroom terraced house for sale in Twelfth Street, Peterlee, SR8 — £60,000 • 3 bed • 1 bath 3 bedroom terraced house for sale in Twelfth Street, Peterlee, County Durham, SR8 — £60,000 • 3 bed • 1 bath • 926 ft²

3 bedroom terraced house for sale in Twelfth Street, Peterlee, County Durham, SR8 — £60,000 • 3 bed • 1 bath • 926 ft² 2 bedroom semi-detached house for sale in Neville Road, Peterlee, SR8 — £72,000 • 2 bed • 1 bath • 743 ft²

2 bedroom semi-detached house for sale in Neville Road, Peterlee, SR8 — £72,000 • 2 bed • 1 bath • 743 ft²