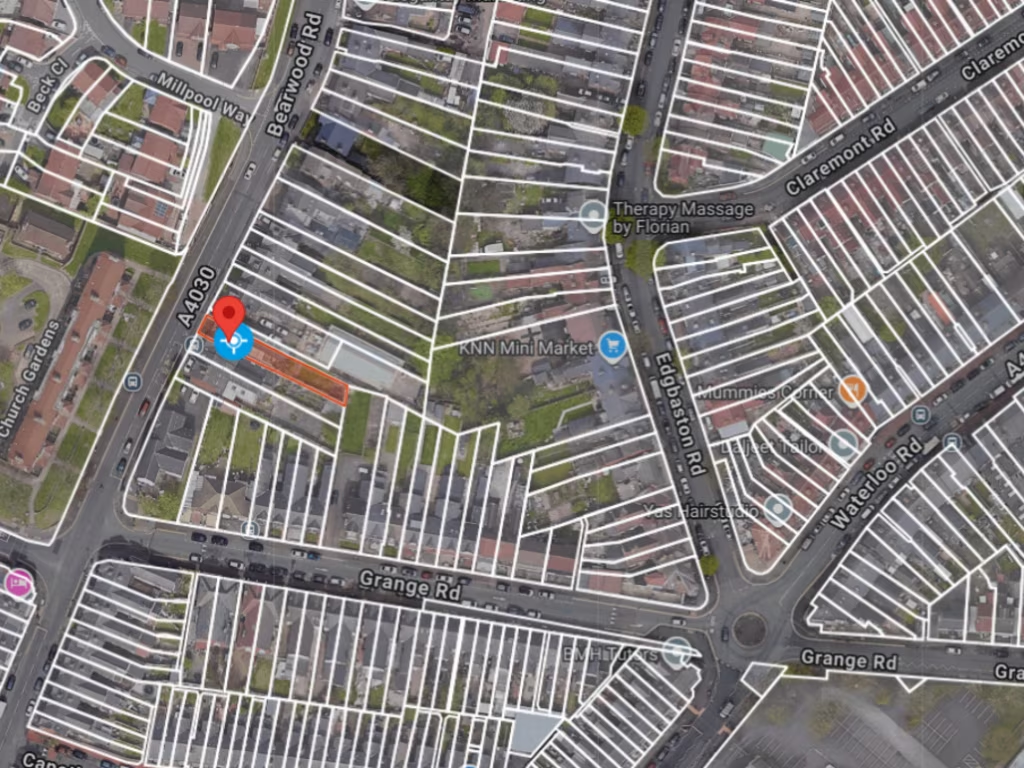

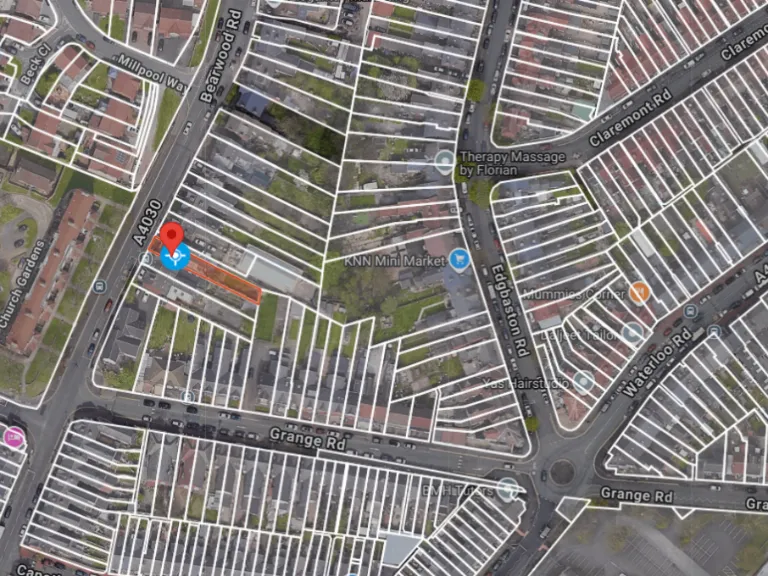

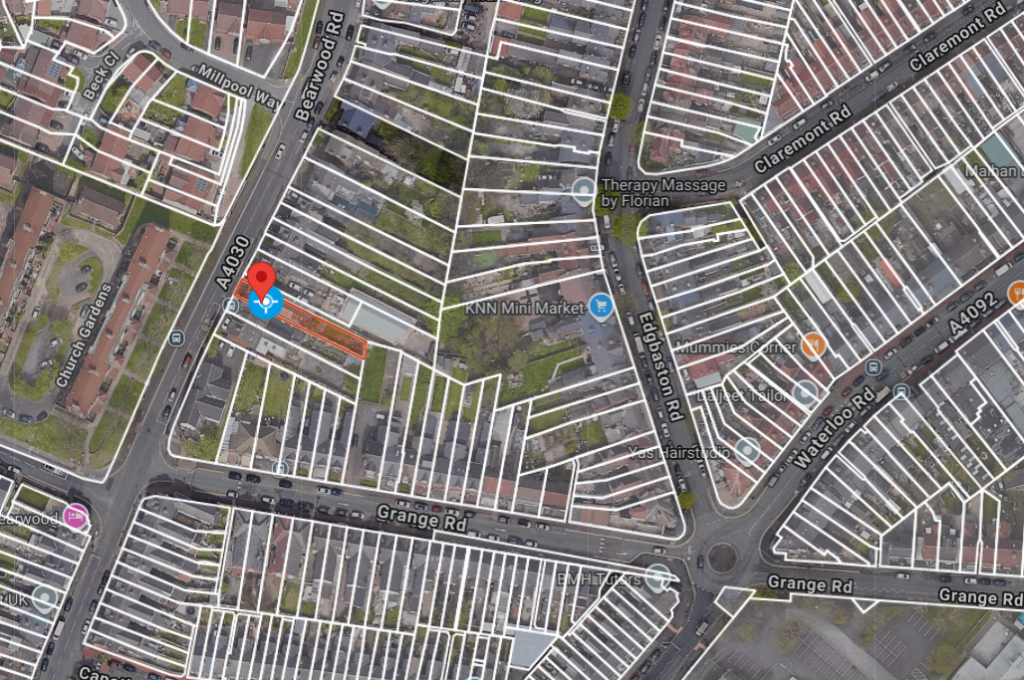

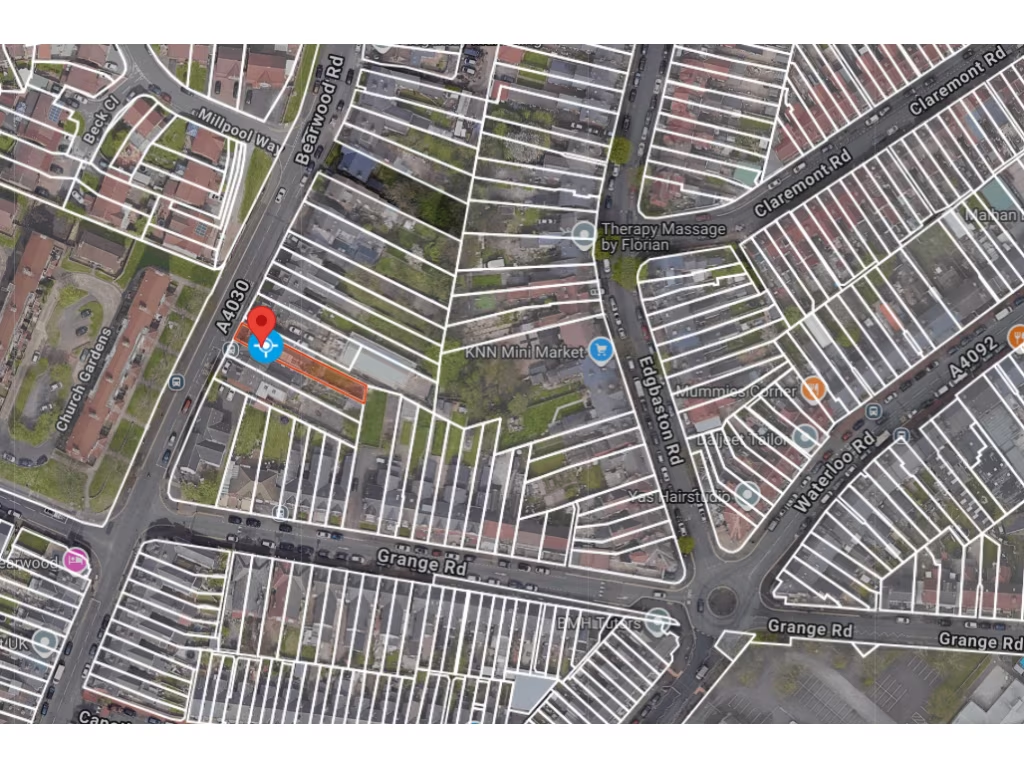

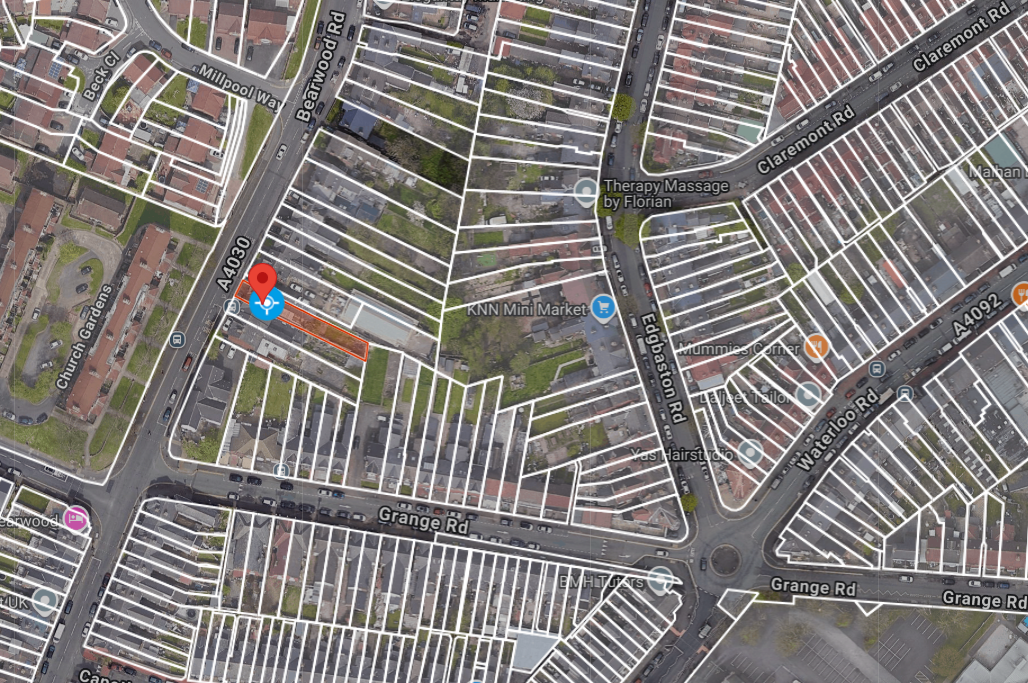

Summary - 155 BEARWOOD ROAD SMETHWICK B66 4LN

7 bed 4 bath House of Multiple Occupation

Freehold 5-bed HMO plus two studios, fully let and income producing..

5-bedroom HMO plus two self-contained studio flats producing £3,985 pcm

Sold freehold with full title deed ownership, no service charge

HMO licence in place for 9 persons (7 households)

Fully let on ASTs — immediate rental income and yield

Victorian end-terrace with high ceilings and period features

Area: very deprived with above-average crime — consider tenant risk

No step-free access and no level-access shower; limited accessibility

Solid brick walls likely without cavity insulation — potential retrofit costs

This freehold Victorian end-terrace on Bearwood Road is a ready-made rental investment: a 5-bed HMO plus two self-contained studio flats, producing £3,985 pcm (£47,820 pa) on AST tenancies and sold with an HMO licence for nine persons. The property is fully let and offered with full title deed ownership, no service charge and no ground rent—appealing to cash buyers or investors seeking immediate income.

Internally the building combines traditional period features—high ceilings and bay windows—with modernised, furnished lets including a loft flat, a ground-floor studio and five HMO bedrooms arranged over two floors with communal kitchen/diner and two communal bathrooms. There is a rear garden and driveway facilities nearby, and strong transport links toward Birmingham city centre, supporting consistent tenant demand.

Buyers should note material considerations: the area is classed as very deprived with above-average crime rates, and the property has solid brick construction likely without cavity insulation. There is no step-free access or level-access shower, and parking is on-street only. Prospective purchasers must carry out their own due diligence and review the full property pack and tenancy documentation.

This asset is best suited to experienced landlords or investors seeking an income-producing HMO with scope for operational savings or light refurbishment. The current rental yield and HMO licence make it a practical grab-and-go purchase, but factor in local area risks and potential refurbishment or landlord compliance costs when assessing returns.

7 bedroom house of multiple occupation for sale in Hatfield Road - 7 Bed HMO, Birmingham, B19 — £420,000 • 7 bed • 2 bath • 1734 ft²

7 bedroom house of multiple occupation for sale in Hatfield Road - 7 Bed HMO, Birmingham, B19 — £420,000 • 7 bed • 2 bath • 1734 ft² 4 bedroom house for sale in Bloomsbury Street, Birmingham, B7 — £199,999 • 4 bed • 1 bath

4 bedroom house for sale in Bloomsbury Street, Birmingham, B7 — £199,999 • 4 bed • 1 bath 4 bedroom property for sale in Edgbaston Road - Block Of 4 x Flats , Smethwick, B66 — £550,000 • 4 bed • 4 bath

4 bedroom property for sale in Edgbaston Road - Block Of 4 x Flats , Smethwick, B66 — £550,000 • 4 bed • 4 bath Commercial property for sale in Handsworth Wood Rd - £335,000 P.A Net Rent, Handsworth, Birmingham, B20 — £1,675,000 • 28 bed • 28 bath

Commercial property for sale in Handsworth Wood Rd - £335,000 P.A Net Rent, Handsworth, Birmingham, B20 — £1,675,000 • 28 bed • 28 bath 4 bedroom property for sale in Dyas Rd- Net Returns Of 15% - Fully Managed & Reliable , Great Barr, Birmingham, B44 — £299,950 • 4 bed • 4 bath

4 bedroom property for sale in Dyas Rd- Net Returns Of 15% - Fully Managed & Reliable , Great Barr, Birmingham, B44 — £299,950 • 4 bed • 4 bath 4 bedroom house for sale in Markby Rd -Net Returns Of 15% – Fully Managed & Hands Off, Birmingham, B18 — £299,950 • 4 bed • 4 bath • 1668 ft²

4 bedroom house for sale in Markby Rd -Net Returns Of 15% – Fully Managed & Hands Off, Birmingham, B18 — £299,950 • 4 bed • 4 bath • 1668 ft²