Summary - High Street, Kingswinford DY6 8BF

2 bed 1 bath Ground Flat

Two-bedroom ground-floor buy-to-let with tenants in situ and a strong current yield..

Tenants in situ with current rental yield 7.78% (income-producing)

Cash buyers only (sale condition applies)

Compact footprint ~393 sq ft — small, efficient unit

Leasehold with c.117–125 years remaining

Service charge c. £1,400–£1,600 pa; ground rent £350 pa

Electric storage heating — higher running costs likely

Allocated communal parking space included

Area classified as deprived — strong rental demand, limited capital growth

This ground-floor two-bedroom flat on High Street, Kingswinford is offered with tenants in situ and currently delivers a headline rental yield of 7.78% — a clear short-term income play for buy-to-let portfolios. The flat sits within a larger, utilitarian/residential block close to local shops, good bus links and Kingswinford town centre. An allocated communal parking space is included.

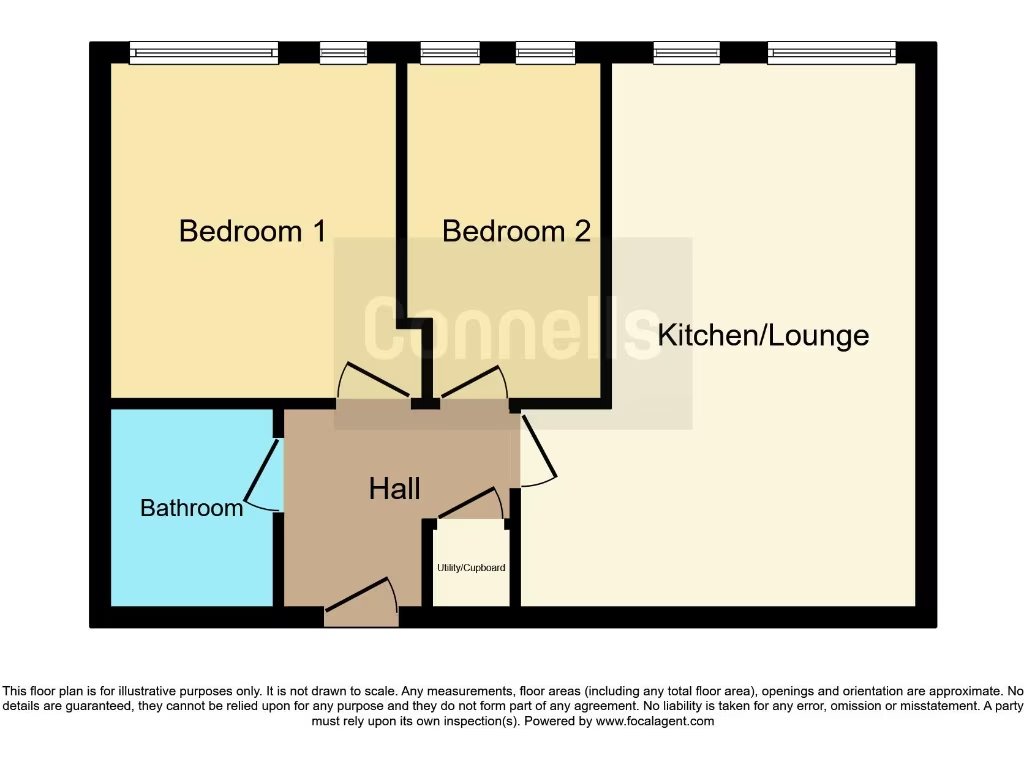

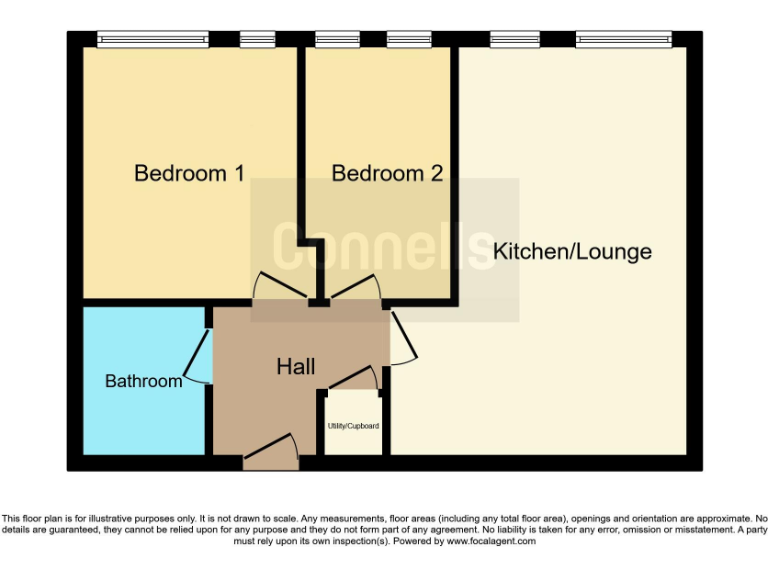

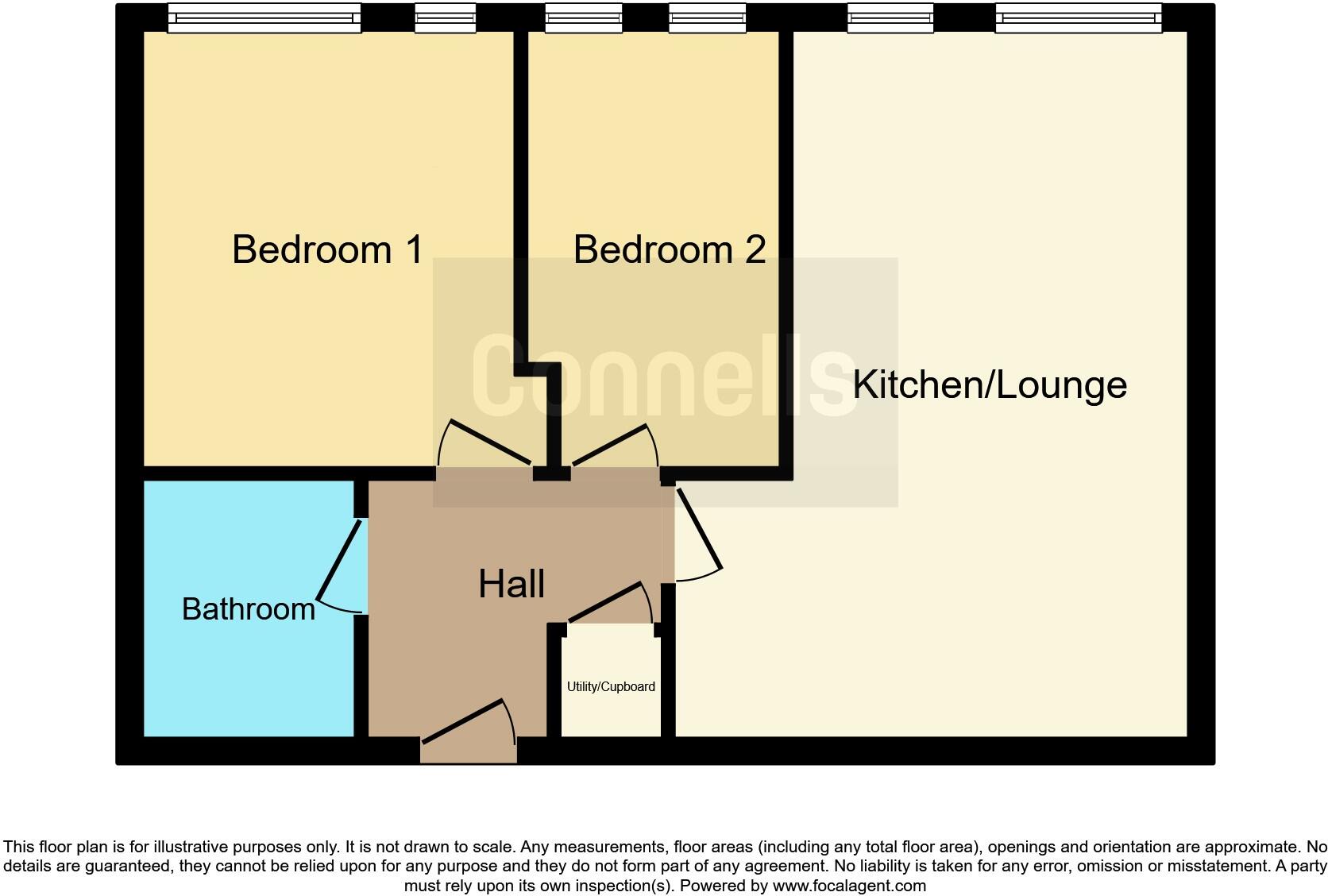

Accommodation is compact (approximately 393 sq ft) and arranged in a traditional layout: open-plan kitchen/lounge, two bedrooms and a bathroom. The property is heated by electric storage heaters and radiators and has double-glazed windows. The lease has long unexpired term (around 117–125 years reported), but the property is leasehold with annual service charge and ground rent liabilities.

Practical running costs and management considerations are important here. Service charge is relatively high for size (quoted c. £1,400–£1,600 pa) and ground rent is c. £350 pa; heating is electric, which can mean higher tenant energy costs and potential demand for future upgrades. The area is classified as deprived with an industrious, working‑class profile — strong for letting but may limit capital-growth expectations.

This is a straightforward acquisition for cash buyers and landlords looking to add a small, income-generating flat to their portfolio. It suits investors who prioritise immediate yield and are comfortable managing leasehold charges, tenant-in-situ arrangements and potential future refurbishment to maximise long-term value.

2 bedroom ground floor flat for sale in KINGSWINFORD, Larch House, High Street, DY6 — £80,000 • 2 bed • 1 bath • 561 ft²

2 bedroom ground floor flat for sale in KINGSWINFORD, Larch House, High Street, DY6 — £80,000 • 2 bed • 1 bath • 561 ft² 2 bedroom flat for sale in KINGSWINFORD, Larch House, High Street, DY6 — £73,500 • 2 bed • 1 bath • 679 ft²

2 bedroom flat for sale in KINGSWINFORD, Larch House, High Street, DY6 — £73,500 • 2 bed • 1 bath • 679 ft² 1 bedroom flat for sale in KINGSWINFORD, High Street, DY6 — £68,000 • 1 bed • 1 bath • 389 ft²

1 bedroom flat for sale in KINGSWINFORD, High Street, DY6 — £68,000 • 1 bed • 1 bath • 389 ft² 1 bedroom apartment for sale in High Street, Kingswinford, DY6 — £65,000 • 1 bed • 1 bath • 463 ft²

1 bedroom apartment for sale in High Street, Kingswinford, DY6 — £65,000 • 1 bed • 1 bath • 463 ft² 1 bedroom flat for sale in KINGSWINFORD, Larch House, High Street, DY6 — £60,000 • 1 bed • 1 bath • 425 ft²

1 bedroom flat for sale in KINGSWINFORD, Larch House, High Street, DY6 — £60,000 • 1 bed • 1 bath • 425 ft² 1 bedroom apartment for sale in 241 High Street, Kingswinford, DY6 — £65,000 • 1 bed • 1 bath • 332 ft²

1 bedroom apartment for sale in 241 High Street, Kingswinford, DY6 — £65,000 • 1 bed • 1 bath • 332 ft²