Summary - 13, BIRNAM PLACE, HAMILTON ML3 9PU

1 bed 1 bath Flat

Ready-let one-bed freehold with high yield and short-term uplift potential..

Freehold one-bedroom flat producing £450pcm (£5,400pa)

13.5% gross yield at £42,500 purchase price

Rental uplift potential to ~£525pcm (£6,300pa)

Small bathroom with dated fittings — cosmetic work advised

Located in very deprived area; constrained renter market

Fast broadband, no flood risk, affordable council tax

Average mobile signal; practical commuter links (M74/M8)

Immediate income — available for immediate purchase

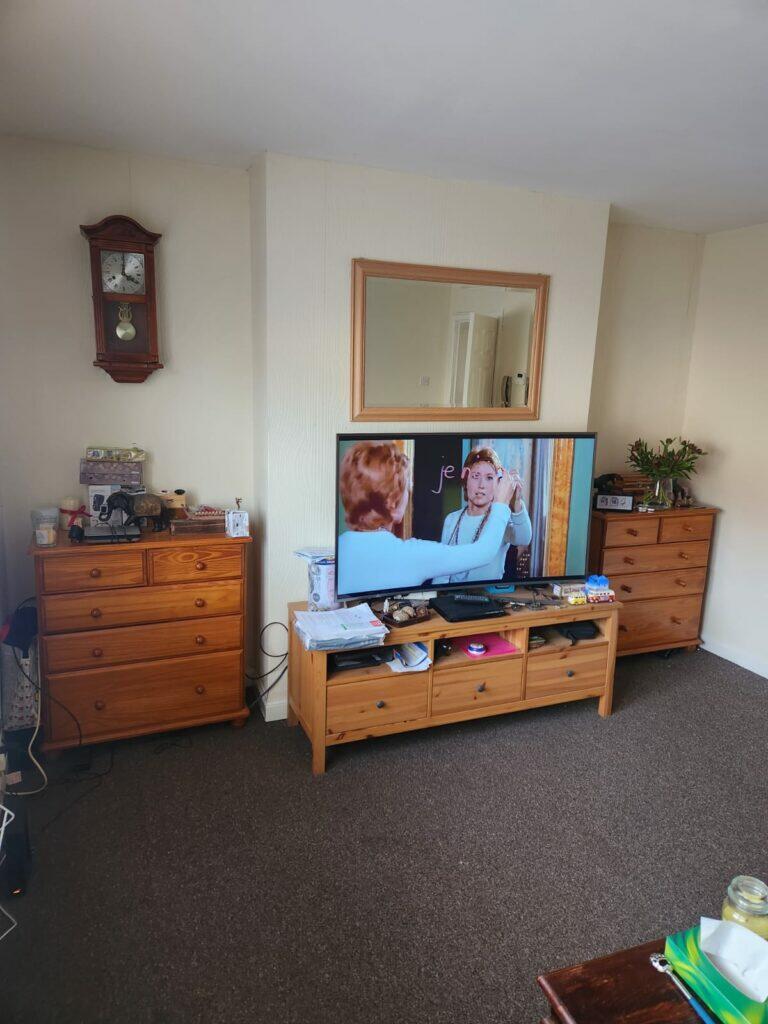

This one-bedroom freehold flat in Hamilton is offered as a ready-let investment, producing £450pcm (£5,400pa) and showing a headline yield of 13.5% at the current asking price. The property is arranged with an entrance hallway, lounge, kitchen, bedroom and small bathroom. It is immediately income-producing for a buyer seeking a straightforward rental purchase.

There is clear upside: achievable rental evidence suggests potential to let for around £525pcm (£6,300pa), improving returns for a hands-on investor. Practical positives include fast broadband, no flood risk, affordable council tax and simple one-bedroom accommodation that is popular with single tenants or couples in town locations.

Buyers should note material context and maintenance items. The local area is classified as very deprived with a transitional Eastern European neighbourhood and a constrained renter base; this can mean tenant turnover and tighter local market conditions. The bathroom has dated fittings and is compact, so some cosmetic investment would increase long-term appeal and rental prospects.

Overall this is a pragmatic, low-cost entry investment for someone targeting rental yield rather than lifestyle occupation. It suits an investor comfortable working within a tougher local market and willing to carry minor refurbishment to lift rental value and reduce void risk.

1 bedroom flat for sale in Quarry Street, Hamilton, Lanarkshire, ML3 — £50,000 • 1 bed • 1 bath • 355 ft²

1 bedroom flat for sale in Quarry Street, Hamilton, Lanarkshire, ML3 — £50,000 • 1 bed • 1 bath • 355 ft² 2 bedroom flat for sale in 25 Birnam Place, Hamilton, ML3 9PU, ML3 — £57,500 • 2 bed • 1 bath

2 bedroom flat for sale in 25 Birnam Place, Hamilton, ML3 9PU, ML3 — £57,500 • 2 bed • 1 bath 3 bedroom flat for sale in 113 Kelvin Gardens, Hamilton, ML3 9NR, ML3 — £50,000 • 3 bed • 1 bath

3 bedroom flat for sale in 113 Kelvin Gardens, Hamilton, ML3 9NR, ML3 — £50,000 • 3 bed • 1 bath 2 bedroom flat for sale in Roseberry Place, Burnbank, Hamilton, ML3 — £50,000 • 2 bed • 1 bath

2 bedroom flat for sale in Roseberry Place, Burnbank, Hamilton, ML3 — £50,000 • 2 bed • 1 bath 3 bedroom apartment for sale in Townhill Road, Hamilton, ML3 — £59,995 • 3 bed • 1 bath • 858 ft²

3 bedroom apartment for sale in Townhill Road, Hamilton, ML3 — £59,995 • 3 bed • 1 bath • 858 ft² 2 bedroom flat for sale in May Wynd, Hamilton, ML3 — £115,000 • 2 bed • 1 bath • 710 ft²

2 bedroom flat for sale in May Wynd, Hamilton, ML3 — £115,000 • 2 bed • 1 bath • 710 ft²