Summary - 69 BROADWAY PONTYPRIDD CF37 1BD

3 bed 1 bath Terraced

Immediate rental income with clear scope for refurbishment and higher returns.

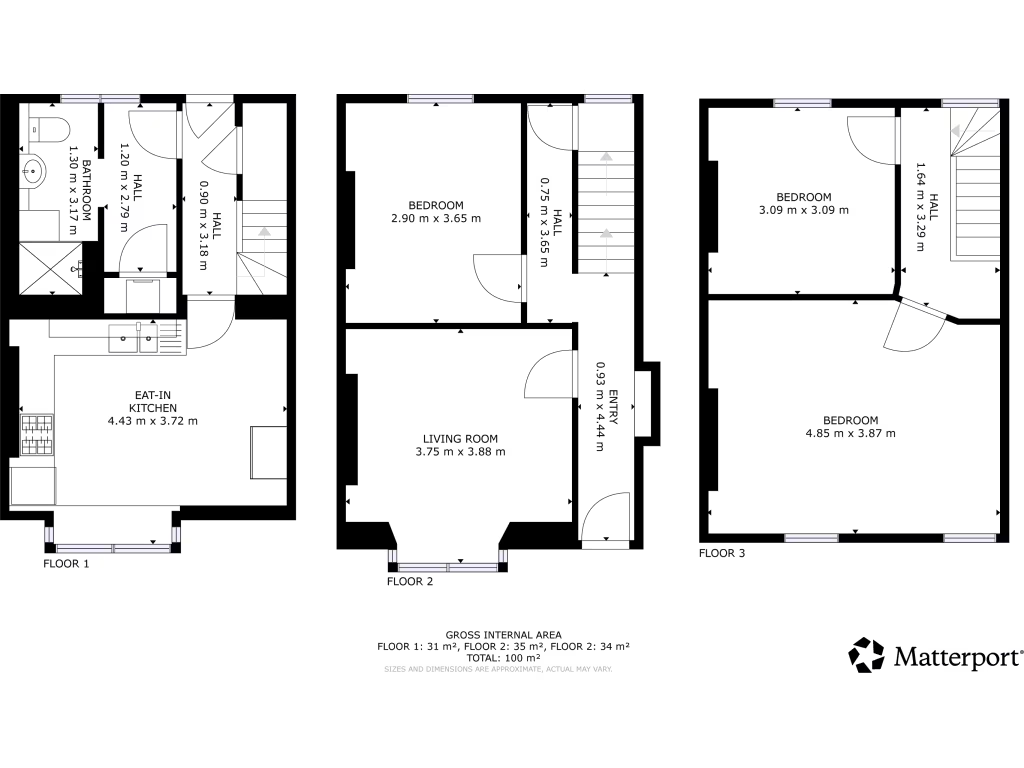

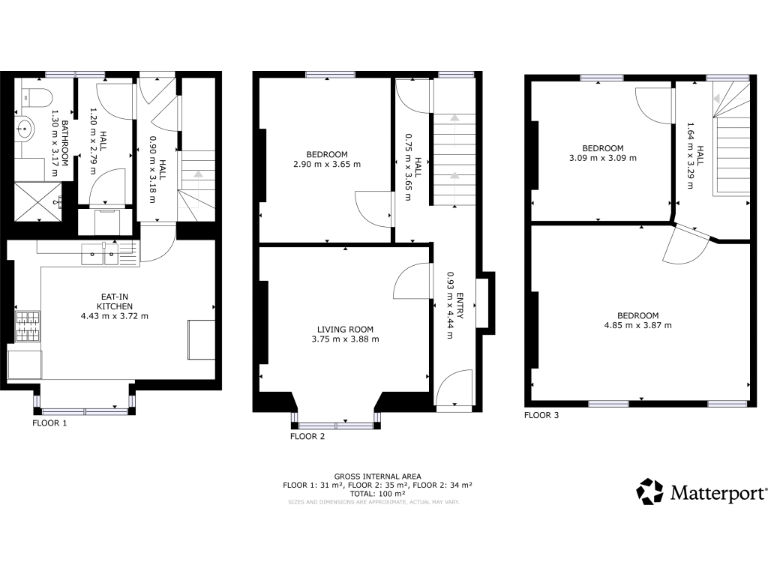

Three bedrooms with potential to convert to four bedrooms

A three-bedroom mid-terraced property offered with a long-term tenant in situ and clear buy-to-let potential. The home produces an annual gross income of £7,800, giving an approximate gross yield of around 6% at the asking price of £130,000. It includes private front and rear garden space and on-street parking.

Internally the property shows mid-20th-century fittings and some outdated decor; photographs and descriptions indicate renovation potential and scope to convert to four bedrooms subject to consents. Fast broadband and proximity to local amenities and transport links support lettability, while the existing tenancy provides immediate rental income for a new owner.

Important considerations: the area is classified as very deprived with average crime levels, the plot is small, and the property will likely require updating to maximise capital or rental growth. A Buyers Premium applies to secure the sale, and the current tenants intend to remain, so purchasers should be prepared to buy with a tenancy in place.

This opportunity suits investors or developers seeking an income-producing asset with scope for improvement and reconfiguration. Obtain the full Let Property Pack, tenancy documentation, and a condition report before committing to purchase.

4 bedroom terraced house for sale in Broadway, Pontypridd, CF37 — £135,000 • 4 bed • 1 bath • 1109 ft²

4 bedroom terraced house for sale in Broadway, Pontypridd, CF37 — £135,000 • 4 bed • 1 bath • 1109 ft² 3 bedroom terraced house for sale in Aberllechau Road, Porth, CF39 — £100,000 • 3 bed • 1 bath • 851 ft²

3 bedroom terraced house for sale in Aberllechau Road, Porth, CF39 — £100,000 • 3 bed • 1 bath • 851 ft² 3 bedroom house for sale in Stow Hill, Pontypridd, CF37 1RZ, CF37 — £135,000 • 3 bed • 1 bath • 1140 ft²

3 bedroom house for sale in Stow Hill, Pontypridd, CF37 1RZ, CF37 — £135,000 • 3 bed • 1 bath • 1140 ft² 3 bedroom terraced house for sale in Hopkin Street, Treorchy, CF42 5HL, CF42 — £80,000 • 3 bed • 1 bath • 601 ft²

3 bedroom terraced house for sale in Hopkin Street, Treorchy, CF42 5HL, CF42 — £80,000 • 3 bed • 1 bath • 601 ft² 4 bedroom terraced house for sale in Tudor Street Rhydyfelin, Pontypridd, CF37 — £170,000 • 4 bed • 2 bath • 1008 ft²

4 bedroom terraced house for sale in Tudor Street Rhydyfelin, Pontypridd, CF37 — £170,000 • 4 bed • 2 bath • 1008 ft² 3 bedroom terraced house for sale in Court Street, Clydach Vale, Tonypandy, Rhondda Cynon Taf, CF40 — £89,995 • 3 bed • 1 bath • 739 ft²

3 bedroom terraced house for sale in Court Street, Clydach Vale, Tonypandy, Rhondda Cynon Taf, CF40 — £89,995 • 3 bed • 1 bath • 739 ft²