Summary - MASSON PLACE, 1 APARTMENT 1002 HORNBEAM WAY MANCHESTER M4 4AQ

1 bed 1 bath Flat

Ready-income city apartment with balcony and long lease, ideal for buy-to-let investors.

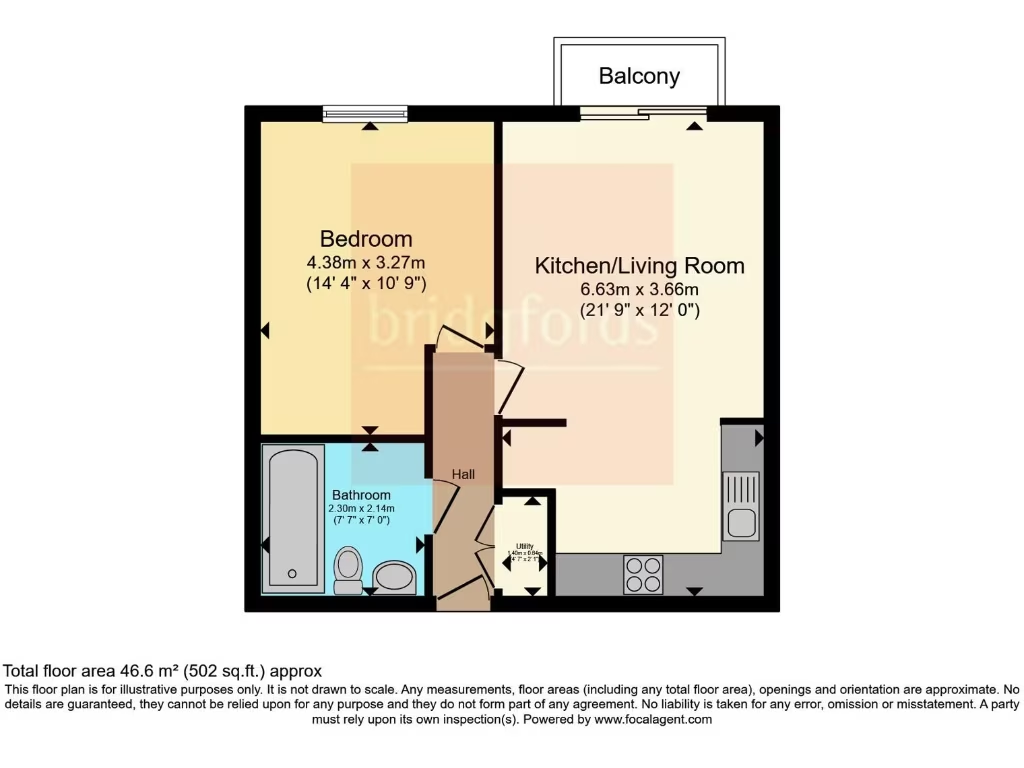

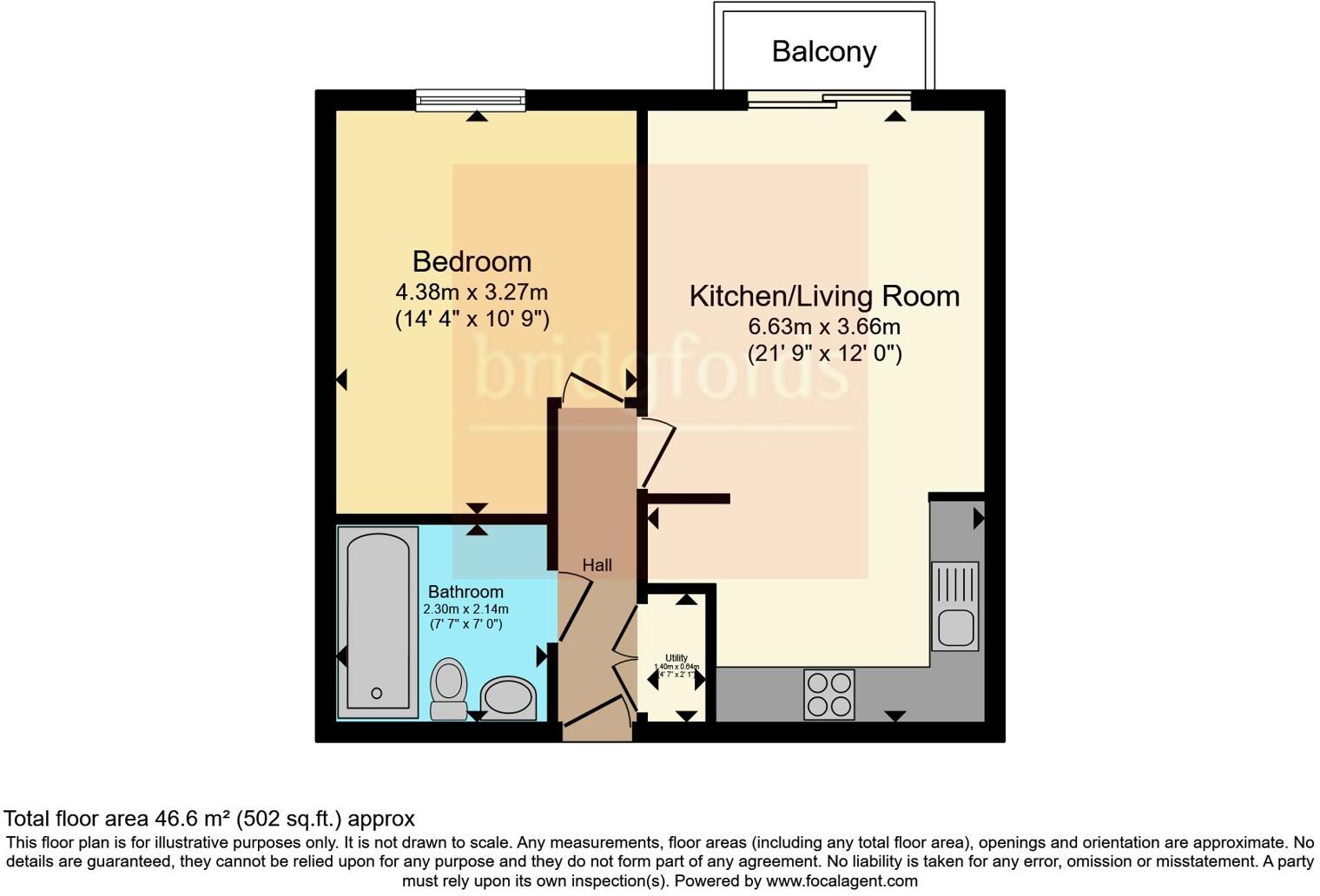

- Top-floor one-bedroom with balcony and open-plan living

- 502 sq ft (average-sized city apartment)

- Tenant in situ until December 2025, income £1,095 pcm

- Gross yield roughly 9.4% at asking price

- Long lease: 163 years remaining

- Service charge £1,585/year; ground rent £250/year

- Electric room heating — potentially higher running costs

- Located in a predominantly student, very-deprived area

A top-floor one-bedroom apartment in Manchester’s Green Quarter, offered with a long lease and tenant in place. The 502 sq ft layout includes an open-plan living area with fitted kitchen, balcony and a three-piece bathroom. The property is currently achieving £1,095 pcm, presenting a strong gross yield for buyers focused on income.

Practical strengths include a 163-year lease remaining, double glazing, an EPC C rating and no flood risk. The building is modern (constructed c.2003–2006) and benefits from city-centre access, excellent mobile signal and fast broadband — useful for student or city-centre rentals.

Important considerations: the apartment uses electric room heaters, which can mean higher running costs than gas-heated homes. Annual service charge (£1,585) and ground rent (£250) reduce net income. The area is classified as very deprived and primarily a cosmopolitan, student neighbourhood; that shapes tenant demand and can affect long-term capital growth compared with more residential districts.

The flat is sold leasehold with a tenant in situ until December 2025, so buyers should factor in occupation when planning viewings or repositioning. For investors seeking a straightforward, centrally located income property with an immediate return and a long lease, this represents a clear, ready-to-roll opportunity.

2 bedroom flat for sale in Masson Place, 1 Hornbeam Way, Manchester, Greater Manchester, M4 — £180,000 • 2 bed • 2 bath • 758 ft²

2 bedroom flat for sale in Masson Place, 1 Hornbeam Way, Manchester, Greater Manchester, M4 — £180,000 • 2 bed • 2 bath • 758 ft² 1 bedroom apartment for sale in Masson Place, Hornbeam Way, M4 — £150,000 • 1 bed • 1 bath • 541 ft²

1 bedroom apartment for sale in Masson Place, Hornbeam Way, M4 — £150,000 • 1 bed • 1 bath • 541 ft² 1 bedroom flat for sale in Hornbeam Way, Manchester, Greater Manchester, M4 — £158,000 • 1 bed • 1 bath • 550 ft²

1 bedroom flat for sale in Hornbeam Way, Manchester, Greater Manchester, M4 — £158,000 • 1 bed • 1 bath • 550 ft² 1 bedroom flat for sale in Hornbeam Way, Manchester, Greater Manchester, M4 — £158,000 • 1 bed • 1 bath • 550 ft²

1 bedroom flat for sale in Hornbeam Way, Manchester, Greater Manchester, M4 — £158,000 • 1 bed • 1 bath • 550 ft² 2 bedroom apartment for sale in Masson Place, Hornbeam Way, M4 — £195,000 • 2 bed • 2 bath • 665 ft²

2 bedroom apartment for sale in Masson Place, Hornbeam Way, M4 — £195,000 • 2 bed • 2 bath • 665 ft² 2 bedroom flat for sale in Masson Place, 1 Hornbeam Way, Manchester, Greater Manchester, M4 — £190,000 • 2 bed • 2 bath • 630 ft²

2 bedroom flat for sale in Masson Place, 1 Hornbeam Way, Manchester, Greater Manchester, M4 — £190,000 • 2 bed • 2 bath • 630 ft²