Substantial freehold mixed-use building, c.6,383 sq ft

Current gross income £63,000pa; potential in excess of £72,000pa

Ground-floor commercial unit newly let at £36,000pa

Two three-bed apartments and one one-bed penthouse included

Grade II listed frontage — listed consents may be required

Only seven years remaining on lease structure — lenders may refuse

Located town centre, five-minute walk to Northampton station

High crime and very deprived area — increased management risk

A substantial freehold mixed-use building in Northampton town centre, 10 Gold Street offers immediate income and clear upside. The ground-floor commercial unit is newly let at £36,000pa and the three flats currently produce a total gross income of £63,000pa, with estimated rental potential in excess of £72,000pa — delivering an attractive current yield of around 10% and scope for rental growth.

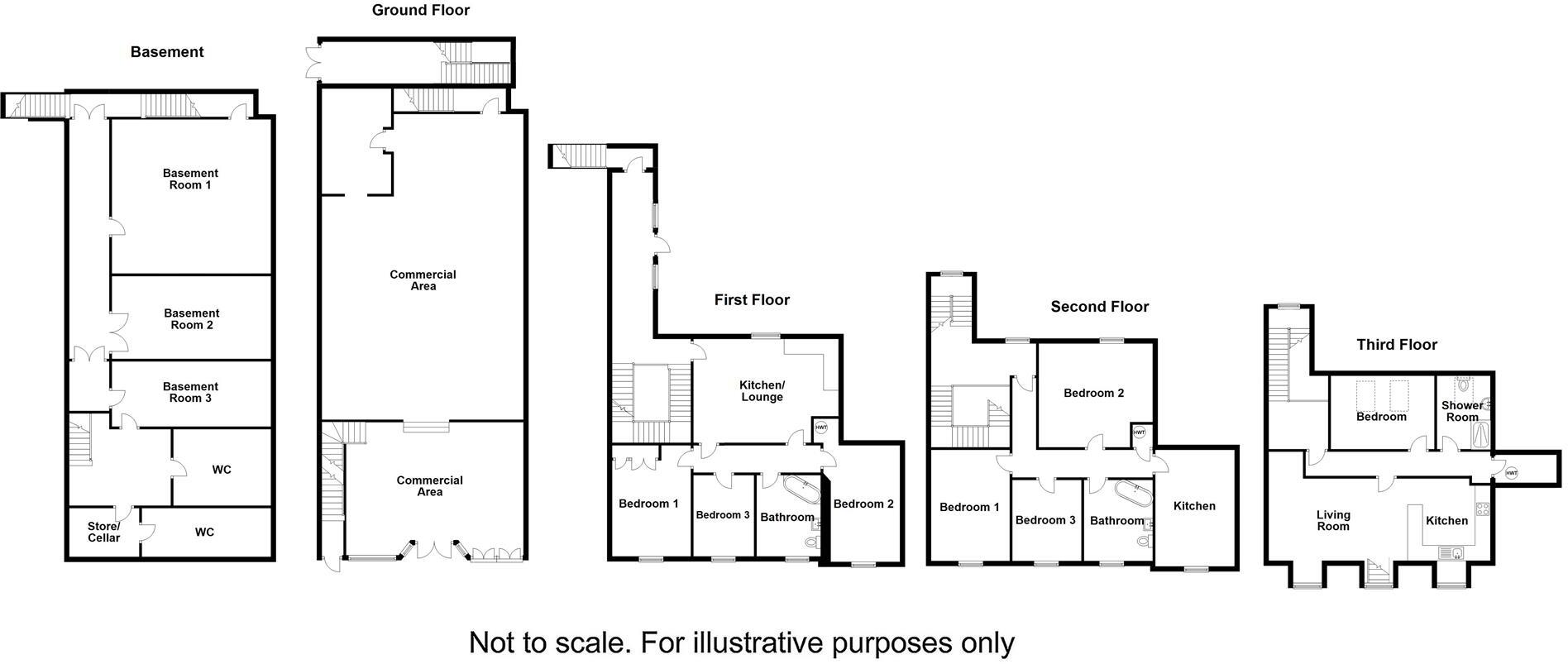

The property occupies approximately 6,383 sq ft across multiple storeys with generous room sizes, high ceilings and period Georgian frontage. The three residential units (two three-bed apartments and a one-bed penthouse) all have modern fitted kitchens and EPC ratings of C for the flats; there is a communal decked garden and excellent pedestrian links to Northampton station and town-centre amenities.

Key investment cautions are material and must be factored into buyer due diligence. The newly granted commercial lease is for seven years with a three-year mutual break; there are only seven years remaining overall on the lease structure flagged, which may cause mortgage lenders to refuse lending. The front is Grade II listed, meaning external and some internal works will need listed-building consent. The property sits in a very high crime, very deprived area — these social indicators affect tenant mix, management needs and long-term rental security.

The lot is being sold at auction with guide price £600,000 to £650,000; buyers should allow for auction fees: a purchaser’s administration charge (£1,140) and buyers’ premium (£9,600) plus VAT. VAT is applicable to the sale. This is a clear, high-yielding central investment for a cash buyer or specialist investor willing to manage listed-building constraints, leasing risk and enhanced on-site management requirements.