Summary - A/1, 99, HIGH STREET, DUNDEE, LOCHEE DD2 3BX

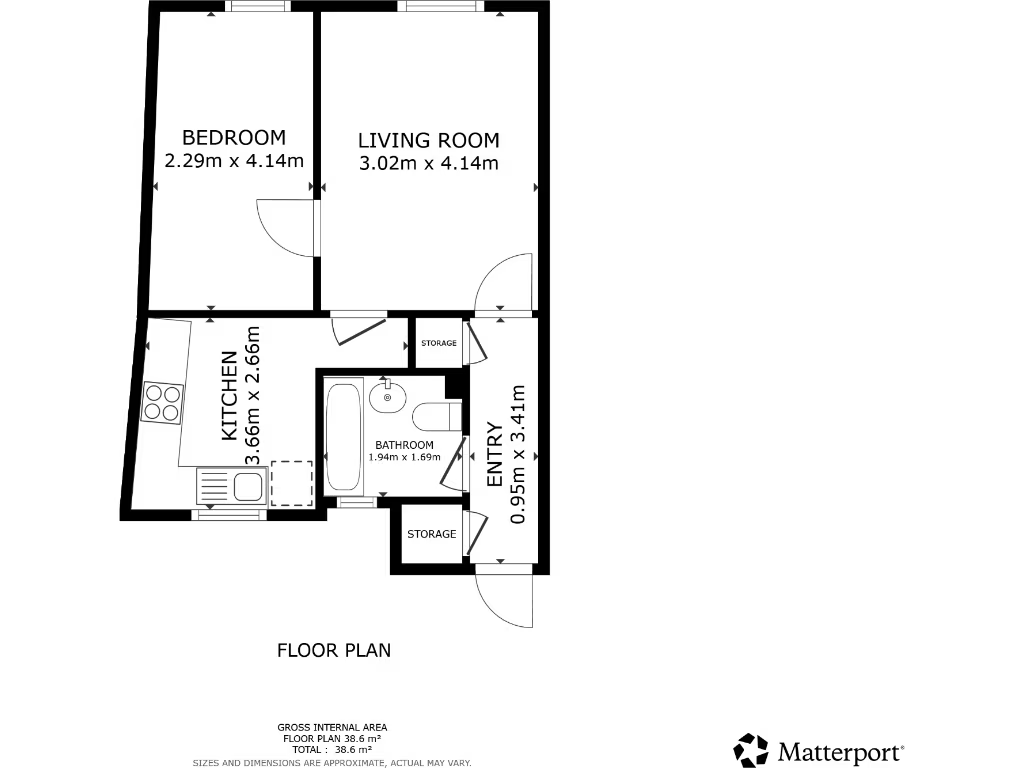

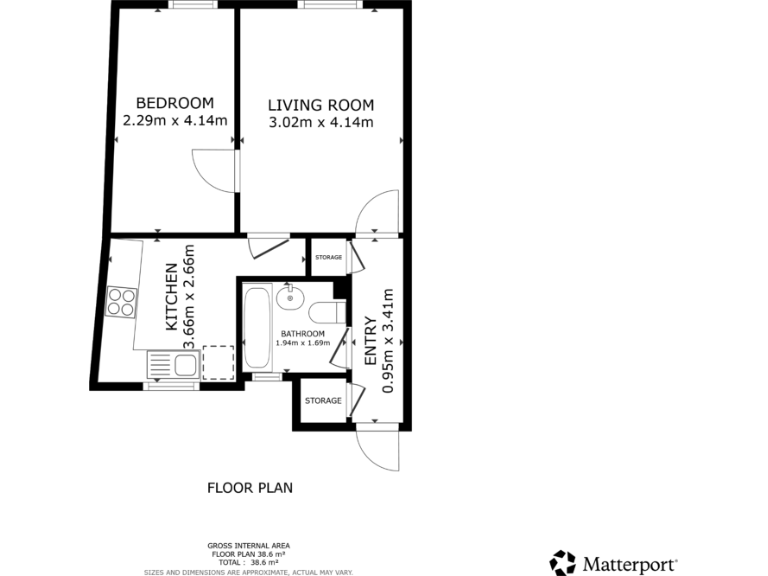

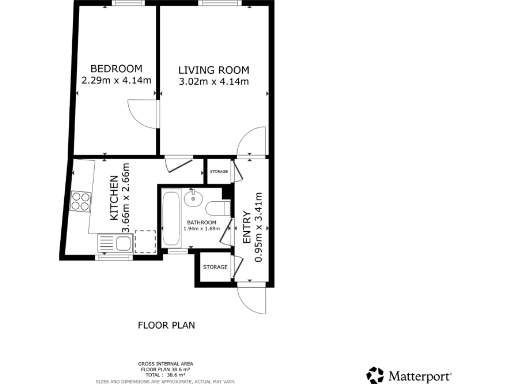

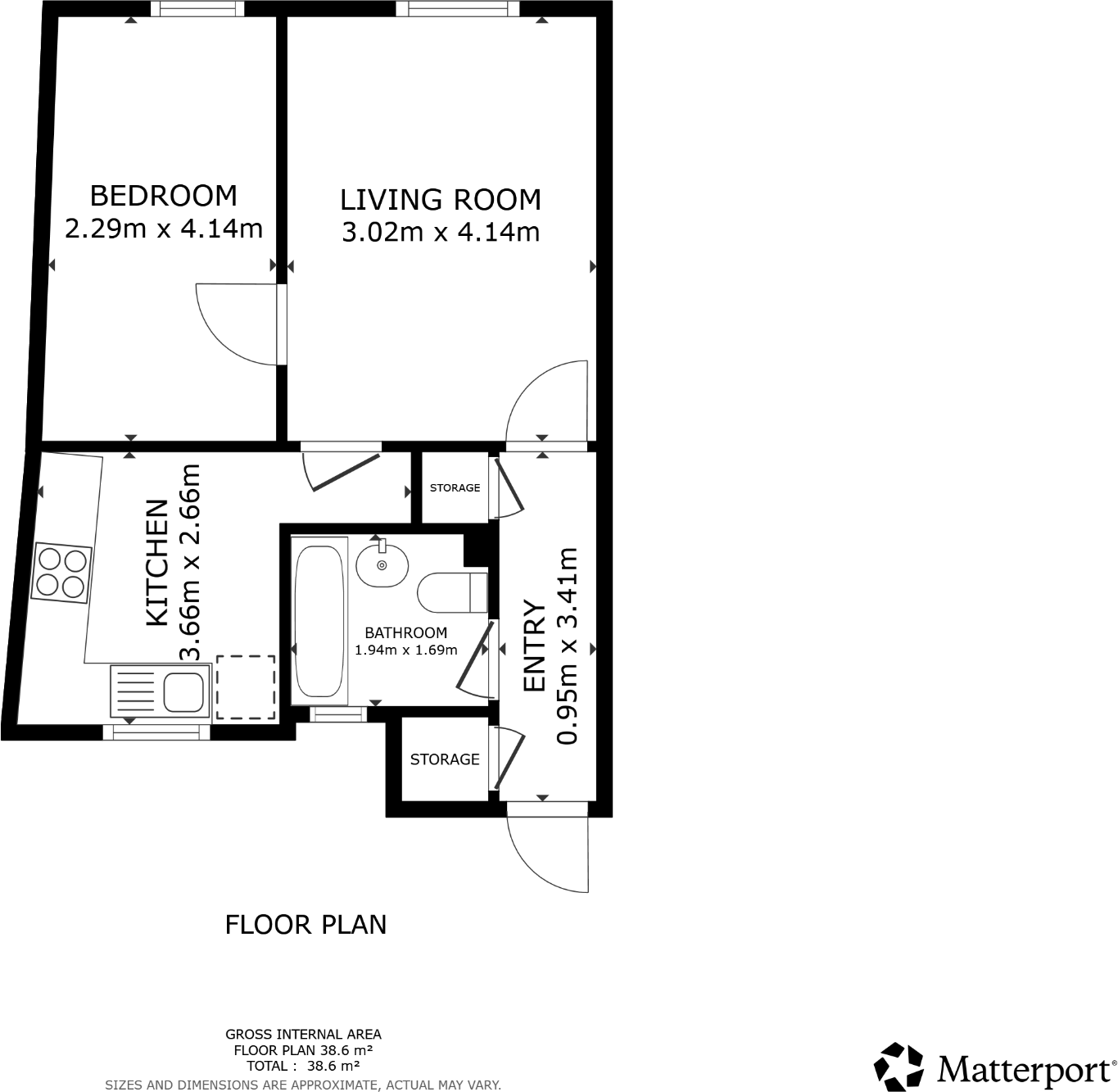

1 bed 1 bath Flat

Compact income-producing flat with long-term tenants and refurbishment potential.

Freehold one-bedroom flat on Dundee High Street

A compact one-bedroom flat on Dundee High Street presented as a straightforward buy-to-let purchase. The property is freehold, currently let to long-term tenants who have consistently paid rent and intend to remain, producing a gross annual income of £4,800. The location on a busy town-centre parade gives easy access to shops, transport and local services, supporting lettability.

The flat is small (approximately 420 sq ft) and forms part of a Victorian mixed-use building with traditional stone façade and high ceilings on some levels. Internal photos and detailed condition reports are not provided; the living room image appears cluttered and would benefit from cleaning and inspection. Buyers should verify exact internal condition, layout and any necessary repairs via the Let Property Pack and a physical viewing.

This listing is aimed at investors or developers seeking an immediate income stream and potential for rental uplift through refurbishment or rent review. Note: a Buyers Premium will apply to secure the sale. The property sits in a very deprived area—this supports demand for affordable lettings but can affect long-term capital growth and management considerations.

Material points: the unit has no obvious private external space, the overall size is small, and the tenancy is in place (limiting vacant possession options). Prospective buyers should review tenancy terms, obtain up-to-date energy and safety certificates, and budget for any refurbishment or management needs before purchase.

1 bedroom flat for sale in Fleming Gardens East, Dundee, DD3 — £65,000 • 1 bed • 1 bath • 667 ft²

1 bedroom flat for sale in Fleming Gardens East, Dundee, DD3 — £65,000 • 1 bed • 1 bath • 667 ft² 1 bedroom flat for sale in Albert Street, Dundee, DD4 — £52,000 • 1 bed • 1 bath • 430 ft²

1 bedroom flat for sale in Albert Street, Dundee, DD4 — £52,000 • 1 bed • 1 bath • 430 ft² 2 bedroom flat for sale in East Dock Street, Dundee, DD1 — £170,000 • 2 bed • 1 bath • 818 ft²

2 bedroom flat for sale in East Dock Street, Dundee, DD1 — £170,000 • 2 bed • 1 bath • 818 ft² 2 bedroom flat for sale in Hilltown, Dundee, DD3 — £65,000 • 2 bed • 1 bath • 657 ft²

2 bedroom flat for sale in Hilltown, Dundee, DD3 — £65,000 • 2 bed • 1 bath • 657 ft² 2 bedroom flat for sale in Dochart Terrace, Dundee, DD2 — £80,000 • 2 bed • 1 bath • 797 ft²

2 bedroom flat for sale in Dochart Terrace, Dundee, DD2 — £80,000 • 2 bed • 1 bath • 797 ft² 1 bedroom flat for sale in St Andrews Street, Dundee, DD1 — £68,995 • 1 bed • 1 bath • 494 ft²

1 bedroom flat for sale in St Andrews Street, Dundee, DD1 — £68,995 • 1 bed • 1 bath • 494 ft²