Summary - 83 Fore Street,St Marychurch,Torquay,TQ1 4PY TQ1 4PZ

1 bed 1 bath Mixed Use

Prominent corner asset with immediate income and ready-to-let flat.

Freehold mixed-use building with commercial and residential parts

Commercial unit currently let at £950 pcm until October 2025

Recently renovated flat is vacant and ready to occupy or relet

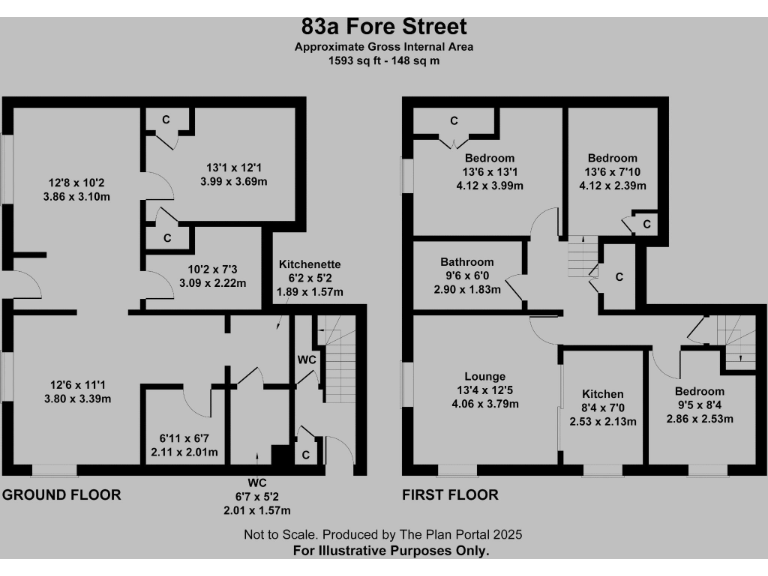

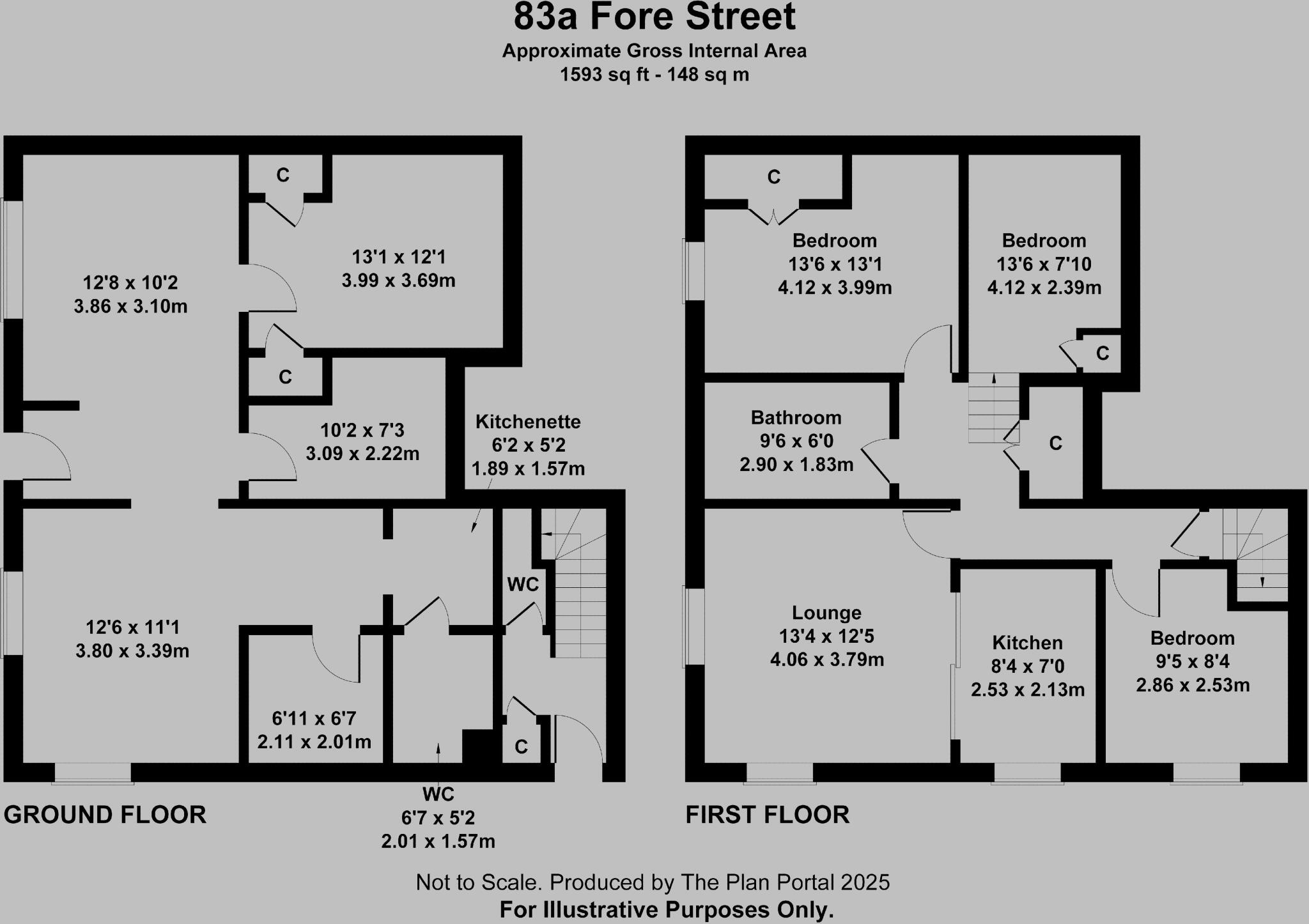

Approx. 1,593 sq ft total gross internal area (large overall size)

Corner position on Fore Street with strong pedestrian visibility

Area classed as very deprived — may affect long-term rental demand

Small plot size; limited external space and redevelopment room

Conflicting bedroom data: descriptions say 3 beds, structured data lists 1 bed

This freehold mixed-use building sits on Fore Street in St Marychurch, combining ground-floor commercial space with an upper self-contained flat. The commercial unit is currently let at £950 pcm until October 2025, providing immediate income, while the recently renovated flat is vacant and ready for occupation or re-letting. The property’s large overall size (approx. 1,593 sq ft) and prominent corner position offer strong visibility and flexibility for a range of businesses or continued owner-landlord use.

The flat is described as recently renovated and in good condition, offering a straightforward lettable unit or immediate owner occupation. The ground-floor salon benefits from large windows and strong footfall in a desirable local precinct, supporting steady customer traffic. Being freehold removes leasehold complications and increases control over future changes and income management.

Buyers should note some material considerations. The broader area is classified as very deprived and ageing urban communities, which can affect long-term rental yields and tenant demand; local retail strength relies on independent traders rather than major multiples. The commercial lease expires in October 2025, so income beyond that date is not secured. Also, there is conflicting bedroom data in the supplied information (descriptions state a three-bedroom flat but structured data lists one bedroom); prospective purchasers must verify the flat’s actual bedroom count and layout before exchange.

This asset suits investors seeking a town-centre income property with immediate returns, or an owner-operator wanting a ground-floor business with living accommodation above. Its size and corner location also create refurbishment or reconfiguration potential, subject to checks and market conditions.

Mixed use property for sale in Torquay, TQ1 — £210,000 • 1 bed • 1 bath • 344 ft²

Mixed use property for sale in Torquay, TQ1 — £210,000 • 1 bed • 1 bath • 344 ft² Commercial property for sale in Torquay, TQ1 — £185,000 • 1 bed • 1 bath

Commercial property for sale in Torquay, TQ1 — £185,000 • 1 bed • 1 bath 3 bedroom mixed use property for sale in Fore Street, Torquay, Devon, TQ1 — £285,000 • 3 bed • 1 bath • 1090 ft²

3 bedroom mixed use property for sale in Fore Street, Torquay, Devon, TQ1 — £285,000 • 3 bed • 1 bath • 1090 ft² Commercial property for sale in 51 Fore Street, St Marychurch , TQ1 — £550,000 • 2 bed • 1 bath • 1660 ft²

Commercial property for sale in 51 Fore Street, St Marychurch , TQ1 — £550,000 • 2 bed • 1 bath • 1660 ft² Mixed use property for sale in Torquay, TQ1 — £430,000 • 1 bed • 1 bath

Mixed use property for sale in Torquay, TQ1 — £430,000 • 1 bed • 1 bath Mixed use property for sale in Paignton, TQ3 — £380,000 • 1 bed • 1 bath

Mixed use property for sale in Paignton, TQ3 — £380,000 • 1 bed • 1 bath