Summary - Lusso Churchill Way, Macclesfield, SK11 SK11 6AY

15 bed 1 bath Apartment

15 fully tenanted modern apartments next to Macclesfield station — immediate income.

Fully tenanted 15-unit portfolio (13 studios, 2 one-beds)

Prime town-centre location next to Macclesfield train station

Built 2021 with high-spec finishes; sold fully furnished and managed

Gross annual income £160,680; gross yield c. 8.46%

Service charge & management circa 20% — reduces net yield

Ground rent £3,000 pa (very expensive) — impacts returns

Reported high-speed fibre but local data shows very slow broadband

Likely limited parking and no private gardens; urban town-centre asset

LUSSO Churchill Way is a turnkey, income-generating portfolio of 15 serviced apartments (13 studios and 2 one-beds) located immediately next to Macclesfield train station. Built in 2021, the scheme benefits from contemporary build quality, high-spec internal finishes and an established management/lettings structure, making it suitable for a hands-off investor seeking immediate rental income and strong commuter demand. The portfolio currently produces a reported gross annual income of £160,680 (gross yield c. 8.46%).

The building offers resident amenities that support short-stay and PRS models — concierge, gym, rooftop dining rooms, coworking hub and landscaped sky garden — and the units are sold fully furnished and managed, with utilities reportedly included in tenant packages. The long lease (247 years remaining) and modern construction reduce near-term maintenance risk; the town-centre location and immediate station access are key demand drivers from professionals and visitors.

Material points to verify: the advertised in-apartment tech (high-speed fibre) conflicts with separately supplied data showing very slow broadband speeds for the area — confirm actual delivered connectivity. Service charges and management costs are significant (circa 20% reported) and ground rent is high (£3,000 pa), both of which materially affect net returns. The wider area statistics indicate deprivation and a ‘hampered aspiration’ classification; factor local market dynamics and tenant profile when modelling reversionary rents and valuation.

Practical considerations include likely limited on-site parking, no private gardens, and constrained individual apartment footprints (small overall size noted). The asset suits investors prioritising cashflow and immediate occupation rather than capital-light refurbishment upside. Prospective purchasers should request verified occupancy/tenancy schedules, service charge accounts, parking provision, actual broadband performance and any company-ownership details before exchange.

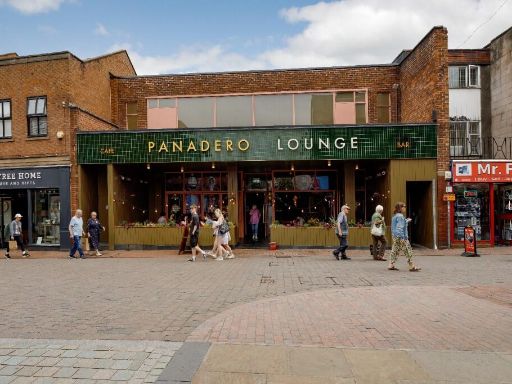

Restaurant for sale in Mill Street, Macclesfield, Cheshire, SK11 — £950,000 • 1 bed • 1 bath • 9076 ft²

Restaurant for sale in Mill Street, Macclesfield, Cheshire, SK11 — £950,000 • 1 bed • 1 bath • 9076 ft² Commercial property for sale in Chester Road, Macclesfield, Cheshire, SK11 — £700,000 • 1 bed • 1 bath • 5000 ft²

Commercial property for sale in Chester Road, Macclesfield, Cheshire, SK11 — £700,000 • 1 bed • 1 bath • 5000 ft² Studio apartment for sale in Deluxe Studio - Alexandra House - Stockport, SK1 — £155,000 • 1 bed • 1 bath • 420 ft²

Studio apartment for sale in Deluxe Studio - Alexandra House - Stockport, SK1 — £155,000 • 1 bed • 1 bath • 420 ft² Commercial property for sale in Church Street, Macclesfield, SK11 — £220,000 • 1 bed • 4 bath • 1907 ft²

Commercial property for sale in Church Street, Macclesfield, SK11 — £220,000 • 1 bed • 4 bath • 1907 ft² Commercial property for sale in 89 Mill Street, Macclesfield SK11 6NN, SK11 — £155,000 • 1 bed • 1 bath • 2146 ft²

Commercial property for sale in 89 Mill Street, Macclesfield SK11 6NN, SK11 — £155,000 • 1 bed • 1 bath • 2146 ft² High street retail property for sale in 10-16 Great King Street, Macclesfield, SK11 6PL, SK11 — £285,000 • 1 bed • 1 bath • 2000 ft²

High street retail property for sale in 10-16 Great King Street, Macclesfield, SK11 6PL, SK11 — £285,000 • 1 bed • 1 bath • 2000 ft²