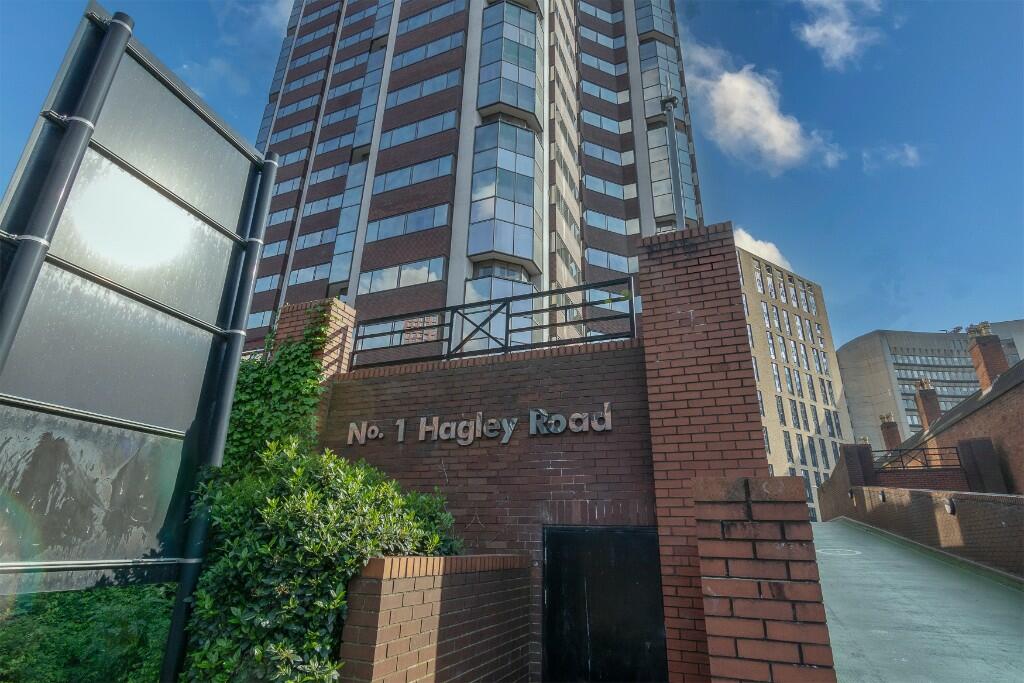

Summary - 1810, 1, HAGLEY ROAD B16 8JA

2 bed 1 bath Flat

Two-bed let property with strong income and clear rent uplift potential.

Immediate buy-to-let with long-term tenant in situ

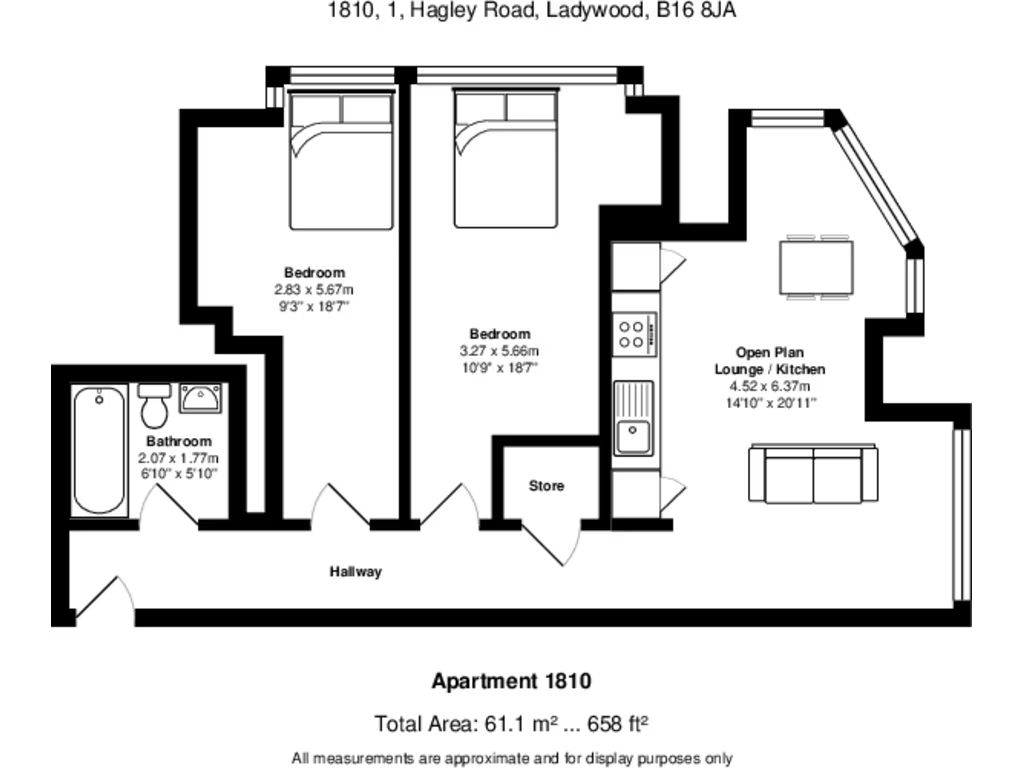

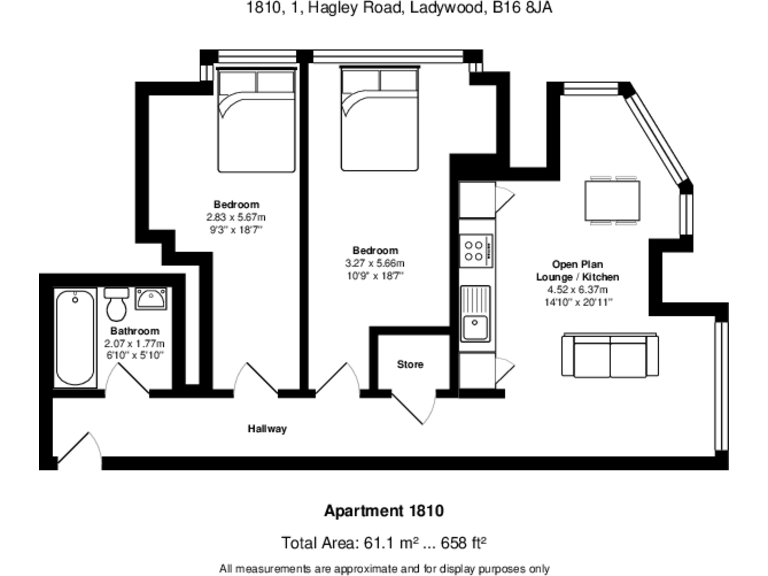

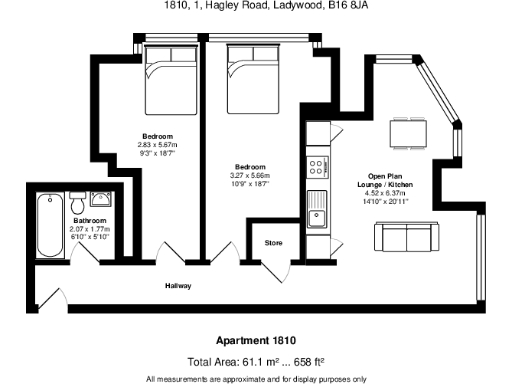

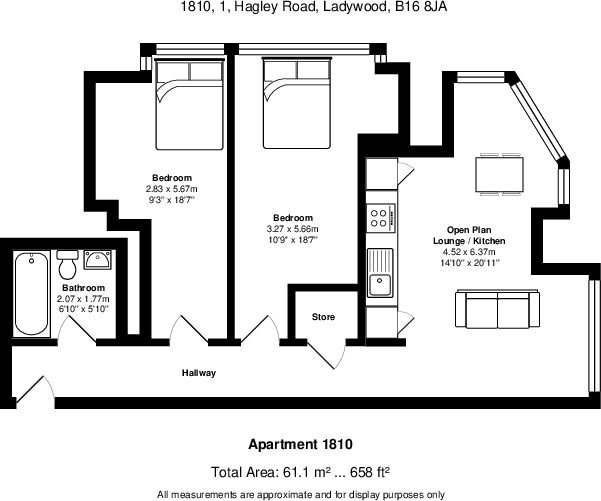

A straightforward buy-to-let in Hagley Road offering immediate rental income and clear upside. This two-bedroom, open-plan flat (approx. 658 sq ft) sits in a modern high-rise and is currently let to long-term tenants, producing a gross income of £10,740 pa with market rent potential around £14,400 pa. At the asking price of £130,000 this equates to a current gross yield of about 8.3% and a potential gross yield near 11.1%—figures that will appeal to yield-focused investors.

The property is well maintained and benefits from a bright, modern open-plan living/kitchen, sizeable bedrooms and a three-piece bathroom. The 100-year lease remaining and no flood risk provide useful tenure and location reassurance. Broadband and mobile signals are strong and the building is close to extensive amenities and transport links, supporting good tenant demand in an inner-city setting.

Buyers should note the material negatives: the area records high crime levels and is classed as very deprived, which may affect future tenant mix, management costs and resale. The property is sold with sitting tenants who intend to remain, limiting immediate vacant possession and owner-occupation options. A buyer’s premium applies on sale—factor this into acquisition costs.

This is best suited to investors or developers able to manage a rental asset in an inner-city market and who prioritise steady income with upside from rent reversion. The combination of maintained condition, long-term tenancy and scope to increase rent makes this a clear addition for a growing portfolio, provided purchasers accept the neighbourhood risk profile and additional sale fees.

2 bedroom flat for sale in Hagley Road, Birmingham, B16 — £130,000 • 2 bed • 1 bath • 676 ft²

2 bedroom flat for sale in Hagley Road, Birmingham, B16 — £130,000 • 2 bed • 1 bath • 676 ft² 1 bedroom flat for sale in Orchard Avenue, Birmingham, B16 — £95,000 • 1 bed • 1 bath • 463 ft²

1 bedroom flat for sale in Orchard Avenue, Birmingham, B16 — £95,000 • 1 bed • 1 bath • 463 ft² 2 bedroom flat for sale in Hall Street, Birmingham, B18 — £193,000 • 2 bed • 2 bath • 764 ft²

2 bedroom flat for sale in Hall Street, Birmingham, B18 — £193,000 • 2 bed • 2 bath • 764 ft² 2 bedroom flat for sale in Gravelly Lane, Birmingham, B23 — £120,000 • 2 bed • 1 bath • 549 ft²

2 bedroom flat for sale in Gravelly Lane, Birmingham, B23 — £120,000 • 2 bed • 1 bath • 549 ft² 2 bedroom flat for sale in Hagley Road, Birmingham, B17 — £160,000 • 2 bed • 2 bath • 657 ft²

2 bedroom flat for sale in Hagley Road, Birmingham, B17 — £160,000 • 2 bed • 2 bath • 657 ft² 1 bedroom flat for sale in Masshouse Plaza, Birmingham, B5 — £122,000 • 1 bed • 1 bath • 506 ft²

1 bedroom flat for sale in Masshouse Plaza, Birmingham, B5 — £122,000 • 1 bed • 1 bath • 506 ft²